|

市場調査レポート

商品コード

1850374

家具:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 家具:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月06日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

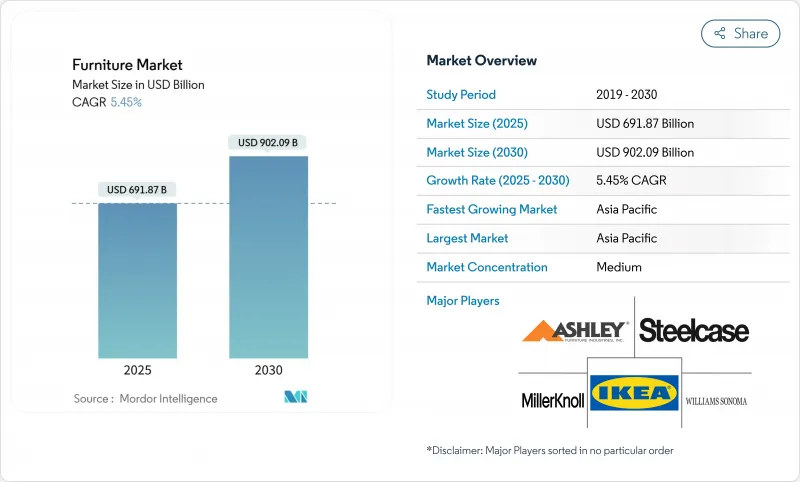

家具市場は2025年に6,918億7,000万米ドルに達し、2030年には9,020億9,000万米ドルに達すると予測され、期間中のCAGRは5.45%です。

都市部への移住、持続可能性の義務化、急速なデジタル化により、カテゴリーへの投資はリサイクル素材、コネクテッド製品、オムニチャネル販売形態へと方向転換しています。新興都市における中流階級の所得増加により、対応可能な家具市場は従来の大都市中心部をはるかに超えて拡大する一方、消費者は認証された持続可能な仕上げやスマートホームへの対応に具体的な価値を見出すようになり、プレミアム化が勢いを増しています。生産は、労働力の入手可能性、原材料の近接性、貿易の連携によって陸揚げコストを下げ、競争力のある価格設定と柔軟な供給を支える東南アジアの輸出クラスターへと着実にシフトしています。逆に、欧州では使用済み製品の管理に関する規制が強化され、グローバルブランドはサーキュラーデザインのフレームワークを標準化し、コンプライアンス期限に先駆けて投資を行うようになっています。競合レベルでは、断片的な地域プレーヤーと、規模、統合eコマース・プラットフォーム、データ主導の商品企画を活用して利幅を確保し、商品速度を加速させる多国籍既存プレーヤーが共存しています。

世界の家具市場の動向と洞察

ミレニアル世代による住宅リフォームが多機能家具の需要を後押し

ミレニアル世代の世帯は、可処分所得の上昇に伴い、スペースを有効活用するソリューションが必要なコンパクトな住宅への投資を続けています。若い購買層のオンラインに対する信頼は厚く、価格のハシゴをなくし、納期を短縮する消費者直販専門店へのチャネルシフトを加速させる。2024年7月から9月にかけて実施されたPwC 2024「消費者の声」調査では、北米、欧州、アジア太平洋の主要な家具市場を対象に、27カ国で9,800人以上の消費者から洞察を得た。この調査では、ミレニアル世代の67%が、高額な家具商品を、事前に実物を確認することなくオンラインで購入することに前向きであることが明らかになりました。これとは対照的に、団塊の世代では38%しかこのような感情を共有しておらず、デジタル・ファースト・ブランドへのシフトが急速に進んでいることが浮き彫りになりました。ミレニアル世代は、2024年には世界の家具消費額の約22%を占め、毎年3-4%ずつシェアを伸ばすと予測されていることから、2030年には市場の35%近くを支配する勢いです。

急速な都市化が省スペース型モジュール型家具の売上を牽引

世界的な都市化の加速に伴い、スペース効率の高い家具に対する需要が、特に人口増加が最も著しい新興国市場で高まっています。アジア太平洋地域の都市人口は年率1.5~2%で増加しており、新興国市場の0.5~0.8%を上回っています。この格差が、スペースを最適化するソリューションへの需要の高まりを後押ししています。堅苦しいキャビネットは、壁付けデスク、折り畳み式ベッド、日中と夜間の役割に適応する変形シーティング・システムにシェアを譲る。住宅コストの上昇により、多くの世帯がコスト負担を強いられており、買い替えサイクルを先延ばしにする、耐久性がありながら汎用性の高いアイテムへの需要が高まっています。

EUの拡大生産者責任(EPR)規則が輸出業者のコンプライアンス・コストを引き上げる

2025年1月に施行される新たな義務により、欧州経済地域に進出するすべての家具サプライヤーは、使用済み製品の回収、リサイクル、検証済みの廃棄に資金を提供することが義務付けられます。リバース・ロジスティクス・ネットワークを持たない企業は現在、輸出マージンを侵食する手数料、行政報告、潜在的な罰則に直面しています。サーキュラー・デザインのロードマップを持つ大手既存企業が優位に立つ一方、新興諸国の小規模生産者は、市場参入への高い障壁に直面するか、集団引き取りスキームを通じて協力しなければならないです。短期的なコンプライアンス費用の増加は、目先の輸入量を制約するかもしれないが、受益者には、材料回収やトレーサビリティ・プラットフォームを専門とするサービス・プロバイダーが含まれます。時間の経過とともに、EPR原則との整合は、リサイクル可能な基材をめぐる世界的な収束に拍車をかけるはずであり、それによってサプライチェーンは安定し、多くの消費者がすでに求めている環境に関する物語が強化されることになります。

セグメント分析

家庭用家具セグメントは、2024年の売上全体の68%を占めました。家庭は、所有または賃貸住宅内の快適性、美観、持続可能性のアップグレードを優先するため、需要は好調を維持した。この分野では、バスルームコレクションのCAGRが6.9%と他のサブカテゴリーを上回りました。成長の背景には、健康のための儀式への投資の増加、耐湿性再生ポリマーの採用拡大、空気の質やスキンケア習慣を追跡するスマートミラーなどがあります。小売業者は、リフォームの意思決定チェーンを簡素化すると同時に、平均受注額を高めるために、洗面台、収納、備品などのパッケージをコーディネートしています。これと並行して、オフィスの家具は、企業がハイブリッド居住をサポートするコラボレーションゾーンを改修することで回復し、一方、ホスピタリティの改修は、旅行リバウンドとソーシャルメディアへのエンゲージメントを獲得するために加速しました。多機能性は依然として横断的な物語であり、デザイナーに充電ポート、統合照明、隠し収納を日常的なアイテムに組み込むことを促し、密集した都市部のアパートメントにおける平方フィートの実用性を伸ばしています。

バスルームの家具のイノベーションの弧は、抗菌コーティング、タッチフリー水洗メカニズム、資源管理を強化する中水リサイクルモジュールにまで広がっています。色、仕上げ、ハードウェアのカスタマイズを提供するサプライヤーは、自宅でもブティックホテルのような美観を求める消費者の欲求を活用しています。アジア太平洋地域のプレハブ住宅プロジェクトでは、コンパクトなモジュール式バスルームの普及が進んでおり、バリューエンジニアリング製品群の川下顧客層が拡大しています。高齢化社会が安全性の向上を追求する中、形と機能を融合させたグラブ一体型キャビネットや腰掛け式シャワーベンチへの需要が高まっています。全体として、バスルームが今後のカテゴリー支出に占める割合が高まっていることは、ウェルネスと持続可能性の優先順位が家具市場の購買行動を支配していることを浮き彫りにしています。

2024年の家具市場では、再生可能なイメージと永続的な美的温もりに支えられた木材のシェアが55%を占めました。しかし、プラスチックとポリマーの代用品は、リサイクル素材とバイオベースのコンポジットの画期的な進歩により、2030年までのCAGRが7.2%と予測され、最速の上昇を記録しています。メーカー各社は、消費者使用後の樹脂と天然繊維を組み合わせて、屋内外での使用に適した軽量かつ強靭なパネルを製造しており、バージン材料への依存を削減し、仕上げの一貫性の課題を緩和しています。アルミニウムもまた、耐腐食性と良好な強度対重量比のため、商業的仕様で利用されるようになってきており、二次製錬業者がスクラップから低炭素ビレットを供給しています。木材フレームとポリマー・ジョイントを統合したハイブリッド・フレームは、寸法安定性を最適化し、廃棄物を削減し、使用後の分離を容易にします。

持続的な研究開発投資は、環境に優しい接着剤、VOCフリーのコーティング剤、再生プラスチックの前面に木目を模倣したデジタル仕上げを対象としています。アクゾノーベルの新しい再生プラスチック・ラッカー・システムは、表面の耐久性を高め、隠れた構造要素から目に見える高級用途へのポリマーの移行を可能にします。設計者はジェネレイティブ・ソフトウェアを利用して、より少ない材料で剛性を維持する格子構造を設計し、カーボンフットプリントをさらに削減しています。森林破壊やEPRをめぐる規制の動きは、追跡可能なサプライチェーンへの関心を高め、サプライヤーにCoC認証やQRコードベースの材料パスポートの提供を促します。規制と消費者の嗜好が相まって、ポリマーは木材の優位性に対する確かな課題者として確固たる地位を築いているが、責任ある方法で調達された木材は、家具市場の多くの美的スタイルにとって不可欠な存在であり続けると思われます。

地域分析

アジア太平洋地域は、都市人口の拡大、持ち家志向の高まり、堅調な輸出生産を背景に、2024年の売上高の42%を占め、世界の売上高をリードしています。この地域は、部品メーカー、ハードウェアメーカー、仕上げ工場が共存する統合供給クラスターの恩恵を受けており、サイクルタイムと在庫コストを削減しています。アジア太平洋の中では、東南アジアの2030年までのCAGRが7.8%になると予測されています。これは、ベトナムの2桁の工場生産高成長率、インドネシアの若年人口統計、主要消費者市場への免税アクセスを認める貿易協定による支援などが原動力となっています。ベトナムとマレーシアの政府奨励策は、自動化とエネルギー効率のアップグレードを助成し、生産性と環境パフォーマンスを向上させる。

北米は、ライフスタイルのアップグレード、ハイブリッド・ワークの再計画、および資金調達オプションをサポートする成熟した信用環境が原動力となり、一世帯当たりのチケットサイズが高いです。トレーサビリティと室内空気品質に関する厳しい購買基準が、低VOC認定製品に対する需要を高め、サプライヤーはGREENGUARDとFSCラベルの確保を促します。3PLネットワークと迅速配備のフルフィルメント・センターへの組織的投資により、かさばる商品の配送信頼性が向上し、オンライン化率が維持されます。カナダでは移民受け入れが増加し、住宅形成がさらに促進され、必須家具カテゴリーの需要が安定的に増加します。

欧州は、材料構成、修理可能性、リサイクル可能性を文書化できる生産者を優遇するEPR義務化によって、規制変革の最前線に立っています。北欧の消費者は、一人当たりの再生品への支出額が世界最高水準にあり、循環型ソリューションへの意欲を示しています。中欧と東欧の製造拠点は、リードタイムの短縮と輸送排出量の削減を求める西欧ブランドから、ニアショアリング投資を集めています。さらに南では、スペインとイタリアが、内装の改修を含むことが多い政府のエネルギー改修補助金を背景に、改修活動の活発化を目の当たりにしています。

中東とアフリカは、都市インフラが拡大し、観光投資がホスピタリティの改装に拍車をかけているため、絶対額では控えめながら、相対的な成長率は最速の部類に入る。湾岸協力会議の巨大プロジェクトでは、高温の気候に適した高級屋外用家具やウェルネス用家具が求められ、耐候性ポリマーやアルミラインの輸出機会が創出されています。サハラ以南のアフリカの需要は、主に地域の木材基地から調達される手頃な価格の木製家具が牽引しているが、eコマースの浸透に伴い、組み立て式の既製品の輸入量も増加しています。

南米は、ブラジルとコロンビアのマクロ安定化に伴って見通しが改善し、住宅ローンの利用可能性と住宅建設パイプラインがベッドルームとキッチン部門の受注を刺激します。メルコスール内の貿易回廊は、パーティクルボード、金物、椅子張り生地の域内調達を促し、コスト効率の高い組み立てを促進します。各大陸の家具市場は、為替レート、運賃、政策シフトに敏感であるが、根底にある都市化とライフスタイルの動向は、持続的な上昇軌道を描いています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場促進要因

- ミレニアル世代の住宅リフォーム支出が多機能家具の需要を牽引

- 急速な都市化が省スペースモジュラー家具の販売を促進している

- デジタルファーストD2Cの拡大家具オンライン浸透を加速するブランド

- 企業のESG義務がリサイクルおよびバイオベースの素材の採用を促進

- スマートホームの普及により、IoT対応の調整可能な家具の需要が高まっています

- 市場抑制要因

- EUの拡大生産者責任(EPR)規則により輸出業者のコンプライアンスコストが上昇

- 国境を越えた物流コストの高さと破損率の高さが、大型家具のEコマースにおける利益率を圧迫

- 木材輸入制限が原材料価格を高騰させる

- 業界バリューチェーン分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 市場の最新動向とイノベーションに関する洞察

- 市場における最近の動向(新製品の発売、戦略的取り組み、投資、パートナーシップ、合弁事業、拡張、M&Aなど)に関する洞察

- 主要地域における家具業界の規制枠組みと業界標準に関する洞察

第5章 市場規模と成長予測

- 用途別

- 家庭用家具

- 椅子

- テーブル(サイドテーブル、コーヒーテーブル、ドレッシングテーブルなど)

- ベッド

- ワードローブ

- ソファ

- ダイニングテーブル/ダイニングセット

- キッチンキャビネット

- その他ホーム家具(バスルーム家具、屋外家具など)

- オフィス用家具

- 椅子

- テーブル

- 収納キャビネット

- 机

- ソファやその他の柔らかい座席

- その他のオフィス家具

- ホスピタリティ用家具

- 教育機関用家具

- ヘルスケア用家具

- その他の用途(公共の場、小売モール、官公庁など)

- 家庭用家具

- 材料別

- 木材

- 金属

- プラスチックとポリマー

- その他の材料

- 価格帯別

- エコノミー

- ミッドレンジ

- プレミアム

- 流通チャネル別

- B2C/小売

- ホームセンター

- 専門店家具

- オンライン

- その他流通チャネル

- B2B/プロジェクト

- B2C/小売

- 地域別

- 北米

- カナダ

- 米国

- メキシコ

- 南米

- ブラジル

- ペルー

- チリ

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ベネルクス(ベルギー、オランダ、ルクセンブルク)

- 北欧諸国(デンマーク、フィンランド、アイスランド、ノルウェー、スウェーデン)

- その他欧州地域

- アジア太平洋地域

- インド

- 中国

- 日本

- オーストラリア

- 韓国

- 東南アジア(シンガポール、マレーシア、タイ、インドネシア、ベトナム、フィリピン)

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- IKEA

- Ashley Furniture Industries Inc.

- Steelcase Inc.

- MillerKnoll, Inc.

- HNI Corporation

- Williams-Sonoma Inc.

- La-Z-Boy Incorporated

- Hooker Furniture Corp.

- Kimball International Inc.

- Haworth Inc.

- Wayfair LLC

- Godrej Interio

- Durian Industries Ltd.

- Foshan Huasheng Furniture

- KOKUYO Co. Ltd.

- Shanghai UE Furniture

- Leggett & Platt Inc.

- Okamura Corporation

- Nitori Holdings Co. Ltd.

- KUKA Home