|

市場調査レポート

商品コード

1437955

オーガニック飲料:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Organic Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オーガニック飲料:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 160 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

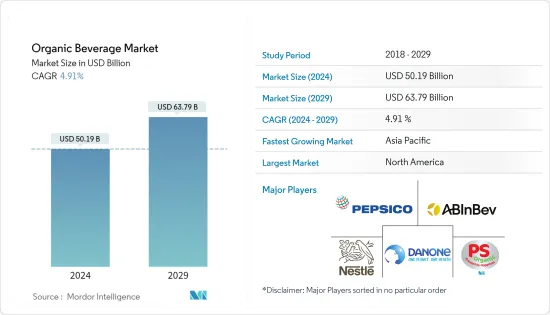

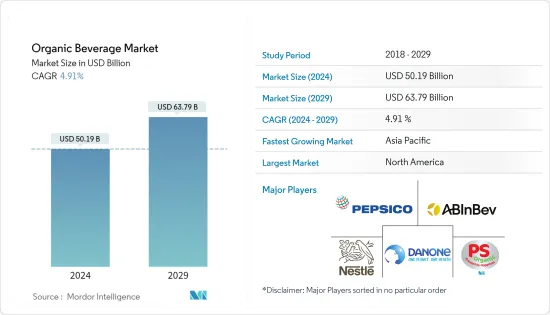

オーガニック飲料市場規模は2024年に501億9,000万米ドルと推定され、2029年までに637億9,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に4.91%のCAGRで成長します。

調査対象の市場は、従来の飲料製造で使用される有害な化学物質への曝露を制限するという消費者の意識の高まりと、オーガニック製品の利点に対する意識の高まりによって推進されています。さらに、調査対象の市場は、クリーンラベル製品とよりクリーンな食生活への傾向によって推進されています。世界中の消費者は、より新鮮で健康的な食品や飲料の選択肢を求めるようになっています。調査対象の市場で観察されたもう1つの重要な傾向は、革新的なパッケージングと、主に認知的および身体的発達に焦点を当てた、重大な健康上の利点を持つオーガニック成分の使用です。

オーガニック飲料は、腸のバランスを維持し、免疫力を高めることで腸の健康状態を改善するのに役立ちます。そのため、オーガニック飲料に含まれる純粋で天然の成分に対する需要が高まっており、市場の主要企業は広範な本格的なフルーツベースのオーガニック飲料の製品ラインナップを拡大しています。甘くないノンカフェイン飲料に対する消費者の需要の高まりに加えて、ターメリック、アロエベラ、活性炭などの新しいフレーバーや成分が、魅力的で持ち運びやすいパッケージや店頭で入手可能になったことも寄与する可能性があります。オーガニック飲料業界の成長に貢献します。

オーガニック飲料市場動向

健康志向の消費者はオーガニック飲料をますます求めています

消費者が健康を意識し、香料、保存料、合成農薬を含まない飲料を好むようになったため、世界的にオーガニック飲料の需要が高まっています。消費者の好みや健康上の利点が変化する中、消費者は革新的で進化するフレーバーに対する関心をますます高めています。消費者は他の炭酸飲料を飲む代わりに、オーガニック飲料に切り替えています。オーガニックの果物や野菜ジュースは、その栄養価の高さから人気が高まっています。

メーカーは、消費者層を魅了するために、さまざまなオーガニックフレーバーのブレンドを提供することで、新製品の開発に注力しています。たとえば、2022年 1月、ドレイクスオーガニックスピリッツは新しいボックステールフレーバー、ドレイクスパーフェクトマルガリータボックステールを導入しました。これは、ミントモヒート、スイカティーニ、マンゴーパンチ、ブラックチェリーライムエードを含むドレイクのレディ・トゥ・ドリンク(RTD)カクテルのラインに加わります。さらに、オーガニックビジネスに対するさまざまな国の支援政策の増加により、オーガニック飲料市場は予測期間中にさらに成長すると予想されます。

北米は最大の市場

消費者の関心がナチュラル製品やクリーンラベル製品に移っているため、北米は依然としてオーガニック飲料の最大の市場です。米国では、飲料を含むオーガニック製品がライフスタイルの選択肢から、大多数のアメリカ人によって少なくとも時折消費されるようになりました。オーガニックの果物や野菜のジュースは、消費者が栽培プロセスやUSDAなどの認証をより意識するようになり、従来のものではなくオーガニックソースからの飲料を求めるようになったことで、引き続き好調を維持しました。このセグメントに参入するプライベートブランド飲料メーカーの数により、オーガニック飲料市場は予測期間中にさらに成長すると予測されています。さらに、消費者のオーガニック製品に対する意識レベルの向上と新製品の継続的な発売により、北米地域全体のオーガニック飲料市場がサポートされると予想されます。

オーガニック飲料業界の概要

この市場で事業を展開している主要企業は、アンハイザー・ブッシュ・インベブ、ネスレSA、ペプシコ(リプトン)、ダノンSA(ホライズンオーガニック)、パーカーズオーガニックジュースです。これらの企業は、それぞれ自社の地位を強化し、提供内容を最適化するための重要な戦略として、合併と買収と新製品の開発に着手しています。たとえば、ダノンは乳製品の製品ポートフォリオを拡大するためにホワイトウェーブを買収しました。さらに今回の買収により、ホライゾン・オーガニック・ミルクなどのブランドによる同社の製品ラインが強化されることになります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品タイプ

- アルコール依存症

- ワイン

- ビール

- スピリッツ

- その他のアルコール飲料

- ノンアルコール

- 果物と野菜のジュース

- 乳製品

- コーヒーと紅茶

- その他のノンアルコール飲料

- アルコール依存症

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- 専門小売店

- オンライン小売業者

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 北米のその他の地域

- 欧州

- スペイン

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- 南アフリカ

- アラブ首長国連邦

- 残りの中東およびアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Anheuser-Busch InBev

- Drake's Organic Spirits LLC

- PS Organic, LLC

- James White Drinks

- Nestle SA

- PepsiCo Inc.

- Danone SA

- Whitewave Foods Company

- Bison Organic Beer

- Lacorata Beverage LLC.

- SYSTM Foods Inc.

- Organic Valley

第7章 市場機会と将来の動向

The Organic Beverage Market size is estimated at USD 50.19 billion in 2024, and is expected to reach USD 63.79 billion by 2029, growing at a CAGR of 4.91% during the forecast period (2024-2029).

The market studied is driven by the growing awareness among consumers to limit exposure to harmful chemicals used in conventional beverage production and the rising awareness of the benefits of organic products. Additionally, the market studied is driven by the trend toward clean-label products and cleaner diets. Consumers across the world are increasingly reaching for fresher and healthier food and beverage options for themselves. Another key trend observed in the market studied is innovative packaging and the use of organic ingredients that have significant health benefits, primarily focused on cognitive and physical development.

Organic beverages can help in improving the health conditions of the gut by maintaining the balance of the intestine and increasing immunity. Hence, there is an increasing demand for pure and natural ingredients in organic beverages, which has led the key players in the market to expand their product offerings with an extensive range of authentic fruit-based organic drinks. In addition to growing consumer demand for non-sweet, non-caffeinated beverages, the availability of new flavors and ingredients like turmeric, aloe Vera, and activated charcoal in attractive, easy-to-carry packaging and in-store packaging is likely to contribute to the growth of the organic beverage industry.

Organic Beverages Market Trends

Health-conscious consumers are increasingly demanding organic beverages

Globally, there is an increase in demand for organic beverages as consumers are becoming health-conscious and prefer beverages that are free from flavoring agents, preservatives, and synthetic pesticide-free. With changing consumer tastes and health benefits, consumers are increasingly interested in innovative and evolving flavors. Instead of drinking other carbonated drinks, consumers are switching to organic beverages. Organic fruits and vegetable juice are becoming more popular due to their high nutrient content.

Manufacturers are focusing on new product developments by bringing various blends of organic flavors to attract the consumer base. For instance, in January 2022, Drake's Organic Spirits introduced a new BOXTAIL flavor: Drake's Perfect Margarita BOXTAIL. It joins Drake's line of ready-to-drink (RTD) cocktails including the Minted Mojito, Watermelon-Tini, Mango Punch, and Black Cherry Limeade. Further, with an increase in supportive policies from various countries toward organic business, the market for organic beverages is expected to grow further during the forecast period.

North America is the Largest Market

North America remains to be the largest market for organic beverages due to the shift in consumer interest toward natural and clean-label products. In the United States, organic products, including beverages, have shifted from being a lifestyle choice to being consumed at least occasionally by the majority of Americans. Organic fruit and vegetable juices continued to perform well as consumers become more aware of the growing process as well as certifications such as USDA, which is driving them to go for beverages from organic sources rather than conventional ones. With the number of private-label beverage manufacturers entering the segment, the market for organic beverages is projected to grow further during the forecast period. Moreover, Increasing awareness levels for organic products among consumers and continuous launches of new product variants are expected to support the organic beverage market across the North American region.

Organic Beverages Industry Overview

Anheuser-Busch InBev, Nestle SA, PepsiCo (Lipton), Danone SA (Horizon Organic), and Parkers Organic Juices are the major companies that are operating in this market. These companies are embarking on mergers and acquisitions and new product developments as their key strategies to strengthen their positions and optimize their offerings, respectively. For instance, Danone acquired WhiteWave to expand its product portfolio for dairy products. Further, the acquisition will strengthen the company's product line with brands, including Horizon Organic milk.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Alcoholic

- 5.1.1.1 Wine

- 5.1.1.2 Beer

- 5.1.1.3 Spirits

- 5.1.1.4 Other Alcoholic Beverages

- 5.1.2 Non-alcoholic

- 5.1.2.1 Fruit and Vegetable Juices

- 5.1.2.2 Dairy

- 5.1.2.3 Coffee and Tea

- 5.1.2.4 Other Non-alcoholic Beverages

- 5.1.1 Alcoholic

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialist Retailers

- 5.2.4 Online Retailers

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Anheuser-Busch InBev

- 6.3.2 Drake's Organic Spirits LLC

- 6.3.3 PS Organic, LLC

- 6.3.4 James White Drinks

- 6.3.5 Nestle SA

- 6.3.6 PepsiCo Inc.

- 6.3.7 Danone SA

- 6.3.8 Whitewave Foods Company

- 6.3.9 Bison Organic Beer

- 6.3.10 Lacorata Beverage LLC.

- 6.3.11 SYSTM Foods Inc.

- 6.3.12 Organic Valley