|

市場調査レポート

商品コード

1852180

消化器系健康サプリメント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Digestive Health Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 消化器系健康サプリメント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年09月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

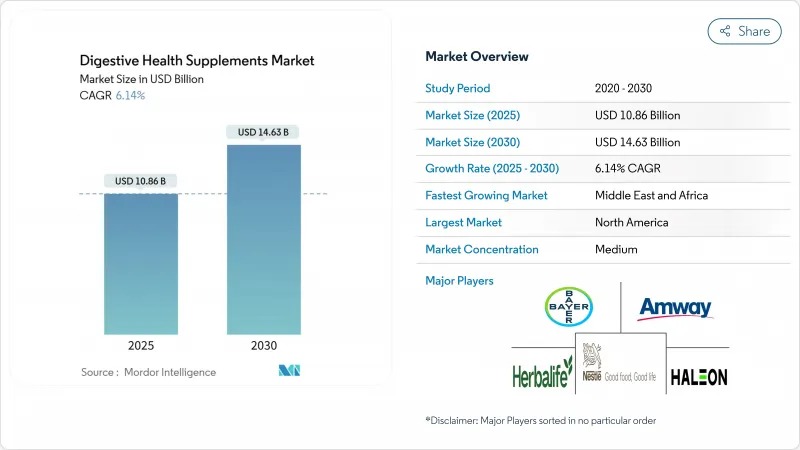

消化器系健康サプリメント市場規模は2025年に108億6,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは6.14%で、2030年には146億3,000万米ドルに達すると予測されます。

予防的な健康意識、マイクロバイオーム介入の臨床的検証、世界的な監視体制の強化が市場の勢いを駆り立てています。これらの要因が消費者の嗜好を形成し、業界をより高い基準へと押し上げています。加齢に伴う健康上の懸念に対処するための代謝サポートを求める高齢化社会、ソーシャルメディアに影響される若年層の消費者、腸管と免疫の関連性とその全体的な健康への影響の解明、個々の健康ニーズに対応するためのデータ主導型のパーソナライゼーション・サービスを展開する企業などが需要を後押ししています。規制の収束、特に米国食品医薬品局による海外での抜き打ち検査は、国内と海外の施設間の歴史的な品質格差を埋め、一貫した製品基準を確保することでこのカテゴリーへの信頼を醸成しています。同時に、クリーンラベルの位置づけや透明性の高い調達といった属性は、プレミアムな特典から不可欠な基準へと移行しており、ブランドは消費者の期待や規制要件を満たすために、追跡可能なサプライチェーンや第三者検証への投資を余儀なくされています。

世界の消化器系健康サプリメント市場の動向と洞察

胃腸障害の発生率の上昇が成長を後押し

機能性胃腸障害の有病率が高まるにつれ、サプリメントは臨時の治療薬から長期的な健康管理の定番品へと移行しつつあります。世界保健機関(WHO)の報告によると、腸疾患の年間患者数は17億人を超えており、裕福な地域では炎症性疾患が顕著に増加しています。過敏性腸症候群、胃食道逆流症、乳糖不耐症に直面する人が増えているため、消化器系サプリメントの消費が増加しています。国立糖尿病・消化器・腎臓病研究所は、毎年約6000万から7,000万人のアメリカ人が消化器系の病気と闘っていると指摘しています。ネスレ・ヘルスサイエンスのような製薬大手は、この分野に信頼を寄せています。Vowst社は、再発性C.ディフィシル感染症に対する経口マイクロバイオータ治療薬として初めてFDAに認可されたという実績を誇っており、これは極めて重要な動きです。臨床エビデンスの裏付けにより、特定の菌株は消費者の嗜好を揺さぶり、気軽な臨床試験から的を絞った治療へと移行しつつあります。このような進化は、景気低迷期でも安定した需要を確保するだけでなく、科学的に検証された製品にプレミアム価格をつける道を開き、市場の価値を単なる数量成長以上に高めています。

微生物ー免疫軸に対する消費者の意識の高まりが需要を牽引

免疫健康における腸の重要な役割が調査によって浮き彫りになり、消費者が特定のプロバイオティクス菌株を好むようになりました。アッカーマンシア(Akkermansia muciniphila)がいかに腸のバリアを強化し、炎症を抑制し、代謝の健康を促進するかを強調する研究は、こうした特殊なプロバイオティクスの需要急増の原動力となっています。腸内マイクロバイオームが健康全般に及ぼす影響に対する認識が高まったことで、特定の健康懸念に対処する標的介入への関心が高まっています。パンデミック(世界的大流行)後の変化として、消費者は長期的な健康維持と潜在的な健康課題に対する回復力を目指し、反応的な治療よりも予防的な健康対策を重視するようになっています。ディータ・ヘルス社の検便アプリのようなデジタル・イノベーションは、バイオマーカーデータをパーソナライズされた製品提案に巧みに変換し、消費者が十分な情報に基づいた選択ができるようにしています。このような技術の進歩は、科学的な洞察と消費者のアクセシビリティのギャップを埋め、個人が独自の健康ニーズをよりよく理解することを可能にしています。その結果、特定の健康問題をターゲットにしたサプリメントへの傾倒が顕著になり、消費者は画一的な代替品よりもオーダーメイドのソリューションを好むようになっています。

シンバイオティクス・ブレンドの厳しい表示と新規食品認可の遅れが成長を妨げる

欧州の新規食品規制は植物性成分について詳細な書類を要求しているが、その解釈は加盟国によって異なります。多菌種・多食物繊維のシンバイオティクスの承認取得には18ヶ月以上かかることもあり、開発コストが膨らみ、製品発売が延期されることもあります。厳しい安全性評価と様々な国の基準への準拠を伴う承認プロセスの複雑さが、こうした遅れをさらに悪化させています。中小企業にとって、こうした長いコンプライアンス・プロセスに必要な資金を調達することは困難であり、経験豊富な薬事チームを擁する大企業が競争上優位に立つことになります。デンマークのアシュワガンダに対する規制のような国家的措置は、地域の決定がEU全体の承認をいかに覆すかを浮き彫りにし、スケールメリットを損なう地域特有の再製剤を必要とします。このような再製剤は、研究開発への追加投資を必要とすることが多く、中小企業の経営資源をさらに圧迫しています。

セグメント分析

2024年には、プロバイオティクスが売上高の82.12%を占め、市場を独占しています。これは、長年にわたる菌株別の研究と消費者の信頼の高まりを反映しています。プロバイオティクスの有効性を裏付ける強力なエビデンスが、消化器系の健康のために広く採用される原動力となっています。2030年までCAGR 7.45%で成長すると予測される酵素は、乳糖不耐症と膵臓機能不全に対処するソリューションに対する需要の高まりにより、支持を集めています。これらの酵素は特定の健康ニーズに対応しており、健康志向の消費者にアピールしています。その他」のカテゴリーにはポストバイオティクスとシンバイオティクスが含まれるようになり、Akkermansia muciniphila製品は2024年に欧州食品安全局の承認を受ける。このような進歩は消化器系健康サプリメント市場を再形成し、消費者の新たな需要に応える臨床的に検証されたソリューションに焦点を当てています。

臨床的な裏付けがある酵素はプレミアム価格で取引され、ヘルスケア専門家が推奨する開業医チャネルで存在感を示しています。プロバイオティクスは、消化器系の健康だけでなく、精神的な健康にも対応するため、年齢別や気分を高めるタイプへと多様化しています。メーカー各社は熱に安定した菌株に投資し、グミや焼き菓子への利用を拡大することで、機能性食品市場に参入しています。ポストバイオティクス分野の新規参入企業は、進化する競合情勢を反映して、保存安定性と免疫上の利点を重視しています。企業が科学的裏付けのある高度なソリューションに対する需要の高まりに対応するにつれて、こうしたイノベーションが差別化と成長を促進するものと予想されます。

地域分析

北米は世界売上高の42.44%と圧倒的なシェアを占めており、これはFDAの明確なガイドラインが健康強調メッセージの発信を後押ししているためです。同地域の消費者は、サプリメントを必要不可欠な予防医療と見なすようになっています。Council for Responsible Nutrition Survey 2023によると、米国では成人の74%近くが消化器系サプリメントを含む栄養補助食品を利用していると回答しています。さらに、マイクロバイオーム治療薬に保険が適用されれば、この傾向はさらに強まり、すでに成熟しているこの地域の消化器系健康サプリメント市場が強化される可能性があります。

中東とアフリカは急成長しており、2030年までのCAGRは8.62%と最速です。この成長には、可処分所得の増加、薬局チェーンの拡大、サウジアラビアの「ビジョン2030」のような政府の積極的な健康政策が寄与しています。若年層が多く、文化的にハーブ調味料への親しみが根付いているこの地域は、最新のプロバイオティクスと酵素の採用に適しています。多様な規制状況に対応し、欧米の製剤と土着の植物製剤をシームレスに融合させるため、多国籍企業は現地の販売業者とパートナーシップを結び、市場情勢を確固たるものにしています。

欧州の規制環境は、チャンスと課題の両方を提供しています。EU全体のハーモナイゼーションは市場参入を容易にするが、各国の解釈はさまざまであり、コンプライアンス上のハードルとなっています。持続可能性の義務化は、オーガニック原料やリサイクル可能な包装へのシフトを促しています。消費者は科学的根拠を慎重に評価する一方で、実績のある製品への投資は厭わないです。アジア太平洋地域では、伝統的な治療法と現代科学が融合し、急速な普及が進んでいます。中国の規制枠組みは、国内のイノベーションを支援する一方で、越境eコマースによる輸入を加速させています。都市化と高タンパク・低繊維食への食生活シフトが、オーダーメイドの消化器系ソリューションへの需要を押し上げています。遺伝子とマイクロバイオームに関する知見を統合した個別化栄養サービスは、市場の成長をさらに促進します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 消化器系疾患の増加で成長が加速

- 微生物免疫軸に対する消費者意識の高まりが需要を牽引

- 消化器系サプリメントの日常栄養摂取への統合が成長を促進する

- デジタルメディアプラットフォームを通じた消化器系健康意識の向上が成長に拍車をかける

- クリーンラベルと植物由来のサプリメント製剤の増加傾向

- 代謝の低下した高齢者の間で消化補助剤の使用が増加

- 市場抑制要因

- シンバイオティクス・ブレンドの厳しい表示と新規食品認可の遅れが成長を妨げる

- ブランドの信頼に影響を与えるサプライチェーンにおける不純物混入と効能劣化

- プレミアムサプリメントの消費を制限する価格感応度

- 代替自然療法との競争が成長に影響

- サプライチェーン分析

- ポーターのファイブフォース分析

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- プレバイオティクス

- プロバイオティクス

- 酵素

- 植物

- その他のタイプ

- 形態別

- カプセルとソフトジェル

- タブレット

- グミとチュアブル

- 粉体

- その他の形態

- 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- 専門店・健康ショップ

- オンライン小売業者

- その他流通チャネル

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング

- 企業プロファイル

- Neste SA

- The Procter & Gamble Company

- Bayer AG

- Amway Corp.

- Herbalife Nutrition Ltd.

- Haleon plc

- Glanbia plc

- GNC Holdings LLC

- Abbott Laboratories Inc

- Reckitt Benckiser Group plc

- BioGaia AB's

- Renew Life Supplements

- Jarrow Formulas, Inc.

- Novozymes A/S

- Now Health Group Inc

- Zenwise Health Inc,

- Konscious LLC.(Whilesome Brands)

- Seed Health Inc.

- Otsuka Pharmaceutical Co.,Ltd(Pharamtive LLC)

- Enzyme Science(Enzymedica)