|

市場調査レポート

商品コード

1851667

ジェット燃料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Jet Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ジェット燃料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月05日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

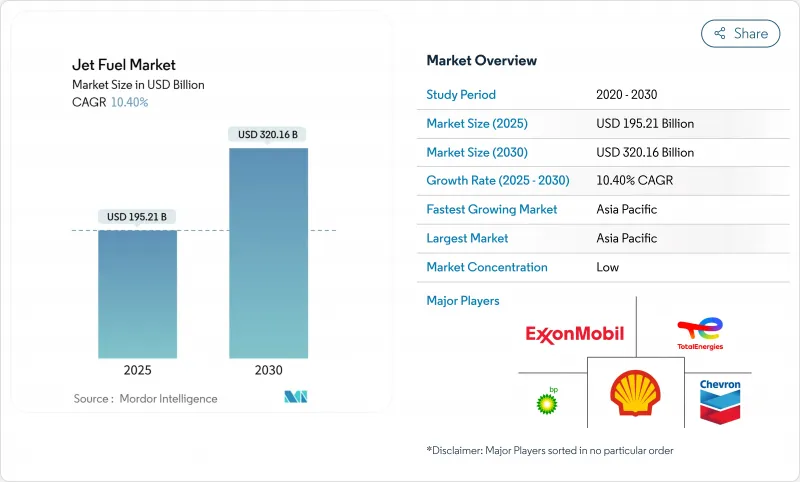

ジェット燃料市場規模は2025年に1,952億1,000万米ドルと推計され、予測期間中(2025~2030年)のCAGRは10.40%で、2030年には3,201億6,000万米ドルに達すると予測されます。

民間航空は予想を上回るスピードで回復しており、アジア、北米、欧州の旅客搭乗率は、旅行需要が長年の鬱積した需要を解消するにつれて、すでに2019年のベンチマークを上回っています。格安航空会社の拡大、eコマース主導の貨物機需要の持続、中東におけるメガハブの出現が、ジェット燃料市場の構造的成長を支えています。同時に、持続可能な航空燃料(SAF)の義務化は、コスト割高にもかかわらず調達シフトを加速させ、原料の柔軟性と製油所構成は大手総合サプライヤーに価格優位性をもたらしています。原油の品質に対する地政学的圧力と欧州における炭素規制の強化は、さらなる価格変動をもたらし、航空会社と燃料供給会社に長期引取契約と混合インフラへの投資を促す動機となっています。

世界のジェット燃料市場の動向と洞察

コビッド後のロードファクター回復がアジアのジェット燃料需要を押し上げる

中国、インド、東南アジアの主要市場の国内線輸送量は、2023年後半までに2019年の水準を上回り、国際線は90%近く回復しています。航空機納入の遅れに直面している航空会社は、航空機の利用を強化し、新世代のジェット機が単位消費量の削減を約束したにもかかわらず、航空機1機あたりの燃料消費量を歴史的基準を上回る水準に押し上げています。シンガポールと韓国で製油所のメンテナンスが同時に行われたため、スポット市場の需給が逼迫し、柔軟な貯蔵・混合能力を持つ売り手が報われました。その結果、ジェットA仕様の高騰が地域のロジスティクスに負担をかけるが、高いケロシン収率に設定された製油所にとってはプレミアム価格設定のチャンスとなります。レジャーとビジネス旅行の勢いが持続しているため、炭素規制による航空券コストの圧力が迫っているにもかかわらず、当面の需要回復力は確保されます。

アフリカとASEANにおける格安航空会社の拡大

格安航空会社は、ナイジェリア、ケニア、タイ、ベトナムの二次都市ペアの座席数を増やし、域内路線図を塗り替えています。かつてはわずかな燃料供給地であった二次空港は、現在ではより頻繁なターンアラウンドを扱い、以前は主要なサプライチェーンから外れていた地域のジェット燃料市場を引き上げています。ラゴス、ナイロビ、プーケットでは、新たな燃料ファームへの投資が運営の信頼性を支え、航空会社とサプライヤーの直接契約は従来の流通層をバイパスするため、マージンは圧縮されるもの、販売量は刺激されます。低コスト・モデルでは、1日の利用率が高いことが重視されるため、給油窓口が狭められ、給水栓インフラを持つ統合サプライヤーはサービス・プレミアムを得ることができます。このような力学は、歩留まり圧力が航空会社の収益性に課題するとしても、長期的な需要を強固なものにします。

EU-ETSフェーズIVの航空券課徴金がレジャーフライトを抑制

フェーズIVでは、2026年までに無償排出枠が撤廃されるため、コスト転嫁が進み、価格に敏感な旅行者が鉄道やEU域外のハブ空港にシフトすることで、2030年までにレジャー需要が最大5%減少する可能性があります。航空会社は、炭素価格が変動する中、コンプライアンス費用の増加に直面し、一部の航空会社は、サーチャージの影響を受けにくい北アフリカや中東のゲートウェイにワイドボディのキャパシティを再配置することを余儀なくされます。輸送量の大幅な減少よりもむしろ輸送量の再分配が、予測を複雑にしているが、欧州のジェット燃料の上昇を全体として抑制しています。世界のジェット燃料市場は、アジアと中東の代償的な成長によってこの縮小の一部を吸収しているが、欧州で大きなエクスポージャーを持つサプライヤーは、製油所の収量計画を見直す必要があります。

セグメント分析

ジェット燃料A-1は2024年の消費量の72.5%を占めたが、これは民間および多くの軍事用燃料として普遍的な仕様であることを反映しています。良好な凝固点および引火点特性は、気候を問わない信頼性を支えており、ジェット燃料市場における中心的な役割を確実なものにしています。ジェットAは依然として北米の航空機に集中しており、ジェットBとTS-1は、極端な環境や地域的な環境におけるニッチな要件に対応しています。

SAFが主導する「その他」のカテゴリーは、2030年までのCAGRが17.5%を記録しており、これはEUの混合燃料要求の高まりと航空会社の自主的な取り組みに後押しされています。トータルエナジーは、2030年までに年間150万トンのSAFを供給する計画で、これはエアバスの欧州需要の約半分に相当します。現在の生産量は世界需要のわずか0.53%にすぎず、需給の不均衡を拡大し、価格プレミアムを高めています。1トン当たり最高1万6,300ユーロのコンプライアンス違反に対する罰金が、調達の緊急性を高め、初期段階の生産者に不釣り合いな収益アップサイドをもたらします。このような背景から、代替グレードのジェット燃料市場規模は、絶対量が従来型ケロシンに比べて小幅であるにもかかわらず、急上昇すると予想されます。

ジェット燃料市場レポートは、燃料タイプ(ジェットA、ジェットA-1、ジェットB、その他)、用途(民間航空、防衛航空、一般航空)、流通チャネル(機内供給、固定基地オペレーターへのバルク供給)、地域(北米、アジア太平洋、欧州、南米、中東アフリカ)で区分されています。市場規模および予測は金額(米ドル)で提供されます。

地域別分析

アジア太平洋地域は2024年に世界消費の36.0%を占め、2030年までのCAGRは11.5%です。中国の航空機保有数は2043年までに2倍の9,740機になると予測され、この地域の需要を支えています。東南アジアの航空会社は、ASEANのオープンスカイ政策に助けられ、国内線トラヒックを2019年レベルの100%まで回復させ、国際線は90%以上の回復を記録しています。インドは、裁量所得の上昇とIndiGoとAir Indiaによる積極的な容量拡大により勢いを増し、南アジア全域のジェット燃料市場を激化させる。

北米は、効率性の向上が容量増を部分的に相殺し、緩やかな成長を示しました。FAAの予測によると、米国の国際線輸送量は2044年まで毎年2.8%増加し、長距離路線の利回りはプレミアムクラスの回復に助けられます。カナダは、バンクーバーとトロントをハブ空港とする太平洋横断貨物輸送量から利益を得て、この軌道を反映しています。

欧州は複雑な見通しに直面しています。EUROCONTROLは、炭素賦課金にもかかわらず、2050年までにフライトが52%増加すると予測しているが、SAF混合義務化とEU-ETSサーチャージは、低所得層における短期的なレジャー旅行を侵食します。航空会社は、イスタンブール、ドバイ、ドーハを経由するキャパシティを追加することでエクスポージャーを希薄化し、ジェット燃料市場の上昇分を中東のハブにシフトさせることで対応します。

中東は、メガハブ戦略と湾岸航空会社の長距離ネットワークから利益を得ています。エミレーツ航空の過去最高益227億AEDは旺盛な需要を示しており、サウジアラビアの2030年観光促進策がさらなる成長をもたらします。エチオピア航空のマルチハブモデルとラゴスとナイロビの空港改修により、大陸内の接続性が確保され、分散型の燃料需要ノードが追加されました。

ラテンアメリカは、国内交通とeコマース・ロジスティクスで回復しました。ブラジルのコンゴーニャス空港とコロンビアのエルドラド空港は、給水栓の拡張に投資しており、チリのJETSMARTモデルは低価格のダイナミズムを加えています。この地域は、絶対量ではアジアに劣るもの、2桁台の成長率で世界のジェット燃料市場の拡大に大きく貢献しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- Covid後のロードファクター回復がアジアのジェットA需要を押し上げる

- アフリカとASEANにおける格安航空会社の拡大

- 太平洋横断路線でワイドボディ貨物機の受注が急増

- 中東におけるメガハブの生産能力増強がファーム投資を後押し

- 米国とNATOの大規模な航空演習がJP-8の引き取りを後押し

- EUの2%SAFブレンド義務化、密度低下によるプール容積の増加

- 市場抑制要因

- EU-ETSフェーズ4の航空券課徴金でレジャーフライトが減少

- 低燃費機への機材更新が1フライトあたりの燃費を削減

- SAFプレミアムの高騰が航空会社のヘッジと燃料高騰を圧迫

- 芳香族リッチ原油不足がUSGCジェット収率を低下させる

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 燃料の種類別

- ジェットA

- ジェットA-1

- ジェットB

- その他[TS-1、持続可能な航空燃料(SAF)]

- 用途別

- 商用航空

- 防衛航空

- 一般航空

- 流通チャネル別

- 機内(空港内)

- 固定ベースオペレーター(FBO)へのバルク供給

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- 北欧諸国

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- ASEAN諸国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的な動き(M&A、パートナーシップ、PPA)

- 市場シェア分析(主要企業の市場ランク/シェア)

- 企業プロファイル

- Shell PLC

- Exxon Mobil Corp

- BP PLC(Air BP)

- Chevron Corp

- TotalEnergies SE

- Qatar Jet Fuel Company(QJet)

- Gazprom Neft PJSC

- Bharat Petroleum Ltd

- Indian Oil Corporation

- China Petroleum & Chemical Corp(Sinopec)

- PetroChina Co Ltd

- Neste OYJ

- LanzaJet Inc.

- Gevo Inc.

- World Fuel Services Corp

- Phillips 66 Aviation

- Vitol Aviation

- PETRONAS Dagangan Berhad

- Petrobras Distribuidora SA

- OMV AG

- Eni SpA

- Saudi Aramco(SAF-focused JVs)

- Idemitsu Kosan Co.

- Rosneft PJSC