|

市場調査レポート

商品コード

1642176

スマートホスピタル:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Smart Hospital - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートホスピタル:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

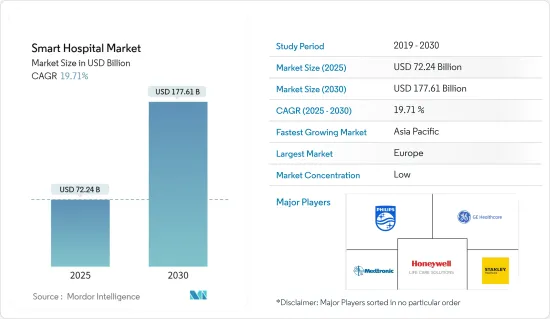

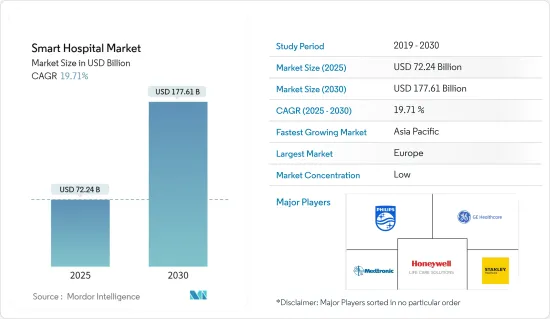

スマートホスピタルの市場規模は2025年に722億4,000万米ドルと推定され、予測期間中(2025~2030年)のCAGRは19.71%で、2030年には1,776億1,000万米ドルに達すると予測されます。

モノのインターネット(IoT)動向の高まりは、ヘルスケア提供サービスをかつてないペースで変革し続けています。接続された医療機器は患者の安全性と効率を高めています。こうした技術が医療機関のエコシステム全体に適用されれば、それは"スマートホスピタル"となります。

主なハイライト

- 高額な投資が必要なため、世界中の病院はこうした技術や手法の導入に消極的でした。しかし、技術コストが低下し、デジタル接続ソリューションの重要性を示す使用事例が急速に開発されていることから、今日の病院はデジタル接続ソリューションの採用を余儀なくされています。こうした技術的変化は、人員管理、資産追跡、スケジューリングをデジタル化し、業務効率を向上させることで、病院にも利益をもたらすと思われます。

- 多くの地域で高齢化が進み、長期的な慢性疾患患者が増加しているため、遠隔患者モニタリング・ソリューションに対する需要が高まっています。これが市場の成長に大きな影響を与えています。病院管理者には、患者ケアの水準を継続的に向上させながらコストを削減するよう常にプレッシャーがかかっています。病院は、より効率的に運営し、患者のケアをサポートし、患者の体験を改善するために、ワイヤレス技術に目を向けています。

- 例えば、看護スタッフのワークフローをよりよく理解し、強化するために、病院は看護師のIDバッジに病院のWi-Fiネットワークと連動するRFIDタグを装備しています。これらのタグは、シフトを通じて看護師の動きを追跡します。データは取得され、分析され、病院がどのように手順をアップグレードするかについての洞察を提供します。

- ワイヤレスRFID技術によって、病院は重要な機器の位置や機器の状態をリアルタイムで追跡することもできます。このワイヤレス技術を採用することで、フロリダのシャンズ病院では、紛失した物品の捜索に費やす時間が98.8%削減されました。

- COVID-19の大流行は、病院のキャパシティを超えました。しかし、危機への対応は革新を促すものでもあった。社会的な距離を保ち、酷使された労働者を最も有意義に活用することが要求されたため、デジタル化の進展が加速したのです。

スマートホスピタル市場の動向

ソフトウェア・セグメントは大幅な成長が見込まれる

- 病院スタッフにとって最も困難な課題のひとつに、患者の待ち時間短縮があります。さまざまなソフトウェアを導入することで、ワークフローを最適化し、患者ケアを向上させ、スタッフの燃え尽きを減らすことができます。そのためベンダーは、病院の効率を高めるソフトウェアやソリューションの開発に注力しています。

- AI、3Dレンダリング、クラウドベースの技術は、医療機器業界の喫緊の課題に対するデジタルソリューションです。これらは予測期間中に導入可能です。近い将来、多くの医療機器メーカーがこのようなデジタルソリューションを導入すると思われます。これらの技術は、決して労働者に取って代わるものではないが、医療従事者が労働力と連携して活動するのに役立つと思われます。

- 調査された市場では、戦略的投資、買収、製品革新を目の当たりにしています。例えば、2022年7月、ドイツ北西部のエッセン大学病院は、臨床ケアにAIを導入するためにエヌビディアとの協業を発表しました。この協業は、効率性を強化し、医療の意思決定プロセスに新たなデータ次元を追加することを目的としていました。

- 米国立衛生研究所によると、臨床医が時間の35%を文書作成に費やす一方で、患者ケアに費やされるのはわずか19%だといいます。したがって、スマートプラットフォームは、医師が患者により良いサービスを提供するのに役立つと期待されています。

- 例えば、ハミルトン・ヘルス・サイエンス(HHS)では、ThoughtWireのEarlyWarningを利用することで、コードブルー(心停止の危険を知らせるコール)が61%減少しました。EarlyWarningアプリケーションは、医療システムの最大の課題である医療費の高騰、臨床医の燃え尽き症候群、データの迅速な運用ができないこと、データのサイロ化などにも対応しています。このようなアプリケーションが市場を押し上げると期待されています。

欧州が最大の市場シェアを占める

- ドイツ、英国、スウェーデン、オランダなどの欧州諸国は、次世代医療情報学アプリケーションを導入し、スマート病院を構築するための高度なインフラを有しています。これらの国々では、スマート医療サービスのためにAIを使用し、IoTを使用してデバイスを接続し、患者データを転送して健康リスクを低減しています。

- 企業、消費者、労働者が幅広く関与する英国におけるインダストリー4.0の迅速な導入は、同国にとって革命的な一歩であり、スマート病院の発展につながります。

- Brexitシナリオのためにいくつかの規制上の制約が課されたもの、欧州はスマートデバイスのトップメーカーの1つになることができました。また、主に以前から計画されていたプロジェクトの開始により、ヘルスケア分野への投資が着実に行われていることも、調査対象市場にチャンスをもたらすと期待されています。

- この地域の多くの企業は、医療モノのインターネット(IoMT)などの技術の導入を目の当たりにしており、これは確立されたヘルスケア産業を推進すると期待されています。例えば、2021年10月、Royal Philipsは、統合と相互運用性を可能にする新しいデバイスドライバのリリースにより、Philips Capsule Medical Device Information Platform(MDIP)が1,000以上のユニークな医療機器モデルを統合するというマイルストーンを超えたと発表しました。

スマートホスピタル業界の概要

スマートホスピタル市場は、主要企業によって適度に断片化されています。これらのプレーヤーには、Koninklijke Philips NV、GEヘルスケア、Medtronic PLC、Honeywell Life Care Solutions、Stanleyヘルスケアなどが含まれます。激しい競争を維持するために、各社が採用する主要な成長戦略には、製品の発売、研究開発費の高騰、提携や買収などがあります。

2022年7月、GEヘルスケアは同社初の5Gイノベーションラボを開設しました。このラボは、5Gや人工知能、拡張知能、仮想現実、高度な視覚化などのスマートソリューションを採用し、画像転送や遠隔画像診断を効率化することで、ヘルスケアソリューションを開発することを目的としていました。同社はまた、さまざまな学界、産業界の研究者、新興企業とのコラボレーションを促進し、将来対応可能なソリューションを共同開発することも可能にしました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- 産業バリューチェーン分析

- COVID-19の市場への影響評価

- 市場促進要因

- ヘルスケアインフラの近代化がスマート病院の需要を後押し

- 病院におけるコネクテッドデバイスと機器の普及拡大

- 市場抑制要因

- コネクテッドシステムの高コスト

- 技術開発

- 新たな使用事例

- 主な規制枠組み

第5章 技術スナップショット

- スマートホスピタルの展望

- 遠隔医療システム

- ネットワーク医療機器

- モバイル機器

- ウェアラブル外部機器

- インプラント機器

- 据置型機器

- 支援ロボット

- 識別システム

- 生体認証スキャナー

- RFIDシステム

- その他の識別システム

- 臨床情報システム

- 病院情報システム

- 検査情報システム

- その他臨床情報システム

第6章 市場セグメンテーション

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- 用途別

- 電子カルテ

- 遠隔患者モニタリング

- 薬局オートメーション

- 医療資産追跡

- その他の用途

- 地域別

- 北米

- 欧州

- アジア太平洋

- 世界のその他の地域

第7章 競合情勢

- 企業プロファイル

- Koninklijke Philips NV

- GE Healthcare(General Electric)

- Medtronic PLC

- Honeywell Life Care Solutions(Honeywell International Inc.)

- Stanley Healthcare

- SAP SE

- Microsoft Corporation

- Allscripts Healthcare Solutions Inc.

- Cerner Corporation

- McKesson Corporation

- Schneider Electric Healthcare

- ThoughtWire Corp.

第8章 投資分析

第9章 将来の機会

The Smart Hospital Market size is estimated at USD 72.24 billion in 2025, and is expected to reach USD 177.61 billion by 2030, at a CAGR of 19.71% during the forecast period (2025-2030).

The rising trend of the Internet of Things (IoT) continues to transform healthcare delivery services at an unprecedented pace. Connected medical devices are increasing patient safety and efficiency. When such technologies apply to the complete healthcare organization ecosystem, it becomes a "Smart Hospital."

Key Highlights

- Due to the high investments involved, hospitals worldwide have been reluctant to adopt these technologies and practices. However, with the diminishing cost of technology and in the light of fast-developing use cases that show the importance of digital connectivity solutions, hospitals today are being forced to embrace them. These technological changes will also benefit hospitals by digitizing personnel management, asset tracking, and scheduling for better operational efficiency.

- Owing to the rise in the aging population and long-term chronic disease conditions in many regions, there is an increasing demand for remote patient monitoring solutions. This is a significant factor impacting the market's growth. There is constant pressure on hospital administrators to lower costs while continuing to improve the standard of patient care. Hospitals are turning to wireless technologies to operate more efficiently, support patient care, and improve their experiences.

- For instance, to better understand and enhance the workflow of nursing staff, hospitals are equipping nurse ID badges with an RFID tag that works with the hospital's Wi-Fi network. These tags track the movement of the nurses throughout their shifts. The data is captured and analyzed, providing insights to the hospitals on how to upgrade their procedures.

- The wireless RFID technology also allows hospitals to track the real-time location of critical equipment and the condition of the equipment. By adopting this wireless technology, the Shands hospital in Florida experienced a 98.8% reduction in the hours spent searching for missing items.

- The COVID-19 pandemic had pushed hospitals beyond their capacity. Yet, the response to the crisis also encouraged innovation. Progressing digital transition was sped up by the requirement to maintain social distance and make the most meaningful use of overworked workers.

Smart Hospital Market Trends

Software Segment is Expected to Show Significant Growth

- One of the most challenging tasks for the hospital's staff includes reducing the wait time for any patient. Implementing various software would help optimize workflows, improve patient care, and reduce staff burnout. Therefore, vendors are focusing on developing software and solutions to enhance hospitals' efficiency.

- AI, 3-D rendering, and cloud-based technology are digital solutions to the medical device industry's most pressing issues. They can be implemented during the forecast period. Many medical device organizations will take up such digital solutions in the near future. These technologies will not replace workers by any measure but will help medical workers operate in conjunction with the workforce.

- The market studied is witnessing strategic investments, acquisitions, and product innovation. For instance, in July 2022, the University Hospital Essen in Northwestern Germany announced a collaboration with NVIDIA to implement AI in clinical care. The collaboration aimed to bolster efficiency and add new data dimensions for the medical decision-making process.

- According to the National Institutes of Health, while clinicians spend 35% of their time on documentation, only 19% of it is spent on patient care. Therefore, smart platforms are expected to help doctors serve patients much better.

- For instance, Hamilton Health Sciences (HHS) witnessed a 61 % reduction in code blues (calls signaling the risk of a cardiac arrest) with the help of ThoughtWire's EarlyWarning. The EarlyWarning application also addresses some of the biggest challenges for health systems, which include the rising cost of healthcare, clinician burnout, the inability to operationalize data quickly, disconnected data silos, etc. Such applications are expected to boost the market.

Europe Occupies the Largest Market Share

- European countries, such as Germany, the United Kingdom, Sweden, and the Netherlands, have advanced infrastructure to deploy next-generation health informatics applications and build smart hospitals. These countries use AI for smart medical services, and IoT to connect devices to transfer patient data and reduce health risks.

- With wide-scale involvement for businesses, consumers, and workers, the rapid implementation of Industry 4.0 in the United Kingdom is a revolutionary step for the country, thereby leading to the development of smart hospitals.

- While several regulatory constraints were posed due to the Brexit scenario, Europe has managed to be one of the top smart device manufacturers. Also, the steady flow of investments into the healthcare sector, primarily due to starting projects previously in the pipeline, is expected to create opportunities for the market studied.

- Many companies in the region are witnessing the introduction of technologies, such as Internet of Medical Things (IoMT), which is expected to propel the well-established healthcare industry. For instance, in October 2021, Royal Philips announced that with the release of its new device drivers that enable integration and interoperability, Philips Capsule Medical Device Information Platform (MDIP) exceeded the milestone of integrating more than 1,000 unique medical device models.

Smart Hospital Industry Overview

The Smart Hospital market is moderately fragmented because of the major players. These players include Koninklijke Philips NV, GE Healthcare, Medtronic PLC, Honeywell Life Care Solutions, and Stanley Healthcare. To sustain intense competition, some prime growth strategies that the companies adopt are product launches, high expenses on research and development, partnerships and acquisitions, etc.

In July 2022, GE Healthcare inaugurated the company's first 5G innovation lab. The lab aimed at developing healthcare solutions by employing 5G and other smart solutions, such as artificial intelligence, augmented and virtual reality, and advanced visualization to streamline image transfers and teleradiology. It also enabled the company to foster collaborations with various academia, industry researchers, and startups to co-create future-ready solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment Of The Impact Of COVID-19 On The Market

- 4.5 Market Drivers

- 4.5.1 Modernization of Healthcare Infrastructure is Boosting the Demand for Smart Hospitals

- 4.5.2 Increasing Penetration of Connected Devices and Instruments in Hospitals

- 4.6 Market Restraints

- 4.6.1 High Cost of Connected Systems

- 4.7 Technology Development

- 4.8 Emerging Use-cases

- 4.9 Key Regulatory Frameworks

5 TECHNOLOGY SNAPSHOT

- 5.1 Smart Hospital Landscape

- 5.1.1 Remote Care System

- 5.1.2 Networked Medical Devices

- 5.1.2.1 Mobile Devices

- 5.1.2.2 Wearable External Devices

- 5.1.2.3 Implantable Devices

- 5.1.2.4 Stationary Devices

- 5.1.2.5 Assistive Robots

- 5.1.3 Identification Systems

- 5.1.3.1 Biometric Scanners

- 5.1.3.2 RFID Systems

- 5.1.3.3 Other Identification Systems

- 5.1.4 Interconnected Clinical Information Systems

- 5.1.4.1 Hospital Information Systems

- 5.1.4.2 Laboratory Information Systems

- 5.1.4.3 Other Interconnected Clinical Information Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Application

- 6.2.1 Electronic Health Record

- 6.2.2 Remote Patient Monitoring

- 6.2.3 Pharmacy Automation

- 6.2.4 Medical Asset Tracking

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips NV

- 7.1.2 GE Healthcare ( General Electric)

- 7.1.3 Medtronic PLC

- 7.1.4 Honeywell Life Care Solutions ( Honeywell International Inc.)

- 7.1.5 Stanley Healthcare

- 7.1.6 SAP SE

- 7.1.7 Microsoft Corporation

- 7.1.8 Allscripts Healthcare Solutions Inc.

- 7.1.9 Cerner Corporation

- 7.1.10 McKesson Corporation

- 7.1.11 Schneider Electric Healthcare

- 7.1.12 ThoughtWire Corp.