|

市場調査レポート

商品コード

1406065

包装用コーティング添加剤:市場シェア分析、産業動向と統計、2024年~2029年の成長予測Packaging Coating Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 包装用コーティング添加剤:市場シェア分析、産業動向と統計、2024年~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

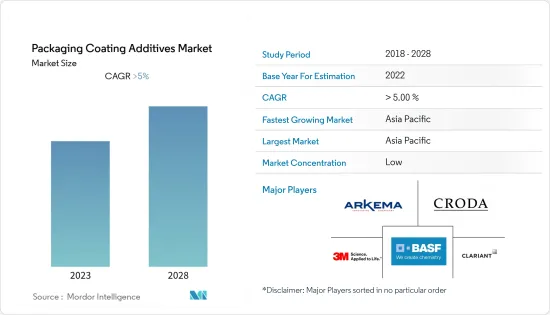

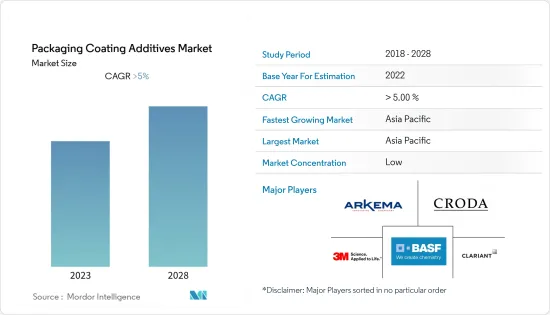

包装用コーティング添加剤の市場規模は2024年に8億2,000万米ドルと推定され、2029年には10億1,000万米ドルに達すると予測され、予測期間中(2024年~2029年)のCAGRは5%以上で成長する見込みです。

COVID-19の大流行は包装用コーティング添加剤市場を混乱させ、世界のサプライチェーンの混乱と政府の規制により、販売、生産、流通の減少を引き起こしました。しかし、多くの経済が平常に戻りつつあることから、市場はパンデミック以前の段階に向かって成長しているように見えます。

産業用パッケージングにおける需要の増加や、飲食品パッケージング用途における防曇・抗菌添加剤の需要拡大が、市場の成長を後押しすると予想されます。

反面、プラスチックの使用に関する政府の厳しい政策や原材料価格の変動が市場の成長を妨げています。

柔軟なコーティング添加剤に対する需要の高まりと、新興国だけでなく先進国でもeコマースの動向は、市場の成長に十分な機会を提供すると予想されます。

アジア太平洋地域は、中国、インド、日本といった国々からの莫大な消費量で世界市場を独占しています。

包装用コーティング添加剤の市場動向

飲食品包装セグメントからの需要増加。

- 包装材料は摩擦や化学的安定性などの問題を抱えやすいです。包装用コーティング材料の性能を向上させるため、pH安定性を高め、表面の摩擦をなくし、包装食品に抗菌性を誘発する添加剤が加えられています。

- 可処分所得の増加や消費者の多忙なライフスタイルにより、包装食品や加工食品の消費量は世界的に増加しており、これが包装用コーティング剤の需要を刺激するため、包装用コーティング添加剤市場が拡大します。

- 包装食品や加工食品の販売増加は、食品の腐敗や漏れを防止し、包装食品の耐用年数を延ばすのに役立つため、包装コーティング添加剤の需要拡大に役立ちます。

- さらに、防曇包装コーティング添加剤の使用は、包装コーティングの透明性と透視性を維持し、食品を顧客に見えるようにするため、包装食品の売上増加に役立ちます。

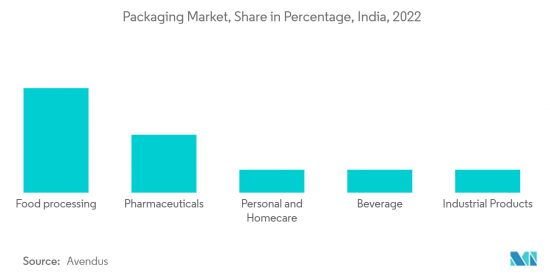

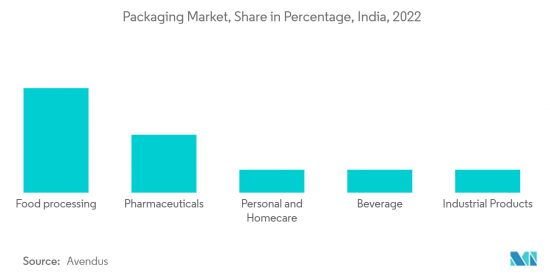

- インベスト・インディアによると、2025~2026年までに5,350億米ドルの生産高が見込まれるインドの急成長する食品加工部門は、インドの食品・飲料包装業界の著しい成長を牽引しており、2029年には年間成長率14.8%に後押しされて860億米ドルに達すると予測されています。この成長は、食品包装に不可欠な部品である包装用接着剤とコーティング用接着剤の需要を促進しています。

- 消費者の習慣の変化により、米国の飲料業界は大幅な成長を遂げています。PMMIの飲料レポートによると、北米の飲料産業は2018年から2028年にかけて4.5%の成長が見込まれています。北米における飲料販売の大部分は、米国で売り手が達成しています。

- 前述の要因から、包装用コーティング添加剤市場は予測期間中に急成長が見込まれています。

市場を独占するアジア太平洋地域

- 予測期間中、アジア太平洋地域が包装用コーティング添加剤市場を独占すると予想されます。中国やインドのような国々では、中間層の所得が大幅に上昇し、包装食品の需要が増加しているため、同地域では包装用コーティング添加剤のニーズが高まっています。

- eコマースの成長は、同地域の包装コーティング産業、ひいては包装コーティング添加剤市場に有利な機会をもたらすと期待されています。中でも飲食品包装分野は急成長しています。

- eコマース市場では中国が最大のシェアを占めており、eコマース全体の売上の30%以上を占めています。

- 持続可能性が重視されるようになり、紙器メーカーは特に乳製品分野で革新的なパッケージング・ソリューションの導入を促しています。2022年3月、SIG India社はインドで高まる紙パック入り乳製品の需要に対応するため、アルミニウムを使用しない無菌紙パックを発売しました。

- 持続可能な包装に向けた重要な一歩として、ITC LimitedのYippee!ブランドは2023年2月、廃棄されたYiPPee!ラップトップ・スリーブ、トートバッグ、ステーショナリー・ポーチなど、環境に優しいライフスタイル製品に生まれ変わらせる。

- 上記の要因が政府の支援と相まって、包装用コーティング添加剤市場の成長を後押ししています。

包装用コーティング添加剤産業の概要

包装用コーティング添加剤市場は、その性質上非常に細分化されています。主要企業(順不同)には、Croda International Plc、BASF SE、Arkema、3M、CLARIANTなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の成果

- 調査の前提

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 飲食品包装の需要拡大

- 工業用包装における需要の増加

- その他の促進要因

- 抑制要因

- プラスチックの使用に関する政府の厳しい政策

- 原材料価格の変動

- 業界のバリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(市場規模)

- 剤形

- 水性

- 溶剤ベース

- 粉末ベース

- 機能性

- 滑り

- 帯電防止

- 防曇

- 抗菌

- アンチブロック

- 用途

- 飲食品

- 工業用

- ヘルスケア

- 消費財

- その他の用途(栄養補助食品)

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- 3M

- Ampacet Corporation

- Arkema

- BASF SE

- BYK Group(ALTANA)

- CLARIANT

- Croda International Plc

- DAIKIN INDUSTRIES, Ltd.

- DIC CORPORATION

- Evonik Industries AG

- Lonza

- PCC Group

- Solvay

第7章 市場機会と今後の動向

- フレキシブルコーティング添加剤に対する需要の高まり

- eコマースの動向拡大

The Packaging Coating Additives Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 1.01 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the packaging coating additives market, causing declines in sales, production, and distribution due to global supply chain disruptions and government restrictions. However, the market is seemingly growing towards its pre-pandemic stages as many economies are returning to normalcy.

Increasing demand in industrial packaging and growing demand for anti-fog and anti-microbial additives in food and beverage packaging applications are expected to fuel the market growth.

On the flip side, strict government policies regarding the use of plastics and fluctuation in raw material prices are hindering the growth of the market.

Rising demand for flexible coating additives and growing trends for e-commerce in developing as well as developed countries are expected to offer ample opportunities for the growth of the market.

Asia-Pacific dominated the global market's most significant enormous consumption from countries such as China, India, and Japan.

Packaging Coating Additives Market Trends

Increasing Demand from Food and Beverages Packaging Segment.

- Packaging Materials are prone to problems such as friction and chemical stability. To improve the performance of packaging coating materials, additives are added, which increase the pH stability, make the surface frictionless, and induce anti-microbial properties to the packaged food items.

- Packaged and processed foods consumption is increasing globally owing to increasing disposable income and the hectic lifestyle of consumers, which will help stimulate the demand for packaging coatings, thus enhancing the market for packaging coating additives.

- Increasing sales of packaged and processed foods will help in increasing the demand for packaging coating additives as they help in preventing food spoiling & leakage and also help in increasing the serviceable life of packaged food items.

- Furthermore, the use of antifog packaging coating additive helps to increase the sales of packaged food items as antifog additives helps to maintain the clarity and transparency of packaged coatings, thus making food items visible to the customer.

- According to Invest India, India's burgeoning food processing sector, with an anticipated output of USD 535 billion by 2025-2026, is driving significant growth in the Indian food and beverage packaging industry, which is projected to reach USD 86 billion in 2029, fueled by an annual growth rate of 14.8%. This growth fuels the demand for packaging and coating adhesives, essential food packaging components.

- Due to the changing consumer habits, the beverage industry in the United States has noticed substantial growth. According to PMMI's Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Sellers achieve the major portion of the beverage sales in North America in the United States.

- Owing to the aforementioned factors, the packaging coating additives market is expected to grow rapidly during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for packaging coating additives during the forecast period. In countries like China and India, due to the significant rise in the income of the middle-class population and the increasing demand for packaged foods, the need for packaging coating additives has been increasing in the region.

- Growth in e-commerce is expected to provide lucrative opportunities for the packaging coatings industry and, consequently, for the packaging coating additives market in the region. The food and beverage packaging segment is the fastest-growing among them.

- China holds the largest share in the e-commerce market, accounting for more than 30% of the total e-commerce sales.

- The growing emphasis on sustainability prompts folding carton manufacturers to introduce innovative packaging solutions, particularly in the dairy segment. In March 2022, SIG India launched an aluminum-free folding carton aseptic packaging to cater to the rising demand for carton-packaged milk products in India.

- In a significant step towards sustainable packaging, ITC Limited's Yippee! The brand introduced "Terra By YiPPee!" in February 2023, a waste upcycling initiative that transforms discarded YiPPee! Wrappers into eco-friendly lifestyle products, including laptop sleeves, totes, and stationery pouches.

- The above factors, coupled with government support, have fueled the growth of the packaging coating additives market.

Packaging Coating Additives Industry Overview

The packaging coating additives market is highly fragmented in nature. The major players (not in any particular order) include Croda International Plc, BASF SE, Arkema, 3M, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in Food & Beverages Packaging

- 4.1.2 Increasing Demand in Industrial Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Government Policies Regarding the Use of Plastics

- 4.2.2 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Formulation

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Powder-based

- 5.2 Function

- 5.2.1 Slip

- 5.2.2 Anti-static

- 5.2.3 Anti-fog

- 5.2.4 Antimicrobial

- 5.2.5 Anti-block

- 5.3 Application

- 5.3.1 Food and Beverage

- 5.3.2 Industrial

- 5.3.3 Healthcare

- 5.3.4 Consumer Goods

- 5.3.5 Other Applications (Nutraceuticals)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ampacet Corporation

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 BYK Group (ALTANA)

- 6.4.6 CLARIANT

- 6.4.7 Croda International Plc

- 6.4.8 DAIKIN INDUSTRIES, Ltd.

- 6.4.9 DIC CORPORATION

- 6.4.10 Evonik Industries AG

- 6.4.11 Lonza

- 6.4.12 PCC Group

- 6.4.13 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Flexible Coating additives

- 7.2 Growing Trend for E-commerce