|

|

市場調査レポート

商品コード

1687821

レーザーベースガス分析器:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Laser-based Gas Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| レーザーベースガス分析器:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 160 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

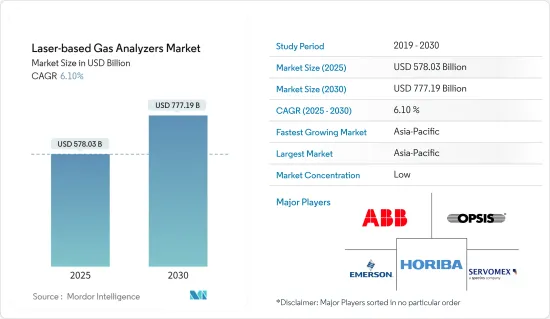

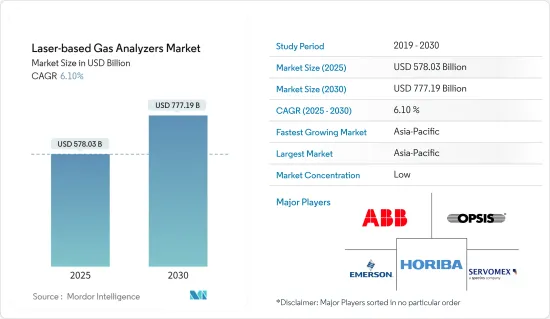

レーザベースガス分析器市場規模は、2025年に5,780億3,000万米ドルと推定され、2030年には7,771億9,000万米ドルに達すると予測され、予測期間(2025年~2030年)のCAGRは6.1%です。

レーザベースガス分析器の世界需要は、シェールガスやタイトオイルの発見の増加によって押し上げられています。また、レーザベースガス分析器の使用は、政府の法律や労働安全衛生規則の施行により、いくつかの産業現場で強制されています。

主なハイライト

- ガス漏れや排出の危険性に対する社会的意識の高まりが、レーザベースガス分析器の採用拡大に寄与しています。メーカーは、レーザベースガス分析器を携帯電話やその他のワイヤレスデバイスと統合し、リアルタイムモニタリング、リモートコントロール、データバックアップを提供しています。

- さらに、職場の有毒ガスや有害ガス関連の危険性に対する意識の高まりも、特に石油・ガス、化学・石油化学、金属・鉱業でレーザベースガス分析器の採用を後押ししています。

- さらに、自動車排出ガス分析計は、自動車からのCO2排出に関する政府の規制により、市場で人気を博しています。自動車メーカーは、CO2排出対策としてエンジン性能の向上に努めています。そのため、多くの自動車メーカーや自動車試験会社がレーザベースのガス分析システムを採用しています。

- 競争力を高め、リスクへの露出を減らすことは、市場のすべてのメーカーに共通しています。このことは、製品の複雑化、コストへの絶え間ないプレッシャー、環境フットプリントの最小化という法規制につながります。

- COVID-19パンデミックの間、いくつかの産業における科学の進歩とインフラを支援するための政府による投資の増加は、研究開発と自動化への焦点と相まって、調査された市場に大きな影響を与えています。

レーザーベースガス分析器市場動向

化学産業が成長

- 化学産業では、酸素は反応に影響を与えたり、企業の最終製品を劣化させたりする多くの望ましくない汚染物質の一つです。例えば、オレフィン共触媒システムでは、オレフィン原料の流れに酸素がなければ、最終的なポリオレフィン製品の品質と収率が高くなります。このような場合、酸素ガス分析計は、製品を最適なレベルに維持できるよう、低ppm機能を備えた重要な役割を果たします。

- ブランケティングは、可燃性の高い製品を保管または輸送する際に、爆発の危険性を減らすために行われる最も一般的な作業の1つです。ブランケティングでは、レーザーガス分析計が爆発リスク以下の望ましくないガスの存在を監視するために使用されます。

- 例えば、炭化水素系液体をタンクに貯蔵する際、液面上のヘッドスペースに空気が漏れ、爆発性の混合ガスが形成される可能性があります。このような場合、液面上部のヘッドスペースに二酸化炭素や窒素を注入し、その存在を除去します。

- プロセスガス分析計は、数多くの化学製造工程の安全な操業と効率性を確保する上で重要な役割を果たしています。プロセスガス分析計は、反応器における爆発状態の発生防止から熱酸化器における燃焼制御まで、重要なコンポーネントです。

- 水素は、化学工業において不可欠な製品や中間体のひとつです。例えば、水素はアンモニアを製造するための原料として一般的に使用されています。そのため、混合ガス中の水素濃度を測定するために使用される水素分析計の需要は、化学産業において非常に大きいです。

- 最近の化学産業の力強い成長は、ガス分析計の需要を大きく促進すると予想されます。例えば、BASFによると、2021年の世界の化学産業の成長率は6.1%です。同団体によると、2022年の世界の化学生産は3.5%成長すると予想されており、これはコロナウイルスのパンデミック前の数年間の平均を上回っています。

アジア太平洋が市場を独占する

- アジア太平洋は、近年石油・ガス生産能力の増加を記録した唯一の地域です。同地域では約4ヵ所の製油所が新設され、世界の原油生産量に日量約75万バレルが追加されました。石油・ガス、鉄鋼、電力、化学、石油化学の新プラントへの投資の増加や、国際的な安全基準・慣行の採用の高まりは、市場成長に影響を与えると予想されます。

- 同地域の産業開発は、石油・ガス産業におけるプロセス監視、安全性向上、効率化、品質向上などの用途により、ガス分析計の成長を促進しています。そのため、同地域の製油所ではガス分析計を工場に導入しています。

- アジア太平洋は高齢者人口が最も多いです。人口問題研究所によると、中国の65歳以上の人口は約1億6,600万人で、これは日本、ドイツ、イタリアを合わせた高齢者人口の2倍に相当します。

- さらに、ガス分析器は都市全体の汚染レベルを分析するためにも使われています。中国やインドのような国では、汚染レベルが史上最高レベルに達しているため、ガス分析計が汚染レベルの監視と制御のために導入されています。

- 研究者たちは世界中で温室効果ガスの削減に取り組んでおり、その分析目的でガス分析計を使用しています。例えば、東南アジアの科学者たちは、ヤギや牛から排出される温室効果ガス(GHG)の測定に投資しており、様々な給餌レジームの影響を調査し、Gasmet TechnologiesのポータブルFTIRガス分析器ーを導入しています。これらの要因がこの地域のガス分析器市場を牽引すると予想されます。

レーザーベースガス分析器産業概要

レーザーベースガス分析器市場では、著名メーカーの存在感が高まっており、予測期間中に競争企業間の敵対関係が激化すると予想されます。ABB Ltd.、Opsis AB、Emerson Electric Co.、HORIBA Ltd.、Servomex Group Limited、Honeywell International Inc.などの市場既存企業が市場全体に大きな影響を与えています。

- 2022年12月、ABBは天然ガスの品質を監視する画期的な分析器Sensi+を発表しました。ABBのレーザーベースの技術により、誤測定はほとんどなくなり、信頼性の高いプロセス制御のための迅速な応答時間も提供します。Sensi+は卓越した性能と低い総所有コストを提供し、遠隔地や危険な環境用に設計されています。

- 2022年6月、Servomexは最先端の光ガス分析ソリューションを提供する新しい分析器ーを発表しました。より使いやすいデジタルプラットフォームを中心に設計されたこの新しい分析器ーは、エチレン生産、炭素捕獲、エチレンジクロライド生産及び直接還元鉄プロセスを含む広範囲の工業アプリケーションに対応できる堅牢で信頼性の高い製品です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- 排出規制の強化

- 堅牢でモジュール化されたシステムに対する需要

- 市場抑制要因

- 複雑な数学的分析プロセスと高コスト

第6章 市場セグメンテーション

- プロセス別

- インサイチュ

- 抽出法

- タイプ別

- チューナブルダイオードレーザー分光法(TDLS)

- ラマン分光法(RA)

- キャビティリングダウン分光法(CRDS)

- 量子カスケードレーザー分光法(QCLS)

- エンドユーザー産業別

- 電力

- 鉱業・金属

- ヘルスケア

- 自動車

- パルプ・製紙

- 石油・ガス

- 化学

- その他エンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- ABB Ltd

- Opsis AB

- Emerson Electric Co.

- HORIBA Ltd

- Servomex Group Limited

- KNESTEL Technology & Electronics GmbH

- Hangzhou Zetian Chunlai Technology Co. Ltd

- Yokogawa Electric Corporation

- NEO Monitors AS(Nederman Group)

- Endress+Hauser AG

- Fuji Electric Co. Ltd

- Siemens AG

- Anton Paar GmbH

- AMETEK Land Instruments International

- Bruker Corporation

- Mettler Toledo

第8章 投資分析

第9章 市場の将来

The Laser-based Gas Analyzers Market size is estimated at USD 578.03 billion in 2025, and is expected to reach USD 777.19 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The global demand for laser-based gas analyzers has been boosted by increased shale gas and tight oil discoveries since these resources are utilized to stop corrosion in the infrastructure of natural gas pipelines. The use of laser-based gas analyzers has also been enforced in several industrial settings by government law and the enforcement of occupational health and safety rules.

Key Highlights

- The growing public consciousness of the dangers of gas leaks and emissions contributed to the increased adoption of laser-based gas analyzers. Manufacturers are integrating laser-based gas analyzers with mobile phones and other wireless devices to offer real-time monitoring, remote control, and data backup.

- Moreover, the growing awareness of workplace toxic and hazardous gas-related dangers is also driving the adoption of laser-based gas analyzers, especially in the oil and gas, chemicals and petrochemicals, and metals and mining industries.

- Further, automotive emission analyzers gained popularity in the market due to government stringencies over the CO2 emissions from vehicles. Automotive manufacturers are making efforts to improve their engine performances, to combat CO2 emissions. Hence, many automotive and automotive testing companies are adopting laser-based gas analyzer systems.

- Increasing competitiveness and reducing exposure to risk is common to all manufacturers in the market. This translates into increased product complexity, constant pressure on costs, and legislated minimization of environmental footprint, which in turn requires better control, more cheaply and with less waste.

- During the COVID-19 pandemic, the growing investments by governments to support scientific progress and infrastructure in several industries, coupled with the focus on R&D and automation, have significantly impacted the studied market.

Laser Based Gas Analyzers Market Trends

Chemical Industry to Witness Growth

- In the chemicals industry, oxygen is one of the many undesired contaminants that can impact the reaction or degrade the final product of the company. For example, olefin co-catalyst systems provide high quality and yield of the final polyolefin product if the olefin feedstock stream is free from oxygen. In such cases, oxygen gas analyzers play a vital role, with low ppm capabilities, to ensure that the products can be maintained at an optimum level.

- Blanketing is one of the most common activities performed when highly flammable products are stored or transported to reduce the risk of explosion. In blanketing, laser gas analyzers are used to monitor the presence of undesired gases below the explosion risk.

- For instance, while storing hydrocarbon liquids in tanks, it is possible that air will leak into the headspace above the liquid level, which may form explosive gas mixtures. Carbon dioxide or nitrogen is injected above the liquid into the headspace to remove its presence.

- Process gas analyzers play a crucial role in ensuring the safe running and efficiency of numerous chemical production steps. Process gas analyzers are critical components, from preventing the development of explosive conditions in reactors to controlling combustion in thermal oxidizers.

- Hydrogen is one of the essential products and intermediates of the chemical industry. For instance, hydrogen is commonly used as feedstock in the industry to produce ammonia. Thus, a significant demand exists for hydrogen analyzers in the industry, which are used to determine the concentration of hydrogen in a gas mixture.

- The strong growth in the chemicals industry in recent times is expected to fuel the demand for gas analyzers significantly. For instance, BASF shows that growth in the global chemical industry was 6.1% in 2021. According to the organization, global chemical production was expected to grow by 3.5% in 2022, which is above the average for the years before the coronavirus pandemic.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the only region to register an oil and gas capacity growth in recent years. About four new refineries were added in the region, which has added about 750,000 barrels per day to global crude oil production. Increased investments in new plants in oil and gas, steel, power, chemical, and petrochemicals and the rising adoption of international safety standards and practices are expected to influence market growth.

- The development of industries in the region is driving the growth of gas analyzers, owing to their use in the oil and gas industry, such as monitoring processes, increased safety, enhanced efficiency, and quality. Hence, the refineries in the region are deploying gas analyzers in the plants.

- The APAC region has the largest older population demographic. As per the Population Reference Bureau, China has about 166 million citizens aged over 65, which is twice the elderly population of Japan, Germany, and Italy combined.

- Furthermore, gas analyzers are also being used to analyze the pollution levels across a city. In countries like China and India, pollution levels are at an all-time high, leading to gas analyzers being deployed to monitor and control pollution levels.

- Researchers are making efforts to reduce greenhouse gas across the world, and for the analysis purposes of these gases, they are using the gas analyzer. For example, scientists from Southeast Asia are investing in measuring Greenhouse Gas (GHG) emissions from goats and cattle by investigating the effects of different feeding regimes and implementing a portable FTIR gas analyzer from Gasmet Technologies. These factors are expected to drive the market for gas analyzers in the region.

Laser Based Gas Analyzers Industry Overview

The growing presence of prominent manufacturers in the Laser-based Gas Analyzers Market is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as ABB Ltd., Opsis AB, Emerson Electric Co., HORIBA Ltd, Servomex Group Limited, Honeywell International Inc., etc., greatly influence the overall market.

- In December 2022, ABB introduced Sensi+, a ground-breaking analyzer for monitoring natural gas quality. False readings are almost eliminated by ABB's laser-based technology, which also offers quick response times for dependable process control. Sensi+ provides exceptional performance and a low total cost of ownership and is designed for remote and dangerous settings.

- In June 2022, Servomex unveiled a new analyzer to deliver the most advanced photometric gas analysis solution. Designed around an easier-to-use digital platform, the new analyzer is a rugged and reliable product ready to handle a wide range of industrial applications, including ethylene production, carbon capture, ethylene dichloride production, and the direct reduction iron process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emission Regulation

- 5.1.2 Demand for Robust and Modular Systems

- 5.2 Market Restraints

- 5.2.1 Complex Mathematical Analysis Process and High Costs

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 In Situ

- 6.1.2 Extractive

- 6.2 By Type

- 6.2.1 Tuneable Diode Laser Spectroscopy (TDLS)

- 6.2.2 Raman Spectroscopy (RA)

- 6.2.3 Cavity Ring Down Spectroscopy (CRDS)

- 6.2.4 Quantum Cascade Laser Spectroscopy (QCLS)

- 6.3 By End-user Industry

- 6.3.1 Power

- 6.3.2 Mining and Metal

- 6.3.3 Healthcare

- 6.3.4 Automotive

- 6.3.5 Pulp and Paper

- 6.3.6 Oil and Gas

- 6.3.7 Chemical

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Opsis AB

- 7.1.3 Emerson Electric Co.

- 7.1.4 HORIBA Ltd

- 7.1.5 Servomex Group Limited

- 7.1.6 KNESTEL Technology & Electronics GmbH

- 7.1.7 Hangzhou Zetian Chunlai Technology Co. Ltd

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 NEO Monitors AS (Nederman Group)

- 7.1.10 Endress + Hauser AG

- 7.1.11 Fuji Electric Co. Ltd

- 7.1.12 Siemens AG

- 7.1.13 Anton Paar GmbH

- 7.1.14 AMETEK Land Instruments International

- 7.1.15 Bruker Corporation

- 7.1.16 Mettler Toledo