|

|

市場調査レポート

商品コード

1851749

自転車:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自転車:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月25日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

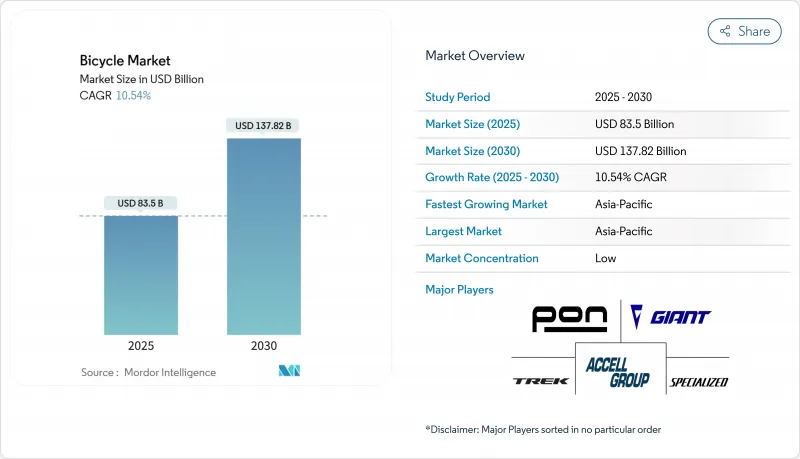

自転車の市場規模は2025年に835億米ドルと推定され、予測期間(2025~2030年)のCAGRは10.54%で、2030年には1,378億2,000万米ドルに達すると予測されます。

都市中心部では渋滞料金の導入が進む一方、雇用主はウェルネス・プログラムに自転車奨励策を組み込んでおり、自転車需要を持続的に牽引しています。こうした需要は、二酸化炭素排出量削減を目的とした気候変動政策の強化に加え、すでに予測を上回っている政府のインフラ投資によってさらに強化されます。さらに、バッテリーの安全技術の進歩が続いており、安全性への懸念に対処することで潜在的な消費者層が拡大しています。消費者直販ブランドの台頭と、ソフトウェア対応のフリート・サービスの統合は、小売の情勢を再定義し、経営効率を最適化し、顧客にとっての利便性を高めています。燃料価格の高騰は、原動機付き車両に対する自転車のコスト優位性をさらに高め、経済的に実行可能な選択肢となっています。全体として、自転車市場は、良好な規制枠組み、技術の進歩、持続可能でアクティブなモビリティ・ソリューションへの都市生活様式のシフトに支えられ、成長を続けています。

世界の自転車市場の動向と洞察

政府の支援が環境に優しい交通手段を後押し

世界各国の政府は、サイクリングを単なるレクリエーションではなく、気候インフラの重要な要素として認識しつつあります。この変化は、欧州連合(EU)が2024年4月に「サイクリングに関する欧州宣言」を採択したことからも明らかです。この宣言では、サイクリング・インフラを強化し、持続可能な交通システムへの統合を促進するために、加盟国に対して36の拘束力のある約束が定められています。同様に米国では、アクティブ交通インフラ投資プログラム(Active Transportation Infrastructure Investment Program)が毎年4,450万米ドルを提供し、サイクリストのアクセシビリティと安全性を向上させるサイクリング・ネットワークを整備しています。州レベルでは、カリフォルニア州が4年間で9億3,000万米ドルを投じて265マイルのサイクリングロードを新設し、都市計画におけるサイクリングの重要性をさらに強調しています。こうした包括的な政策措置は、サイクリング関連製品やサービスに対する持続的な需要を促し、メーカーに生産能力の拡大を促し、小売業者には市場ニーズの高まりに対応するために在庫量を増やすよう動機づけています。

都市の混雑が日常通勤での自転車利用を促進

特にアジア太平洋の巨大都市では、交通渋滞の経済的・社会的コストに直面し、都市密度の圧力が高まるにつれ、サイクリングソリューションの必要性が重要になっています。渋滞価格と低排出ガスゾーンは、自家用車よりも自転車利用をさらに促進します。ハイブリッド勤務モデルも通勤の形を変え、サイクリングは短時間でフレキシブルな移動に理想的なものとなっています。オランダは、サイクリングハイウェイを鉄道網とリンクさせ、環境とモビリティの課題に取り組みながら、自動車所有に匹敵する複合交通システムを構築し、サイクリング統合の成功例を示しています。企業は、従業員の健康増進への取り組みや持続可能性報告義務に後押しされ、ますますサイクリングを採用するようになっています。サイクリング・インフラへの投資は、人材を惹きつけ、環境・社会ガバナンス(ESG)目標に沿った二酸化炭素削減目標を達成するのに役立っています。

自転車のような代用品や他の高速交通手段が利用可能であることが、自転車の利用を抑制しています。

電動スクーター、ライドシェアリングサービス、自律走行車の試験運行が短距離モビリティに対応するにつれて、交通手段間の競合が激化しています。都市部では、e-bikeの所有コストが電動スクーターやライドシェアの契約コストに匹敵するようになり、価格競争が激化しています。マイクロモビリティ・プラットフォームの統合が推進する統合交通アプリは、自転車を数ある交通手段の選択肢の一つにしました。地下鉄網が発達したアジア太平洋の都市では、公共交通機関の進歩により、長時間の通勤における自転車の魅力が低下しています。代替交通手段に対する規制が急速に進む一方で、自転車のインフラ整備は遅れに直面しています。例えば、電動スクーター・シェアリング・プログラムは迅速に認可を受けるが、サイクリング・プロジェクトは時間がかかります。しかし、サイクリングの健康と環境への利点は、代替の脅威を制限し、市場での存在感を確保しています。

セグメント分析

電子自転車は2024年に自転車市場の51.25%を占め、2030年までのCAGRは12.76%と予測されます。UL2849のような安全認証が消費者の信頼を高めていることも後押ししています。バッテリーは取り外し可能で、航空機にも対応するようになり、使用事例が広がっています。一方、従来型のロードバイクやシティバイクは販売台数が多く、部品メーカーのスケールメリットが維持されています。

統合ナビゲーション、盗難追跡、予知メンテナンスは、ライダー体験を豊かにし、プレミアム価格帯を押し上げます。アジア太平洋地域のメーカーはコスト効率の高い生産能力から恩恵を受け、欧州のアセンブラーは近接性を活用してプレミアム・ニッチを獲得します。中国ではバッテリーのリサイクルが義務化され、他の地域もこれに倣う可能性があります。バイクにフリート分析をバンドルし、モビリティ予算へのアセット・ライト・アクセスを提供するソフトウェア・ネイティブ企業には、市場参入の余地が残されています。

2024年の自転車市場は、引き続きレギュラーフレームが85.78%の大幅な市場シェアを占め、支配的です。この優位性は、大量生産可能な形状、費用対効果の高い価格設定、既存のインフラとのシームレスな互換性といった強力な魅力が、レギュラーフレームを消費者に好まれる選択肢にしていることを浮き彫りにしています。一方、折りたたみ式は力強い成長軌道を描くと予測され、2030年までのCAGRは11.43%という驚異的な数字を記録します。この成長率は自転車市場全体の2倍に相当するが、これは主にコンパクトでスペース効率の高いソリューションに対する需要の高まりによるもので、特に都市部の限られた住宅スペースや、鉄道網との効率的なラストワンマイル接続に対するニーズの高まりといった課題に対応しています。

マグネシウム・ヒンジやクイックリリース・クランプといった素材の進歩により、重量プレミアムが制限されるようになり、通常の自転車と同等の保証が受けられるようになったことで、過去のためらいが解消されました。自転車業界では、机の下や小さなロッカーに安全に収納できるため、企業も従業員用自転車として折りたたみ式を好んでいます。ドイツやオランダをはじめとする、鉄道と自転車を組み合わせた通勤を支援する欧州の政策は、折りたたみ式モデルに規制上の追い風を与えています。しかし、年間販売台数の大部分は、折りたたみの小売価格がその差を縮めるまで、通常の自転車によるものであることに変わりはないです。

地域分析

2024年、アジア太平洋地域は世界市場の48.11%を占め、主要な売上貢献地域としての地位を固めました。この地域は、いくつかの要因によって、2030年までCAGR13.33%の力強い成長を遂げると予測されています。中国では、e-bikeの普及、バッテリーリサイクルの義務化、持続可能な交通手段として二輪車の利用を積極的に奨励する都市交通政策などにより、自転車市場が大きく成長しています。他方、日本は、輸出手続きを簡素化し、国内ブランドの国際競争力を高めるため、認証枠組みを戦略的に欧州規格と整合させつつあります。

北米と欧州では、大規模なインフラ投資計画が安定的かつ持続的な自転車需要を生み出しています。市場の地理的分布は、アジアへの生産活動の集中を浮き彫りにしており、先進国市場は有利な政策措置に牽引されて成長を遂げています。このダイナミズムは貿易の流れを促進し、アジアの既存メーカーの優位性を強化するだけでなく、高品質で革新的な製品に価値を見出す消費者層に対応し、欧米市場でのプレミアム製品ポジショニングの機会も生み出しています。

中東・アフリカの自転車市場は力強い成長を遂げており、E-BIKEの普及は2桁のペースで加速しているが、従来型の自転車は安定した需要を維持しています。ドバイ、ケープタウン、ナイロビ、テルアビブといった主要都市の都市消費者は、自転車、特にe-bikeを、自動車やバイクといった従来の乗り物に代わる、環境に配慮した近代的な乗り物として認識するようになっています。しかし、標準化された安全規制、保険の枠組み、交通権の欠如が依然として課題となっており、アフリカ諸国の自転車市場の急速な正式化を妨げています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 都市の混雑が毎日の通勤に自転車利用を促進

- フィットネス動向がサイクリング人気を高める

- 政府の支援により環境に優しい交通手段が奨励される

- 環境意識と持続可能性が消費者の自転車利用を促進

- 職場のウェルネス・プログラムが従業員の自転車利用を促進

- 燃料価格の上昇により、自転車が費用対効果の高い代替手段となる

- 市場抑制要因

- バイクや他の高速交通手段のような代用品が、自転車の利用を阻害

- 偽造自転車の存在が市場成長を妨げる

- e-bikeのコストが高く、世界の普及が制限される

- 農村部の劣悪な道路事情がスムーズな自転車利用を妨げる

- 規制情勢

- 技術的進歩

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- ロード/シティ

- マウンテン/オールテレーン

- ハイブリッド

- 電動自転車

- その他のタイプ

- 設計別

- レギュラー

- 折りたたみ

- エンドユーザー別

- 男性

- 女性

- 子ども

- 流通チャネル別

- オフライン小売店

- オンライン小売店

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Specialized Bicycle Components Inc.

- Shimano Inc.

- Scott Sports SA

- Merida Industry Co. Ltd

- Stryder Cycle Private Limited

- Cycles Devinci inc.

- Pending System GmbH & Co. KG

- Brompton Bicycle Ltd

- Decathlon SA

- Rad Power Bikes Inc.

- Riese and Muller GmbH

- Bulls Bikes GmbH

- Yadea Group Holdings Ltd

- Canyon Bicycles GmbH

- Hero Cycles Limited

- Ribble Cycles