|

市場調査レポート

商品コード

1851080

血友病:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Hemophilia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 血友病:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月15日

発行: Mordor Intelligence

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

概要

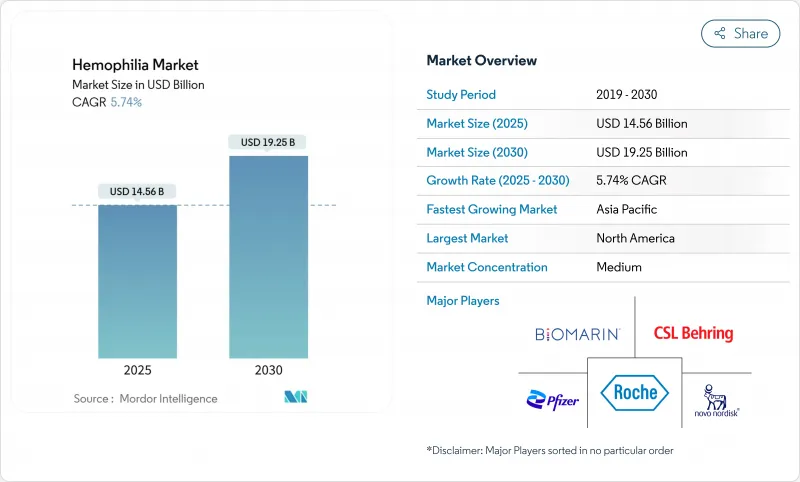

血友病市場規模は2025年に145億6,000万米ドルと評価され、2030年には192億5,000万米ドルに拡大し、期間中のCAGRは5.74%を記録すると予測されています。

診断の拡大、有利な償還、半減期延長(EHL)組換え因子や単回投与遺伝子治療などの革新的な選択肢の商業化が、血友病市場の展望を再形成しています。インヒビター患者に対する非因子薬の普及、メーカー間の競合激化、新生児スクリーニングプログラムの拡大も持続的な需要に寄与しています。主要なリスクは、遺伝子治療の耐久性に関する疑問、持続的な血漿採取不足、支払者の予算制約です。しかし、革新的な予防的アプローチによってもたらされる長期的なコスト・オフセットが支払者に認識されつつあることから、全体的な勢いは依然として前向きです。

世界の血友病市場の動向と洞察

診断有病率の上昇と平均余命の改善

血友病症例の特定は急増しており、新興国における検査能力の持続的な拡大により、2025年には世界の診断人口は約110万人に達します。中国は、2008年から2018年の間に平均診断遅延を13.3年から0.4年に短縮しており、改善のペースを示しています。CDCのサーベイランスでは、血友病治療センターを通じて管理される患者の死亡率が低下しています。構造化されたケアネットワークを持つ国々では、現在、ほぼ正常な平均余命が得られており、先進的治療に対する着実な需要が強化されています。

半減期延長(EHL)組換え因子の発売

ALTUVIIIOは週1回の投与を可能にし、標準的な因子と比較して輸液回数を半減させる。臨床データでは、使用者の65%が予防中の出血を経験しており、10年間の独占権を持つ欧州の承認が規制当局の信頼性を高めています。EHL因子はコールドチェーンの負担を軽減し、関節の転帰を改善し、アドヒアランスを強化する一方で、従来の製品に匹敵する外科的安全性を維持します。

高額な治療費と支払者の予算圧力

米国の年間治療費は患者一人当たり213,874米ドルから869,940米ドルであり、予算を圧迫しています。遺伝子治療は定価が350万米ドル近くとなり、審査が厳しくなっています。欧州では血漿の供給不足がインフレ圧力をさらに高め、中国の都市部の患者は可処分所得の30%を超える自己負担を強いられており、予防療法の普及を制限しています。ブラジルの年間支出額は患者1人当たり平均450,831米ドルで、2025年には全国で51億9,000万米ドルに達します。

セグメント分析

血友病Aは、男性出生5,000人に1人という高い有病率により、2024年の血友病市場シェアの75.12%を占めました。血友病Bは、第IX因子の長い半減期が遺伝子治療の持続的な有効性を支えているため、成長が加速しています。アンメットニーズ業界では、両サブタイプにまたがるアンメットニーズに対応する非因子薬の進歩が補完的であると見ています。

血友病Aの勢いは、ALTUVIIIOのようなEHL因子とエミシズマブのような非因子分子に由来し、これらは共にアドヒアランスと出血コントロールを改善します。血友病Bにおける並行するブレークスルーは、確立された因子集中が治療の柔軟性を維持する一方で、遺伝子治療のサクセスストーリーが投資を刺激するバランスの取れたパイプラインを創出します。血友病Cおよびその他の稀な第VII因子欠乏症は、小規模ではあるが臨床的に重要なセグメントであり、日本における第VII因子欠乏症の研究では、遺伝子組換え活性化第VII因子製剤による効果的な管理が実証され、45.7%の優れた止血効果と33.6%の有効な止血効果を達成しています。全体として、伝統的な治療法と先進的な治療法の融合は、より広範な市場においてダイナミックな競争を維持しています。

置換療法は2024年に92億3,000万米ドルとなり、血友病市場規模の63.41%を占めました。しかし、遺伝子治療は2030年までのCAGRが最も高く、若年層にアピールする単回注入による治癒の可能性に後押しされています。非因子予防薬は、医師がインヒビター患者をバイパス薬から簡便な皮下レジメンに移行させるにつれて急速に拡大します。

代替療法は、点滴頻度を下げるEHLの技術革新の恩恵を受け、遺伝子治療が拡大してもシェアは維持されます。逆に、支払者は生涯コストの相殺を重視しており、遺伝子治療は年間60万米ドルを超える予防薬代を相殺する可能性があります。非因子分子は選択肢をさらに多様化させ、各モダリティが明確な臨床ニーズを満たすマルチトラックアプローチを強化します。

地域分析

北米は、2024年の世界売上高の47.59%を占め、146の連邦政府出資の治療センターが52,000人以上の血友病患者を管理しています。強固な償還の枠組みには、遺伝子治療に対するメディケアの適用や、医薬品取得を助成する340Bプログラムなどがあります。CDCのCommunity Countsレジストリのデータは、134,000人のベストプラクティスガイドラインに反映され、新規薬剤のエビデンスに基づく採用を加速しています。CSLベーリングは、資金があるにもかかわらず、HEMGENIXの導入が予想より遅れていることを指摘し、高コストの治療薬に伴う微妙な意思決定の経路を示しています。

アジア太平洋地域は最も急速に拡大している地域であり、2025年から2030年のCAGRは6.88%と予測されています。中国は診断の遅れを0.4年に短縮し、償還の拡大に伴い年間因子消費量を増加させました。日本の彦星調査によれば、毎月の第VIII因子投与量は2005年から2019年の間に5倍に増加しており、積極的な予防の動向を反映しています。それにもかかわらず、中国の血友病A患者の3.2%しか予防薬にアクセスできておらず、財政的な格差が浮き彫りになっています。各地域のワーキンググループは、治療基準を調和させるために、国家登録と協調ケアプログラムを推進しています。

欧州は、成熟したインフラと先進的な償還を享受しているが、血漿不足に直面しています。欧州圏は血漿の約40%を米国から輸入しており、供給を安定させるために200万人の新規ドナーを求めています。中東・アフリカと南米は顕著なアクセス不足に直面しており、アフリカの症例のわずか8%しか診断されておらず、専門スタッフの不足が続いています。血液凝固因子の消費量は治療基準値を大きく下回っているため、アンメットニーズが維持されており、インフラと償還が改善されれば、これらの地域は将来の成長機会となります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 診断普及率の上昇と寿命の改善

- 半減期延長(EHL)組換え因子の上市

- 一回限りの遺伝子治療の商業的利用可能性

- 有利な償還制度と国家的な血友病プログラム

- インヒビター患者に対する非因子療法の拡大

- 精密投与分析を可能にする実世界登録

- 市場抑制要因

- 高い治療費と支払者の予算圧力

- 低・中所得国における医療アクセスの格差

- 単回投与遺伝子治療の耐久性ー不確実性

- 血漿採取不足によるPD製品供給の混乱

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 疾患タイプ別

- 血友病A

- 血友病B

- 血友病C &その他

- 療法別

- 代替療法

- 遺伝子療法

- 非因子療法

- 製品タイプ別

- 遺伝子組換え凝固因子濃縮製剤

- 血漿由来因子濃縮製剤

- バイパス&補助剤

- 治療環境別

- 予防

- オンデマンド

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 競合ベンチマーキング

- 市場シェア分析

- 企業プロファイル

- Bayer AG

- BioMarin Pharmaceutical Inc.

- Catalyst Biosciences Inc.

- CSL Ltd.(CSL Behring)

- F. Hoffmann-La Roche AG

- Freeline Therapeutics

- GC Pharma

- Grifols SA

- Kedrion SpA

- Medexus Pharmaceuticals Inc.

- Novo Nordisk A/S

- Octapharma AG

- OPKO Health Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sangamo Therapeutics

- Sanofi SA

- Silence Therapeutics plc

- Sobi AB

- Takeda Pharmaceutical Co. Ltd.

- uniQure NV