|

市場調査レポート

商品コード

1687458

スマート廃棄物管理:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Smart Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマート廃棄物管理:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 148 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

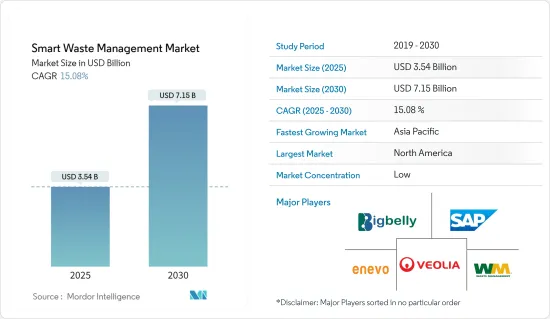

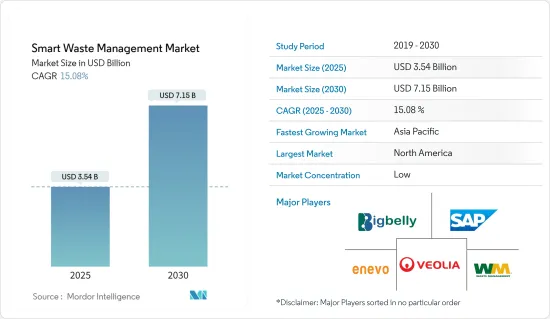

スマート廃棄物管理の市場規模は2025年に35億4,000万米ドルと推計され、市場推計・予測期間(2025-2030年)のCAGRは15.08%で、2030年には71億5,000万米ドルに達すると予測されます。

スマート廃棄物管理は、廃棄物にセンサーを使用することで、自治体の廃棄物収集サービスの状況をリアルタイムで観察し、いつゴミ箱を空にするか埋めるかを決定します。また、センサーやデータベースによって収集された過去の情報を追跡し、ドライバーのルートや充填パターンを特定・強化し、運営コストを削減するために活用することもできます。遠隔監視とIoTベースのゴミ箱があれば、効果的なゴミ収集がより機能的になります。都市化と急速な工業化は、スマート廃棄物管理市場の2つの主要促進要因です。そのため、自治体や産業部門からの廃棄物量は増加しています。環境意識の高まりにより、廃棄物の日常的な収集と処分が増加しています。

主なハイライト

- スマート廃棄物管理は、都市部のライフスタイルを改善するスマートシティ(水管理、交通管理、エネルギー管理などとともに)の開発において極めて重要です。各地域で革新的な都市構想の採用が増加していることが、スマート廃棄物管理市場の成長を後押ししています。廃棄物管理産業は、収集、処分、輸送、リサイクルなど多様な活動を含みます。この業界は、廃棄物管理のさまざまな段階で効率性の問題に直面しています。運用コストは廃棄物の収集と輸送に等しく、それによってスマート廃棄物管理の採用が増加しています。

- 近年、人口の増加と都市化に伴い、廃棄物管理に対する世界の需要と、老朽化したインフラを維持することによるコストへの影響に対処する需要が、スマート廃棄物管理市場の成長の主な原動力となっています。

- さらに、スマート廃棄物管理市場の開拓は、リアルタイムの廃棄物管理システムを搭載した使い捨てタグ、容器、掃除機などの製品によって支えられています。廃棄物管理システムの利用が増加しているのは、環境問題への関心が高まっているためでもあります。

- しかし、世界的に熟練労働者が不足しているため、ほとんどの労働者がサービスエリアまで出向いて問題を解決しなければならず、メンテナンス費用が増加すると予想されます。とはいえ、遠隔管理への注目が高まっていることから、予測期間中はコスト負担が軽減される可能性があります。

スマート廃棄物管理市場の動向

アナリティクス分野が大きな成長を遂げる

- 技術の進歩と急速な都市化の時代において、廃棄物管理は世界の都市にとって極めて重要な課題となっています。スマート廃棄物管理は有望なソリューションとして浮上しています。スマート廃棄物管理システムでは、フリート管理が中心的な役割を果たしています。

- フリート・マネジメント・ソリューションは、データ通信、ロギング、分析を利用して、車両活動の管理強化を提供するシステムを指すことが多いです。FMSの様々なサービスには、車両・資産管理、運行管理、サプライチェーン管理、規制遵守が含まれます。車両管理ソリューションを導入することで、燃料費など車両運行経費の大部分を占める要因を削減することができます。このように、FMSが提供するメリットによって、車両運用コストを最小限に抑えることができます。

- スマート廃棄物管理における車両管理は、廃棄物収集車両の監視と追跡、ルートの最適化、メンテナンスのスケジューリング、パフォーマンス分析など、さまざまな活動を含んでいます。エリクソンによると、近距離モノのインターネット(IoT)デバイスの普及台数は2027年までに250億台に増加し、広域IoTデバイスは2027年までに54億台に達すると予測されており、廃棄物収集車両の位置と動きをリアルタイムで追跡するために使用されます。

- これらの車両にGPSデバイスとセンサーを装備することで、廃棄物管理当局は、業務効率に関する貴重な洞察を得て、改善点を特定し、収集プロセス中に発生する可能性のある問題に即座に対応することができます。さらに、ルート最適化ソフトウェアを車両管理システムに統合することで、廃棄物管理当局はより効率的なルートを計画できるようになります。

北米が最大の市場シェアを占める

- 米国のスマートシティでは、廃棄物の収集・処理問題を解決するためにスマート廃棄物管理ソリューションの利用頻度が高まっており、これが市場の売上を押し上げると予想されます。また、国全体で二酸化炭素排出量の削減を管理する厳しい規則が、今後数年間の市場売上を押し上げると予想されます。持続可能性を推進し、廃棄物のネット・ゼロを達成しようとする政府の取り組みが活発化していることも、この分野の需要を引き続き押し上げると思われます。

- 米国の各都市はすでに戦略的プログラムを実施しています。同国だけで年間排出量の大半を占めるゴミの量は約2億3,000万トンで、その大部分を民間事業体が処理しています。米国は、持続可能性を推進する政府の取り組みと、都市集中度の高い地域全体にスマートシティ構想が浸透していることから、スマート廃棄物管理市場で大きなシェアを占めると予想されます。

- 産業部門の生産量の増加は、スマート管理ソリューションに対する需要を生み出しています。化学製造業は、TRI化学廃棄物の半分以上(55%)を管理しています。BEAによると、2022年、化学製品の生産による付加価値は約5,013億9,000万米ドルに達し、2021年には4,475億5,000万米ドルでした。これは、米国の化学産業が生み出す価値が大幅に増加していることを示しています。

- カナダの人口は、移民、自然増、都市化によって着実に増え続けています。人口が拡大するにつれ、商品、サービス、インフラに対する全体的な需要も増加し、廃棄物発生量の増加につながります。StatCanによると、現在、カナダの年間移民数は約50万人で、これは世界のどの国よりも人口あたりの移民数が多い国のひとつです。2023年の時点で、カナダに住む永住権を持つ移民の数は800万人を超え、これはカナダの総人口の約20%にあたる。

- カナダの企業は、コストを削減しながら廃棄物を持続的に管理する新しい方法を見出しています。その変化には、センサーやその他のクラウドベースのテクノロジーを統合して廃棄物の量を減らし、サービスレベルを最適化することが含まれます。また、企業は温室効果ガスの排出量を削減するために、排出される廃棄物の二酸化炭素排出量を測定しています。

- 同国は、政府業務、イベント、会議での過剰な使い捨てプラスチックの使用をなくし、修理、再使用、再利用が可能な、より持続可能なプラスチック製品の購入に向けて取り組んでいます。政府は2030年までに、製品寿命を延ばし、行政からプラスチック廃棄物の少なくとも75%を取り除くことを目指しています。

スマート廃棄物管理市場の概要

スマート廃棄物管理市場は細分化されています。スマートコネクテッド製品の機能が大幅に拡大したことで、各社はライバルに追いつこうとし、製品性能の向上しすぎた製品を手放すことになりかねないです。このような環境はコストを上昇させ、業界の収益性を侵食します。同市場の主要企業には、SAP SE、Veolia Environmental Services、Enevo、Waste Management Inc.、Bigbelly Inc.などがいます。

- 2023年10月-ヴェオリアは、香港の非有害廃棄物の処理に関する20億ユーロの歴史的な契約を獲得し、香港の生態系の変革と資源の再生を継続します。香港で30年以上事業を展開し、1,000人以上の従業員を擁するヴェオリア・グループは、水、廃棄物、エネルギーに関する複数の契約を通じて、香港のエコロジー転換を加速させるため、現地で脱炭素化に取り組んでいます。

- 2023年9月-WMはオハイオ州クリーブランドに10万平方フィートのリサイクル施設を新設。この施設には最新の技術が導入されており、毎日最大420トンのリサイクル品を処理できます。ガラス回収装置、光学選別機、非包装スクリーン、バリスティックセパレーターを含むWMの新しいリサイクル施設技術は、地域のリサイクルプログラムの成長と、リサイクル材料を原材料として新製品を製造する顧客のための高品質材料の生産をサポートするために設計されています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19の影響とその他のマクロ経済要因が市場に与える影響

第5章 市場力学

- 市場促進要因

- 廃棄物量の増加が市場を押し上げる

- スマートシティ導入の増加による市場の活性化

- 市場の課題

- 導入コストの高さ

第6章 技術スナップショット

- 技術概要

- 廃棄物管理に革命をもたらす革新的技術

- スマート廃棄物管理の段階-コネクター別

- スマート廃棄物管理市場におけるセンサーの応用

- スマート廃棄物管理ステージ

- スマート回収

- スマート処理

- スマートエネルギー回収

- スマート廃棄

第7章 市場セグメンテーション

- ソリューション別

- フリート管理

- 遠隔監視

- 分析

- 廃棄物タイプ別

- 産業廃棄物

- 住宅廃棄物

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア

- インド

- 中国

- オーストラリア

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第8章 競合情勢

- 企業プロファイル

- SAP SE

- Veolia Environmental Services

- Enevo

- Waste Management Inc.

- Bigbelly Inc.

- Covanta Holding Corporation

- Evoeco

- Pepperl+Fuchs GmbH

- IBM Corporation

- BIN-e

第9章 投資分析

第10章 市場の将来

The Smart Waste Management Market size is estimated at USD 3.54 billion in 2025, and is expected to reach USD 7.15 billion by 2030, at a CAGR of 15.08% during the forecast period (2025-2030).

Smart waste management directs the use of sensors in waste to observe the real-time status of municipal waste collection services and decide when bins should be emptied or filled. It also maintains track of past information collected by sensors and databases that can be utilized to pinpoint and enhance driver routes, fill patterns, and lower operating costs. Effective waste collection is more functional with remote monitoring and IoT-based waste bins. Urbanization and rapid industrialization are the two main drivers of the smart waste management market. Therefore, the volume of waste from the municipal and industrial sectors has grown. The routine collection and disposal of waste have risen due to rising environmental awareness.

Key Highlights

- Smart waste management is crucial in developing smart cities (along with water management, traffic management, energy management, etc.) to improve lifestyles in urban areas. The increasing adoption of innovative city initiatives across regions helps the smart waste management market's growth. The waste management industry involves diverse activities, such as collection, disposal, transportation, and recycling. The industry has been facing efficiency problems at different stages of waste management. The operational costs equal the collection and transport of the waste, thereby increasing the adoption of smart waste management.

- In recent years, owing to the growing population and urbanization, the global demand for waste management and the demand to address the cost implications of maintaining an aging infrastructure have been among the primary motivating factors for the smart waste management market's growth.

- Moreover, the development of the smart waste management market has been assisted by products like disposable tags, containers, and vacuum cleaners that contain real-time waste management systems. The rising usage of waste management systems also results from growing environmental concerns.

- However, the lack of skilled laborers worldwide is expected to increase maintenance costs as most of them have to travel down to the service areas and resolve issues. Nevertheless, the growing focus on remote management may reduce the cost burden during the forecast period.

Smart Waste Management Market Trends

Analytics Sector to Witness Major Growth

- Waste management has become a crucial issue for cities worldwide in the era of technological advancements and rapid urbanization. Smart waste management has emerged as a promising solution. Fleet management plays a central role in smart waste management systems.

- Fleet management solutions often refer to systems that offer greater control over fleet activities using data communications, logging, and analytics. FMS's various services include vehicle and asset management, operation management, supply chain management, and regulatory compliance. Deploying fleet management solutions reduces factors that account for a significant portion of fleet operation spending, such as fuel costs. Thus, by the benefits they provide, FMS minimizes the cost of fleet operation.

- Fleet management in smart waste management encompasses a range of activities, including monitoring and tracking waste collection vehicles, route optimization, maintenance scheduling, and performance analysis. One of the crucial components of fleet management in this context is using GPS and Internet of Things technologies; according to Ericsson, the adoption number of short-range Internet of Things (IoT) devices is forecast to increase to 25 billion by 2027. and wide-area IoT devices are predicted to reach 5.4 billion by 2027 and used to track the location and movement of waste collection vehicles in real-time

- By equipping these vehicles with GPS devices and sensors, waste management authorities can gain valuable insights into their operations' efficiency, identify improvement areas, and respond immediately to any issues that may arise during the collection process. Moreover, the integration of route optimization software into fleet management systems enables waste management authorities to plan more efficient routes.

North America Holds Largest Market Share

- Smart cities in the United States use smart waste management solutions more frequently to solve waste collection and disposal issues, which is expected to boost market sales. In addition, strict rules governing the reduction of carbon emissions across the country are anticipated to drive market sales in the coming years. The increasing government's efforts to promote sustainability and achieve net-zero waste will continue to drive up demand in the area.

- Cities in the United States are already implementing strategic programs. The country alone contributes most of the yearly waste produced, with around 230 million metric tons of trash, a significant chunk of which private entities handle. The United States is expected to account for a significant share of the smart waste management market due to government initiatives promoting sustainability and the penetration of smart city initiatives across the high urban concentration region.

- The industrial sector's increased production creates a demand for smart management solutions. The chemical manufacturing industry manages over half (55%) of all TRI chemical waste. According to the BEA, in 2022, the value added from producing chemical products reached approximately USD 501.39 billion, which was USD 447.55 billion in 2021. This demonstrates a substantial increase in the value generated by the chemical industry in the United States.

- Canada's population continues to grow steadily, driven by immigration, natural population increase, and urbanization. As the population expands, so does the overall demand for goods, services, and infrastructure, leading to increased waste generation. As per StatCan, currently, annual immigration in Canada amounts to almost 500,000 new immigrants, which is one of the highest rates per population of any country in the world. As of 2023, there were more than eight million immigrants with permanent residence living in Canada, roughly 20% of the total Canadian population.

- Companies in the country are finding new ways to manage waste sustainably while cutting costs. The changes include integrating sensors and other cloud-based technologies to reduce waste volumes and optimize service levels. Companies are also measuring the carbon footprint of the waste produced to reduce greenhouse gas emissions.

- The country is working towards eliminating the excessive use of single-use plastics in government operations, events, and meetings and purchasing more sustainable plastic products that can be repaired, reused, or repurposed. By 2030, the government aims to extend product life and remove at least 75% of plastic waste from public administrations.

Smart Waste Management Market Overview

The Smart Waste Management Market is fragmented. The vast expansion of capabilities in smart connected products may tempt companies to keep up with rivals and give away too much improved product performance. This environment escalates costs and erodes industry profitability. Some of the key players in the market are SAP SE, Veolia Environmental Services, Enevo, Waste Management Inc., and Bigbelly Inc.

- October 2023 - Veolia continues Hong Kong's ecological transformation and the regeneration of its resources, following the award of a historic EUR 2 billion contract to dispose of the city's non-hazardous waste. With a presence in Hong Kong for over 30 years and more than a thousand employees, the Group is working locally to decarbonize the city's activities through multiple water, waste, and energy contracts to accelerate the local ecological transformation.

- September 2023 - WM has opened a new 100,000-square-foot recycling facility in Cleveland, Ohio. The facility has the latest technology and can process up to 420 tonnes of recyclables daily. WM's new recycling facility technology, which includes glass recovery equipment, an optical sorter, a non-wrapping screen, and ballistic separators, is designed to support the growth of recycling programs in the region and the production of high-quality material for customers who use recycled material as raw material to create new products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Waste to Boost the Market

- 5.1.2 Rising Adoption of Smart Cities to Flourish the Market

- 5.2 Market Challenges

- 5.2.1 High Costs of Implementation

6 Technology Snapshot

- 6.1 Technology Overview

- 6.2 Innovative Technologies Revolutionizing Waste Management

- 6.3 Smart Waste Management Stages - By Connectors

- 6.4 Application of Sensors in the Smart Waste Management Market

- 6.5 Smart Waste Management Stages

- 6.5.1 Smart Collection

- 6.5.2 Smart Processing

- 6.5.3 Smart Energy Recovery

- 6.5.4 Smart Disposal

7 MARKET SEGMENTATION

- 7.1 By Solution

- 7.1.1 Fleet Management

- 7.1.2 Remote Monitoring

- 7.1.3 Analytics

- 7.2 By Waste Type

- 7.2.1 Industrial Waste

- 7.2.2 Residential Waste

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 United Kingdom

- 7.3.2.3 France

- 7.3.2.4 Spain

- 7.3.2.5 Italy

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Australia

- 7.3.3.4 Japan

- 7.3.3.5 Australia and New Zealand

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 SAP SE

- 8.1.2 Veolia Environmental Services

- 8.1.3 Enevo

- 8.1.4 Waste Management Inc.

- 8.1.5 Bigbelly Inc.

- 8.1.6 Covanta Holding Corporation

- 8.1.7 Evoeco

- 8.1.8 Pepperl+Fuchs GmbH

- 8.1.9 IBM Corporation

- 8.1.10 BIN-e