|

市場調査レポート

商品コード

1687401

シミュレーションソフトウェア:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| シミュレーションソフトウェア:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

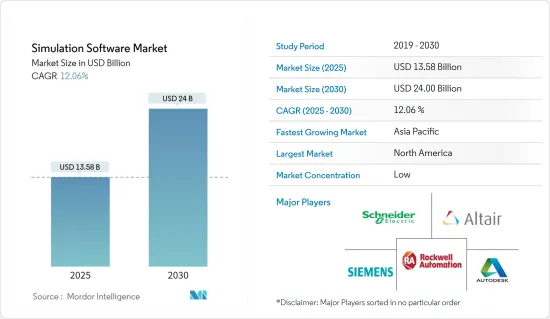

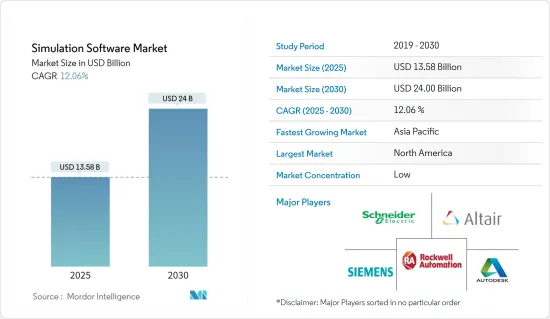

シミュレーションソフトウェア市場規模は2025年に135億8,000万米ドルと推計され、予測期間(2025~2030年)のCAGRは12.06%で、2030年には240億米ドルに達すると予測されます。

シミュレーションソフトウェアは、高度な設計、テスト、モデリング環境に依存する産業にとって不可欠です。この技術は、自動車、航空宇宙、防衛、エネルギー、通信、教育などの主要分野で広く利用されています。このソフトウェアにより、ユーザーは物理的な実験を行うことなく、デジタル・プロトタイプを作成し、実世界のアプリケーションをシミュレートし、複雑なシステムをテストすることができます。これにより、コスト削減、効率性の向上、イノベーションサイクルの迅速化が実現します。

主なハイライト

- 主な促進要因:自動車産業が成長に与える影響自動車産業はシミュレーションソフトウェア市場の拡大に大きく貢献しています。電気自動車(EV)や自律走行技術に対する需要の高まりにより、複雑な車両システムを設計、テスト、改良するための高度なシミュレーションツールが必要とされています。これらのツールは、パワートレイン、バッテリーシステム、車載インフォテインメント技術の開発と最適化に不可欠です。同様に、航空宇宙・防衛産業では、リスクの高い環境のモデル化、航空機設計の安全性と性能の向上、防衛システムとミッションクリティカルな運用の強化にシミュレーションソフトウェアが不可欠です。エネルギー分野では、風力発電や太陽光発電などの再生可能エネルギーシステムを最適化し、変動性や予測不可能性を軽減するためにシミュレーションソフトウェアの導入が進んでいます。

- クラウドベースのシミュレーションソフトウェア:成長動向クラウドベースのシミュレーションソフトウェア市場は顕著な成長を遂げています。クラウドプラットフォームは、従来のオンプレミスのソリューションに比べて拡張性、柔軟性、コスト面で優れています。クラウドベースのシステムでは、ユーザーはインターネット経由で強力なシミュレーションツールにアクセスできるため、コラボレーションが促進され、多額のインフラ先行投資の必要性が低減されます。この動向は、デジタル変革に向けた業界全体のシフトと一致しています。クラウドベースのソリューションは、人工知能(AI)と機械学習(ML)の統合にも対応しており、より効率的なシミュレーションとワークフローの最適化が可能です。

自動車セクターからの需要の高まり

主なハイライト

- EVシミュレーションのニーズの高まり:電気自動車(EV)開発の急増により、高度なシミュレーションツールのニーズが高まっています。自動車メーカーは、バッテリーシステムや充電インフラなどのEVコンポーネントの設計とテストにシミュレーションソフトウェアを活用しています。実際の性能をシミュレーションすることで、メーカーは開発の初期段階で潜在的な問題を特定し、コストと市場開拓期間を削減することができます。

- 自律走行技術のシミュレーション:自律走行車には、現実世界では再現が困難なさまざまな条件下での広範なテストが必要です。シミュレーションソフトウェアを使用すれば、複数の道路状況や気象条件下で自律走行システムを仮想的にテストすることができ、複雑な環境下での安全な運用が保証されます。大手自動車メーカーやテクノロジー企業は、自律走行車の開発を加速させるためにこうしたツールを採用しています。

- デジタル・ツインが車両開発を強化:インフォテインメントシステムから安全機能まで、車載技術をモデル化するための自動車シミュレーションにおいて、デジタルツイン(物理的な製品の仮想レプリカ)の利用が増加しています。デジタルツインを使用することで、自動車メーカーはさまざまな条件下での性能をシミュレーションし、ユーザーエクスペリエンスと車両の安全性を向上させることができます。

クラウドベースのシミュレーションソリューションへのシフトが進む

主なハイライト

- クラウドプラットフォームの柔軟性と拡張性:クラウドベースのシミュレーションソフトウェアは、その固有の柔軟性と拡張性により人気を集めています。これらのソリューションにより、あらゆる規模の企業が、大規模なインフラ投資を行うことなく、高度なシミュレーションツールにアクセスできるようになります。クラウドプラットフォームは世界なコラボレーションをサポートし、エンジニアや設計者がシミュレーションデータにリアルタイムでアクセスして分析することを可能にします。

- 中小企業にとっての費用対効果:クラウドベースのシミュレーションソリューションのサブスクリプションモデルは、設備投資を削減し、中小企業でも高度なツールを利用できるようにします。このスケーラビリティにより、ユーザーはプロジェクトのニーズに応じて計算リソースを調整できるため、コスト効率が向上します。

- AIと機械学習の統合:AIを活用したシミュレーションワークフローでは、複数のシナリオを並行して実行し、最も効率的な構成を特定することで、設計プロセスを最適化できます。この機能は、わずかな効率向上でも大幅なコスト削減につながる製造業において特に有用です。

シミュレーションソフトウェア市場の動向

自動車分野の成長が加速する見込み

- 自動車セグメントの成長加速:バーチャルプロトタイピング、衝突試験、システム運用の必要性から、自動車業界におけるシミュレーションソフトウェアへの依存度は高まり続けています。これらのツールは、メーカーが物理的なプロトタイプを作成することなく、自動車の安全性と性能を向上させるのに役立っています。また、自動車部品メーカーは、研究開発(R&D)コストを削減するためにシミュレーション技術を採用しています。

- 自動車性能モニタリングにおけるデジタルツイン:自動車業界におけるデジタルツインの統合により、メーカーはリアルタイムの車両性能データをシミュレートできるようになり、メンテナンスの問題が深刻化する前に検出できるようになりました。このプロアクティブなアプローチにより、車両の信頼性を向上させるとともに、排出ガスや安全性に関する規制基準に適合させることができます。シミュレーションツールはEVバッテリーの開発とテストに不可欠であり、市場機会はさらに拡大しています。

- リアルタイムシミュレーションツールの普及:リアルタイムシミュレーションソフトウェアは、自動車メーカーにとって極めて重要なツールになりつつあります。エンジニアはこれらのシステムを使用して車両コンポーネントを継続的にテストし、さまざまな走行条件下で性能を最適化しています。例えば、BMWのような企業は自律走行技術のシミュレーションセンターを開発し、電気自動車や自律走行車の技術革新を加速させています。

- クラウドプラットフォームが市場の効率性を高める:クラウドベースのシミュレーションプラットフォームは、自動車企業にコスト効率と拡張性に優れたソリューションを提供しています。テスト時間の短縮、コラボレーションの強化、製品品質の向上が可能なため、中小企業での採用が進んでおり、シミュレーションソフトウェア市場における同分野の成長にさらに貢献しています。

北米がシミュレーションソフトウェア市場をリード

- 技術革新における市場のリーダーシップ:北米は世界のシミュレーションソフトウェア市場で最大のシェアを占めており、これは強力な技術進歩と充実した研究開発投資に支えられています。航空宇宙、自動車、ヘルスケア分野がシミュレーションソフトウェア導入の最前線にあります。Ansys社、Dassault Systemes社、Siemens社などの大手企業が技術革新を推進し、各業界の業務最適化、コスト削減、安全性向上に貢献しています。

- 政府の取り組みが市場成長を後押し持続可能性と効率性に関する規制圧力が、業界全体でシミュレーションソフトウェアの採用に拍車をかけています。例えば、自動車メーカーは、政府のグリーンエコノミーの目標に沿い、厳しい排出基準を満たすためにシミュレーションツールに投資しています。防衛分野では、政府が支援するプロジェクトが、ミッションプランニングやシステム開発にシミュレーションソフトウェアを活用しています。

- ヘルスケア部門がシミュレーションツールを採用北米のヘルスケア分野では、医療トレーニング、手術計画、医療機器開発にシミュレーションソフトウェアを活用する動きが加速しています。これらのアプリケーションは複雑であるため、高度なシミュレーション技術が要求され、従来のエンジニアリング分野を超えた市場の拡大がさらに加速しています。

- クラウドプラットフォームによる拡張性:北米ではクラウドベースのシミュレーションソフトウェアの採用が増え続けており、大幅なコスト削減と遠隔地からのリアルタイムシミュレーションが可能になっています。中小企業から大企業まで、あらゆる組織に対応できる拡張性が、同地域におけるシミュレーションソフトウェアの市場シェアを拡大し、世界の業界展望におけるリーダーシップを確固たるものにしています。

シミュレーションソフトウェア業界の概要

世界プレイヤーによる細分化された市場シミュレーションソフトウェア市場は非常に断片化されており、多国籍企業とニッチソリューションプロバイダーが混在しています。Siemens AG、Autodesk Inc.、Rockwell Automation Inc.などの企業が支配的な地位を維持する一方で、小規模な企業が特定の産業アプリケーションの技術革新に貢献しています。このような競争は、自動車から学術研究まで、さまざまな分野の進歩を促進しています。

主要企業がイノベーションを推進:シーメンス、ロックウェル・オートメーション、シュナイダー・エレクトリック、オートデスク、アンシスなどの世界・プレーヤーは、航空宇宙、自動車、製造業などの業界で技術の限界を押し広げています。各社の強力な研究開発力と市場展開力により、シミュレーションソフトウェア市場の世界の成長を牽引しながら、進化する顧客ニーズに対応しています。

主な動向:クラウド、AI、デジタルツイン:クラウドベースのソリューション、AI、デジタルツインの統合が市場を変革しています。これらの技術を採用する企業は成功する態勢を整えています。競争力を維持するためには、特に中小企業にとって、ソフトウェアの使いやすさ、クロスプラットフォーム機能、費用対効果の高いソリューションを優先する必要があります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響

- 市場促進要因

- 自動車業界からの需要の高まり

- クラウドベースのシミュレーションソリューションへのシフトの高まり

- 市場抑制要因

第5章 市場セグメンテーション

- 展開タイプ

- オンプレミス

- クラウド

- エンドユーザー産業

- 自動車

- IT・通信

- 航空宇宙・防衛

- エネルギー・鉱業

- 教育・研究

- 電気・電子

- その他のエンドユーザー産業

- 地域

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Altair Engineering Inc.

- The MathWorks Inc.

- Autodesk Inc.

- Cybernet Systems Corp.

- Bentley Systems Incorporated

- PTC Inc.

- CPFD Software LLC

- Design Simulation Technologies Inc.

- Synopsys Inc.

- Siemens AG

- Ansys Inc.

- Dassault Systeemes SE

- Simio LLC

- Lanner Group Ltd

- SIMUL8 Corporation

- CONSELF Srl

- SolidWorks Corporation

- Rockwell Automation Inc.

- The COMSOL Group

- Schneider Electric SE

第7章 市場投資分析

第8章 市場機会と今後の動向

The Simulation Software Market size is estimated at USD 13.58 billion in 2025, and is expected to reach USD 24.00 billion by 2030, at a CAGR of 12.06% during the forecast period (2025-2030).

Simulation software is integral to industries that depend on advanced design, testing, and modeling environments. This technology is widely utilized across key sectors such as automotive, aerospace, defense, energy, telecommunications, and education. The software enables users to create digital prototypes, simulate real-world applications, and test complex systems without the need for physical experimentation. This leads to cost reduction, increased efficiency, and faster innovation cycles.

Key Highlights

- Key Drivers: Automotive Industry's Impact on Growth The automotive sector is a significant contributor to the expansion of the simulation software market. The rising demand for electric vehicles (EVs) and autonomous driving technologies necessitates sophisticated simulation tools to design, test, and refine complex vehicle systems. These tools are essential for developing and optimizing powertrains, battery systems, and in-vehicle infotainment technologies. Similarly, in the aerospace and defense industries, simulation software is critical for modeling high-risk environments, improving safety and performance in aircraft design, and enhancing defense systems and mission-critical operations. In the energy sector, simulation software is increasingly adopted to optimize renewable energy systems such as wind and solar power, mitigating variability and unpredictability.

- Cloud-Based Simulation Software: A Growing Trend The market for cloud-based simulation software has experienced notable growth. Cloud platforms offer scalability, flexibility, and cost advantages over traditional on-premise solutions. With cloud-based systems, users can access powerful simulation tools over the internet, fostering collaboration and reducing the need for significant upfront infrastructure investments. This trend aligns with the broader industry shift toward digital transformation. Cloud-based solutions also support artificial intelligence (AI) and machine learning (ML) integration, enabling more efficient simulations and optimized workflows.

Rising Demand from the Automotive Sector

Key Highlights

- Increased Need for EV Simulation: The surge in electric vehicle (EV) development has amplified the need for advanced simulation tools. Automakers leverage simulation software to design and test EV components, such as battery systems and charging infrastructure. By simulating real-world performance, manufacturers can identify potential issues during the early stages of development, reducing costs and time-to-market.

- Simulation for Autonomous Driving Technologies: Autonomous vehicles require extensive testing under various conditions, which can be difficult to replicate in the real world. Simulation software allows for the virtual testing of autonomous driving systems across multiple road and weather conditions, ensuring their safe operation in complex environments. Major automakers and technology firms have embraced these tools to accelerate the development of autonomous vehicles.

- Digital Twins Enhance Vehicle Development: Digital twins-virtual replicas of physical products-are increasingly used in automotive simulation to model in-vehicle technologies, from infotainment systems to safety features. By using digital twins, automakers can simulate performance under diverse conditions, improving user experience and vehicle safety.

The Growing Shift to Cloud-Based Simulation Solutions

Key Highlights

- Flexibility and Scalability of Cloud Platforms: Cloud-based simulation software is gaining traction due to its inherent flexibility and scalability. These solutions allow companies of all sizes to access advanced simulation tools without heavy infrastructure investments. Cloud platforms support global collaboration, enabling engineers and designers to access and analyze simulation data in real-time.

- Cost-Effectiveness for SMEs: The subscription model of cloud-based simulation solutions reduces capital expenditure, making advanced tools accessible to small and medium enterprises (SMEs). This scalability allows users to adjust computational resources according to project needs, enhancing cost efficiency.

- AI and Machine Learning Integration: AI-driven simulation workflows can optimize design processes by running multiple scenarios in parallel, identifying the most efficient configurations. This capability is particularly valuable in manufacturing, where even minor gains in efficiency can result in significant cost savings.

Simulation Software Market Trends

Automotive Segment is Expected to Grow at a Faster Pace

- Automotive Segment Growth Accelerates:The automotive sector's reliance on simulation software continues to grow, driven by the need for virtual prototyping, crash testing, and system op mization. These tools help manufacturers improve vehicle safety and performance without the need for physical prototypes. Automotive suppliers are also adopting simulation technologies to reduce research and development (R&D) costs.

- Digital Twins in Automotive Performance Monitoring: The integration of digital twins in the automotive industry allows manufacturers to simulate real-time vehicle performance data, helping detect maintenance issues before they escalate. This proactive approach improves vehicle reliability while aligning with regulatory standards on emissions and safety. Simulation tools are vital in the development of EV batteries and testing, further expanding market opportunities.

- Real-Time Simulation Tools Gain Popularity: Real-time simulation software is becoming a pivotal tool for automotive manufacturers. Engineers use these systems to continuously test vehicle components, optimizing performance under various driving conditions. For instance, companies like BMW are developing simulation centers for autonomous driving technologies, helping accelerate the innovation of electric and autonomous vehicles.

- Cloud Platforms Enhance Market Efficiency: Cloud-based simulation platforms are providing cost-effective, scalable solutions for automotive companies. The ability to reduce testing times, enhance collaboration, and improve product quality is driving adoption among SMEs, further contributing to the sector's growth within the simulation software market.

North America Leads the Simulation Software Market

- Market Leadership in Technological Innovation: North America holds the largest share in the global simulation software market, underpinned by strong technological advancements and substantial R&D investments. The aerospace, automotive, and healthcare sectors are at the forefront of simulation software adoption. Major players, including Ansys, Dassault Systemes, and Siemens, are driving innovation, helping industries optimize operations, reduce costs, and improve safety.

- Government Initiatives Fuel Market Growth: Regulatory pressures regarding sustainability and efficiency are spurring the adoption of simulation software across industries. For example, automotive manufacturers are investing in simulation tools to meet stringent emissions standards, aligning with governmental green economy goals. In the defense sector, government-backed projects depend on simulation software for mission planning and system development.

- Healthcare Sector Embraces Simulation Tools: In North America, the healthcare sector is increasingly utilizing simulation software for medical training, surgical planning, and medical device development. The complexity of these applications demands sophisticated simulation technologies, further driving market expansion beyond traditional engineering fields.

- Scalability with Cloud Platforms: The adoption of cloud-based simulation software continues to grow in North America, providing significant cost savings and enabling remote, real-time simulations. The ability to scale across organizations, from SMEs to large enterprises, is broadening the market share of simulation software in the region, cementing its leadership in the global industry outlook.

Simulation Software Industry Overview

Fragmented Market with Global Players: The simulation software market is highly fragmented, with a mix of multinational corporations and niche solution providers. Companies like Siemens AG, Autodesk Inc., and Rockwell Automation Inc. maintain dominant positions, while smaller entities contribute to innovation in specific industry applications. This competition fosters diverse advancements across sectors ranging from automotive to academic research.

Leading Companies Drive Innovation: Global players such as Siemens, Rockwell Automation, Schneider Electric, Autodesk, and Ansys are pushing technological boundaries in industries like aerospace, automotive, and manufacturing. Their strong R&D capabilities and market reach enable them to meet evolving customer needs while driving global growth in the simulation software market.

Key Trends: Cloud, AI, and Digital Twins: The integration of cloud-based solutions, AI, and digital twins is transforming the market. Companies that embrace these technologies are poised for success. To remain competitive, firms must prioritize software usability, cross-platform functionality, and cost-effective solutions, particularly for SMEs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Rising Demand from the Automotive Sector

- 4.4.2 The Growing Shift to Cloud-Based Simulation Solutions

- 4.5 Market Restraints

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 IT and Telecommunication

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy and Mining

- 5.2.5 Education and Research

- 5.2.6 Electrical and Electronics

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Altair Engineering Inc.

- 6.2.2 The MathWorks Inc.

- 6.2.3 Autodesk Inc.

- 6.2.4 Cybernet Systems Corp.

- 6.2.5 Bentley Systems Incorporated

- 6.2.6 PTC Inc.

- 6.2.7 CPFD Software LLC

- 6.2.8 Design Simulation Technologies Inc.

- 6.2.9 Synopsys Inc.

- 6.2.10 Siemens AG

- 6.2.11 Ansys Inc.

- 6.2.12 Dassault Systeemes SE

- 6.2.13 Simio LLC

- 6.2.14 Lanner Group Ltd

- 6.2.15 SIMUL8 Corporation

- 6.2.16 CONSELF Srl

- 6.2.17 SolidWorks Corporation

- 6.2.18 Rockwell Automation Inc.

- 6.2.19 The COMSOL Group

- 6.2.20 Schneider Electric SE