|

市場調査レポート

商品コード

1910536

照明制御システム:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Lighting Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 照明制御システム:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

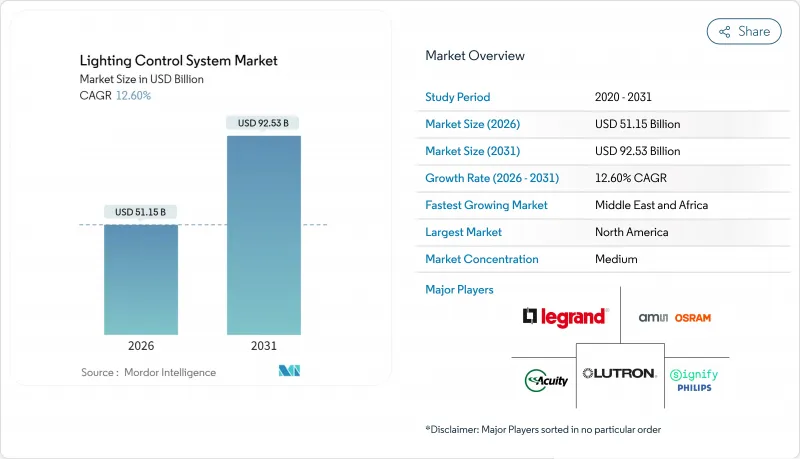

照明制御システム市場は、2025年の454億3,000万米ドルから2026年には511億5,000万米ドルへ成長し、2026年から2031年にかけてCAGR12.6%で推移し、2031年までに925億3,000万米ドルに達すると予測されております。

この成長加速は、義務化された省エネルギー要件、スマートシティ計画の普及、そして照明器具をデータソースに変えるIoT対応ビルオートメーションの広範な利用を反映しています。政府は現在、自動消灯、昼光調光、在室検知を建築基準に組み込んでおり、これにより非任意的な需要が創出されています。LED部品の価格下落により投資回収期間が短縮され、小規模施設においても包括的な制御システムの導入が経済的に実現可能となりました。無線メッシュプロトコルの普及により設置の複雑さが軽減され、2020年以前に建設された既存施設への改修機会が拡大しています。一方で、サイバーセキュリティ脅威の増大と半導体供給のボトルネックが継続しており、サプライヤーや施設所有者にとって短期的な運用リスクが存在します。

世界の照明制御システム市場の動向と洞察

省エネルギー型照明システムへの需要拡大

世界中の施設では、従来の蛍光灯設備と比較して照明エネルギーを最大80%削減するインテリジェント制御とLEDを組み合わせることで、運用コストとカーボンフットプリントの低減を追求しています。実証済みの産業プロジェクトでは、導入後12ヶ月で照明エネルギーを87%削減した事例があり、大規模プラントでも短期間での投資回収が可能であることを裏付けています。在室検知、自然光利用、スケジュール制御により、業務フローに影響を与えずに継続的な最適化が実現できるため、光熱費が上昇し続ける状況下でも設備投資の承認が容易になります。建物所有者は、多くのプロジェクトが1会計年度以内に投資回収を実現する点を高く評価しており、他の建設支出が精査される中でも需要を持続させる追い風となっています。

厳格な建築物エネルギー基準とグリーン認証義務

国際省エネルギー基準2021(IECC 2021)は、商業施設における自動消灯機能と自然光対応制御を義務付け、任意のアップグレードから必須要件へと転換しました。カリフォルニア州タイトル24(2022年)は、4kWを超えるプロジェクトにおいて需要応答型調光を推進し、事実上すべての大規模建築物における制御システムの導入を保証します。LEED評価システムは先進的な照明制御に対してポイントを与え、規制圧力と、現在ESG対応資産を優先する資本市場を一致させています。コンプライアンスは譲れない要件であるため、照明制御システム市場はマクロ経済の変動を緩和する防御的な成長基盤を獲得しています。

初期導入・統合コストの高さ

包括的な制御システム改修は、基本的なLEDランプ交換の2~3倍の資本を必要とするため、中小企業には障壁となります。複雑なプロジェクトでは熟練した試運転技術者が必要ですが、特に成熟地域以外では人材不足が人件費を押し上げています。年間10万831米ドルの節約効果がある著名なホテル改修事例でさえ、多額の資本と1.62年の回収期間を要しており、中小企業の資金調達障壁を浮き彫りにしています。新興市場ではエネルギー融資が不足しているため、資金調達のギャップが最も大きいままです。

セグメント分析

2025年にはハードウェアが収益の56.80%を占めました。ドライバー、センサー、ゲートウェイはあらゆるインテリジェント化アップグレードの基盤となるためです。サービス分野は12.83%という最速のCAGRが見込まれています。大規模な導入には設計コンサルティング、現場での試運転、定期的な最適化が不可欠だからです。AIベースの分析には継続的な調整が求められるため、照明制御システムのサービス市場規模は今後さらに拡大する見込みです。エネルギー管理共同プロジェクト(EMC)のBluetoothメッシュプロジェクト(43地域で3,685台のコントローラーを導入)のような世界の展開は、サービス依存度の高い複雑性と継続的収益の可能性を示しています。

プロフェッショナルサービスは長期契約を確保し、単発の資本プロジェクトを予測可能なキャッシュフローに変換します。ファームウェア更新、故障解析、エネルギー報告は、企業が外部委託するマネージドサービス契約の対象となるケースが増加しています。その結果、ハードウェアベンダーはライフサイクル契約をバンドル化し、照明制御システム市場を部品販売ではなくソリューションエコシステムへと導いています。この戦略的転換は、設計・サポートリソースを欠く企業にとって参入障壁を高めています。

有線プロトコルは2025年時点で63.40%のシェアを維持し、ミッションクリティカルな工場が求めるEMI耐性と安定した遅延が評価されています。ネットワークダウンタイムが許容されない病院やデータセンターでは、有線DALI-2設置に紐づく照明制御システム市場規模が依然として大きい状況です。エンジニアは専用配線の決定論的性能と固有の物理的セキュリティを重視しています。

無線導入は14.85%のCAGRで差を縮めています。Bluetooth Meshは自己修復経路とスマートフォンベースのコミッショニングを提供し、人件費を大幅に削減します。Matterエコシステムへの統合により、住宅用・商業用デバイスが共通管理シェル下で連携され、仕様決定者の受容が加速します。2026年までに計画されているThread 1.4のアップグレードではボーダールータの柔軟性が追加され、施設管理チームは配線変更なしでネットワークを拡張できるようになります。歴史的建造物や営業中の小売店舗など、停止時間が制限される環境では、混乱の低減が大きな魅力となります。

照明制御システム市場は、提供形態(ハードウェア、ソフトウェア、サービス)、通信プロトコル(有線、無線)、設置タイプ(新築、改修)、用途(屋外、屋内)、地域別にセグメンテーションされます。市場予測は金額(米ドル)ベースで提供されます。

地域別分析

北米は厳格な省エネ基準とスマートシティ導入の先行により、2025年に34.10%の収益シェアを占めました。照明制御システム市場は、投資回収を促進する連邦政府の効率化プログラムや税制優遇措置の恩恵を受けています。センサーパッケージを対象とした公益事業リベート制度は、商業施設改修の経済性をさらに高めます。カナダの州は米国基準を反映しており、メキシコの産業回廊ではマキラドーラ拡張に照明制御を統合し、運営費の最小化を図っています。

欧州は2030年までの確固たる脱炭素目標により勢いを維持しています。ドイツ、フランス、英国では公共部門の調達規則にインテリジェント照明が組み込まれています。EUタクソノミー開示により、不動産所有者はエネルギー強度削減を証明する義務が生じ、これによりセンサーを豊富に備えたアップグレードへ資本が誘導されます。DALI-2や新たに登場したETSI EN 303 645セキュリティフレームワークによる標準化の取り組みにより、複数ベンダーの展開リスクが低減され、単一市場全体での普及が促進されています。

中東・アフリカ地域では2031年までにCAGR12.74%という最速の伸びが見込まれます。サウジアラビアやUAEで建設中のメガシティでは、制御対応型照明器具が当初からマスタープランに組み込まれています。スマートインフラ向け政府予算は、石油収入が変動してもプロジェクトパイプラインを堅調に維持します。サハラ以南アフリカでは、電力網の不安定さが電圧低下時に負荷を調光するセンサー導入を促進し、設備保護と照明器具の寿命延長を実現しています。開発銀行による融資支援は初期コスト障壁の解消に寄与し、持続的な数量成長を保証します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 省エネルギー型照明システムに対する需要の増加

- 厳格な建築物エネルギー基準およびグリーン認証義務

- LED価格の急激な下落によるROI拡大

- 適応型街路照明を活用したスマートシティ計画

- ESG連動型金融がスマート改修を加速

- Li-Fi導入準備が新たな収益源を開拓

- 市場抑制要因

- 初期導入・統合コストの高さ

- マルチベンダー環境における相互運用性の課題

- サイバーセキュリティおよびデータプライバシーリスク

- 有資格の試運転専門家の不足

- サプライチェーン分析

- 規制情勢

- 技術展望(IoTエッジ制御、AI、Li-Fi)

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 市場に対するマクロ経済的要因の評価

第5章 市場規模と成長予測

- 提供別

- ハードウェア

- LEDドライバ

- センサー

- スイッチと調光器

- 中継ユニット

- ゲートウェイおよび制御パネル

- ソフトウェア

- サービス

- ハードウェア

- 通信プロトコル別

- 有線

- 無線

- 設置タイプ別

- 新築

- 改修

- 用途別

- 屋内

- 営業事務所

- 産業・倉庫

- 住宅用

- ホスピタリティとレジャー

- その他

- 屋外

- 道路・通り

- 建築・ファサード

- スポーツ・スタジアム

- その他

- 屋内

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- エジプト

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 戦略的動向

- 企業プロファイル

- Signify(Philips Lighting)

- Acuity Brands

- Legrand

- Lutron Electronics

- ams OSRAM

- Schneider Electric

- Eaton(Cooper Lighting)

- Hubbell Lighting

- Honeywell

- Cisco Systems

- Siemens(Enlighted)

- Delta Electronics

- Panasonic

- Zumtobel Group

- Helvar

- Synapse Wireless

- WAGO

- Cree Lighting

- Leviton Manufacturing

- Digital Lumens

- ABB