|

市場調査レポート

商品コード

1850319

スモールセルネットワーク:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Small Cell Networks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スモールセルネットワーク:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月20日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

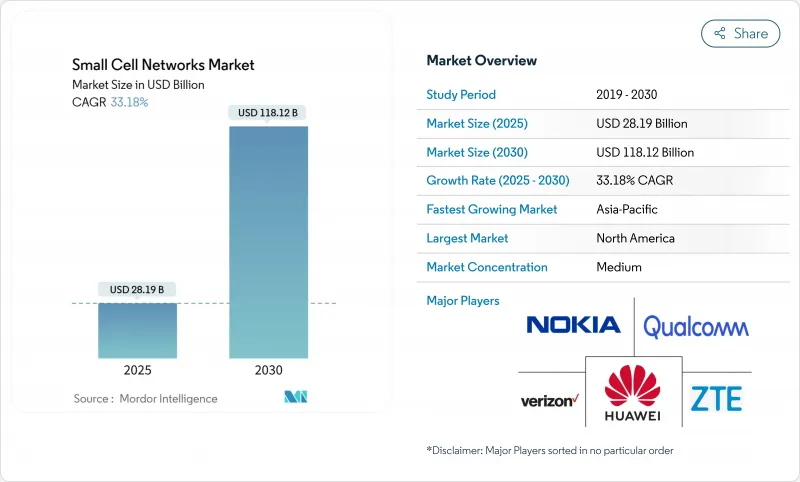

スモールセルネットワーク市場の2025年の市場規模は281億9,000万米ドルで、CAGR 33.18%で堅調に拡大し、2030年には1,181億2,000万米ドルに達すると予測されています。

モバイルデータ量の増加、より高周波の5G帯への移行、周波数政策の支持により、スモールセルはニッチソリューションからコアネットワーク資産へと移行しました。ミリ波やミッドバンドの信号は急速に減衰するため、特にトラフィックの80%以上が屋内で発生します。共有モデルやニュートラル・ホスト・モデルの初期段階での成功により、所有コストが削減される一方、AIを活用した自己最適化機能により、従来の分散型アンテナ・システムと比較してエネルギー使用量が最大45%削減されています。2026年6月までに完了するAWS-3オークションを前に、既存事業者が規模の優位性を求めて統合が激化しており、このオークションでは30億~45億米ドルのミッドバンド周波数帯が商業利用されると予測されています。

世界のスモールセルネットワーク市場動向と洞察

5G周波数オークションがネットワークの高密度化を加速

ミッドバンド周波数帯の割り当てにより、5Gに必要なスペクトルのヘッドルームが解放されつつあります。独立した経済モデリングによると、100MHz増えるごとにGDPに2,640億米ドルが追加されます。間もなく始まるAWS-3の販売は、この効果をさらに強めると思われます。認可の迅速化により、米国の認可サイクルは数年から数ヶ月に短縮され、事業者はマクロサイトから1都市あたり数千の街頭ノードまで規模を拡大できるようになりました。ミリ波の信号は減衰が激しいため、連続したカバレッジを実現するには、従来のマクロセルの最大10倍のスモールセルが必要となり、コンパクトな無線機や統合アンテナの受注を後押ししています。

モバイルデータ爆発が普及を促進

エリクソンによると、年間トラフィックは20%増加しており、5Gは2029年までに75%のビットを伝送するといいます。UHDビデオのストリーミング、XRコンテンツ、クラウドゲームは、セクター化されたマクロに負担をかけるホットスポット需要プロファイルを生み出します。スモールセルのクラスターをターゲットとすることで、本格的なオーバーレイを行うことなくローカライズされた容量を提供し、事業者はユーザーエクスペリエンスを維持しながら設備投資を抑えることができます。業界団体は、今後10年間で8倍になると予想しています。

規制のハードルが普及速度を妨げる

連邦政府による合理化後も、地域のルールは大きく異なります。歴史地区はしばしば設計審査を課し、承認を12~24ヶ月に伸ばし、建設予算を膨れ上がらせています。米国では現在、およそ20の州がスモールセルに関する法令を定めているが、解釈に一貫性がないため、複数州をまたいだ建設が複雑になっています。事業者はポールトップの囲いを標準化し、ストリートファニチャーのリースを活用してサイクルを短縮しているが、摩擦が屋外展開のブレーキとなっています。

セグメント分析

フェムトセルは、家庭や小規模オフィス向けの手頃な価格を反映して、2024年の売上の37%を占めました。フェムトセルは約60フィート(約1.6メートル)以内に最大6人のユーザーを収容できるため、屋内のスポット的な改善には最適です。しかし、マイクロセルはCAGR 35.30%で最も急成長する予定であり、1,000フィート(約1,000m)以内で200人のユーザーにサービスを提供できることから、密集したショッピング街や交通機関の駅に最適です。通信事業者がこれらのノードをエッジコンピューティングと組み合わせ、遅延の影響を受けやすいユースケースをサポートするため、マイクロセル層のスモールセルネットワーク市場規模は急速に拡大すると予想されます。無線設計もOpen RAN標準に収束しつつあり、ロックインを低減しイノベーションを加速するマルチベンダー・エコシステムが可能になります。

ピコセルにおける互換性のアップグレード(中規模会場では750フィート(約3.5メートル)をカバー)は、新たな企業契約のロックを解除しており、メトロセルは歩行者レベルでのハンドオフをスムーズにするために幹線道路に沿って展開されています。屋内無線ドットアーキテクチャは、120のオペレータを通過し、最小限の現場設備でマクロパリティの速度を実現しています。これらの動向を総合すると、スモールセルネットワーク市場が単一デバイスの提案ではなく、多層的なエコシステムになりつつあることがわかる。

スモールセルネットワーク市場レポートは、セルタイプ(フェムトセル、ピコセル、マイクロセル、メトロセル、ラジオドットシステム)、動作環境(屋内および屋外)、エンドユーザー業界別(BFSI、ITおよびテレコム、ヘルスケア、小売、電力およびエネルギー、スマートシティおよび政府)、地域別に分類されています。

地域分析

北米は、初期のCバンドオークションと連邦政府の立地改革に支えられ、2024年の売上高の35%を占めました。米国だけで、2022年までに452,000以上の屋外ノードを数え、メトロコアを超えて拡大するために5G Fund for Rural Americaを通じて90億米ドルを投資する予算が組まれています。画期的な140億米ドルの近代化プロジェクトは、レガシーベースバンドをオープンアーキテクチャ無線に置き換えるもので、ベンダーの多様性に対するキャリアのコミットメントを示しています。

アジア太平洋地域のCAGRは38.49%と予測され、この地域で最も急勾配となります。中国は50万以上の5G基地局を配備し、インドのデジタル通信政策は全国的な権利障壁を緩和しています。この地域のモバイルエコシステムは2023年にGDPに8,800億米ドルを上乗せし、経済的な重要性を強調しています。KTのスマートオフィス向けRadio Dotの展開など、屋内スモールセル導入のフラッグシップは、エンタープライズグレードの屋内カバレッジのビジネスケースを実証しています。

欧州は持続可能性を重視し、現場のエネルギーを最大45%削減するソリューションを追求しています。国家ロードマップ(ドイツの5G戦略がその一例)では、自動運転やインダストリー4.0をサポートするタイトグリッド・スモールセルが優先されています。この地域の通信事業者は、街灯に小型無線機を埋め込むことを日常的に行っています。ロンドンのあるパイロットでは、ウェストミンスター全域に80のセルを追加したが、視覚的な影響は最小限でした。

中東とアフリカの一部では、サウジアラビアがマクロセルとスモールセルのレイヤーを組み合わせたマルチベンダープログラムを実施しているように、巡礼地やスマートシティの回廊向けに5Gの拡張を進めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 5G周波数オークションとネットワーク高密度化の義務化

- モバイルデータとビデオトラフィックの爆発的な増加

- プライベート5G/LTE-Aネットワークに対する企業の需要

- 規制当局主導のスペクトル共有とCBRSの普及

- 中立ホストと共有インフラ投資の波

- AI駆動型自己最適化ネットワークがOPEXを削減

- 市場抑制要因

- 複雑な用地取得と自治体の許可

- バックホールファイバー/電源可用性のギャップ

- エネルギー効率コンプライアンスコストの上昇

- RFフロントエンドチップセットの輸出規制と供給リスク

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 投資・資金調達動向分析

第5章 市場規模と成長予測

- 細胞の種類別

- フェムトセル

- ピコセル

- マイクロセル

- メトロセル

- ラジオドットシステムズ

- 動作環境別

- 屋内

- 屋外

- エンドユーザー別

- BFSI

- ITおよび通信

- ヘルスケア

- 小売り

- 電力とエネルギー

- スマートシティと政府

- 地域別

- 北米

- 南米

- 欧州

- アジア太平洋地域

- 中東・アフリカ

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- CommScope Inc.(incl. Airvana)

- American Tower Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Verizon Communications Inc.

- Crown Castle International Corp.

- Airspan Networks Holdings Inc.

- Qucell Inc.

- Cirrus Core Networks

- Casa Systems Inc.

- Sercomm Corporation

- Baicells Technologies

- Comba Telecom Systems Holdings Ltd.

- IP.Access Ltd.

- Boingo Wireless Inc.

- Parallel Wireless Inc.

- JMA Wireless

- Corning Inc.(SpiderCloud)