|

市場調査レポート

商品コード

1641972

決済ゲートウェイ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Payment Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 決済ゲートウェイ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

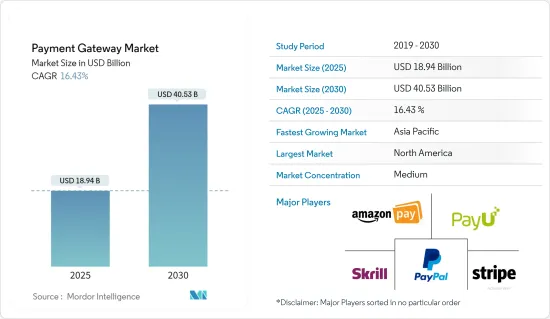

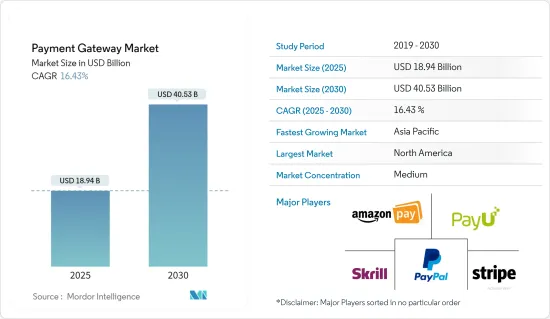

決済ゲートウェイの市場規模は2025年に189億4,000万米ドルと推計され、2030年には405億3,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは16.43%です。

さらに、COVID-19の大流行により、世界中で数百万人が隔離されたため、商品、サービス、娯楽のオンライン販売が世界的に拡大しました。ACI Worldwide社が世界のオンライン小売業者の数百件の取引を調査した結果によると、ほとんどの小売セクターの取引量は、過去数年の同時期と比較して今年度は74%増加しており、市場成長を牽引しています。

主なハイライト

- 決済方法は、トークン方式からキャッシュプール、キャッシュレス決済へと、ここ数年でめまぐるしく進化しています。決済ゲートウェイは、実店舗やオンライン小売業などのあらゆるビジネスが、機密データを損なうことなく、顧客の希望する銀行を通じて集金できるようにします。あらゆる業界において、決済ゲートウェイを統合することは、あらゆる組織にとって不可欠なコンポーネントのひとつとなっています。また、予測期間を通じてオンライン取引が増加し、市場の拡大に拍車がかかると予想されます。

- 金融サービス企業は、eコマース売上の増加や世界中のインターネット普及率の高さにより、独自のデジタルサービスを顧客に提供できるようになり、決済ゲートウェイ市場の成長を後押ししています。高速インターネットの普及と利用可能性の高まりは、今後も決済ゲートウェイ市場の拡大に拍車をかけると思われます。

- 決済ゲートウェイ市場は、モバイルベースの決済に対する世界の需要の高まりによっても牽引されています。テイクアウトの購入、映画館のチケット購入、スマートフォンゲームのアップグレードなど、さまざまな取引でモバイル決済が利用されていることが、予測期間中の市場拡大に拍車をかけると予想されます。また、先進国でも開発途上国でも、これらの決済にはデビットカードやクレジットカードが使用されています。この側面が、調査対象市場のさらなる成長を後押しすると予想されます。これは、スマートフォンでの決済が容易で、カード情報を保存できるためです。

- ほとんどの顧客がカード情報を保存しているため、データを盗むサイバー攻撃事例が増加する可能性があり、これが抑制要因となっています。また、遠隔地でのインターネットアクセスの欠如、国境を越えた決済に関する国際標準の欠如、国によって異なる政府の規制など、その他の要因も調査期間中の市場を抑制する可能性があります。

- ロックダウンによるeコマースへの世界のシフト、COVID-19の大流行、それに伴うロックダウンが決済ゲートウェイ市場に悪影響を及ぼしたため、eコマースウェブサイトからのオンライン購入のオンライン決済を促進する多くの決済ゲートウェイが立ち上げられました。このため、パンデミック危機にもかかわらず市場は拡大しました。パンデミック後の環境を合わせたUPIの重要性が高まっているため、予測期間中、市場はデジタル分野で成長を遂げると思われます。

決済ゲートウェイ市場の動向

小売業における決済ゲートウェイの採用拡大

- 世界中の小売店や小売サービスでは、PayPal、Samsung Pay、Apple Pay、AliPay、WeChat Payなどのモバイル決済アプリケーションが急速に採用され、支払いに対応しています。さらに、ライフスタイルの変化、日常的な商取引、オンライン小売の急成長により、この動向は予測期間中も続くと予想されます。世界のオンライン小売の需要の高まりがオンライン決済を促進し、予測期間中の決済ゲートウェイ市場を押し上げると予想されます。

- 小売業者は、宅配やオンラインショッピングの利便性経済諸国から利益を得るために新たな戦略を開発しています。決済ゲートウェイは、決済のインフラとして大きな役割を果たしています。オンラインショッピングカート、POSシステム、仮想端末が決済プロセスにリンクするためには、現代経済において必要な接続ポイントです。この要因が決済ゲートウェイ市場の成長を促進すると予想されます。

- 消費者の行動に合わせて、調査対象の市場も変化しています。キャッシュレス経済、モバイルバンキング、即時決済、デジタルコマース、規制当局の影響拡大などは、小売部門に影響を与えるいくつかの動向です。オンライン決済は、消費者にとって決済プロセスをより簡単で便利なものにし、列の短縮、キャッシュオンハンド問題の解消、列の移動速度の向上といったメリットをもたらしています。

- 現地銀行と統合された決済ゲートウェイの需要を促進する主な要因は、銀行がデジタル技術を採用するようになっていることです。金融取引を行う際、この決済ゲートウェイはユーザーを銀行に誘導し、そこでユーザーが金融情報を入力できるようにします。この決済ソリューションはセットアップが迅速かつ簡単なため、中小企業での利用が加速しています。このように、現地銀行と統合された決済ゲートウェイに対する需要の高まりは、小売部門向け決済ゲートウェイ市場の成長を促進すると予想されます。

- 例えば、インドを拠点とするPayUは、複雑なサービスプロバイダーが残したギャップを埋めるために設計された、最も利用しやすいeコマース決済ソリューションの1つと考えられています。PayUが支持される理由は、その最高のコンバージョン率にあります。Netflix、Airbnb、Bookmyshowなどの有名企業がPayUの決済ゲートウェイを利用しています。2022年11月、10分で食料品を配達するZeptoは、同社のモバイルアプリにキャッシュフリーペイメントの決済ゲートウェイAPIを統合することで、より迅速で直感的な決済UPIエクスペリエンスを提供できるようになった。このゲートウェイは、より多くの加盟店をオンライン化するための付加価値サービス機能を備えています。このような取り組みが市場の成長を促進すると期待されています。

- 多くの小売業者がロジスティクスに苦慮しているにもかかわらず、閉鎖以来、eコマースの売上は、特に食料品や健康食品で増加しています。例えば、英国ではCOVID-19の発生以来、一部の商品でオンライン小売の注文量が200%以上増加しています。

著しい成長を遂げる中国

- アリババやテンセントといった中国の大手企業は、デジタル加盟店決済のパイオニアであり、中国経済の現金離れに貢献しています。両社のモバイル決済製品であるアリペイとWeChat Payは、中国の決済事情を急速に変化させました。また、その規模は世界最大級です。

- 中国銀聯のデビットカードとクレジットカードは、最も利用されているカードブランドです。アリペイやウィーチャットペイなどのモバイル・ウォレットやデジタル・ウォレットは現在、中国のオンライン市場を独占し、実店舗を増やしています。アリペイやウィーチャットペイに代表されるモバイル・ウォレットやデジタル・ウォレットは、国内のeコマース取引の71%を占めています。

- 99Bill Corporation、YEEPAY、Pay Easeなどの他の企業も中国で決済ゲートウェイを提供しています。99Bill Corporationは、中国でのオンライン取引を促進するオンライン決済プラットフォーム・サービスの提供に重点を置くインターネット企業です。同社は業界チェーンの開発を重視しており、80以上の金融機関と300以上のアクセスポイントを有しています。オンライン・ショッピング、物流、衣料品、旅行業、保険、教育など20の業界にまたがる110万以上の加盟店パートナーを持っています。

- YeePayも中国を代表する決済サービス・プロバイダーで、テクノロジーとイノベーションを通じて、より優れた電子決済ソリューションと付加価値の高い金融サービスを提供することに注力しています。中国国内の100行以上の商業銀行と取引があり、中国人民銀行から一般決済ライセンスを取得した最初の企業のひとつです。

決済ゲートウェイ業界の概要

決済ゲートウェイ市場は、以下のような有力企業によって高度に統合されています。 PayPal, PayU, Amazon Payments, and Stripe. However, other companies are trying to attain larger market shares through mergers and acquisitions to gain more consumers.

2022年11月、大手B2BおよびB2Cビジネス向けの決済オーケストレーション・プラットフォームであるBlueSnapは、eコマースのトップエージェンシーであるobjectsourceとの提携を拡大し、進化するEU市場向けにMagentoとの統合を強化するため、欧州全域のオンライン販売者をサポートします。

2022年9月、英国の決済会社Paysafeは、決済オーケストレーションプラットフォームのSpreedlyと提携し、英国および欧州全域の加盟店の国際決済を支援し、eコマース、小売、旅行、暗号、金融サービス分野に焦点を当てたPaysafeの決済ゲートウェイを通じた取引が可能になります。

2022年8月、金融サービス・プラットフォームのMswipe Technologiesは、インド準備銀行(RBI)から決済アグリゲーター(PA)ライセンスを取得しました。この認可により、エムスワイプは自社でオンライン決済ゲートウェイを開発することができます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

- 市場概要

- 産業魅力度モデル- ファイブフォース分析分析

- 新規参入業者の脅威

- 消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 業界バリューチェーン分析

- COVID-19の市場への影響

第4章 市場力学

- 市場促進要因

- eコマース売上の増加と高いインターネット普及率

- モバイルベースの決済需要の増加

- 小売業における決済ゲートウェイの採用拡大

- 市場の課題

- プライバシーとセキュリティ関連の脅威が引き続き懸念材料に

第5章 市場セグメンテーション

- タイプ別

- ホステッド型

- 非ホホステッド型

- 企業別

- 中小企業(SME)

- 大企業

- エンドユーザー別

- 旅行

- 小売

- BFSI

- メディア・エンターテイメント

- その他業界別

- 地域別

- 北米

- 欧州

- ラテンアメリカ

- アジア太平洋

- 中東・アフリカ

第6章 競合情勢

- 企業プロファイル

- PayPal Holdings Inc.

- Amazon Pay

- Stripe Inc

- Skrill Limited

- PayU Group

- Adyen NV

- Payza

- Ingenico Group

- Alipay.com

- Payoneer Inc

- Paytm Mobile Solutions Pvt. Ltd

- Verifone Holdings Inc

第7章 投資分析

第8章 市場機会と今後の動向

The Payment Gateway Market size is estimated at USD 18.94 billion in 2025, and is expected to reach USD 40.53 billion by 2030, at a CAGR of 16.43% during the forecast period (2025-2030).

Additionally, due to the COVID-19 pandemic, online sales of goods, services, and entertainment grew globally due to millions of people being quarantined worldwide. According to a study by ACI Worldwide of hundreds of transactions from global online retailers, transaction volumes in most retail sectors witnessed a 74% rise in current year compared to the same period last few years, driving the market growth.

Key Highlights

- The payment method has evolved at a dizzying pace in the past few years, from the token system to cash pooling and cashless payments. A payment gateway allows any business, such as brick-and-mortar or online retailing, to collect money through the customer's preferred bank without compromising sensitive data. In every industry, integrating a payment gateway has emerged as one of the essential components of every organization. Additionally, rising online transactions are anticipated throughout the forecast period to fuel market expansion.

- Financial service companies have been able to offer unique digital services to customers due to increased e-commerce sales and the high rate of internet penetration around the world, which helps the growth of the payment gateway market. High-speed internet's rising popularity and availability will continue to fuel the market's expansion for payment gateways.

- The market for payment gateways is also driven by the increasing global demand for mobile-based payments. The use of mobile payments for various transactions, such as purchasing takeout, purchasing cinema tickets, and upgrading smartphone games, is anticipated to fuel the market's expansion over the forecast period. Also, developed and developing nations use debit or credit cards to make these payments. This aspect is anticipated to help the market under study grow even more. This is due to the ease with which payments may be made on smartphones and the ability to save card information on them.

- As most customers save their card details, there is a prone for the rising number of cyber attack cases that steal data which is a restraint. Also, other factors, such as lack of internet access in remote areas, no international standards for cross-border payments, and varying government restrictions in different countries, could restrain the market over the study period.

- Due to a global shift towards e-commerce caused by lockdowns, the COVID-19 pandemic, and the ensuing lockdowns negatively impact the payment gateway market, which has led to the launch of many payment gateways that facilitate online payments for online purchases from e-commerce websites. Due to this, the market has expanded despite the pandemic crisis. Due to UPI's growing importance in the combined post-pandemic environment, the market would experience growth in the digital sector over the projection period.

Payment Gateway Market Trends

Growing adoption of payment gateway in Retail

- Retail stores and services worldwide are rapidly adopting and have integrated mobile payment applications, such as PayPal, Samsung Pay, Apple Pay, AliPay, and WeChat Pay, to accept payments. Further, owing to the changing lifestyles, daily commerce, and rapid growth in online retailing, this trend is expected to continue during the forecast period. The raging demand for online retailing worldwide is expected to drive online payment, propelling the payment gateway market over the forecast period.

- Retailers are developing new strategies to profit from the at-home delivery and online shopping convenience economies. Payment gateways are playing a bigger role in the infrastructure of payments. For online shopping carts, point-of-sale systems, and virtual terminals to link to the payment process, they are a necessary connection point in the modern economy. This factor is expected to drive the growth of the payment gateway market.

- The market studied is changing in line with consumer behavior. The cashless economy, mobile banking, instant payments, digital commerce, and the growing impact of regulatory agencies are a few trends affecting the retail sector. Online payments make the payment process easier and more convenient for consumers, who benefit from shorter lines, cash-on-hand issue elimination, and faster-moving queues.

- The main factor driving the demand for local bank-integrated payment gateway is banks' growing adoption of digital technology. When doing a financial transaction, this payment gateway points users to banks where they can enter their financial information. This payment solution's quick and simple setup has accelerated its uptake in SMEs. Thus the mounting demand for local bank-integrated payment gateway is expected to drive the growth of the payment gateway market for the retail sector.

- For instance, the India-based company, PayU, is considered one of the most accessible e-commerce payment solutions designed to fill in the gaps left by complex service providers. PayU is favored due to the best conversion rates it offers. Notable companies like Netflix, Airbnb, and Bookmyshow use the PayU payment gateway. In November 2022, Zepto, the 10-minute grocery delivery service, would now be able to offer a faster and more intuitive payments UPI experience through the integration of Cashfree Payments' Payment Gateway API into its mobile app. The gateway is equipped with added-value service capabilities to bring more merchants online. Such initiatives are expected to fuel the growth of the market.

- Since the lockdown, e-commerce sales have increased, particularly for groceries and health products, even though many retailers are struggling with logistics. For instance, online retail order volumes in the United Kingdom have risen by over 200 % on some products since the COVID -19 outbreak.

China to Witness Significant Growth

- Chinese giants, such as Alibaba and Tencent, have pioneered digital merchant payments and are instrumental in the shift away from cash in the Chinese economy. The companies' mobile payments products, Alipay and WeChat Pay, have rapidly reshaped China's payments landscape. They are also among the largest in the world.

- China UnionPay debit and credit cards are the most used card brand. Mobile and digital wallets, such as Alipay and WeChat Pay, currently dominate the country's online market and increase physical stores. The mobile and digital wallets led by Alipay and WeChat Pay account for 71% of e-commerce transactions in the country.

- Other companies such as 99 Bill Corporation, YEEPAY, and Pay Ease also offer payment gateway in China. 99Bill Corporation is an internet organization focusing on providing online payment platform services to facilitate online transactions in China. The company has emphasized developing its industry chain and has over 80 financial institutions with over 300 access points. It has over 1.1 million merchant partners that span 20 industries, including online shopping, logistics, clothing, travel business, insurance, and education, among others.

- YeePay is another leading payment service provider in China, which focuses on offering better e-payment solutions and value-added financial services through technology and innovation. With access to more than 100 commercial banks in China, the company was among the first businesses to obtain a general payment license from the People's Bank of China.

Payment Gateway Industry Overview

The Payment Gateway Market is highly consolidated by prominent players such as PayPal, PayU, Amazon Payments, and Stripe. However, other companies are trying to attain larger market shares through mergers and acquisitions to gain more consumers.

In November 2022, BlueSnap, the payment orchestration platform for leading B2B and B2C businesses, expanded its partnership with the top eCommerce agency, objectsource, to support online sellers across Europe to enhance Magento integration for evolving EU Market.

In September 2022, British payments company Paysafe allied with Spreedly, a payments orchestration platform, to help merchants with their international payments across the UK and Europe would be able to make transactions through Paysafe's payment gateway with a focus on e-commerce, retail, travel, crypto, and financial services sectors.

In August 2022, Financial services platform Mswipe Technologies received an in-principal Payment Aggregator (PA) license from the Reserve Bank of India (RBI). With this approval, Mswipe can develop an in-house online payment gateway.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

- 3.2 Industry Attractiveness Model - 'Porter's Five Forces Analysis'

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Consumers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Impact of COVID-19 on the Market

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased e-commerce Sales and the High Internet Penetration Rate

- 4.1.2 Increase Demand for Mobile Based Payments

- 4.1.3 Growing adoption of payment gateway in Retail

- 4.2 Market Challenges

- 4.2.1 Privacy and Security-related Threats Continue to Remain a Concern

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hosted

- 5.1.2 Non-Hosted

- 5.2 By Enterprise

- 5.2.1 Small and Medium Enterprise (SME)

- 5.2.2 Large Enterprise

- 5.3 By End User

- 5.3.1 Travel

- 5.3.2 Retail

- 5.3.3 BFSI

- 5.3.4 Media and Entertainment

- 5.3.5 Other End-user Verticals

- 5.4 BY Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Latin America

- 5.4.4 Asia Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 PayPal Holdings Inc.

- 6.1.2 Amazon Pay

- 6.1.3 Stripe Inc

- 6.1.4 Skrill Limited

- 6.1.5 PayU Group

- 6.1.6 Adyen NV

- 6.1.7 Payza

- 6.1.8 Ingenico Group

- 6.1.9 Alipay.com

- 6.1.10 Payoneer Inc

- 6.1.11 Paytm Mobile Solutions Pvt. Ltd

- 6.1.12 Verifone Holdings Inc