|

市場調査レポート

商品コード

1907299

軍事用レーダー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Military Radars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍事用レーダー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

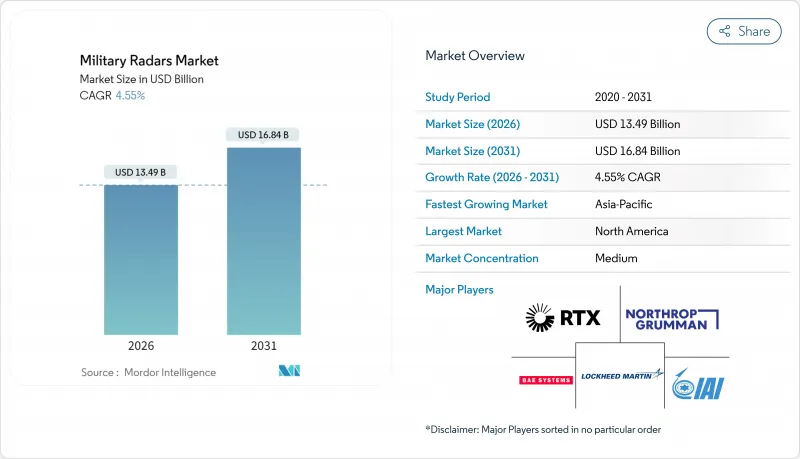

軍事用レーダー市場は、2025年に129億米ドルと評価され、2026年の134億9,000万米ドルから2031年までに168億4,000万米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは4.55%と見込まれます。

高まる地政学的緊張、迅速な対UAS(無人航空機システム)要件、機械式走査アレイからソフトウェア定義AESA(アクティブ電子走査アレイ)プラットフォームへの移行が相まって、需要を後押ししております。米国宇宙開発庁のトラッキングレイヤーなどの新たな衛星群は、宇宙ベースの赤外線データが数秒で地上レーダーに目標を引き継ぎ、超音速・群れ脅威に対するキルチェーンを強化する実例を示しております。しかしながら、5G周波数帯の干渉や窒化ガリウム(GaN)半導体の供給不足により、認証サイクルが長期化し、プログラムリスクが高まっています。プラットフォーム需要は二極化しており、陸上システムが依然として収益の大部分を占める一方、航空機搭載型および宇宙センサーが最も高い研究開発費配分を受けています。ソフトウェア定義レーダー(SDR)が技術構成を主導する中、初期段階の量子プロトタイプは、長期的な破壊的進歩の可能性を示唆しています。

世界の軍事レーダー市場の動向と洞察

高まる地政学的緊張と防衛近代化予算

2024年、NATO加盟23カ国がGDP比2%の防衛費目標を達成し、レーダー近代化プログラムに多額の資金を配分したことで、防衛支出は平時としては過去最高を記録しました。ポーランドの47億5,000万米ドル規模の「ヴィスワ計画」では、パトリオットミサイルとジラフ4Aセンサーを組み合わせ、東方向400kmの探知範囲を拡大します。台湾は2024年度のレーダー予算を7.7%増額し、天弓III迎撃ミサイルのフェーズドアレイ化を段階的に推進。日本も北朝鮮の試験で露呈した巡航ミサイル防衛の弱点を補うため、超地平線レーダーを調達しました。これらの計画により、少なくとも中期的に軍事レーダー市場の基盤は安定すると見込まれます。

対UAS・極超音速脅威への迅速配備ニーズ

極超音速兵器は交戦可能時間を6分未満に圧縮し、従来型センサーに課題をもたらします。米国は2024年、8基の追跡衛星を軌道に投入し、地上レーダーへの終末迎撃誘導を実施。NATOのTWISTER計画ではTRML-4D地上アレイと宇宙データ連携により滑空体追跡を実現しています。2019年の石油施設攻撃を受けてサウジアラビアが47基のKuRFSレーダーを設置したことは、対ドローン対策の緊急性が高まっていることを示しています。ウクライナが2024年に200基以上の移動式対UASレーダーを戦場に導入したことも、この動向を裏付けるものです。したがって、迅速に展開可能でソフトウェア再構成可能なセンサーへの需要が、世界の軍事レーダー市場の成長軌道を押し上げています。

GaN半導体材料のサプライチェーン制約

軍事レーダーシステムにおけるGaN技術の採用拡大は、GaN半導体材料の世界の供給網に負荷をかけています。GaNは電力密度、熱効率、広帯域性能の向上をもたらし、先進的なAESAレーダーシステムにとって不可欠です。しかしながら、その供給は様々な要因により制約されています。2024年における世界のGaNウエハー生産能力は約180万枚(6インチ換算)に達しましたが、防衛プログラムだけでその総量のほぼ4分の1を占め、供給をさらに逼迫させています。Wolfspeed社は52週間のリードタイムを報告しており、AN/TPY-4の納入は9ヶ月遅延しています。ガリウムの精製量の80%を占める中国は2023年に輸出ライセンシングを導入し、欧米の請負業者は代替供給源の確保や認証を余儀なくされました。米国CHIPS法の資金配分ではGaN向けが5%未満に留まっているため、2027年以前の供給改善は見込み薄です。このボトルネックが軍事レーダー市場の短期的な成長を抑制しています。

セグメント分析

2025年の軍事レーダー市場収益の38.74%を陸上プラットフォームが占めました。これはNATO東部戦線及び朝鮮半島における対砲兵システムや統合防空システムの導入が牽引したものです。しかしながら、各国がAESAレーダーの改修を加速し無人早期警戒ノードを展開する中、航空機搭載センサーは年率5.92%で拡大しています。E-7ウェッジテイルの調達により老朽化したE-3が置き換えられ、ノースロップ・グラマン社の180トラック多目的アレイが導入されることで、この取り組みの勢いが強調されています。予算上の摩擦により短期的な海軍発注は抑制されていますが、オーストラリアのホバート級艦のアップグレードや日本のイージス装備艦が漸増的な需要を支えています。カペラ・スペースなどの宇宙ベース合成開口レーダーコンソーシアムは、15分間隔の再訪時間を目標とするベンチャーキャピタルを注入し、軍事レーダーの市場シェアを低緯度画像領域へ拡大しようとしています。予測期間中、陸上分野が最大の収益源であり続ける見込みです。しかしながら、航空機搭載型および宇宙ドメインが研究開発予算の増加分を獲得し、マルチドメイン機動性への漸進的な移行を示唆しています。

追跡・射撃管制センサーは2025年収益の31.12%を占め、パトリオット、THAAD、イージスの継続的近代化を反映しています。一方、監視・早期警戒レーダーはCAGR6.18%と軍事レーダー市場で最速のペースで成長すると予測されています。ドイツのF126フリゲート艦は、16発のミサイル誘導と360度連続監視が可能なタレス社製「シーファイア」を採用しており、機能統合への需要を示しています。5年前にはほとんど存在しなかった対ドローンセンサーは、都市航空モビリティ(UAM)や民生用ドローンの普及に伴い、短距離での低コスト検知が求められることから、現在二桁成長を遂げています。ウクライナがこれらのシステムの戦場価値を実証したことで、兵器探知システムおよび対ドローン防衛システム(C-RAM)の調達が増加しました。ソフトウェアによるモード切替への移行により、運用者はハードウェアを交換せずに新たな任務をアップロードできるようになり、これにより軍事レーダー市場は単一用途の品目を超えた多様化が進んでいます。

地域別分析

北米地域は2025年の軍事レーダー市場収益の36.95%を占め、米国防総省の8,500億米ドルを超える支出(うち48億米ドルがレーダー更新・新規導入に充当)に支えられています。AN/TPY-4やLTAMDSプログラムが示すように、同地域はソフトウェア定義アーキテクチャとJADC2対応インターフェースにおいて主導的立場にあります。カナダのNORAD近代化計画は北極圏需要を創出し、中期的な受注パイプラインを維持しています。

アジア太平洋地域は6.86%のCAGRで成長しており、これは世界最速のペースです。インドの6億5,000万米ドル規模のウッタムAESA生産ライン、日本の4,200億円(26億8,000万米ドル)のレーダー近代化計画、韓国のKF-21搭載AESAは、地域における国産化とオフセットの動向を総合的に示しています。中国の強硬姿勢により近隣諸国は調達を加速させており、2030年代初頭までにアジア太平洋地域が北米の収益主導権に課題する態勢が整いつつあります。

欧州の成長は緩やかであり、ウクライナにおける砲兵兵器の使用後、資金が弾薬備蓄へシフトしています。GDPの4.7%を占めるポーランドの防衛支出と、ドイツの3億5,000万ユーロ(4億345万米ドル)に上るTRML-4D契約は、この分野への重点投資を浮き彫りにしています。中東地域では、アラブ首長国連邦(UAE)による海上レーダー「SeaVue」を含むMQ-9Bパッケージ(2億9,000万米ドル相当)など、外国軍事販売(FMS)の活用が継続しております。

一方、南米とアフリカは依然として小規模な貢献度にとどまり、両地域を合わせた売上高は全体の8%未満です。全体として、地理的な分散は循環的なリスクを軽減し、軍事レーダー市場の着実な成長を支えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高まる地政学的緊張と防衛近代化予算

- 対UAS(無人航空機システム)および極超音速脅威への迅速な配備ニーズ

- 多機能AESAおよびソフトウェア定義レーダーへの移行

- レーダーデータの統合:全領域統合指揮統制(CJADC2)への統合

- モジュラー・オープンシステム・アーキテクチャ(MOSA)によるライフサイクルコスト削減の推進

- 極海航路の開通に伴う氷下・北極圏監視の必要性

- 市場抑制要因

- 窒化ガリウム半導体材料のサプライチェーン制約

- 商用5G/6G展開に伴う周波数割当の圧力

- ネットワーク中心型レーダーアーキテクチャにおけるサイバー脆弱性

- マルチバンドシステム向け資本集約的な試験・認証

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者の交渉力/

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- プラットフォーム別

- 陸地

- 海洋

- 航空

- 宇宙

- 製品タイプ別

- 監視・空中早期警戒レーダー

- 追跡・射撃管制レーダー

- 多機能レーダー

- 兵器探知・C-RAMレーダー

- 地中探査レーダー

- 気象レーダー

- 対ドローンレーダー

- その他

- 技術別

- ソフトウェア定義レーダー

- 従来型レーダー

- 量子レーダー

- 範囲別

- 短距離

- 中距離

- 長距離

- コンポーネント別

- アンテナ

- 送信機

- 受信機

- 信号処理装置

- パワーアンプ

- 安定化システム

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- イスラエル

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Lockheed Martin Corporation

- RTX Corporation

- Northrop Grumman Corporation

- Thales Group

- Leonardo S.p.A.

- Saab AB

- Hensoldt AG

- BAE Systems plc

- Israel Aerospace Industries

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Indra Sistemas S.A.

- Mitsubishi Electric Corporation

- Rohde & Schwarz GmbH

- NEC Corporation

- Bharat Electronics Limited

- Teledyne FLIR LLC

- Aselsan A.S.

- Terma A/S