|

市場調査レポート

商品コード

1641957

デジタルプロセスオートメーション:市場シェア分析、産業動向、成長予測(2025年~2030年)Digital Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタルプロセスオートメーション:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

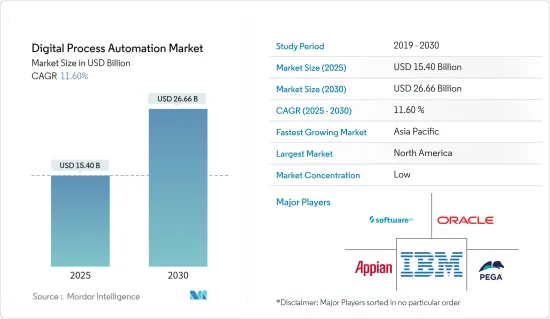

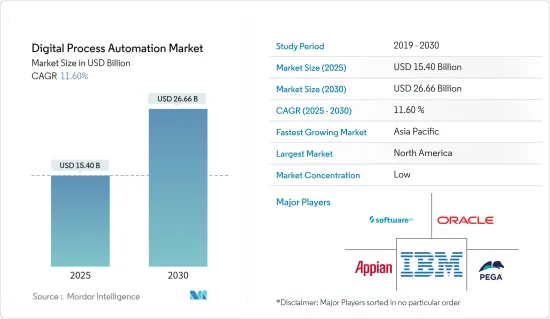

デジタルプロセスオートメーション市場規模は、2025年に154億米ドルと推定され、予測期間(2025~2030年)のCAGRは11.6%で、2030年には266億6,000万米ドルに達すると予測されます。

新技術の動向と加速に伴い、仮想世界と物理世界の融合が新たなビジネスモデルを生み出しています。メーカー各社は、デジタルツインのようなデジタルサービスや製品を販売する新しいビジネスモデルを導入しています。

主要ハイライト

- 業務効率の改善とビジネスプロセスの簡素化は、あらゆる産業の組織にとって最優先事項です。推論によると、この効率性の重視がDPAソリューションの需要を促進しています。手作業や反復作業を自動化・最適化することで、企業はミスを減らし、ボトルネックを解消し、プロセス効率を高めることができます。企業はワークフローを自動化し、プロセスを標準化することで、納期短縮、生産性向上、コスト削減を実現できます。顧客体験の向上、オペレーショナル・エクセレンスの推進、変化する市場での競合維持を目指す企業にとって、DPAソリューションのニーズは高まると予想されます。

- DPAソリューションのもう一つの重要な市場促進要因は、企業が継続的にデジタルトランスフォーメーションを進めていることです。推論によると、企業は業務の変革、消費者体験の向上、競争優位の獲得を目指し、デジタル技術の導入を加速させています。組織の基本的なビジネス活動のデジタル化と自動化を可能にするDPAは、このシフトにおいて極めて重要な役割を果たしています。DPAソリューションは、手作業を自動化し、システムとアプリケーションを連携させ、プロセスパフォーマンスをリアルタイムで可視化することで、エンドツーエンドのプロセス自動化と俊敏性を実現します。DPAのニーズは、デジタル技術を活用し、オペレーションのデジタル成熟度を達成したいという組織のニーズに後押しされています。

- レガシーシステムや複雑なIT環境は、DPAソリューションの採用に大きな足かせとなる可能性があります。推論によると、多くの組織では既存のシステム、アプリケーション、技術を導入しているが、これらはDPAプラットフォームと容易に統合できるようには設計されていないです。このようなレガシーシステムには、DPAソリューションとシームレスに接続するために必要なAPI(Application Programming Interface)や最新のアーキテクチャがないため、統合が困難で時間がかかる可能性があります。また、組織によっては、カスタマイズや独自仕様のソフトウェアが多く、市販のDPAツールとの互換性が低い場合もあります。

- パンデミックは多くのセクターでDPAソリューションの導入拡大を促したが、予算制約や優先順位の変動を招いた組織もあった。推論によると、パンデミックの影響を大きく受けた企業は、コスト削減策や必要不可欠な業務への集中など、当面の課題に対処するためにリソースを流用した可能性があります。その結果、DPAソリューションの導入が遅れたり、計画中のプロジェクトが遅延したりした可能性があります。さらに、財政難に見舞われた組織では、DPAを含む新技術に投資する予算が限られる可能性があります。また、ロシア・ウクライナ戦争が包装エコシステム全体に与えた影響もあった。

デジタルプロセスオートメーション市場の動向

ビジネスプロセス管理(BPM)の採用拡大により、小企業の成長ペースが高まる見込み

- BPMソリューションの採用は、組織が既存のビジネスプロセスをよりよく理解し、改善すべき領域を特定するのに役立ちます。推論によると、組織はBPMイニシアチブを導入するにつれて、プロセスの自動化と最適化のメリットをより強く認識するようになります。このような意識は、効率性、生産性、敏捷性の向上を達成するためにプロセスを自動化する必要性を組織が認識するにつれて、DPAソリューションに対する需要を生み出します。

- BPMソリューションは、デジタルトランスフォーメーション・イニシアチブの礎石として機能することが多く、企業が多くの部門やプラットフォームにわたって業務を統合し、合理化するのに役立ちます。推論によると、企業がBPMを取り入れると、完全なプロセスオーケストレーションと自動化のメリットをより強く認識するようになります。こ洞察により、BPMプラットフォームと容易にリンクできるDPAシステムに対する需要が高まり、自動化機能が拡大され、企業は自動化エコシステム全体にアクセスできるようになります。

- BPMイニシアチブは、多くの場合、変化する小規模なビジネスニーズや市場力学に対応するために、プロセスの拡大と適応を伴います。推論によると、企業はBPMの取り組みをサポートするスケーラブルで柔軟な自動化ソリューションの重要性を認識しています。DPAソリューションは、単純なものから複雑なものまで、幅広いプロセスの自動化に必要な拡大性と柔軟性を提供し、進化するビジネス要件に対応します。BPMの導入により、組織の自動化ニーズの増大に対応できる拡大性と適応性を備えたDPAソリューションの需要が高まっている

- BPMは継続的なプロセス改善の文化を醸成し、組織が定期的にプロセスを評価し、強化することを促します。推論によると、組織はBPMを採用するにつれて、継続的な改善努力を支援する自動化ソリューションを求めるようになります。DPAソリューションは、自動化されたプロセスのモニタリング、分析、最適化を可能にし、効率性の向上と長期的なパフォーマンスの改善を促進します。BPMの採用は、継続的なプロセス改善を促進し、データ主導の意思決定のための分析と洞察を提供するDPAソリューションの需要を促進します。

- コロナウイルス(COVID-19)の流行中、展示会企業は2020年と2021年に世界的に一部の対面式イベントを中止し、デジタル形式の模索を優先しました。2021年6月に実施された調査によると、世界の展示会場の80%が、既存の展示を補完するためにデジタルサービスや製品を取り入れています。一方、サービスプロバイダーの45%は、社内の手順やワークフローをデジタルプロセスに変換することに疑問を呈しています。

北米が市場で大きなシェアを占める

- この地域には大規模なデジタルプロセスオートメーション・ベンダーが存在するため、北米は市場拡大に大きく貢献すると予想されます。同地域のデジタルプロセスオートメーション市場の成長をもたらす主要動向には、先進的センシング技術の需要を高める多様な包装が含まれ、これは自動化製品の増加に直接影響します。

- 米国は、技術の向上と世界サプライチェーン/物流の合理化により著しく成長しています。このような国際的な物流ネットワークの出現は、米国メーカーが完成品や原料を世界中どこへでも効率的かつ効果的に配送できるようになったことを意味します。

- この地域では、こうした可能性を活用するために、提携、合併、買収が急増しています。これらの投資の基本的な原動力は、新しい技術と展開オプションの継続的な成長です。

- 2022年8月、デジタル化、売上成長、システムインテグレーション、ビジネスプロセスの自動化に関するクライアントのビジョンを導く技術コンサルティングとソフトウェア開発会社であるSigma Solveは、北米全域の企業の手に統合デジタル機能とイノベーションをもたらす機能豊富なプラットフォームを提供するLiferay DXPと戦略的パートナーシップを結びました。Sigma Solveのデジタルトランスフォーメーションのアプローチは、LiferayのDXPプラットフォームと完璧に統合されます。

- この動向は、米国の製造業者と国際的な競争相手の経済的機会を大幅に増加させました。ロボティックプロセスオートメーション(RPA)は、企業があらゆるビジネスセグメントで変化の速いペースに対応することを可能にする重要な技術の一つです。RPAは、複雑な作業のタスク、プロセス、ワークフローを自動化する仮想エージェントを記載しています。

デジタルプロセスオートメーション産業概要

デジタルプロセスオートメーション市場は細分化されています。新製品の発売や継続的な技術革新への注力は、主要企業が採用する戦略の一部です。主要参入企業は、IBM Corporation、Pegasystems Inc.、Appian Corporation、Oracle Corporationなどです。最近の市場開拓動向は以下の通りです。

- 2023年3月-エジプトの大手ネットワークプロバイダーであるTelecom Egypt(TE)は、IBMと協業してインテリジェントオートメーション技術を統合し、モバイル、固定、コアネットワークにわたるすべてのオペレーションサポートシステム(OSS)に統一ソリューションを提供すると発表しました。RedHat OpenShift上で稼働するIBM Cloud Pak for Watson AIOpsの利用と、TEによるIBM Robotic Process Automation(RPA)ソリューションの実装が計画されています。このソリューションは、TEにITインフラ全体の全体像を把握させ、迅速なイノベーション、運用コストの削減、ネットワーク関連事象のトラブルシューティングと解決に要する時間の短縮を支援するために作成されます。

- 2022年2月-産業をリードする4/5Gプライベート・ワイヤレスネットワーキングソリューションと関連デジタルサービスを企業に提供し、最先端の新サービスを共同で開発するため、NokiaとAtosの世界の協力関係が発足。新たな作業方法を促進することで、両社の協力は企業の業務効率向上を支援します。AtosまたはNokiaのサーバーでホストされるこの統合製品は、エッジコンピューティングとクラウドコンピューティングの産業リーダーである2社の強みを融合し、4.0産業革命への移行を進める企業をサポートします。このパートナーシップは、AtosがAIのパイオニアであるIpsotekとその比類のないIPとソフトウェア能力を買収したことにより最近強化されたAtos AIコンピュータービジョンプラットフォームと、産業グレードのプライベート無線接続とアプリケーションプラットフォームNokia Digital Automation Cloud(DAC)を活用するものです。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

- 市場促進要因

- 効率的なバックエンドプロセスのためのビジネスプロセスの自動化需要の増加

- アクセシビリティ向上のための低コード自動化の採用増加

- 市場抑制要因

- 熟練労働者の不足

第5章 市場セグメンテーション

- コンポーネント別

- ソリューション

- サービス別

- 展開別

- オンデマンド

- オンプレミス

- 組織規模別

- 中小企業

- 大企業

- エンドユーザー別

- 銀行・金融サービス保険(BFSI)

- 製造業

- IT・通信

- 航空宇宙・防衛

- 医療

- 小売・消費財

- その他

- 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情勢

- 企業プロファイル

- IBM Corporation

- Bizagi Group Limited

- Pegasystems Inc.

- Appian Corporation

- Oracle Corporation

- Software AG

- DST Systems Inc.

- OpenText Corporation

- Newgen Software Technologies Ltd.

- TIBCO Software Inc.

第7章 投資分析

第8章 市場の将来

The Digital Process Automation Market size is estimated at USD 15.40 billion in 2025, and is expected to reach USD 26.66 billion by 2030, at a CAGR of 11.6% during the forecast period (2025-2030).

As new technologies are trending and accelerating, merging the virtual and physical worlds creates new business models. Manufacturers are introducing new business models under which they sell digital services and products, such as digital twins.

Key Highlights

- Improving operational effectiveness and simplifying business processes are top priorities for organizations across all industries. According to inference, this emphasis on efficiency drives the demand for DPA solutions. By automating and optimizing manual and repetitive tasks, firms may lower errors, get rid of bottlenecks, and boost process efficiency. Organizations can achieve faster turn-around times, increased productivity, and cost savings by automating workflows and standardizing processes. The need for DPA solutions is anticipated to increase as companies look to enhance client experiences, drive operational excellence, and maintain their competitiveness in a changing market.

- Another significant market driver for DPA solutions is organizations' continual digital transformation path. According to inference, businesses are embracing digital technology at a faster rate to revolutionize their operations, improve consumer experiences, and gain a competitive advantage. By enabling organizations to digitize and automate their fundamental business activities, DPA plays a crucial part in this shift. DPA solutions enable organizations to achieve end-to-end process automation and agility by automating manual operations, linking systems and applications, and offering real-time visibility into process performance. The need for DPA is fueled by organizations' need to utilize digital technology and attain operational digital maturity.

- Legacy systems and complex IT environments can pose a significant restraint on the adoption of DPA solutions. Inference suggests that many organizations have existing systems, applications, and technologies in place that are not designed to easily integrate with DPA platforms. These legacy systems may lack the necessary APIs (Application Programming Interfaces) or modern architecture to seamlessly connect with DPA solutions, making integration challenging and time-consuming. Additionally, organizations may have heavily customized or proprietary software that is not easily compatible with off-the-shelf DPA tools.

- While the pandemic drove increased adoption of DPA solutions in many sectors, it also introduced budget constraints and shifting priorities for some organizations. Inference suggests that businesses heavily impacted by the pandemic may have diverted resources to address immediate challenges, such as cost-cutting measures or focusing on essential operations. This could have slowed down the adoption of DPA solutions or led to delays in planned projects. In addition, organizations that experienced financial difficulties may have limited budgets for investing in new technologies, including DPA. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Digital Process Automation Market Trends

Small Enterprises are expected to grow at a higher pace on back of growing adoption of Business Process Management (BPM)

- The adoption of BPM solutions helps organizations gain a better understanding of their existing business processes and identifies areas for improvement. Inference suggests that as organizations implement BPM initiatives, they become more aware of the benefits of process automation and optimization. This awareness creates a demand for DPA solutions as organizations recognize the need to automate their processes to achieve greater efficiency, productivity, and agility.

- BPM solutions frequently act as the cornerstone for digital transformation initiatives, helping businesses to integrate and streamline their operations across many divisions and platforms. Inference implies that when businesses embrace BPM, they become more aware of the benefits of complete process orchestration and automation. This insight increases demand for DPA systems that can easily link with BPM platforms, extending automation capabilities and giving businesses access to a whole automation ecosystem.

- BPM initiatives often involve scaling and adapting processes to meet changing small business needs and market dynamics. Inference suggests that organizations recognize the importance of scalable and flexible automation solutions to support their BPM efforts. DPA solutions offer the scalability and flexibility required to automate a wide range of processes, from simple to complex, and accommodate evolving business requirements. The adoption of BPM drives the demand for DPA solutions that can scale and adapt to support the organization's growing automation needs.

- BPM fosters a culture of continuous process improvement, encouraging organizations to regularly evaluate and enhance their processes. Inference suggests that as organizations embrace BPM, they seek automation solutions that support their continuous improvement efforts. DPA solutions enable organizations to monitor, analyze, and optimize their automated processes, driving efficiency gains and performance improvements over time. The adoption of BPM fuels the demand for DPA solutions that facilitate ongoing process improvement and provide analytics and insights for data-driven decision-making.

- During the coronavirus (COVID-19) epidemic, exhibition companies globally stopped some in-person events in 2020 and 2021 in favor of exploring digital formats. According to research conducted in June 2021, 80 percent of global exhibition venues incorporated digital services or products to complement their existing displays. Meanwhile, 45 percent of service provider organizations questioned converting internal procedures and workflows into digital processes.

North America to Account for a Significant Market Share in the Market

- Due to the region's large digital process automation vendors, North America is expected to contribute significantly to market expansion. The major trends responsible for the growth of the digital process automation market in the region include the diverse packaging that increases demand for advanced sensing technology, which will directly impact the increase of automated products.

- The United States is significantly growing due to improved technology and streamlined global supply chains/logistics. This emergence of international logistics networks means that United States manufacturers can now efficiently and effectively deliver the finished products and raw materials anywhere around the world.

- The region has witnessed a surge of partnerships, mergers, and acquisitions to capitalize on these possibilities. The fundamental driver of these investments has been the continued growth of new technologies and deployment options.

- In August 2022, Sigma Solve, a technology consulting and software development company that guides clients' visions for digitization, sales growth, system integration, and business process automation, has formed a strategic partnership with Liferay DXP, which will provide a feature-rich platform that puts integrated digital capabilities and innovation in the hands of businesses across North America. Sigma Solve's digital transformation approach integrates perfectly with Liferay's DXP platform.

- This trend has massively increased the economic opportunities of US manufacturers and international competitors. Robotic process automation (RPA) is one key technology enabling companies to address the fast pace of change across all business areas. RPA provides virtual agents to automate tasks, processes, and workflows for complex work.

Digital Process Automation Industry Overview

The digital process automation market is fragmented. New product launches and focuses on continuous technology innovations are some strategies adopted by the major players. Key players are IBM Corporation, Pegasystems Inc., Appian Corporation, Oracle Corporation, etc. Recent developments in the market are

- March 2023 - Leading network provider in Egypt, Telecom Egypt (TE), announced that it is collaborating with IBM to integrate intelligent automation technologies to provide a unified solution for all of its operations support systems (OSS) across mobile, fixed, and core networks. The use of IBM Cloud Pak for Watson AIOps running on RedHat OpenShift and the implementation of IBM Robotic Process Automation (RPA) solutions by TE are both planned. The solution will be created to give TE a complete picture of its whole IT infrastructure and to assist them in fast innovating, lowering operational costs, and reducing the amount of time needed to troubleshoot and resolve network-related events.

- February 2022 - A global cooperation between Nokia and Atos was launched to offer enterprises industry-leading 4/5G private wireless networking solutions, along with related digital services, and to collaborate on the creation of new, cutting-edge services. By facilitating new working methods, our cooperation will assist businesses in achieving increased operational efficiency. The combined product, which is hosted on servers from Atos or Nokia, combines the strengths of the two industry leaders in edge and cloud computing to support businesses as they transition to the 4.0 industrial revolution. The partnership makes use of the Atos AI computer vision platform, which has recently been strengthened by Atos' acquisition of the AI pioneer Ipsotek and its unmatched IP and software capabilities, as well as the industrial-grade private wireless connectivity and application platform Nokia Digital Automation Cloud (DAC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increase Demand of Automating Business Process for Efficient Back-end process

- 4.4.2 Increase Adoption of Low Code Automation for Greater Accessibility

- 4.5 Market Restraints

- 4.5.1 Lack of Skilled Workforce

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-demand

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small- and Medium-sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End User

- 5.4.1 Banking, Financial Services, and Insurance (BFSI)

- 5.4.2 Manufacturing

- 5.4.3 IT and Telecommunication

- 5.4.4 Aerospace and Defense

- 5.4.5 Healthcare

- 5.4.6 Retail and Consumer Goods

- 5.4.7 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Bizagi Group Limited

- 6.1.3 Pegasystems Inc.

- 6.1.4 Appian Corporation

- 6.1.5 Oracle Corporation

- 6.1.6 Software AG

- 6.1.7 DST Systems Inc.

- 6.1.8 OpenText Corporation

- 6.1.9 Newgen Software Technologies Ltd.

- 6.1.10 TIBCO Software Inc.