|

市場調査レポート

商品コード

1851105

ハイパースケールデータセンター:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Hyperscale Datacenter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハイパースケールデータセンター:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月21日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

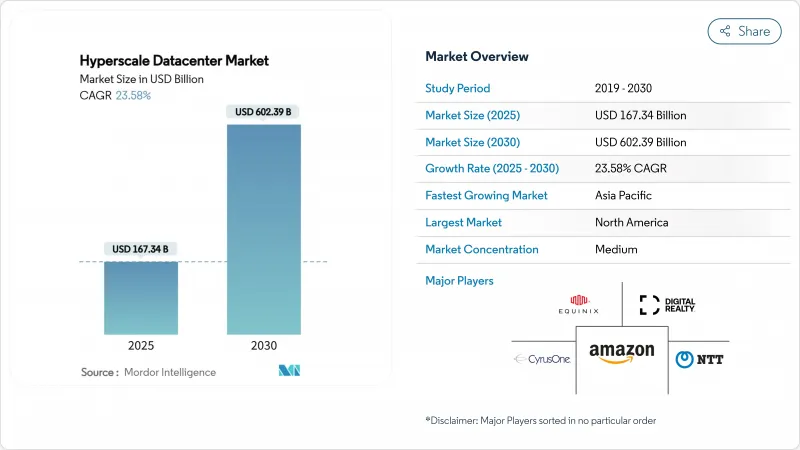

ハイパースケールデータセンター市場の2025年の市場規模は1,673億4,000万米ドル、2030年には6,023億9,000万米ドルに達すると予測され、CAGRは23.58%と堅調に推移します。

規模の経済性、AIを中心としたハードウェア需要、ソブリン・クラウド規制が設備設計を再構築しており、GPUラックの電力密度は日常的に50kWを超えています。欧州とアジア太平洋地域では、主要なフィンテック・ハブにおけるリアルタイム決済の義務化と相まって、新規容量の年間3GWを超える建設パイプラインが維持されています。オペレーターは、空冷からチップに直接冷却する液冷に軸足を移しつつあり、オランダとシンガポールでは規制による熱税が導入され、炭素を考慮した立地選定への関心が高まっています。シリコン不足とユーティリティのリードタイムが長期化する中、戦略的なランドバンキングと複数年のGPU供給契約が決定的な競争力となっています。

世界のハイパースケールデータセンター市場の動向と洞察

米国と中国で50kW以上のラックを必要とするGPU中心のAI/MLワークロードが爆発的に増加

AIトレーニング・クラスターは施設レイアウトを再構築しており、グーグルはすでに±400 VDCの電力を消費する1 MWラックを導入しています。メンフィスにあるxAIの20万GPUキャンパスは、変革の規模を浮き彫りにしており、データセンターチームは、配電、ネットワーク・ファブリック、液冷ループを、レガシー・サーバーよりも160%もエネルギー消費量の多いラックを中心に再設計する必要に迫られています。米国と中国は、支援的なAI資金調達エコシステムと俊敏な許可フレームワークのおかげで、その展開を支配しています。

欧州におけるハイパースケール・クラウド・プロバイダーの主権クラウド展開

欧州のデータ居住法では「EU限定」の運用管理が義務付けられているため、AWSは2040年までにドイツのソブリン・クラウドに78億ユーロ(85億米ドル)を投資します。ドイツテレコムの「8ra」構想は、1万台のエッジノードを目標としており、米国のクラウドスタックへの依存度を下げようという地元の既存企業の意向を示しています。ソブリン・モデルはコンプライアンスにとどまらず、自国のAI研究開発を促進し、地域のハードウェア・サプライチェーンを活性化します。フランスではOrangeとCapgeminiのBleuプラットフォームを通じて既にその勢いが見られ、中東やAPACの一部でも同様の要件が求められることを予感させる。

米国西部とスペインにおける蒸発式冷房の水使用制限

カリフォルニア州の規制当局は現在、水の使用量を削減する冷媒ベースのシステムを義務付けており、設備投資を最大20%増加させています。アリゾナ州では、1MWの施設が年間675万ガロンを消費すると報告されており、データセンターは農業や住宅と並んで監視下に置かれています。スペインの干ばつも同様の規制の引き金となり、デベロッパーは海水淡水化パイプラインのある沿岸部の区画か、閉鎖型ループ液冷を使った内陸部のキャンパスへと舵を切っています。

セグメント分析

アマゾンの1,500億米ドルの複数年ロードマップのような資本集約的なプログラムに乗り、セルフビルド事業者が2024年のハイパースケールデータセンター市場シェアの70.2%を占める。設計をコントロールすることで、AIクラスター向けに調整された特注のパワートレインや独自のネットワークファブリックが可能になります。しかし、ハイパースケール・コロケーションのCAGRは25.6%になると予測されており、新しい地域では市場投入スピードが資産管理に勝るため、所有権格差は縮小します。

コロケーション・プロバイダーは事前に土地と電力を確保し、12ヶ月のリードタイムでモジュラースイートを提供することで、クラウド参入企業の稼働率向上を加速させています。ヴァンテージの92億米ドルの増資は、このような事業拡大を下支えしており、長期的なハイパースケール契約に結びついた経常収益に対するプライベート・エクイティーの意欲を示しています。より多くのソブリン・クラウド契約がローカル・パートナーを規定しているため、コロケーションは新興市場で戦略的関連性を増しています。

このセグメントは、2024年のITインフラ購入によるハイパースケールデータセンター市場規模の48%を占め、GPU、DDR5メモリ、NVMeストレージがウォレットシェアを牽引します。30MWのリチウムイオンファームのような電気的バックアップシステムは現在、標準的な部品表に含まれています。ソフトウェアとサービスはCAGR 27.1%で上昇しており、電力とラック密度の向上をもたらすAI主導のリソースオーケストレーションに対する需要を反映しています。

マルチテナントのAIワークロードがリスクプロファイルを高める中、ゼロトラストフレームワークと統合されたセキュリティスタックがベースラインの監視ツールを上回る。予測期間中、ワークロードの自動配置は、既存の利用を最大化することにより、8~10GWの新規構築を延期すると予測されます。

地域別分析

北米が2024年のハイパースケールデータセンター市場の43.3%を占め、地域別では最大の売上高を記録しました。バージニア州の「データセンター・アレイ」だけで、昨年は2GWの新規変電所需要をクリアしたが、送電網の混雑は現在、アマゾンが複数のAI対応キャンパスに300億米ドルを投入しているオハイオ州、ペンシルベニア州、ノースカロライナ州に需要を誘導しています。電力会社の相互接続スケジュールは最長で7年かかるため、地域間の多様性戦略や、カーボンエクスポージャーをヘッジする再生可能エネルギー電力購入契約が促されています。

アジア太平洋は29.1%のCAGRが予測される明らかな成長エンジンです。日本は、AWSの2兆2,600億円(151億米ドル)の拡張を背景とした投資の中心であり、オラクルとNTTは国内のAIとゲームのワークロードに対応するために容量を追加しています。インドでは、税制優遇措置とデジタル公共財の枠組みにより、ムンバイからハイデラバードまでの全国的なハイパースケール回廊が推進されています。シンガポールは、一時的なモラトリアムにもかかわらず、サステナビリティ・スコアカードに基づく承認を再開し、ASEANのフィンテック・フローに対応する新たなTier IVパイプラインを確保しました。

欧州は、ソブリン・マンデートと北欧の再生可能エネルギーに支えられ、安定した資金流入を享受しています。ブルックフィールドの100億米ドルを投じたスウェーデンのキャンパスや、グーグルの6億ユーロ(6億5,000万米ドル)を投じたノルウェーの施設は、冷涼な気候とグリーン電力網がいかにPUEを1.15以下に抑えたかを示しています。オランダの熱税とダブリン周辺の電力上限は、供給規律を作り出し、事業者を大陸の第2級都市へと誘導しています。今後の成長は、環境制約と「デジタルの10年」のクラウド導入目標の調和にかかっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 米国と中国で50kW以上のラックを必要とするGPU中心のAI/MLワークロードの爆発が市場を牽引

- 欧州におけるハイパースケールクラウドプロバイダーの「Sovereign Cloud」展開が市場を牽引

- FinTechリアルタイム決済の義務化によりシンガポールとインドのTier IV需要が加速、市場を牽引

- 北欧とオセアニアで地域ハブ要件を生み出す5Gエッジコアの統合が市場を牽引

- 市場抑制要因

- 米国西部とスペインにおける蒸発冷却の水使用量規制

- ラックレベルの高密度化を阻むGPUサプライチェーンのボトルネック

- オランダ、シンガポール、ドイツにおける熱税と炭素税の上昇が市場を妨げる

- バリューチェーン分析

- 規制とコンプライアンスの展望

- 技術的展望(液冷、Direct-to-Chip、モジュールビルド)

- 市場のマクロ経済動向の評価

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測数値

- データセンタータイプ別

- エンタープライズ/ハイパースケール・セルフビルド

- ハイパースケール・コロケーション

- コンポーネント別

- ITインフラ

- 電気インフラ

- 機械および冷却インフラ

- ソフトウェアとサービス

- ティアスタンダード別

- ティアIII

- ティアIV

- エンドユーザー業界別

- クラウドサービスプロバイダー

- BFSI

- ソーシャルメディアとデジタルコンテンツ

- ヘルスケアとライフサイエンス

- 政府・公共部門

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- オランダ

- フランス

- アイルランド

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- シンガポール

- 日本

- オーストラリア

- インドネシア

- その他アジア太平洋地域

- 南米

- ブラジル

- チリ

- その他南米

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Digital Realty Trust, Inc.

- Equinix, Inc.

- CyrusOne Inc.

- NTT Ltd.

- Quality Technology Services(QTS)

- Vantage Data Centers LLC

- Amazon Web Services, Inc.

- Microsoft Corporation

- Alphabet Inc.(Google)

- Meta Platforms Inc.

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Baidu, Inc.

- Oracle Corporation

- International Business Machines Corp.

- Switch, Inc.

- STACK Infrastructure

- Flexential Corp.

- Iron Mountain Data Centers

- OVHcloud