|

市場調査レポート

商品コード

1687291

テレマティクス制御ユニット:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Telematics Control Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| テレマティクス制御ユニット:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 118 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

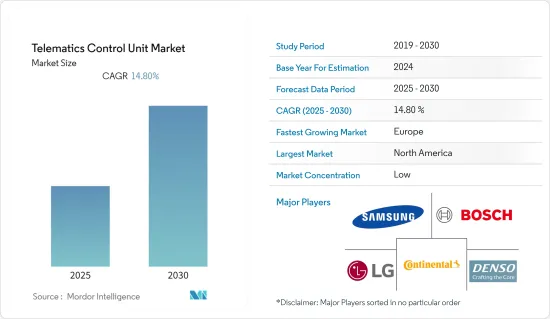

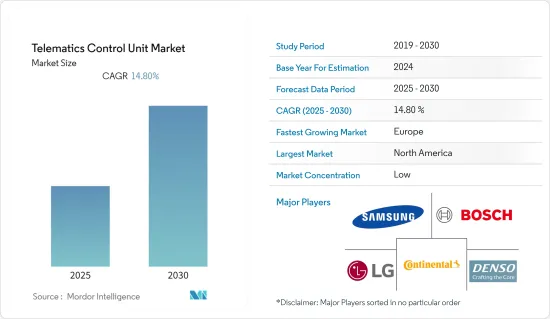

テレマティクス制御ユニット市場は予測期間中に14.8%のCAGRで推移する見込み。

テレマティクスは、自動車産業で採用されている通信システムで、無線ネットワークを介して自動車との間でやり取りされるデータに依存しています。自動車産業は、無線技術、位置情報技術、自動車エレクトロニクスを組み合わせることで、情報化時代に突入しています。

主要ハイライト

- データは自動車ユニットで生成され、バックオフィスシステムに通信されるか、バックオフィスシステムが地図、在庫更新、天気予報、インターネットデータパケットなどのデータを自動車ユニットにプッシュします。このやり取りは、携帯電話や車両に搭載されたユニットによって行われます。自動車は、携帯電話の電波塔と衛星技術のマトリックスを利用して通信し、その所在をマッピングします。この技術はテレマティクス制御ユニットに組み込まれ、制御されます。

- テレマティクス制御ユニットは最近、自動車産業において重要なコンポーネントとなっています。テレマティクス制御ユニット(TCU)の採用率は低いです。コネクテッドカーの概念はまだ初期段階にあり、コネクテッドカーを含む自動車会社はほとんどないです。しかし、5Gと自律走行車の出現により、コネクテッドカーの範囲は拡大する可能性が高いです。Appinventivによると、コネクテッドカーは世界の5Gモノのインターネットエンドポイント市場で最大のセグメントになると予想され、2023年末までに1,900万エンドポイントになると予測されています。

- テレマティクス制御ユニットは、車からクラウド、インフラ、または他の車両への通信を可能にする追加のモデムとプロセッサを導入することで、車両の接続性を高めています。また、電流センシング、診断、ノイズ除去の改善により、アンテナ電力の最適化を可能にします。また、車両運行のあらゆるコンポーネントのデジタル青写真を生成し、フリート管理者が事故防止やドライバーの安全規制の強化に適用できる箇所を評価できるようにします。さらに、テレマティクス制御ユニットは、使用時間情報の分析、保守点検の計画、保証回収、エンジン時間追跡、サービス記録追跡のメモを取ることによって、メンテナンスに役立てることができます。

- しかし、先進地域における認知度の低さ、新興国市場や後進地域における顧客の価格敏感度、テレマティクス制御ユニットに関連するサイバーセキュリティの脅威などの要因が、調査対象市場の成長に引き続き課題を投げかけています。さらに、テレマティクスソリューションに関する世界共通の規制枠組みがないことも、調査対象市場の成長に影響を与えています。

テレマティクス制御ユニット市場の動向

乗用車が市場を独占

- 乗用車は、(運転手を含め)8人以下の乗員を乗せる小型車、中型車、大型車に使用されます。乗用車に搭載されるテレマティクス制御ユニット(TCU)は、緊急サービス通知、盗難車追跡、リモート車両イモビライゼーションなど、さまざまな用途に使用できます。TCUは車両診断データを収集・送信し、遠隔モニタリング・分析を可能にします。これにより、予防保全、潜在的な問題の特定、全体的な車両性能の向上に役立てることができます。

- TCUは一般的に乗用車の車両管理システムに使用され、車両の位置、性能、使用状況をモニタリング・追跡します。これにより、ルーティングを最適化し、ドライバーの行動や車両全体の効率をモニタリングすることができます。また、保険会社に車両データを提供し、インフォテインメント接続、ナビゲーション、地図作成を強化します。

- 電気自動車の普及は、乗用車の需要拡大に寄与しています。政府や個人が持続可能性を優先するにつれ、よりクリーンな輸送手段へのシフトが進んでいます。例えばIEAによると、バッテリー電気自動車の世界販売台数は、2021年の約460万台から2022年には推定730万台に達します。2021年の販売台数は2020年の2倍以上となり、2022年には電気自動車販売台数の新記録を達成します。さらに、多くの国で中間層が増加した結果、購買力が高まり、乗用車に対する需要が高まっている

- OICA(国際自動車工業会)によると、2023年の乗用車販売台数は全世界で約6,530万台となり、前年比約11.3%増となりました。2023年には中国が約2,610万台で最大の地域自動車市場としてトップの座を占めました。

- 自動車産業では、乗用車の生産台数も増加しています。例えば、経済分析局(BEA)によると、2022年には米国で約180万台の自動車が生産されました。これは、2021年と比較して約13%の増加です。このような開発は、調査対象市場の成長を後押しすると考えられます。

北米が最大の市場シェアを占める

- 北米は、自動車部門と最新技術への投資の増加により、調査市場において重要な投資国と採用国のひとつとなっています。テレマティクス制御装置は、自動車部門における安全性、快適性、利便性を提供するために、さまざまな地域で使用されています。

- 米国は、自動車OEMの存在感が大きいこと、一般的な自動車購入者の技術意識が高いこと、自動車におけるインフォテインメントとテレマティクスの嗜好性、4G/5Gの普及、同国における電気自動車、コネクテッドカー、自律走行車の販売増加などにより、同地域におけるコネクテッドカーの重要な市場になると予想されます。

- KBBによると、2023年第1四半期には米国で25万8,900台弱のバッテリー電気自動車が販売されました。この前年同期比の増加率は、2022年第1四半期に記録された販売台数と比較して約44.9%でした。

- 産業大手による研究開発投資の増加、インターネット普及率の上昇、データコストの低下、5Gの利用可能性、自動車の機械的仕様よりも接続機能を好む顧客の増加、電気自動車や自律走行車の販売のピークが、自動車と輸送産業における需要を生み出しており、この地域の研究市場はさらに推進される可能性があります。

テレマティクス制御ユニット産業概要

テレマティクス制御ユニット(TCU)市場は、LG Electronics Inc.、Samsung Electronics(Harman International)、Robert Bosch GmbH、Continental AG、Denso Corporationなどの主要企業が参入しており、非常に細分化されているのが特徴です。市場競合を強化するため、各社は製品ポートフォリオを拡充するために提携や買収などの戦略を採用しています。

2023年3月、LG Electronics Inc.は、ベトナムの研究開発センターが正式に研究開発子会社に移行するという重要な進展を発表しました。この子会社は、車両インフォテインメント(IVI)システム用ソフトウエアの開発と評価で極めて重要な役割を果たす構えです。IVIシステムには、ビデオ、テレマティクス、オーディオ、ナビゲーション(AVN)ソリューションが含まれ、将来のモビリティに不可欠な技術です。さらに、この子会社は、多様な運転関連情報とエンターテインメント機能の提供を促進します。

2022年12月、フィコサは、サイバー攻撃や緊急事態に対する自律走行車やコネクテッドカーの耐性を強化することを目的とした先駆的プロジェクトであるSELFYコンソーシアムに参加し、自動車技術の進歩へのコミットメントを示しました。このコンソーシアムの包括的な目的は、潜在的な脅威を効果的に特定するためのデータの生成、モニタリング、収集が可能な協調ツールを考案することです。この取り組みにより、サイバー脅威やその他の潜在的なサービス中断に対する産業の対応能力が強化されます。このイニシアチブを通じて開発されたツールは、自律型と相互接続型モビリティシステムのプライバシー、機密性、完全性を保護し、自動車セグメントにおける重要な技術的進歩の先駆けとなります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 技術スナップショット

- マクロ動向が市場情勢に与える影響

第5章 市場力学

- 市場促進要因

- 自動車セグメントにおける安全性、快適性、利便性に対する需要の増加

- 5G技術の普及拡大

- 市場抑制要因

- 開発途上地域におけるテレマティクスの普及率の低下

- 規制制裁の遅れ

- 接続性技術の動向(2G/3G対4G対5G)

第6章 市場セグメンテーション

- 用途別

- 安全セキュリティ

- 情報とナビゲーション

- その他

- タイプ別

- 組み込みOEM

- アフターセールス

- 車種別

- 乗用車

- 商用車

- 地域別

- 北米

- 欧州

- アジア

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- LG Electronics Inc.

- Samsung Electronics Co. Ltd(Harman International)

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Marelli Europe S.P.A.

- Visteon Corporation

- Valeo SA

- Ficosa International SA

第8章 投資分析

第9章 マレケットの将来

The Telematics Control Unit Market is expected to register a CAGR of 14.8% during the forecast period.

Telematics is a communication system employed in the automotive industry that depends on data traveling to and from automobiles over wireless networks. The automobile industry is being propelled into the information age by combining wireless technology, location technology, and in-vehicle electronics.

Key Highlights

- Data is either generated in the vehicle unit and communicated to the back-office systems, or the back-office systems push data to the vehicle unit like maps, stock updates, weather reports, internet data packets, etc. This exchange occurs by cellphone or the unit installed in the vehicle. The car communicates and maps its whereabouts utilizing a matrix of cellphone towers and satellite technologies. This technology is incorporated into and controlled by a telematics control unit.

- The telematics control unit has recently become a crucial component in the automobile industry. The adoption of telematics control units (TCU) has been low. The concept of connected cars is still in its early stages, with very few automobile companies including them. However, the emerging prospects of 5G and autonomous vehicles will likely expand the scope of connected cars. According to Appinventiv, connected cars are anticipated to become the largest segment of the global 5G Internet of Things endpoint market, having a projected 19 million endpoints by the end of 2023.

- The telematics control unit facilitates increasing the vehicle's connectivity by introducing additional modems and processors to enable communication from the car to the cloud, infrastructure, or other vehicles. It enables antenna power optimization through improved current sensing, diagnostics, and noise reduction. It generates a digital blueprint of every component of a vehicle's operation, enabling fleet management to evaluate where enhancements in accident prevention and driver safety regulations can be applied. In addition, the telematics control unit can help with maintenance by analyzing hours-of-use information, planning maintenance inspections, and taking note of guaranteed recovery, engine hour tracking, and service records tracking.

- However, factors such as a lower awareness in developed regions, price sensitivity of customers in developing and less developed regions, and the cyber security threat associated with telematics control units continue to challenge the growth of the studied market. Furthermore, the lack of a common global regulatory framework for telematics solutions challenges the growth of the market studied.

Telematics Control Unit Market Trends

Passenger Vehicles to Dominate the Market

- Passenger cars are used for compact, mid-size, and full-size vehicles that convey not more than eight passengers (including the driver). The telematics control units (TCUs) in passenger vehicles can be used for several purposes: emergency services notification, stolen vehicle tracking, and remote vehicle immobilization. TCUs can collect and transmit vehicle diagnostics data, allowing for remote monitoring and analysis. This can help with proactive maintenance, identifying potential issues, and improving overall vehicle performance.

- TCUs are commonly used in passenger vehicles for fleet management systems to monitor and track vehicle location, performance, and usage of vehicles. This helps optimize routing and monitor driver behavior and overall fleet efficiency. They also provide vehicle data to insurance companies for enhanced infotainment connectivity, navigation, and mapping.

- The increasing adoption of electric vehicles contributes to the growing demand for passenger vehicles. As governments and individuals prioritize sustainability, there is a shift towards cleaner transportation options. For instance, according to IEA, global battery-electric vehicle sales reached an estimated 7.3 million in 2022, up from around 4.6 million in 2021. In 2021, these sales more than doubled compared to 2020, and 2022 marks a new record in all-electric sales volume. Moreover, the growth of the middle class in many countries has resulted in increased purchasing power and a higher demand for passenger vehicles.

- According to OICA (International Organization of Motor Vehicle Manufacturers), Around 65.3 million passenger cars were sold worldwide in 2023, showing an increase of approximately 11.3 percent compared to the previous year. China held the top spot as the largest regional automotive market in 2023, with approximately 26.1 million units.

- The automotive industry is also witnessing an increase in the production of passenger vehicles. For instance, according to the Bureau of Economic Analysis (BEA), in 2022, approximately 1.8 million automobiles were produced in the United States. It represents an increase of about 13 percent compared with 2021. Such developments are likely to boost the growth of the studied market.

North America Holds Largest Market Share

- North America is one of the significant investors and adopters in the studied market owing to growing investment in automotive sectors and the latest technologies. Telematics control unit devices are used in various regional verticals to provide Safety, Comfort, and Convenience in the Automotive Sector.

- The United States is anticipated to be the significant market for connected cars in the region due to the significant presence of automotive OEMs, high levels of technology awareness amongst the general car buyers, preference for infotainment and telematics in vehicles, widespread adoption of 4G/5G and increasing sales of electric, connected and autonomous cars in the country.

- According to KBB, in the first quarter of 2023, just under 258,900 battery-electric vehicles were sold in the United States. This year-over-year increase was around 44.9% compared to the sales recorded in the F1Q of 2022.

- The increasing investments in R&D by major industry players, rising Internet penetration, falling data costs, availability of 5G, growing preference of customers for connectivity features over mechanical specifications of cars, and a peak in sales of electric and autonomous automobiles are creating demand in the automotive and transportation industry may further propel the studied market in the region.

Telematics Control Unit Industry Overview

The telematics control unit (TCU) market is characterized by significant fragmentation, with major industry players including LG Electronics Inc., Samsung Electronics Co. Ltd (Harman International), Robert Bosch GmbH, Continental AG, and Denso Corporation. To strengthen their competitive position, companies in this market are employing strategies such as partnerships and acquisitions to augment their product portfolios.

In March 2023, LG Electronics Inc. announced a significant development, as its research and development center in Vietnam officially transformed into an R&D subsidiary. This subsidiary is poised to play a pivotal role in the development and evaluation of software for vehicle infotainment (IVI) systems. IVI systems encompass vital technologies for the future of mobility, encompassing video, telematics, audio, and Navigation (AVN) solutions. Additionally, this subsidiary will facilitate the provision of diverse driving-related information and entertainment functionalities.

In December 2022, Ficosa demonstrated its commitment to advancing automotive technology by participating in the SELFY consortium, a pioneering project aimed at enhancing the resilience of autonomous and connected vehicles against cyber-attacks and emergency situations. The consortium's overarching objective is to devise collaborative tools capable of generating, monitoring, and collecting data to identify potential threats effectively. This effort will strengthen the industry's ability to respond to cyber threats and other potential service disruptions. The tools developed through this initiative are poised to usher in a significant technological advancement in the automobile sector, safeguarding the privacy, confidentiality, and integrity of Autonomous and Interconnected Mobility Systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of Macro Trends on the Market Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Safety, Comfort, and Convenience in the Automotive Sector

- 5.1.2 Increased Deployment of 5G Technology

- 5.2 Market Restraints

- 5.2.1 Slower Rate of Penetration of Telematics in Developing Regions

- 5.2.2 Delayed Regulatory Sanctions

- 5.3 Connectivity Technology Trends (2G/3G Vs. 4G Vs. 5G)

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Safety and Security

- 6.1.2 Information and Navigation

- 6.1.3 Other Applications

- 6.2 By Type

- 6.2.1 Embedded OEMs

- 6.2.2 Aftersales

- 6.3 By Type of Vehicle

- 6.3.1 Passenger

- 6.3.2 Commercial

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Electronics Inc.

- 7.1.2 Samsung Electronics Co. Ltd (Harman International)

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Continental AG

- 7.1.5 Denso Corporation

- 7.1.6 Marelli Europe S.P.A.

- 7.1.7 Visteon Corporation

- 7.1.8 Valeo SA

- 7.1.9 Ficosa International SA