|

市場調査レポート

商品コード

1850359

顧客分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Customer Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 顧客分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月22日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

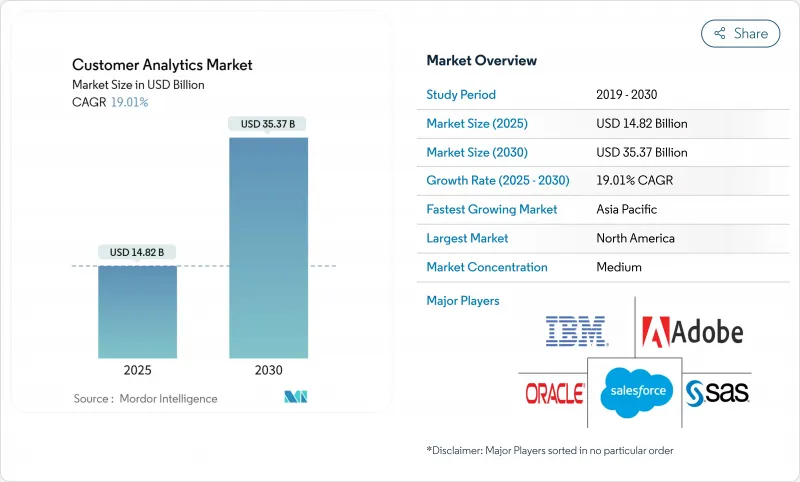

顧客分析の市場規模は2025年に148億2,000万米ドルとなり、2030年には353億7,000万米ドルに達すると予測され、CAGRは19.01%で推移します。

企業がデータ主導のエンゲージメントに軸足を移し、高コストのマス・マーケティングを置き換え、断片化したデジタル・タッチポイントを同期化するにつれて、導入が加速します。企業は資本支出を回避できる拡張性の高い従量課金モデルを好むため、クラウド展開が主要なアーキテクチャであることに変わりはないが、一方で、組織が自動化されたインサイト生成を求める中、AIを活用したモジュールが支持を集めています。小売業だけでなく、アナリティクスがコンプライアンスやパーソナライズされたケアの提供をサポートするヘルスケアなど、規制の厳しい分野への業種別拡大も続いています。プラットフォームベンダーが既存アプリケーションにアナリティクスを組み込んで顧客を囲い込み、小規模な専門企業に対するシェアを守るため、競合の激しさが増しています。同時に、データ主権に関する規制や人材不足により、企業はアーキテクチャの再構築や外部の専門家の活用を余儀なくされ、短期的な事業拡大には歯止めがかからなくなります。

世界の顧客分析市場の動向と洞察

ハイパー・パーソナライズド・カスタマー・エクスペリエンスに対する需要の高まり

獲得コストの高騰により、企業はリテンションを優先せざるを得なくなり、パーソナライゼーションはマーケティングの目標から中核的な経営原則へと昇華しています。アドビは、消費者の71%がブランドによるニーズの先読みを期待しているにもかかわらず、それを大規模に実現している企業は40%未満であることを明らかにしました。ストリーミング・プロバイダーは、その影響を示している:Netflixは、視聴者エンゲージメントの約80%を、リアルタイムの行動シグナルに適応するデータ駆動型のレコメンデーションエンジンに起因するとしています。ホスピタリティ事業者はこのシフトを反映しており、10軒に9軒近くのホテルがAIによって強化されたゲスト・インタラクションを導入しており、プレミアム宿泊料金を獲得しています。洞察の質と収益の向上との関連性は、高度なセグメンテーション、傾向モデリング、次善の策エンジンへの業界横断的な投資を促し、顧客分析市場全体の成長を促進しています。

クラウドネイティブ・アナリティクスが中小企業のTCOを削減

中小企業では、サブスクリプション・モデルによって多額の設備投資が不要になり、導入サイクルが短縮されるため、クラウド・サービスの採用が増加しています。米国の調査によると、多くの中小企業の年間テクノロジー支出は10,000~4万9,000米ドルであり、スケーラブルな従量課金アナリティクスは経済的に魅力的です。パブリッククラウドプロバイダーは、2028年までに支出額が1兆ドルを超えると予測しており、エンタープライズアーキテクトは、2025年までに新しいワークロードの85%がクラウドファーストの原則に従うと報告しています。欧州の中堅企業では、40%がデジタル・プロジェクトの障壁として財務的な不安を挙げており、クラウド・プラットフォームは固定費を営業費用に転換することでこのギャップを埋めています。

データ主権に関する法律がグローバル展開を分断

各国政府は個人データの保管や国境を越えた転送に対する管理を強化しており、多国籍企業は地域固有のスタックや重複したデータパイプラインの構築を余儀なくされています。米国司法省は、懸念される国々による米国の機密データへのアクセスをブロックする規則を制定し、このシフトを例証しています。組織のアーキテクトはGDPR、クラウド法、APACの多様な居住義務とのバランスを取る必要があり、多くの場合、集中処理ではなくローカライズ処理を選択します。これは、統合された顧客ビューのプロジェクトを遅らせ、複雑なオペレーティング・モデルにおける顧客分析市場の採用を遅らせます。

セグメント分析

クラウド・ソリューションは2024年の売上高の62%を占め、2030年までのCAGRは21.40%と予測されます。多くの場合、クラウド導入の市場セグメンテーションの市場規模は、セグメントレベルで2030年までに250億米ドルを超えると予想されます。金融機関や公共機関では、レイテンシーやレジデンシーを厳しく管理するオンプレミス環境が根強く残っているが、その一方で、機密データをローカルに保持しつつ、負荷の高い計算をパブリッククラウドに委ねるハイブリッドアプローチに投資が集中しています。マイクロソフトは、2025年第3四半期のAzureの成長率を35%と報告し、増収分のほぼ半分をリアルタイムのセグメンテーションと傾向モデリングを可能にするAIサービスに起因するとしました。オラクルのAWSとのマルチクラウド契約は、柔軟なアナリティクス移行経路を求める企業の需要に応えるために、以前はライバル関係にあったプラットフォームがいかに相互接続されるようになったかを示しています。

クラウドに移行した企業は、実験サイクルの高速化に注目しています。データチームはサンドボックス環境を数分で立ち上げ、モデルの検証が完了したら、その環境を解除します。サブスクリプション価格は、多額の先行投資を運用コストに変換するため、特に中小企業にとっては予算承認が容易になります。ベンダーが業界固有のコンプライアンス設計図を導入するにつれて、規制対象分野では分析ワークロードの移行が進み、顧客分析市場はさらに拡大しています。

ダッシュボード・レポーティング・ソフトウェアは、2024年の売上高の27%を占めています。しかし、AIを活用したモジュールは2030年までCAGR 24.60%で拡大し、顧客分析市場で最も急成長しているレイヤーに位置付けられています。これらのエンジンは、フィーチャーエンジニアリング、モデル選択、シナリオ分析を自動化し、生データから実用的な洞察へのパスを短縮します。アドビはデジタル・エクスペリエンス・スイート全体にジェネレーティブAIを統合し、2024年に53億7,000万米ドルを創出しました。

顧客の声、ソーシャルメディア、ウェブ分析アプリケーションは、特殊な使用事例を開拓し続けているが、スキーマ、同意、アイデンティティ解決を一元化する、より広範な顧客データプラットフォームの傘下に収束しつつあります。ETLツールはバッチ統合から、フィーチャーストアを数秒でリフレッシュするリアルタイムパイプラインへと進化し、コンテンツエンジンやプライシングエンジンがライブエンゲージメントの間に顧客のコンテキストに反応することを可能にします。このようなフローの中でデータ品質とガバナンスを直接自動化するサプライヤーは、プライバシーに関する監視が強化される中、強い差別化を図ることができます。

顧客分析市場は、導入タイプ(オンプレミス型、クラウド型)、ソリューション(ソーシャルメディア分析ツール、ウェブ分析ツールなど)、組織規模(中小企業、大企業)、サービス(マネージドサービス、プロフェッショナルサービス)、エンドユーザー産業(通信・IT、旅行・ホスピタリティなど)、地域別に分類されています。市場予測は金額(米ドル)で提供されます。

地域分析

北米は、クラウドの深い浸透、成熟したデータサイエンスの人材プール、2024年にAIベンチャー企業への1,091億米ドルを超える強力なベンチャー資金により、支出を支配しています。ベンダーは米国とカナダに点在する高密度のデータセンターを活用し、リアルタイムのパーソナライゼーション・キャンペーン向けに低遅延推論を提供しています。規制政策は比較的柔軟であるが、州レベルのプライバシー保護法では地域特有の同意管理が必要となります。メキシコの新興eコマースエコシステムは、小売業者がオムニチャネルの購買者の行動に関する洞察を求めているため、需要の増加を生み出しています。

欧州では、組織がGDPRを遵守し、プライバシー・バイ・デザイン分析フレームワークの導入を推進しています。ドイツと英国は製造業と金融サービスの近代化に支えられて導入をリードし、フランスとイタリアは政府の支援を受けてデジタルプログラムを加速させています。データのローカライゼーションが義務化されたことで、ベンダーはマルチリージョンクラスターの運用を余儀なくされ、運用コストが増加する一方で、プライバシーに敏感な顧客からの信頼は高まっています。トラステッド・クラウド・ラベルとセキュア・アナリティクス・サンドボックスをめぐるEUの取り組みは、アーキテクチャの決定にさらに影響を与えています。

APACは最も急成長している地域であり、企業の43%が今後1年間でAI予算の20%超の増加を計画しています。中国は現地の規制に対応するため、国内の大規模言語モデルの規模を拡大しており、欧米のプラットフォームとは異なる並列エコシステムを促しています。インドのBFSIと通信セクターは、モバイル・ファーストのユーザーにリーチするため、データ・プラットフォームに多額の投資を行う。日本と韓国はオムニチャネル小売分析を重視し、オーストラリアは強力なクラウドインフラと有利な為替動向を背景に着実な成長を維持しています。全体として、地域のAI支出は2028年までに1,100億米ドルを超える可能性があり、顧客分析市場の堅調な拡大を維持します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ハイパーパーソナライズされたCX(主流)の需要の高まり

- クラウドネイティブ分析により中小企業のTCOが削減される(主流)

- AIを活用したセルフサービス分析により、洞察を民主化(主流)

- 顧客データプラットフォームは、マーケティングテクノロジスイートにバンドルされています(主流)

- 小売メディアネットワークがファーストパーティデータパイプを開設(目立たない形で)

- SaaSワークフロー内の組み込み分析(目立たない)

- 市場抑制要因

- データ主権法は世界の展開を分断する(主流)

- 構成可能なデータ製品人材の不足(主流)

- シャドーITの蔓延により、顧客IDが重複して作成される(気づかれないうちに)

- サードパーティCookieの廃止による広告技術のシグナル損失(目立たない)

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- ライバル関係の激しさ

第5章 市場規模と成長予測

- 展開タイプ別

- オンプレミス

- クラウドベース

- ソリューション別

- ソーシャルメディア分析ツール

- ウェブ分析ツール

- ダッシュボードとレポートツール

- 顧客の声(VoC)

- ETL(抽出・変換・ロード)

- 高度な分析モジュール

- 企業規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- 通信・IT

- 旅行とホスピタリティ

- 小売り

- BFSI

- メディアとエンターテイメント

- ヘルスケア

- 運輸・物流

- 製造業

- その他の産業

- サービス別

- マネージドサービス

- プロフェッショナルなサービス

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Adobe

- Alteryx

- Angoss Software Corp.

- Axtria

- Bridgei2i(Accenture)

- IBM

- Manthan Software

- Microsoft

- NGDATA

- Oracle

- Pitney Bowes

- Salesforce

- SAS Institute

- TEOCO

- Aruba Networks(HPE)