|

市場調査レポート

商品コード

1851078

遺伝子治療:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Gene Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 遺伝子治療:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月11日

発行: Mordor Intelligence

ページ情報: 英文 124 Pages

納期: 2~3営業日

|

概要

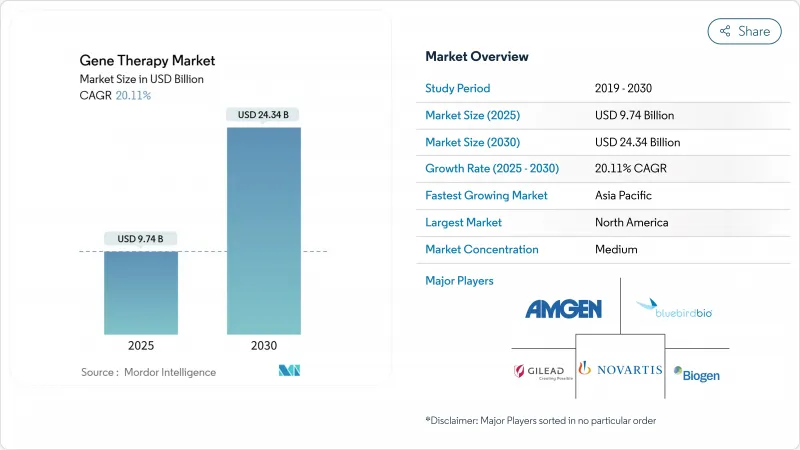

遺伝子治療市場規模は2025年に97億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは20.11%で、2030年には243億4,000万米ドルに達すると予測されます。

規制当局が2024年だけで9つの細胞・遺伝子治療薬を承認したことは、臨床的・商業的可能性に対する信頼が高まり、主要市場における償還経路が拡大することを示しています。バイオファーマやプライベートエクイティからの資金調達が活発化し、後期段階の資産が加速する一方、ウイルス性・非ウイルス性ともに製造能力が拡大し、サプライチェーンの摩擦が減少しています。生体内編集とベクター工学の急速な進歩は、治療範囲を希少疾患から有病率の高い疾患、特に神経学と眼科学に広げつつあります。アジア太平洋地域の二桁の臨床試験成長と北米の政策的インセンティブが相まって、製品価格の高騰と安全性監視要件がアクセス上の逆風となっても、多様な需要基盤が確保されます。

世界の遺伝子治療市場の動向と洞察

臨床的・商業的有用性を示す承認取得の増加

主要規制当局からの頻繁な承認取得により、開発リスクが軽減され、上市までの期間が短縮されています。FDAは2024年までに37の細胞・遺伝子製品を承認しているが、これはFDAの審査官が再生医療先進療法のような専用の枠組みを適用していることを示しています。2025年の劣性ジストロフィー性表皮水疱症に対するZEVASKYNの承認は、適応症が超希少疾患だけでなく、より広範な皮膚科領域へと拡大していることを例証しています。このような治療範囲の拡大は、遺伝子治療市場の複数年にわたる成長を支え、持続的な臨床的利益を期待する支払者からの後続投資を刺激します。

ベクター工学と生体内編集プラットフォームの絶え間ない技術進歩

強化されたカプシド・ライブラリー、機械学習による配列最適化、新規の脂質コンストラクトにより、組織向性は研ぎ澄まされ、免疫原性は低下しています。ペレルマン医科大学の研究者らは、生体内で数ヶ月間持続するDNA担持脂質ナノ粒子を報告し、慢性疾患に対する持続的投与を可能にしました。オルガノイド・プラットフォームは、FDA近代化法の非動物モデル容認に支えられ、トランスレーショナルな予測可能性を向上させるヒト組織特異的テストベッドを提供します。OpenCRISPR-1のようなAI支援アルゴリズムは、設計サイクルを短縮し、編集精度を向上させる。これらの技術革新が相まって、治療法の上限がより高く設定され、反復投与の余地が生まれ、臨床的成功と資本投入の好循環が促進され、遺伝子治療市場が拡大します。

高い治療薬価が生み出すアクセスと値ごろ感の障壁

単回投与による治療薬の定価は37万3,000米ドルから425万米ドルであり、支払者の予算を圧迫し、社会が根治療法に資金を提供する意欲が試されています。医療提供者は、社会的支援の格差、移動距離、事前承認のハードルを、アクセスを妨げる最大の要因として挙げています。アウトカムベースの契約、償却モデル、ワランティといった革新的な償還オプションが登場しつつあるが、複雑なデータ共有と長期フォローアップのインフラが必要です。メディケア&メディケイド・サービスセンターは、2025年にセル・アクセス・モデル(Cell and遺伝子治療Access Model)を立ち上げ、州レベルでのプール購入を奨励し、予算への影響を和らげようとしています。こうした財政的な逆風は、コストに敏感な地域での採用を抑制し、強力な臨床的価値提案にもかかわらず遺伝子治療市場の成長曲線を軟化させると予想されます。

セグメント分析

AAVベクターは、血友病や遺伝性網膜疾患に対する複数の承認製品を支える良好な安全性と持続的な導入遺伝子発現により、2024年の遺伝子治療市場シェアの38.54%を占めています。このリーダーシップは、広範な組織トロピズムと、特異性を向上させる遺伝子組換え血清型の拡大によって強化されています。しかし、非ウイルス性脂質ナノ粒子システムは、より大きな遺伝子ペイロードを運び、製造経済性を簡素化するため、2030年までのCAGRが24.34%になると予測され、最も急速に成長しています。このため、非ウイルス性プラットフォームの遺伝子治療市場規模は、現在の収益ギャップの一部を埋めることになります。レンチウイルスベクターは依然として生体外CAR-T製造の主力であるが、ヘルペスベースのシステムはそのペイロード容量からがん領域で支持を集めています。カプシドライブラリーと合成プロモーターの最適化が継続されることで、ウイルスベクターがコスト効率の高い非ウイルス性の課題者からシェアを守れるかどうかが決まる。

非ウイルス性アプローチの急増は、脂質成分が標準的な医薬品サプライチェーンに適合するため、原材料の制約も緩和します。数ヶ月間活性を維持するDNA搭載ナノ粒子は、反復投与の必要性を低下させ、臓器選択的取り込みのために調整することができます。このような柔軟性は、ペイロードサイズがAAVのパッケージング限界を超える多遺伝性神経疾患をターゲットとする開発者を惹きつける。その結果、市場競争力学はベクターの利用可能性から送達精度へとシフトし、プラットフォームにとらわれないCDMOが新たな需要を獲得する余地を生み出しています。

がん領域への応用は2024年の売上高の42.92%を占め、CAR-Tの着実な承認取得と固形がんを対象とした充実したパイプラインに支えられています。再発血液悪性腫瘍における完全奏効に関する確固たるエビデンスが、価格圧力にもかかわらず支払者の支持を維持しています。しかし、神経領域は2030年までのCAGRが25.62%と最も高い成長軌道を描いています。血液脳関門を通過するカプシドや正確な生体内編集ツールが登場し、レット症候群やハンチントン病などの疾患への直接的な介入が可能になりました。中枢神経系疾患に割り当てられる遺伝子治療市場規模は、二国間の規制インセンティブが開発リスクを圧縮するため、拡大すると予想されます。

希少な代謝性疾患と眼科領域は、組織免疫特権と明確なバイオマーカーが臨床エンドポイントを単純化するため、引き続き新たな承認が得られます。肥大型心筋症のような心血管疾患治療薬がベンチャー企業の資金を獲得しつつあることは、全身疾患治療薬がより広く受け入れられることを示唆しています。治療の幅が広がるにつれ、ポートフォリオの最適化が重要になります。スポンサーは、がん領域のキャッシュフローと、将来性は高いが科学的に複雑な神経領域の資産とのバランスを取る必要があります。

地域分析

北米は、2024年の世界売上高の41.78%を占め、規制環境の整備、ベンチャーキャピタルの潤沢な資金、広範な臨床インフラに支えられています。米国は、2024年だけで34のファースト・イン・クラスの遺伝子治療を承認しており、製品上市の順序決定における中心的役割を強調しています。ARPA-H助成金のような連邦政府のイニシアチブは、製造技術革新と安全性監視に多額の資金を注ぎ込み、遺伝子治療市場におけるこの地域のリーダーシップを強化しています。

欧州は強力な科学的アウトプットを維持し、画期的治療を促進するEMAの適応パスウェイの恩恵を受けています。2025年7月に施行される予定の分散型製造に関する英国の枠組みは、物流負担を軽減し、ポイント・オブ・ケアでの製造を刺激する可能性があります。2025年に施行されるEUの新しい医療技術評価規制は、エビデンス要件の調和を目指しているが、交渉が長期化する可能性もあります。英国とデンマークにおけるヘムジェニックス社との合意で実証されたように、アウトカムベースの支払いモデルは、導入のハードルを徐々に緩和しつつあります。

アジア太平洋地域はCAGR27.68%と最も速い成長を示しています。中国は400を超える細胞ベースの研究を実施し、国内ベクター工場に多額の投資を行っており、需要と供給の両方のエンジンとして位置づけられています。日本の再生医療のための加速パスウェイとシンガポールのデジタルライセンシングポータルは、さらに承認を合理化します。規制基準は欧米の機関に収斂しつつあるが、償還額の変動や遺伝子材料の輸出規制が課題として残っています。とはいえ、継続的な政策支援と成熟しつつある現地CDMOは、アジア太平洋地域が遺伝子治療市場で占める割合が高まることを確実にしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 臨床的・商業的可能性を示す承認数の増加

- ベクター工学と生体内編集プラットフォームの絶え間ない技術進歩

- グローバルなウイルス・ベクターおよび非ウイルス製造インフラの拡大

- 商業用AAV CDMOの生産能力の急速なスケールアップ

- 遺伝子治療研究開発へのバイオファーマとプライベートエクイティからの資金提供の増加

- 希少疾患遺伝子治療の拡大

- 市場抑制要因

- 高い治療薬価がアクセスや購入の障壁となる

- 製造の複雑さとGMPグレードベクターの供給制約

- 長期的なモニタリングを必要とする安全性への懸念

- GMPグレードのプラスミド/カプシド原料の不足がCMCのタイムラインを延長する

- 規制情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- ベクタータイプ別

- アデノウイルスベクター

- アデノ随伴ウイルスベクター

- レンチウイルスベクター

- レトロウイルスベクター

- ヘルペスウイルスベクター

- その他のベクタータイプ

- 適応症別

- 腫瘍学

- 希少代謝疾患

- 眼科

- 神経/中枢神経系

- 循環器および筋骨格

- その他の適応症

- デリバリーモード別

- In Vivo遺伝子デリバリー

- Ex Vivo遺伝子デリバリー

- エンドユーザー別

- 病院とクリニック

- 専門治療/輸液センター

- 学術研究機関

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Novartis AG

- Gilead Sciences Inc.

- F. Hoffmann-La Roche Ltd

- bluebird bio Inc.

- UniQure N.V.

- Amgen Inc.

- Biogen Inc.

- Astellas Pharma Inc.

- Sarepta Therapeutics Inc.

- Regenxbio Inc.

- Krystal Biotech Inc.

- Orchard Therapeutics plc

- Rocket Pharmaceuticals Inc.

- Editas Medicine Inc.

- Intellia Therapeutics Inc.

- Sangamo Therapeutics Inc.

- CSL Behring

- Mustang Bio Inc.

- Poseida Therapeutics Inc.

- Generation Bio Co.