|

市場調査レポート

商品コード

1687730

コーヒーポッドおよびカプセル:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Coffee Pods And Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コーヒーポッドおよびカプセル:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

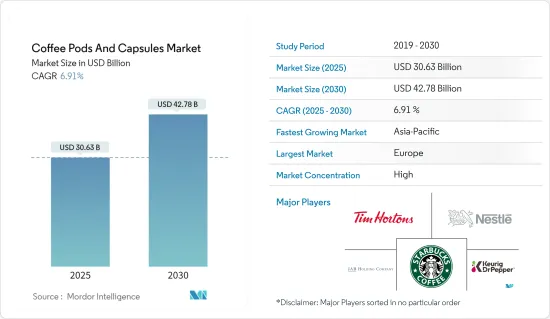

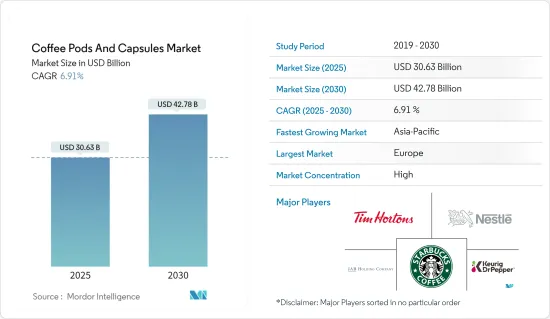

コーヒーポッドおよびカプセルの市場規模は2025年に306億3,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは6.91%で、2030年には427億8,000万米ドルに達すると予測されます。

主なハイライト

- コーヒーポッドおよびカプセルの需要には、1回分のコーヒーで提供される品質、効率、多様な選択肢が重要です。消費者は、カフェスタイルの体験を家庭で再現するためにコーヒーマシンを喜んで購入し、コーヒーポッドおよびカプセルの需要を押し上げています。最新のコーヒーメーカーと好みのカプセルやコーヒーポッドを家庭で使えば、消費者は総合的な種類のコーヒーを素早く作ることができます。

- さらに、消費者の間でコーヒーポッドの人気が高まっている主な要因の1つは、1回限りの使用で使い捨てが可能で、ユーザーに利便性を提供することです。しかし、使い捨て製品であるため、購入者は包装の種類を意識し、持続可能で環境に優しい包装を求めています。これに伴い、市場関係者は環境に優しく生分解性の高いコーヒーカプセルを作る努力をしています。例えば、2022年11月、ネスレのブランドであるネスプレッソは、紙から作られた堆肥化可能なコーヒーカプセルを発売しました。このカプセルはネスプレッソのコーヒーメーカーと互換性があります。

- さらに、コーヒーポッドおよびカプセル市場は、すぐに飲めるコーヒー飲料の需要によって成長しています。個人は多忙なスケジュールのため、迅速なリフレッシュメントと簡単に作れるコーヒーを必要としており、コーヒーポッドおよびカプセルは時間を節約することで彼らの要求に合致しています。このような要因や、世界のコーヒー消費人口の増加が、予測期間中の市場成長をサポートすると予想されます。

コーヒーポッドおよびカプセルの市場動向

スペシャルティおよび有機コーヒーポッドおよびカプセルの需要増加

- 世界的に、ライフスタイルパターンの変化、飲食品への支出の増加、健康食品に対する意識、新製品を味わいたいという欲求などにより、主に茶やコーヒーなどの有機食品・飲料の需要が急速に伸びています。上記の要因は、スペシャルティコーヒーやオーガニックコーヒーのポッドやカプセルの需要を押し上げています。バイヤーや小売業者にとって持続可能性は依然として不可欠であり、有機性の認証はもはやオプションではなく必須要件となっています。さらに、消費者と業界は、有機食品への嗜好の高まりとともに、バリューチェーンにおけるトレーサビリティを求めています。

- 例えば、デンマーク統計局によると、2022年、デンマークの小売店におけるオーガニック・コーヒーの年間売上高は3億3,500万デンマーク・クローネに達しました。同様に、トランスフェアによれば、2021年にドイツで販売されたフェアトレードコーヒーの約74%が有機生産によるものでした。これは、ドイツで販売されたフェアトレードコーヒーの68%が有機栽培によるものであった前年と比較して増加しました。

- さらに、オーガニック・コーヒー・ポッドに対する需要の高まりを受けて、各社はポッドやカプセル形式のオーガニック・コーヒーの提供に力を入れています。これが予測期間中の市場成長を押し上げると予想されます。例えば、2022年12月、持続可能な方法で調達されたオーガニックコーヒーを提供するEmma Chamberlainの発案によるコーヒーライフスタイルブランドであるChamberlain Coffeeは、初のコーヒーポッドを発売し、そのケーシングは商業的に堆肥化可能であるとしています。このような発売は、ブランドにとって利便性の新しい波を示すものであり、革新への継続的なコミットメントと顧客のニーズを満たす能力を示すものであり、最終的には市場の成長を助けるものです。

欧州がコーヒーポッドおよびカプセル市場をリード

- 欧州市場は、インスタント・ノンアルコール飲料の需要の高まりにより、ここ数年スペシャルティコーヒーとシングルサーブ方式の需要が高まっています。中でもドイツとフランスがこの市場の地域リーダーです。この地域のコーヒー生産者は、その適合性、快適性、コーヒー製品や機械の多様性から、コーヒーカプセルの選択に熱心です。

- さらに、スターバックスのような高級コーヒーショップの急増が、高級な淹れたてのコーヒーに対する消費者の欲求を刺激し、欧州におけるコーヒーカプセルとポッドの需要を押し上げています。例えば、スターバックスは2022年に英国で1,156店舗を展開し、そのうちフランチャイズが838店舗、直営店が318店舗で、前年と比べほぼ1,097店舗増加しました。

- さらに、持続可能な素材で作られたコーヒーポッドやカプセルの市場価値が上昇する中、いくつかの国際的な企業やプライベートブランド企業が、革新的なパッケージ商品でこの地域の市場に参入しています。2023年7月、ダーリントンに本社を置くメーカーBeaniesは、英国全土のAldi店舗に堆肥化可能なコーヒーポッドを導入し、大きく躍進しました。同時に同社は、バニラ、キャラメル、ヘーゼルナッツの3種類のおいしいフレーバーの製品を発表しました。

- 同様に、2022年9月、カフェ・ロイヤルは、100%堆肥化可能な植物性シェルに包まれた球形ポッドでコーヒーポッド業界に革命を起こしました。この革新的な製品は、先進パッケージング技術を示すだけでなく、同ブランドを高級でエキゾチックな競合品と競争させるものであり、同地域の大幅な市場成長を牽引すると予測されます。

コーヒーポッドおよびカプセル産業の概要

コーヒーポッドおよびカプセル市場は、主にTim Hortons、Nestle、JAB Holding Companyが支配しており、Nespresso、Keurig、Tassimo、Senseo、Dolce Gustoなどのブランドが世界的に存在感を示しています。Keurig Dr Pepper Inc.やStarbucks Corporationといった他の主要企業も、市場全体で大きなシェアを占めています。しかし、高い製品イノベーション、限定版コーヒーポッドの発売、広範な流通網、より良いサプライチェーンが、コーヒーポッドおよびカプセル市場の高い統合をもたらし、ネスレ(ネスプレッソとドルチェグスト)とJABホールディングス(Senseo、Tassimo、Keurig)が市場全体で最大のシェアを占めています。主要企業は、消費者の需要を満たすために、パッケージのイノベーションと魅力的なフレーバーオプションを持つ製品の発売に注力しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- スペシャルティコーヒーとオーガニックコーヒーのポッドとカプセルの需要

- 包装形態の革新

- 市場抑制要因

- 偽造品の入手可能性

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- ポッド

- カプセル

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- 専門店

- オンライン小売

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 市場シェア分析

- 最も活発な企業

- 企業プロファイル

- Nestle SA

- JAB Holding Company

- The Kraft Heinz Company

- Inspire Brands Inc.(Dunkin'Brands)

- Luigi Lavazza SpA

- Starbucks Corporation

- Gloria Jean's Coffees

- Strauss Group

- Coffeeza

- Trilliant Food & Nutrition LLC

第7章 市場機会と今後の動向

The Coffee Pods And Capsules Market size is estimated at USD 30.63 billion in 2025, and is expected to reach USD 42.78 billion by 2030, at a CAGR of 6.91% during the forecast period (2025-2030).

Key Highlights

- The quality, efficiency, and diverse choices offered in a single serving of coffee are significant for the demand for coffee pods and capsules. Consumers are willing to purchase coffee machines to recreate the cafe-style experience at home, boosting the demand for coffee pods and capsules. Using a modern coffee machine and preferred capsule or coffee pod in the home allows consumers to produce a comprehensive range of coffee quickly.

- Additionally, one of the major factors responsible for the rising popularity of coffee pods among consumers is their one-time use and disposable features that offer convenience to the users. However, as they are single-use products, buyers are conscious about the type of packaging and are looking for sustainable and eco-friendly packaging. In line with this, the market players are making efforts to make environment-friendly and biodegradable coffee capsules. For instance, in November 2022, a Nestle brand, Nespresso, launched compostable coffee capsules made from paper. The capsules are compatible with Nespresso coffee machines.

- Moreover, the coffee pods and capsule market is growing due to the demand for ready-to-drink coffee beverages. Due to the hectic schedules of individuals, they need quick refreshments and easy-to-make coffee, and coffee pods and capsules align with their demands by saving time. Such factors and the increasing coffee-consuming population worldwide are expected to support the market growth during the forecast period.

Coffee Pods and Capsules Market Trends

Increasing Demand For Specialty And Organic Coffee Pods And Capsules

- Globally, the demand for organic food and beverages, mainly tea and coffee, is growing faster due to changes in lifestyle patterns, increased expenditure on food and drink, awareness about healthy foods, and the desire to taste new products. The above factors boost the demand for specialty and organic coffee pods and capsules. Sustainability remains essential for buyers and retailers, and the certification of organic nature is no longer an option but a requirement. In addition, consumers and the industry demand traceability in the value chain with the increasing preference for organic food products.

- For instance, according to Statistics Denmark, in 2022, the annual turnover of organic coffee in retail shops in Denmark amounted to 335 million Danish kroner. Similarly, according to TransFair, in 2021, around 74% of all fair trade coffee sold in Germany came from organic production. This increased compared to the previous year, in which only 68% of all fair trade coffee sold in Germany came from organic production.

- Moreover, with this growing demand for organic coffee pods, players are focused on offering organic coffee in pods and capsule formats. This is expected to boost the market growth during the forecast period. For instance, in December 2022, Chamberlain Coffee, the coffee lifestyle brand and brainchild of Emma Chamberlain that offers sustainably sourced organic coffee, launched their first-ever coffee pods, claiming that their casing is commercially compostable. Such launches mark a new wave of convenience for the brands and showcase their continued commitment to innovation and ability to meet customer needs, which eventually aids the market to grow.

Europe Leads the Coffee Pods and Capsules Market

- The European market witnessed a rising demand for specialty coffee and single-serve methods in the past few years due to the growing demand for instant non-alcoholic drinks. Among all, Germany and France are the regional leaders in the market. Coffee producers in the region are keen on choosing coffee capsules due to their suitability, comfort, and wide diversity of coffee products and machinery.

- Additionally, the proliferation of premium coffee shops, such as Starbucks, has stimulated consumers' appetite for high-end, fresh-brewed coffee, thus boosting the demand for coffee capsules and pods in Europe. For instance, Starbucks had 1,156 stores in the United Kingdom in 2022, of which 838 were franchised and 318 were company-operated locations, which increased from almost 1,097 shops compared to the previous year.

- Moreover, with the rising market value for coffee pods and capsules made of sustainable materials, several international and private-label players are entering the market in the region with their innovative package offerings. In July 2023, Darlington-based manufacturer Beanies made a significant stride by introducing its compostable coffee pods in Aldi stores across the United Kingdom. Simultaneously, the company unveiled its products in three delectable flavors: vanilla, caramel, and hazelnut.

- Similarly, in September 2022, Cafe Royal revolutionized the coffee pod industry with a spherical-shaped pod enveloped in a vegetable-based, 100% compostable shell-a groundbreaking zero-waste solution for capsules. This innovative product not only showcases advancing packaging technologies but also positions the brand to compete with high-end, exotic counterparts, projected to drive substantial market growth in the region.

Coffee Pods and Capsules Industry Overview

The coffee pods and capsules market is primarily dominated by Tim Hortons, Nestle, and JAB Holding Company, with a strong global presence of brands like Nespresso, Keurig, Tassimo, Senseo, and Dolce Gusto. Other key players, such as Keurig Dr Pepper Inc. and Starbucks Corporation, also hold a prominent share of the overall market. However, high product innovations, the launch of limited edition coffee pods, extensive distribution networks, and better supply chains have resulted in high consolidation of the coffee pods and capsules market, with Nestle (Nespresso and Dolce Gusto) and JAB Holdings (Senseo, Tassimo, and Keurig) holding the maximum share in the overall market. Major players are focused on packaging innovations and launching products with attractive flavor options to meet consumer demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Demand for specialty and organic coffee pods and capsules

- 4.1.2 Innovations in packaging formats

- 4.2 Market Restraints

- 4.2.1 Availability of counterfeit products

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pods

- 5.1.2 Capsules

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online Retailing

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Active Companies

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 JAB Holding Company

- 6.3.3 The Kraft Heinz Company

- 6.3.4 Inspire Brands Inc. (Dunkin' Brands)

- 6.3.5 Luigi Lavazza SpA

- 6.3.6 Starbucks Corporation

- 6.3.7 Gloria Jean's Coffees

- 6.3.8 Strauss Group

- 6.3.9 Coffeeza

- 6.3.10 Trilliant Food & Nutrition LLC