|

市場調査レポート

商品コード

1437906

航空機エンジン:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Aircraft Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機エンジン:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

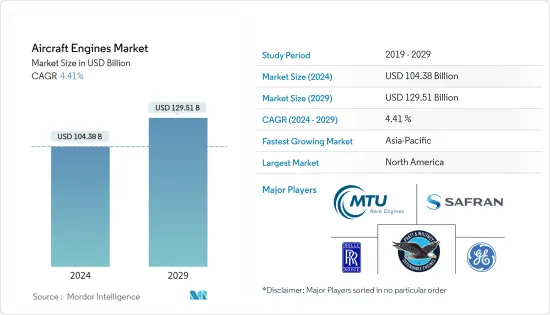

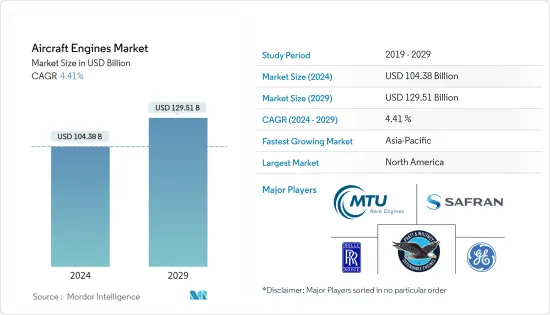

航空機エンジン市場規模は2024年に1,043億8,000万米ドルと推定され、2029年までに1,295億1,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.41%のCAGRで成長します。

航空業界の低迷により、航空機エンジン市場はCOVID-19症パンデミックの影響を大きく受け、その結果、2020年と2021年には航空機エンジンの納入が減少しました。しかし、商業分野における航空機OEMの大規模な受注残により、軍事および一般航空部門が予測期間中に市場を牽引すると予想されます。

航空会社、航空機運航者、軍隊、チャーター事業者が計画している航空機の近代化と拡大計画は、予測期間中に航空機エンジン市場の成長を推進すると予想されます。

市場の成長は、航空機の燃料効率を向上させる、排出ガスが少なく重量が軽い新世代エンジンの需要によっても推進されています。この傾向により、企業は積層造形や複合技術などの最新技術を活用した新しいエンジンモデルの研究開発に投資しています。

しかし、運航中の航空機エンジンの故障や納期の遅れに対する懸念の高まりは、市場の成長を妨げる要因の一部となっています。

航空機エンジン市場動向

民間航空機エンジンの需要は予測期間中に改善すると予想される

現在、民間航空機セグメントが市場を独占しており、世界中で多数の民間航空機が納入され、航空機エンジンの需要が生み出されているため、予測期間中もその優位性は続くと予想されます。 2021年末までにエアバスは7,082機の受注残を報告し、ボーイングの受注残は5,136機となりました。航空機OEMの受注残は、予測期間中の商用エンジン部門の健全な成長をサポートすると予想されます。国内需要は国際旅客需要よりも早くパンデミック前の水準に戻ると予想されるため、ナローボディ機の需要はワイドボディ機よりも早く回復すると予想されます。また、ボーイング 737 MAXが2021年に運航を再開したことにより、ナローボディ機の需要が高まっています。新世代旅客機の技術進歩により、より長い距離を飛行できるようになりました。航空会社は自社の航空機用に旅客機の調達を検討しているため、企業は航続距離を延ばしながら旅客機の燃料効率を向上させることを重視しています。エアバスは、2035年までにゼロエミッション航空機の導入を目指し、水素燃料航空機エンジンの開発で2022年2月にCFMインターナショナルと提携を結びました。こうした計画は市場の成長を促進すると予想されています。

アジア太平洋地域は予測期間中に最高の成長を遂げると予想される

アジア太平洋地域は、新興経済諸国の国内航空旅行に対する強い需要により、予測期間中に最も高い成長を遂げると予想されています。パンデミックにより2020年は旅客輸送量が減少しましたが、中国、インド、韓国、オーストラリアなどの国の国内旅客輸送量は2020年後半から徐々に回復してきました。この地域のコスト航空会社は、路線拡大計画をサポートするために新世代航空機を導入して機材を強化しています。たとえば、2021年11月、インドの新興航空会社であるアカサ航空は、現在発注中の新型ボーイング737 MAX航空機にCFM LEAP-1Bエンジンを選択しました。航空会社は、737-8および高輸送能力の737-8-200モデルを含む、ボーイング 737 MAX航空機72機を発注しました。この地域の航空会社の機材近代化計画の一環としてのこのような堅調な航空機発注により、今後数年間で航空機エンジンの需要が加速すると予想されます。さらに、この地域の地政学的な緊張により、各国は先進的な航空機の調達や老朽化した航空機の更新によって航空能力を強化するための投資を増加させています。インド空軍は、既存の飛行隊数と必要な飛行隊数との間のギャップを埋める計画の一環として、2035年までにインドの北部と西部の国境に配備する戦闘機450機を取得する計画を立てています。このような車両の近代化計画により、今後数年間にわたって、軽量で燃料効率の高い先進的なエンジンに対する需要が生み出される可能性があります。

航空機エンジン業界の概要

航空機エンジン市場は高度に統合されており、民間および軍用機セグメントでは少数の企業が市場を独占しています。航空機エンジン市場の著名な企業には、General Electric Company(GE Aviation経由)、Raytheon Technologies Corporation(Pratt &Whitney経由)、Rolls-Royce Holding PLC、Safran SA、MTU Aero Engines AGなどがあります。前述の企業と、CFM International(GE AviationおよびSafran)、International Aero Engines(Pratt &Whitney、Japanese Aero Engine Corporation、およびMTU Aero Engines)、Engine Alliance(General ElectricおよびPratt &Whitney)などの合弁事業、主要な民間航空機および軍用航空機プログラムにエンジンを提供しています。 2020年と2021年に民間航空機エンジンの納入が連続して減少したにもかかわらず、航空機OEMの航空機受注残の増加により、航空機エンジンメーカーの残存履行義務(RPO)は増加しています。また、エンジンメーカーは航空機メーカーと提携して、軽量でエンジン排出量を削減した持続可能な航空機エンジンソリューションを開発しています。これに加えて、地元の製造業に対する需要の高まりにより、地域の企業は国際的な企業と提携しています。たとえば、2022年3月の時点で、インドの国防研究開発機構(DRDO)は、国産の第5世代先進中型戦闘機(AMCA)用の125KNエンジンの共同開発についてサフランと協議しています(現在初飛行に向けて開発中)。このような発展は、今後数年間で企業の地理的存在感を高めるのに役立つと予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

- USDの通貨換算レート

第2章 調査手法

第3章 エグゼクティブサマリー

- 市場規模と予測、世界、2018~2027年

- エンジンタイプ別の市場シェア、2021年

- 航空機タイプ別の市場シェア、2021年

- 地域別市場シェア、2021年

- 市場の構造と主要参加者

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- ターボファン

- ターボプロップ

- ターボシャフト

- ピストン

- 民間航空

- ナローボディ航空機

- ワイドボディ航空機

- 地域航空機

- 軍用航空

- 戦闘機

- 非戦闘機

- 一般航空

- ビジネスジェット

- ヘリコプター

- ターボプロップ航空機

- ピストンエンジン航空機

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ

- 中東とアフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- その他中東およびアフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- General Electric Company

- Safran SA

- Rolls-Royce Holding PLC

- Raytheon Technologies Corporation

- Honeywell International Inc.

- Rostec

- MTU Aero Engines AG

- IHI Corp.

- Textron Inc.

- Williams International Co. LLC

- Mitsubishi Heavy Industries Aero Engines Ltd

第7章 市場機会と将来の動向

The Aircraft Engines Market size is estimated at USD 104.38 billion in 2024, and is expected to reach USD 129.51 billion by 2029, growing at a CAGR of 4.41% during the forecast period (2024-2029).

The market of aircraft engines was highly affected by the COVID-19 pandemic due to a downturn in the aviation industry, which resulted in reduced deliveries of aircraft engines in 2020 and 2021. However, the large-scale backlog of aircraft OEMs in the commercial, military, and general aviation sectors is expected to drive the market during the forecast period.

The planned fleet modernization and expansion plans of airlines, aircraft operators, armed forces, and charter operators are expected to propel the growth of the aircraft engines market during the forecast period.

The market's growth is also driven by the demand for new generation engines with low emissions and lower weight, which will enhance aircraft fuel efficiency. Due to this trend, companies are investing in research and development of new engine models utilizing the latest technologies, like additive manufacturing and composite technologies.

However, growing concerns over the failure of aircraft engines during operation and delays in deliveries are some of the factors hampering the market's growth.

Aircraft Engine Market Trends

Demand for Commercial Aircraft Engines Expected to Improve During the Forecast Period

The commercial aircraft segment currently dominates the market and is expected to continue its dominance during the forecast period, owing to a large number of commercial aircraft deliveries across the world, which are generating demand for aircraft engines. By the end of 2021, Airbus reported a backlog of 7,082 jets, and Boeing's backlog was 5,136 aircraft. The backlog of the aircraft OEMs is expected to support the commercial engines segment to grow at a healthy rate during the forecast period. The demand for narrow-body aircraft is expected to recover faster than for wide-body aircraft as domestic demand is expected to return to pre-pandemic levels earlier than the international passenger demand. Also, the return of the Boeing 737 MAX into service in 2021 has been boosting the demand for narrow-body aircraft. Technological advancements in newer generation passenger aircraft make it possible for them to fly longer distances. Players are emphasizing increasing the fuel efficiency of passenger aircraft while increasing their range, as airlines are looking to procure such aircraft for their fleets. Airbus entered into a partnership with CFM International in February 2022 to develop a hydrogen-fuelled aircraft engine with the aim of introducing zero-emission aircraft by 2035. Such plans are anticipated to propel the growth of the market.

Asia-Pacific Region Expected to Witness the Highest Growth During the Forecast Period

The Asia-Pacific region is expected to witness the highest growth during the forecast period due to the strong demand for domestic air travel in developing economies. The pandemic led to a decline in passenger traffic in 2020, but domestic passenger traffic in countries like China, India, South Korea, and Australia has been gradually recovering from the second half of 2020. Due to the faster growth of domestic passenger traffic, low-cost airlines in the region are strengthening their aircraft fleet with new generation aircraft to support their route expansion plans. For instance, in November 2021, Akasa Air, a new airline in India, selected CFM LEAP-1B engines for its new Boeing 737 MAX aircraft currently on order. The airline placed an order for 72 Boeing 737 MAX aircraft, including 737-8 and the high-capacity 737-8-200 models. Such robust aircraft orders as part of fleet modernization plans of the airlines in the region are expected to accelerate the demand for aircraft engines over the coming years. Furthermore, due to geopolitical tensions in the region, countries are increasing their investments to strengthen their aerial capabilities with the procurement of advanced aircraft and replace their aging aircraft. The Indian Air Force is planning to acquire 450 fighter aircraft for deployment on the northern and western frontiers of the country by 2035 as part of its plan to bridge the gap between the existing number of squadrons and the required number of squadrons. Such fleet modernization plans will likely generate demand for advanced lightweight and fuel-efficient engines over the coming years.

Aircraft Engine Industry Overview

The aircraft engine market is highly consolidated, with a few players dominating the market in the commercial and military aircraft segments. Some of the prominent aircraft engine market players are General Electric Company (through GE Aviation), Raytheon Technologies Corporation (through Pratt & Whitney), Rolls-Royce Holding PLC, Safran SA, and MTU Aero Engines AG. The aforementioned players, along with their joint ventures such as CFM International (GE Aviation and Safran), International Aero Engines (Pratt & Whitney, Japanese Aero Engine Corporation, and MTU Aero Engines), and Engine Alliance (General Electric and Pratt & Whitney), provide engines for major commercial and military aircraft programs. Despite the decrease in commercial aircraft engine deliveries in 2020 and 2021 consecutively, the remaining performance obligation (RPO) of aircraft engine manufacturers is witnessing an increase due to the increasing aircraft backlog of aircraft OEMs. Also, engine manufacturers are partnering with aircraft manufacturers to develop sustainable aircraft engine solutions that have low weight and reduced engine emissions. In addition to this, due to increasing demand for local manufacturing, regional players are partnering with international players. For instance, as of March 2022, India's Defence Research and Development Organisation (DRDO) was in talks with Safran for joint development of a 125KN engine for the indigenous fifth-generation Advanced Medium Combat Aircraft (AMCA) (currently under development with the first flight planned for 2024). Such developments are anticipated to help the companies increase their geographical presence over the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Engine Type, 2021

- 3.3 Market Share by Aircraft Type, 2021

- 3.4 Market Share by Geography, 2021

- 3.5 Structure of the Market and Key Participants

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2027)

- 5.1 Engine Type

- 5.1.1 Turbofan

- 5.1.2 Turboprop

- 5.1.3 Turboshaft

- 5.1.4 Piston

- 5.2 Aircraft Type

- 5.2.1 Commercial Aviation

- 5.2.1.1 Narrow-body Aircraft

- 5.2.1.2 Wide-body Aircraft

- 5.2.1.3 Regional Aircraft

- 5.2.2 Military Aviation

- 5.2.2.1 Combat Aircraft

- 5.2.2.2 Non-combat Aircraft

- 5.2.3 General Aviation

- 5.2.3.1 Business Jet

- 5.2.3.2 Helicopter

- 5.2.3.3 Turboprop Aircraft

- 5.2.3.4 Piston Engine Aircraft

- 5.2.1 Commercial Aviation

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.1.1 Engine Type

- 5.3.1.1.2 Aircraft Type

- 5.3.1.2 Canada

- 5.3.1.2.1 Engine Type

- 5.3.1.2.2 Aircraft Type

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.1.1 Engine Type

- 5.3.2.1.2 Aircraft Type

- 5.3.2.2 Germany

- 5.3.2.2.1 Engine Type

- 5.3.2.2.2 Aircraft Type

- 5.3.2.3 France

- 5.3.2.3.1 Engine Type

- 5.3.2.3.2 Aircraft Type

- 5.3.2.4 Rest of Europe

- 5.3.2.4.1 Engine Type

- 5.3.2.4.2 Aircraft Type

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.1.1 Engine Type

- 5.3.3.1.2 Aircraft Type

- 5.3.3.2 India

- 5.3.3.2.1 Engine Type

- 5.3.3.2.2 Aircraft Type

- 5.3.3.3 Japan

- 5.3.3.3.1 Engine Type

- 5.3.3.3.2 Aircraft Type

- 5.3.3.4 South Korea

- 5.3.3.4.1 Engine Type

- 5.3.3.4.2 Aircraft Type

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.3.5.1 Engine Type

- 5.3.3.5.2 Aircraft Type

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.1.1 Engine Type

- 5.3.4.1.2 Aircraft Type

- 5.3.4.2 Rest of Latin America

- 5.3.4.2.1 Engine Type

- 5.3.4.2.2 Aircraft Type

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.1.1 Engine Type

- 5.3.5.1.2 Aircraft Type

- 5.3.5.2 Saudi Arabia

- 5.3.5.2.1 Engine Type

- 5.3.5.2.2 Aircraft Type

- 5.3.5.3 Qatar

- 5.3.5.3.1 Engine Type

- 5.3.5.3.2 Aircraft Type

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.5.4.1 Engine Type

- 5.3.5.4.2 Aircraft Type

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Electric Company

- 6.2.2 Safran SA

- 6.2.3 Rolls-Royce Holding PLC

- 6.2.4 Raytheon Technologies Corporation

- 6.2.5 Honeywell International Inc.

- 6.2.6 Rostec

- 6.2.7 MTU Aero Engines AG

- 6.2.8 IHI Corp.

- 6.2.9 Textron Inc.

- 6.2.10 Williams International Co. LLC

- 6.2.11 Mitsubishi Heavy Industries Aero Engines Ltd