|

|

市場調査レポート

商品コード

1642208

プラスチック加工機械:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Plastic Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プラスチック加工機械:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 102 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

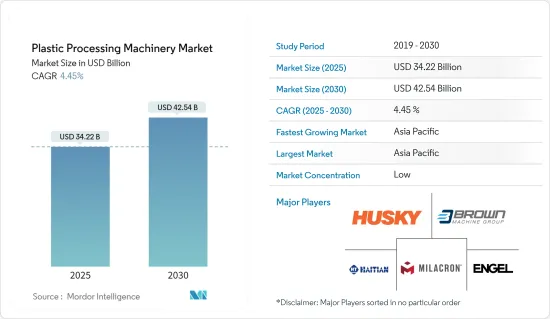

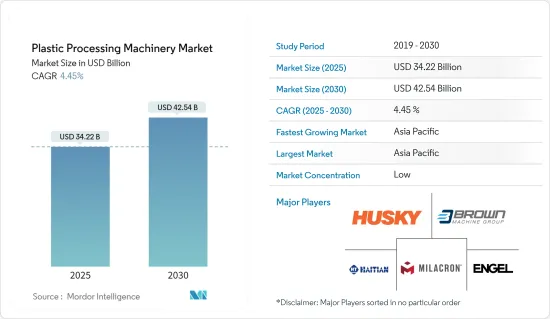

プラスチック加工機械の市場規模は、2025年に342億2,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは4.45%で、2030年には425億4,000万米ドルに達すると予測されます。

プラスチック加工機械の世界市場が急成長すると予想されるのは、設計の柔軟性などプラスチック加工技術の多くの利点が人々に認識されつつあることと、飲食品やその他の最終用途産業がこの種の機械を急速に導入しているためです。

主なハイライト

- プラスチック成形加工技術は、自動車部品、コネクター、ディスプレイ、携帯電話、3C電子製品、プラスチック光学レンズ、生物医学応用製品、一般日用品など、様々な製品の製造に広く使われています。プラスチック成形加工技術は日々進歩しています。なぜなら、より多くの人々がさまざまな方法で製品を使用し、その機能に対してさまざまなニーズを持っているからです。

- 金属、石材、木材など他の素材に比べ、プラスチックは低コストで強い可塑性を持つという利点があります。そのため、経済や日常生活で広く使われています。プラスチック製品とプラスチック産業は、世界で極めて重要な地位を占めています。市場の成長は、強化プラスチックや生分解性プラスチックの需要拡大を含む動向によって牽引されると予想されます。業界は、デジタル技術とプラスチック製造技術の融合による「インダストリー4.0」の概念を取り入れています。

- プラスチック製品の需要が大幅に伸びているため、業界ではプラスチック加工機器の需要が大幅に伸びています。プラスチック射出成形は、他の方法の中でプラスチックを成形する最も一般的な方法の1つです。多数の産業用途があるため、この技術に対する市場の需要は絶えず拡大し、進化しています。オーダーメイドのプラスチック射出成形部品は、低コストで高品質の部品を大量に作る必要がある多くの産業にとって完璧なソリューションです。

- 発展途上国におけるプラスチック加工工場の近代化と相まって、アップグレードの必要性が高まっており、射出成形機などの買い替え需要に拍車がかかると予想されます。この成長は、装置のコストを下げ、価格に敏感な市場でより手頃な価格にしている技術の変化も後押ししています。

- COVID-19の流行の初期段階には、注射器、消毒液ボトル、洗浄液ボトルなどのブロー成形医療品に多大な需要があった。ロシアとウクライナの戦争も、パッケージング・エコシステム全体に変化をもたらしました。

プラスチック加工機械市場の動向

包装業界からのプラスチック需要の増加

プラスチック包装は、食品・飲料、消費財、電子機器、さらには工業などの業界でますます使用されるようになっています。これは、プラスチック包装が、より少ない製品に反応し、アイテムの安全性を保つのに役立つこと、使用される材料を無臭にすることができること、環境からアイテムを保護するのに役立つこと、漏れを防ぐために製品を密封できることなど、多くの利点があるためです。

- 北米はプラスチック包装の主要市場のひとつであり、小売業が組織化され、高度に規制されているため、さまざまなセグメントで物品の安全な保管が規制されています。例えば、米国国勢調査局によると、プラスチック包装材料とラミネート加工されていないフィルムは、2024年に米国で380億米ドルの売上をもたらすと予想されています。

- プラスチックの軽量性が欧州におけるプラスチック包装の成長を促進しています。ガラスはプラスチックに比べてはるかに重いため、輸送の際に多くの回数を要することになります。これは、環境への影響がより大きくなることを意味します。また、最終消費者にとってもガラスの方がはるかに重いのに対し、プラスチックは軽量で持ち運びがはるかに容易です。

国際ボトルウォーター協会(IBWA)によれば、米国では2021年に156億ガロンのボトル入り飲料水が消費され、2020年比で4.5%増加します。また、IBWAに代わってハリス・ポールが行った新しい全国オンライン世論調査によると、10人中9人以上のアメリカ人が、他の飲み物が売られているところならどこでもボトル入りの水を買えるようになると期待していることがわかった。

アジア太平洋が最大のシェアを占める見込み

中国はアジア太平洋地域の新興経済国であり、そこでの製造活動の数は飛躍的な速度で伸びています。これは、多くのエンドユーザー産業で高性能プラスチック部品が必要とされているためです。

- プラスチック加工機械の種類の中では、射出成形機が中国で大きなシェアを占めると予想されています。この市場セグメントでは、Haitian International Holdings Limited、The Chen Hsong Group、L.K. Technology Holdings Limited、Cosmos Machinery Enterprises Limited、Fu Chin Shin Machinery Manufactureなどが有名企業です。

- また、ボトル入り飲料水の生産データは、中国の射出成形機市場が予測期間中に成長することを示唆しています。中国と同様、射出成形機は同国のプラスチック加工機械市場で大きなシェアを占める可能性が高いです。

- 同市場のこのセグメントで事業を展開する有力企業には、Arburg GmbH、Engel Machinery India Pvt Ltd、Haitian Huayuan Machinery(India)Pvt Ltd、Husky Injection Molding Systems Pvt Ltdなどがあります。インド・ブランド・エクイティ財団(IBEF)によると、プラスチック産業は2,000以上の輸出業者を抱え、30,000以上の加工ユニットを有しています。このうち約85~90%が中小企業です。

- 日本政府は、EVの利用による二酸化炭素排出量の削減を計画しており、その結果、EVインフラ開発への多額の投資が行われました。日本では、EVの増加に合わせてEV充電ステーションの数が増加しました。これは、政府がEV購入者に補助金を出し始めたためです。

プラスチック加工機械業界の概要

プラスチック加工機械市場の競争企業間の敵対関係は、ブラウン・マシン・グループやハイチアン・インターナショナル・ホールディングス・リミテッドなどの主要企業の存在により高いです。研究開発を通じて、これらの企業は継続的に製品を革新することで競争上の優位性を獲得してきました。これらのプレーヤーは、技術革新やM&Aを通じて、市場で確固たる地位を築き、技術をさらに発展させることができるようになった。

2022年6月、ALPLAグループ、ブリンク、IPBプリンティングはENGELと提携し、包装業界にとって飛躍的な飛躍となるK 2022を発表しました。PET薄肉容器は、射出成形の単一生産工程で初めて製造できるようになった。オーストリアの射出成形機メーカーENGEL社のスタンドでは、再生PETを加工しています。これは、ENGEL e-speed射出成形機と、新たに開発された非常に強力な射出ユニットを使用して実現されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- 産業バリューチェーン分析

- 市場促進要因

- 包装業界からのプラスチック需要の増加

- 自動車分野からの軽量部品需要の増加が、使用されるプラスチックの需要を促進している

- 市場抑制要因

- プラスチックの使用を最小限に抑えるための政府の規制強化

第5章 市場セグメンテーション

- タイプ別

- 射出成形機

- ブロー成形機

- 押出成形機

- 熱成形機

- 3Dプラスチックプリンター

- その他のタイプ

- エンドユーザー産業別

- パッケージング

- 消費者製品

- 建築

- 自動車

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- KraussMaffei Group(ChemChina)

- Brown Machine Group

- Haitian International Holdings Limited

- Engel Austria GmbH

- Kautex Maschinenbau GmbH

- Graham Engineering Corporation

- Gurucharan Industries

- Milacron LLC(Hillenbrand Inc.)

- The Japan Steel Works Ltd

- Sumitomo Heavy Industries

- Arburg GmbH+Co KG

- Husky Injection Molding Systems Ltd

第7章 投資分析

第8章 市場機会と今後の動向

The Plastic Processing Machinery Market size is estimated at USD 34.22 billion in 2025, and is expected to reach USD 42.54 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The global plastic processing machinery market is expected to grow quickly because people are becoming more aware of the many benefits of plastic processing techniques, such as design flexibility, and because food and beverage and other end-use industries are quickly adopting this type of machinery.

Key Highlights

- Plastic molding processing technology has been widely used in the manufacturing of various products, such as auto parts, connectors, displays, mobile phones, 3C electronic products, plastic optical lenses, biomedical application products, general daily necessities, etc. Plastic molding processing technology is getting better and better every day. This is because more and more people are using products in different ways and have different needs for how they work.

- Compared to other materials, such as metal, stone, and wood, plastic has the advantages of low cost and strong plasticity. Thus, it is widely used in the economy and daily life. Plastic products and industry occupy an extremely important position in the world. Gains in the market are anticipated to be driven by trends, including the expanding demand for reinforced and biodegradable plastics. The industry is embracing the concept of "Industry 4.0" by fusing digital technology with plastic manufacturing techniques.

- Due to the sheer growth in demand for plastic products, the industry is seeing significant growth in demand for plastic processing equipment. Plastic injection molding is one of the most common ways to shape plastic out of other methods.With numerous industrial applications, the market demand for the technology is continually expanding and evolving. Plastic injection-molded parts that are made to order are the perfect solution for many industries that need to make a lot of high-quality parts at a low cost.

- The growing need for upgrades combined with the modernization of plastics processing plants in developing nations is expected to spur the replacement demand for injection molding machinery and other equipment. The growth is also helped by changes in technology, which are lowering the cost of equipment and making it more affordable in price-sensitive markets.

- During the beginning stages of the COVID-19 epidemic, there was a tremendous demand for blow-molded medical items, such as injection syringes, sanitizer bottles, and cleaning solution bottles. The war between Russia and Ukraine has also changed the packaging ecosystem as a whole.

Plastic Processing Machinery Market Trends

Increasing Demand for Plastics from the Packaging Industry

Plastic packaging is being used more and more in industries like food and drinks, consumer goods, electronics, and even industry. This is because plastic packaging has many benefits, such as how it reacts with fewer products and helps keep items safe, how the materials used can be made odorless, how it helps protect items from the environment, and how the product can be sealed to prevent leaks.

- North America is one of the major markets for plastic packaging, as a prominent share of the retail sector is organized and highly regulated, which regulates the safekeeping of items in various segments; owing to this, the demand is significantly higher. For example, the US Census Bureau says that plastic packaging materials and unlaminated films are expected to bring in USD 38 billion in sales in the US in 2024.

- The lightweight property of plastic is driving the growth of plastic packaging in Europe. Glass is much heavier compared to plastic, which means more trips would be required while transporting. This translates to a more significant environmental impact. Glass is also much heavier for the end consumer, whereas plastic is lightweight and much easier to carry.

As per the International Bottled Water Association (IBWA), the United States will consume 15.6 billion gallons of bottled water in 2021, a 4.5% increase over 2020. Also, a new national online poll done by The Harris Poll on behalf of the IBWA found that more than nine out of ten Americans expect to be able to buy bottled water wherever other drinks are sold.

Asia-Pacific is Expected to Hold the Largest Share

China is an emerging economy in the Asia-Pacific region, and the number of manufacturing activities there is growing at an exponential rate. This is because high-performance plastic components are needed in many end-user industries.

- Within the types of plastic processing machinery, injection molding machinery is expected to hold a significant share in China. Haitian International Holdings Limited, The Chen Hsong Group, L.K. Technology Holdings Limited, Cosmos Machinery Enterprises Limited, and Fu Chin Shin Machinery Manufacture Co. Ltd., among others, are well-known companies in this market segment.

- Also, the production data for bottled drinking water is indicative of the fact that the injection molding machinery market in China is poised to grow over the forecast period. Like in China, injection molding machines are likely to have a big share of the market for plastic processing machines in the country.

- Some of the prominent players operating in this segment of the market include Arburg GmbH, Engel Machinery India Pvt Ltd, Haitian Huayuan Machinery (India) Pvt Ltd, and Husky Injection Molding Systems Pvt Ltd, among others. According to the India Brand Equity Foundation (IBEF), the plastics industry hosts more than 2,000 exporters and comprises more than 30,000 processing units. About 85-90% of these units are small and medium-sized enterprises.

- The government of Japan plans to reduce its carbon footprint by using EVs, which has resulted in substantial investments toward EV infrastructure development. Japan saw a rise in the number of EV charging stations to keep up with the growing number of EVs. This is because the government started giving subsidies to people who bought EVs.

Plastic Processing Machinery Industry Overview

The competitive rivalry in the plastic processing machinery market is high owing to the presence of some key players, such as Brown Machine Group and Haitian International Holdings Limited, amongst others. Through research and development, these companies have gained a competitive advantage by continually innovating their offerings. These players, through innovation and mergers and acquisitions, have been able to gain a strong footprint in the market as well as be able to further develop the technology.

In June 2022, ALPLA Group, Brink, and IPB Printing partnered with ENGEL to introduce K 2022, a quantum leap for the packaging industry. PET thin-walled containers can now be constructed for the first time in a single injection molding production step. The stand of the Austrian injection molding equipment company ENGEL processes recycled PET. This is accomplished using an ENGEL e-speed injection molding machine with a freshly created, incredibly potent injection unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Plastics from the Packaging Industry

- 4.4.2 Increasing Demand for Light Weight Components From the Automotive Sector is Fueling the Demand for Plastic Being Used

- 4.5 Market Restraints

- 4.5.1 Stricter Government Regulations toward Minimal Usage of Plastics

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Injection Molding Machinery

- 5.1.2 Blow Molding Machinery

- 5.1.3 Extrusion Machinery

- 5.1.4 Thermoforming Machinery

- 5.1.5 3D Plastic Printers

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Consumer Products

- 5.2.3 Construction

- 5.2.4 Automotive

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 KraussMaffei Group (ChemChina)

- 6.1.2 Brown Machine Group

- 6.1.3 Haitian International Holdings Limited

- 6.1.4 Engel Austria GmbH

- 6.1.5 Kautex Maschinenbau GmbH

- 6.1.6 Graham Engineering Corporation

- 6.1.7 Gurucharan Industries

- 6.1.8 Milacron LLC (Hillenbrand Inc.)

- 6.1.9 The Japan Steel Works Ltd

- 6.1.10 Sumitomo Heavy Industries

- 6.1.11 Arburg GmbH + Co KG

- 6.1.12 Husky Injection Molding Systems Ltd