|

市場調査レポート

商品コード

1850969

光ファイバーケーブル:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Fiber Optic Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 光ファイバーケーブル:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

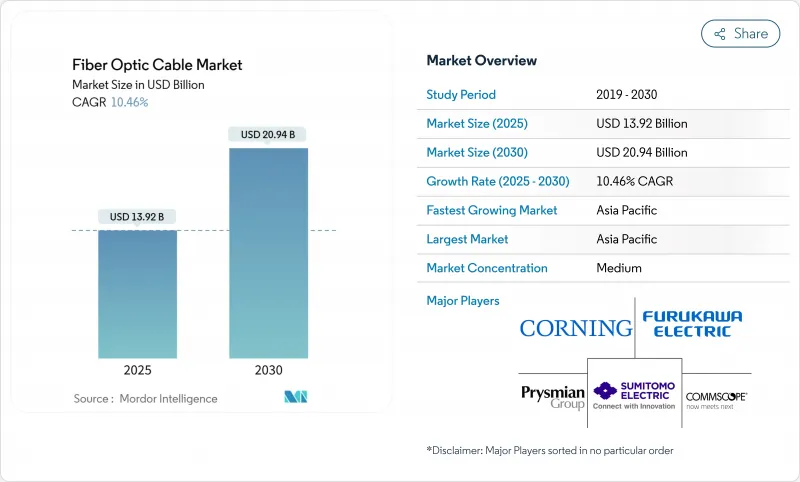

光ファイバーケーブル市場規模は2025年に139億2,000万米ドル、2030年には209億4,000万米ドルに達すると推定・予測され、予測期間(2025-2030年)のCAGRは10.46%です。

人工知能のワークロードが超低遅延を要求し、5Gの高密度化がファイバーディープアーキテクチャを推進し、ハイパースケールデータセンター事業者がレガシーキャリアをバイパスするために前例のないケーブル容量を確保するにつれて、成長は加速します。また、地政学的な緊張がハイテク大手に海底ルートの多様化を促し、成熟した経済圏でも対応可能な光ファイバーケーブル市場が拡大しています。供給側では、垂直統合、地域製造の義務化、マルチコアおよび中空コア技術への投資が競争力学を再構築し、ファイバーを地上および海底接続の決定的なバックボーンとして位置づける。持続可能性の目標の強化は、銅から低炭素ガラスへのシフトをさらに強化し、光ファイバーケーブル市場の永続的な拡大軌道を示唆しています。

世界の光ファイバーケーブル市場の動向と洞察

高速インターネットの普及と世界的なデータトラフィックの急増

帯域幅の需要は急速に増加しており、事業者は現在、8Kビデオ、クラウドゲーム、リアルタイムコラボレーションに十分なヘッドルームを持つ唯一のインフラとしてファイバーを扱っています。世界のIPトラフィックは年率22%で拡大しており、ストリーミングとクラウドサービスが負荷の82%を吸収しています。日本の研究者は、1,505の波長を使用して標準ファイバーで402Tb/秒の伝送を実証し、今日のケーブル投資が卸売りの交換なしに数十年の段階的なアップグレードを維持できることを証明しました。このような画期的な進歩は、通信事業者に、銅線の漸進的な修正ではなく、高密度のファイバー回廊に資本を割り当てる自信を与えるものです。その結果、光ファイバーケーブル市場は、先進地域と新興地域の両方がギガビット・クラスのアクセス・ターゲットに収束するにつれて、より速い注文サイクル、より長い契約期間、より広い地域での展開計画を記録しています。

加速する5Gのロールアウトとファイバー・ディープFTTxの展開

5Gの各スモールセルには専用のファイバーバックホールが必要で、ケーブルの数はレガシー4Gサイトと比べて3倍から5倍になります。AT&Tが2030年までに6,000万カ所のファイバー敷設を目指し、2,380万カ所にまで拡大したことは、無線アクセスの高密度化がいかに光ファイバーケーブル市場を活性化させるかを示しています。エッジクラウドアーキテクチャは、タワーとマイクロデータセンター間の低遅延リンクを必要とすることにより、この牽引力を増幅させ、郊外のグリッドにより深くファイバーを拡張します。通信事業者は、対称型ファイバーがサービスを下支えする場合、ユーザーあたりの5G収益が15~25%高くなると報告しており、高密度リボンケーブルや装甲ケーブルの複数年にわたる調達を促進する要因となっています。通信事業者が新たな回線を敷設しようと競争するにつれ競合は激化し、超低遅延モバイルサービスに不可欠な基盤としてのファイバーの役割が確認されています。

高い土木工事費と複雑な用地権

建設労働力不足と規制のボトルネックにより、主要都市の地下敷設費用は1フィートあたり24米ドルまで上昇し、資本予算が圧迫され、展開速度が低下します。用地承認には6~18カ月を要することもあり、サービス開始が遅れ、暫定的な資金調達コストが上昇します。熟練技術者の不足は年間3万1,500人と推定され、賃金を押し上げ、環境調査はプロジェクト総額に5万~20万米ドルを上乗せします。このような軋轢により、事業者はユニバーサルの建設よりも高密度の通路を優先せざるを得なくなり、その結果、光ファイバーケーブル市場のコストに敏感なポケットにおける対応可能な成長が鈍化しています。

セグメント分析

2024年の光ファイバーケーブル市場の38.0%は装甲製品でした。これは、ケーブルが過酷な地形や公道を横断する場合、オペレータが機械的に堅牢な設計を好むことを示しています。しかし、リボン型は、現場での作業時間を80%も短縮する大量融着接続により、CAGR 11.4%で他を圧倒する勢いです。Ribbonのゲルフリーのバリエーションは、クリーンアップも削減し、ハイパースケールデータセンターの構築速度を向上させる。リボンアーキテクチャの光ファイバーケーブル市場規模は、2030年までに2倍以上に拡大すると予測されています。

サプライヤーは、海底導線や掘削による損傷を受けやすい都市部の導線をターゲットに、波形鋼板と遮水テープによる装甲構造の改良を続けています。逆に、非アーマードケーブルやブレイクアウトケーブルは、耐圧潰性よりも柔軟性や狭い曲げ半径が重要な、安全なキャンパス内で人気があります。設置にかかる労力はプロジェクト費用の半分以上を占めるため、ネットワークプランナーは、スプライスイベントを削減できる多本数のリボンまたはマイクロダクトソリューションに傾倒しており、光ファイバーケーブル市場でのリボンのシェアはさらに急上昇しています。

シングルモード素線は、2024年の光ファイバーケーブル市場シェアの63.2%を占め、メトロポリタン、長距離、数百kmに及ぶ海底リンクに不可欠です。しかし、マルチモードは2030年までのCAGRが13.2%となる見込みであり、100~150mの到達距離とコスト効率の高いVCSELトランシーバーが主流のデータセンターのトップ・オブ・ラック接続によって復活します。中空コアのプロトタイプはレイテンシを30%削減することが期待され、アルゴリズム取引プラットフォームやフェムト秒レベルの同期を必要とする科学サイトを魅了しています。

クラウド事業者がキャンパス・トポロジーをフラット化する中、OM5グレード・ファイバーと400G-SR8トランシーバーを組み合わせることで、800Gbpsのラック・ツー・ラックが実現し、コストと性能の目標が一致します。一方、シングルモードの技術革新は、リピータなしで海盆を横断できる超低損失およびマルチコアフォーマットに軸足を移し、光ファイバーケーブル市場規模のプレミアム海底スライスを拡大しています。したがって、モーダル・ミックスは距離と帯域幅の経済性にかかっています。シングル・モードはバックボーン・ルートに君臨し続け、マルチ・モードはリーチ・エンベロープが控えめなハイパースケール・ホール内でボリュームの足場を確保します。

光ファイバーケーブル市場レポートは、ケーブルタイプ(アーマードケーブル、非アーマードケーブル、リボンケーブル、その他)、ファイバーモード(シングルモードファイバー、マルチモードファイバー、プラスチック光ファイバー)、設置タイプ(空中/架空、地下/埋設、その他)、エンドユーザー産業(通信、電力ユーティリティとスマートグリッド、防衛と航空宇宙、産業オートメーションと制御、その他)、地域別に分類されています。

地域分析

アジア太平洋が58.7%の売上を占め、2030年までのCAGRが12.6%と最も高いです。これは、中国の「一帯一路(Belt and Road)」傘下の国家支援による巨大プロジェクトと、インドの国内着陸ステーションを優遇する新しい規則を反映しています。日本の研究所は光スループットの記録を更新し続けており、この地域のリーダーシップを確固たるものにする研究開発の強みとなっています。韓国と日本の高密度5Gグリッドは1平方キロメートルあたりのファイバー数を増加させ、東南アジアのコンソーシアムは海底クラスターを拡大し、シンガポールを事実上の地域ハブとします。しかし、南シナ海の政治的軋轢はケーブル切断のリスクを高め、冗長ルーティング戦略を促し、光ファイバーケーブル市場の設備投資の上昇を支えています。

第2位の北米は、グリーンフィールドから近代化サイクルに軸足を移しています。424億5,000万米ドルのBEADプログラムにより、地方での建設が活発に行われている一方、AT&TによるLumenへの消費者向けファイバー資産の売却などの合併により、競合のキャンバスが再形成されています。国内コンテンツ義務化により、ノースカロライナ州とサウスカロライナ州では容量拡張が促進され、AIに牽引される帯域幅需要の増大に供給が整合します。欧州はバルト海の事故を受けて海底の回復力を強化し、デジタル主権を守るマルチランディング・アーキテクチャに投資します。

中東・アフリカ、南米が次の波のホットスポットとして浮上します。湾岸諸国の通信事業者は地理的な十字路を活用して複数大陸のケーブルをホストし、2アフリカ・リングはアフリカ全域で遅延と卸売価格を削減する45,000kmの新しい容量をもたらします。Medusaのような地中海沿岸のベンチャーは北アフリカまで到達範囲を広げ、ブラジルはクラウド地域の立ち上げと結びついたラテンアメリカのファイバー展開をリードしています。資金調達、規制の明確化、熟練労働者の確保は課題として残るが、モバイルデータ普及率の向上は、光ファイバーケーブル市場にとって長期的に説得力のある物語を支えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高速インターネットの普及と世界のデータトラフィックの急増

- 5Gの展開とファイバーディープFTTxの展開の加速

- ハイパースケールデータセンター相互接続の需要拡大

- 政府が支援する農村部のブロードバンドおよびデジタル包摂プログラム

- 地政学的回復力のための海底ルートの多様化

- 持続可能性の推進により銅を低炭素ガラス繊維に置き換える

- 市場抑制要因

- 土木工事費の高さと道路使用権の複雑さ

- 原材料価格の変動とヘリウム供給の制約

- 潜水艦航路の環境許可の遅れ

- 飽和状態の都市圏市場における通信会社の設備投資の停滞

- バリューチェーン/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- マルチコアおよび中空コア光ファイバーのロードマップ

- 統合フォトニクスとシリコンフォトニクストランシーバの統合

- 価格分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

- COVID-19の影響と回復の分析

第5章 市場規模と成長予測

- ケーブルタイプ別

- 装甲ケーブル

- 非装甲ケーブル

- リボンケーブル

- その他

- ファイバーモード別

- シングルモードファイバー

- マルチモードファイバー

- プラスチック光ファイバー

- 設置タイプ別

- 空中/オーバーヘッド

- 地下/埋設

- 潜水艦/水中

- 屋内/ドロップケーブル

- エンドユーザー業界別

- 通信

- データセンターとクラウドプロバイダー

- 電力会社とスマートグリッド

- 防衛・航空宇宙

- 産業オートメーションと制御

- ヘルスケアと医療

- 石油・ガス・オフショア

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Prysmian Group

- Corning Inc.

- Sumitomo Electric Industries Ltd.

- Furukawa Electric Co., Ltd.

- CommScope Holding Company Inc.

- Fujikura Ltd.

- Nexans S.A.

- LS Cable and System Ltd.

- OFS Fitel LLC

- Sterlite Technologies Ltd.

- Hengtong Optic-Electric Co. Ltd.

- Yangtze Optical Fiber and Cable(JOFC)

- ZTT Group

- Proterial Ltd.

- Finolex Cables Ltd.

- Belden Inc.

- General Cable Corp.

- Hexatronic Group AB

- HMN Tech Co., Ltd.

- Taihan Fiberoptics Co., Ltd.