|

|

市場調査レポート

商品コード

1910479

プレフィルドシリンジ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Prefilled Syringes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プレフィルドシリンジ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 114 Pages

納期: 2~3営業日

|

概要

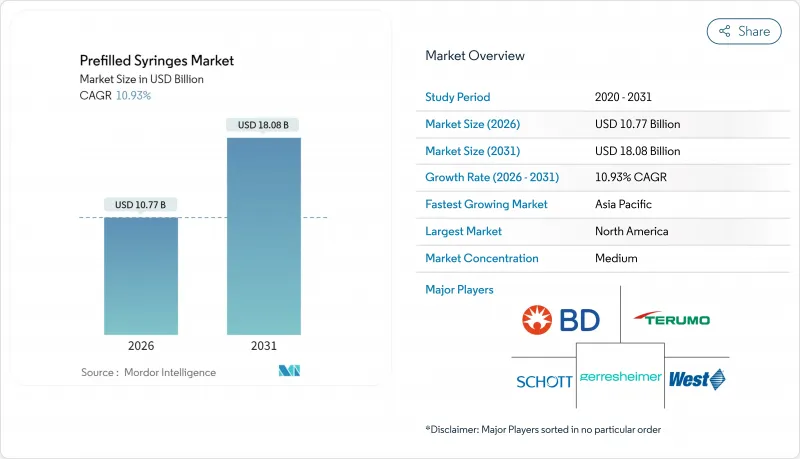

プレフィルドシリンジ市場は、2025年の97億1,000万米ドルから2026年には107億7,000万米ドルへ成長し、2026年から2031年にかけてCAGR 10.93%で推移し、2031年までに180億8,000万米ドルに達すると予測されております。

成長を牽引しているのは、GLP-1肥満治療薬の急増、パンデミック後の充填・仕上げ能力の増強、統合型安全装置を推奨する規制動向です。ポリマー製シリンジバレルの革新により、ガラス製システムの長年の優位性が脅かされています。一方、地域別動向では、北米が規模の面で主導権を維持し、アジア太平洋地域が最も速い数量増加率を示しています。特に高粘度バイオ医薬品における自己注射需要の高まりを受け、メーカー各社は投与形態の改良、ネステッドラインへの投資、環状オレフィンポリマー(COP)プラットフォームへの移行を推進しております。競合上の差別化は、容器と薬剤の適合性、受動的安全機能、高生産性での即使用可能な構成の供給能力に焦点が移っております。

世界のプレフィルドシリンジ市場の動向と洞察

GLP-1系肥満治療薬の自己注射増加

世界のGLP-1市場規模は、2023年の400億米ドルから2032年までに1,500億米ドルへ拡大する見込みであり、高度な自己注射フォーマットへの持続的な需要を喚起しています。ノボノルディスク社は、米国における新たな充填・包装ラインに41億米ドル、フランスにおける注射ペン拡張に21億ユーロを投じる計画であり、この治療領域に向けられるインフラ規模の大きさを示しています。BD社のNeopak XtraFlowシリンジは、より薄い壁のカニューレを採用することで高粘度薬剤の投与を容易にし、幅広い患者様の自己投与を支援すると同時に、看護師の負担軽減に貢献しております。服薬遵守に関する研究では、プレフィルドデバイスによる治療継続率の高さが一貫して示されており、医療機関から在宅ケアへの移行を円滑にし、プレフィルドシリンジ市場に持続的な成長の基盤を築いております。

生物学的製剤に適した環状オレフィンポリマー(COP)製シリンジへの移行

製薬企業は、制御された安定性試験で確認されている懸念事項である、敏感な生物学的製剤におけるタンパク質凝集を引き起こすシリコーンオイルとの相互作用を軽減するため、COPバレルを採用しています。COPシリンジは粒子数が少なく、ISO/EN 10993の生体適合性基準を満たしているため、次世代医薬品に適しています。SCHOTT Pharma社のTOPPAC凍結プラットフォームは、温度に敏感なmRNA療法向けに特別に設計されています。また、ドイツにおけるポリマー生産能力の拡大は、ガラスからの移行を強調するものです。バイオシミラーの発売が加速する中、COP製シリンジを基盤とした差別化されたデリバリーシステムが、プレフィルドシリンジ市場における競争上の優位性として台頭しています。

高pHバイオ医薬品におけるガラス剥離による回収事例

剥離は、溶液のpHおよびイオン含有量によりガラスフレークが医薬品に溶出することで発生します。この故障メカニズムにより、複数のリコールやFDA警告書が発生しています。高pHの生物学的製剤は特に脆弱であるため、規制当局は承認前に徹底的な容器閉鎖系適合性試験を義務付けています。プレフィルド製剤は多くのストレス指標においてバイアルを上回っていますが、残存リスクがあるため、製薬企業はポリマー代替品の検討を進めています。その結果生じる材料の入れ替えは不確実性を生み、試験コストを増加させ、プレフィルドシリンジ市場の短期的な成長を抑制しています。

セグメント分析

2025年時点で、ガラス製シリンジはプレフィルドシリンジ市場収益の68.25%を占めており、確立された規制上の知見と拡張可能なホウケイ酸ガラス供給の恩恵を受けています。しかしながら、製薬企業がシリコーンとの相互作用を回避し、サブ可視粒子を低減するCOPバレルへ移行する中、プラスチックは11.71%のCAGRで急速に追い上げています。ポリマー製プレフィルドシリンジ市場規模は2031年までに2倍以上に拡大する見込みであり、容器選定基準がコストから医薬品との適合性へ移行していることを示しています。COPはISO/EN 10993で検証された高感度タンパク質への中立性により、mRNA、遺伝子治療、高粘度GLP-1製剤の主要素材としての地位を確立しています。SCHOTT Pharmaなどの早期採用企業は現在、ドイツと米国で専用ポリマーラインの拡大を進めており、調達戦略の不可逆的な転換を示しています。

また、層間剥離によるリコールが規制当局や品質管理責任者の警戒感を高める中、ガラス容器からの移行の動きも加速しています。窒素充填パウチに保管されたポリマー製バレルは、従来の注射器に見られる遊離シリコーン層がなく、2~8℃でガラスと同等の安定性を示します。バイオ医薬品のパイプラインが拡大し(現在では世界の研究開発資産の半数以上を占める)、調達チームはポリマーをリスク保険として捉える傾向が強まっています。とはいえ、ガラスは酸化バリア性と既存の変更管理ファイルにおいて優位性を維持しており、プレフィルドシリンジ市場では両素材の長期的な共存が確実視されます。

2025年の出荷量では1~2.5mLクラスが51.68%を占め、大半の単回投与型生物学的製剤レジメンに適していることを反映しています。しかしながら、1mL以下のセグメントが成長の原動力となっており、高濃度GLP-1製剤や高効力抗がん剤など微量投与を必要とする薬剤の需要により、CAGR11.73%で拡大しています。ミリリットル未満の容量では許容誤差が厳格化されるため、サプライヤーは充填機にインラインビジョンシステムを後付けし、±2マイクロリットル以内の分注精度を保証しています。この投資の波は、支払者と臨床医が注射負担の軽減で一致する中、小型バレル用プレフィルドシリンジの市場シェアを拡大させています。

一方、2.5mLを超える容量化はISO 11040-4の寸法制限に抵触するケースが多く、プランジャーの詰まりやライン停止が散見されます。5mL超の二重チャンバー型はさらに高いハードルに直面し、バリデーションコストを押し上げます。こうした経済性から、コンパクトなバレルに収められた高濃度製剤が優位となり、製造スループットと価値に基づく医療の要請が一致する形となっています。

地域別分析

北米は2025年の収益の38.40%を占め、豊富な生物学的製剤パイプラインと堅固な安全規制が基盤となっています。BD社は米国生産能力を40%拡大し、SCHOTT Pharma社は初の米国工場に3億7,100万米ドルを投資しており、これらはリショアリング政策とGLP-1需要急増への対応を目的とした動きです。FDAの複合製品承認経路への迅速なアクセスが製品発売を効率化するとともに、OSHAの規制要件が受動的安全フォーマットの安定した需要を保証しています。大統領令14017に基づく連邦政府の優遇措置が国内生産の魅力をさらに高め、この地域がプレフィルドシリンジ市場における主導的地位を確固たるものにしています。

欧州は堅調な5%台前半の成長を維持しており、安全設計を優先する厳格な針刺し事故防止指令が後押ししています。ゲレスハイマー社は東欧での生産量を倍増させると同時に、ドイツとスイスでイノベーションセンターを運営しています。欧州医薬品庁(EMA)の確立されたバイオシミラー承認プロセスは製品承認を円滑化し、スポンサーが差別化された注射器形態を選択するよう促しています。一方、ブレグジットの複雑さにより、一部企業は二重在庫拠点を構築する動きも見られますが、全体的な供給の回復力は維持されています。

アジア太平洋地域は2031年までCAGR11.79%で業界を牽引します。中国の国家薬品監督管理局(NMPA)が2025年改革計画に組み込んだ迅速承認制度は、バイオシミラーの市場投入を加速させ、現地の注射器需要を押し上げています。日本における高齢化は自己注射の普及を促進し、インドの競合するバイオシミラークラスターは輸出能力を拡大しています。ニプロ社がノースカロライナ州に工場を開設する決定は、アジアと欧米を結ぶ双方向の供給フローを浮き彫りにしています。地域政府は輸入赤字抑制のため国内医療機器製造を支援しており、プレフィルドシリンジ市場の長期的な需要拡大を後押ししています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

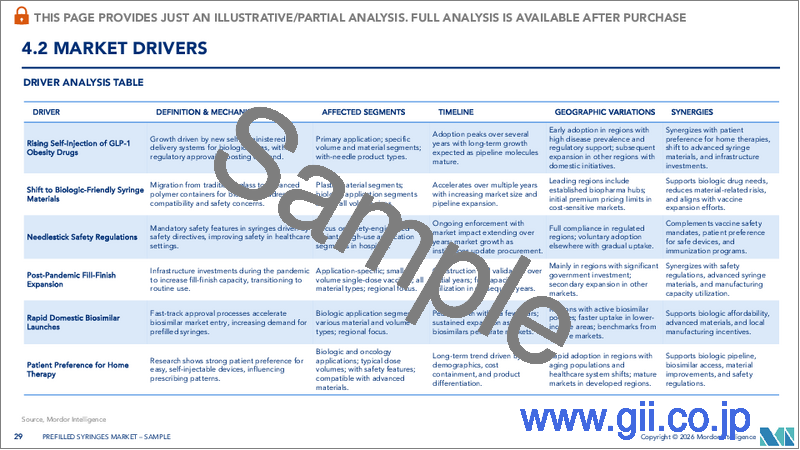

- 市場促進要因

- GLP-1系肥満治療薬の自己注射増加

- 生物学的製剤に適した環状オレフィンポリマー(COP)製注射器への移行

- 針刺し事故防止指令による安全設計済みプレフィルドシリンジ需要の加速

- ポストCOVIDワクチン充填・仕上げ工程の拡張

- 中国国家薬品監督管理局(NMPA)の迅速承認制度による国内バイオシミラーの急速な上市

- 患者様の在宅リウマチ治療へのご要望

- 市場抑制要因

- 高pH生物製剤におけるガラス剥離によるリコール

- ネスト型PFSラインの高額な設備投資がCMOを躊躇させる

- ISO 11040-4規格に準拠した5mL超の二重チャンバー設計における寸法不適合

- ヘパリン汚染訴訟による外部委託の抑制

- バリュー/サプライチェーン分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 素材別

- ガラス

- プラスチック

- バレル単位での量別

- 1mL以下

- 1~2.5 mL

- 2.5mL以上

- 製品タイプ別

- 針付き

- 針を使用しない

- 用途別

- 糖尿病

- アナフィラキシー

- ワクチン接種

- 関節リウマチ

- 腫瘍学

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Becton, Dickinson and Company

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services Inc.

- Terumo Corporation

- Stevanato Group S.p.A.

- Nipro Corporation

- Catalent Pharma Solutions

- Vetter Pharma

- Haselmeier GmbH

- Baxter International Inc.

- Fresenius Kabi

- Nemera

- Taisei Kako Co. Ltd.

- Oval Medical Technologies

- SHL Medical

- Owen Mumford

- Plas-Tech Engineering Inc.

- Laboratoire Aguettant S.A.

- Credence MedSystems

- Aptar Pharma