|

|

市場調査レポート

商品コード

1526808

プレフィルドシリンジ市場:タイプ別、デザイン別、素材別、用途別、地域別 - 2030年までの予測Prefilled Syringes Market by Type (Conventional, Safety), Material (Glass Prefilled Syringe, Plastic), Design (Single-Chamber Prefilled Syringe, Dual-Chamber), Application (Diabetes, Cancer, and Rheumatoid Arthritis), & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| プレフィルドシリンジ市場:タイプ別、デザイン別、素材別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2024年07月29日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

プレフィルドシリンジの市場規模は、予測期間中に10.8%のCAGRで拡大し、2024年の71億米ドルから2030年には131億米ドルに達すると予測されています。

プレフィルドシリンジ市場は、糖尿病、関節リウマチ、心血管障害などの慢性疾患の罹患率の上昇など、多くの要因によって力強い成長を遂げています。さらに、プレフィルドシリンジは、患者のコンプライアンスを向上させ、投与ミスの可能性を低下させる、すぐに使用できる用量を提供することにより、慢性疾患の患者への正確かつ一貫した薬剤投与を容易にします。また、自己投与の動向の高まりも市場の成長に大きな役割を果たしています。プレフィルドシリンジは、投与量の測定が不要なため安全性が向上し、汚染の危険性が低く、その快適さと使いやすさから患者に好まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、デザイン別、素材別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

タイプ別では、いくつかの要因から従来型プレフィルドシリンジセグメントがプレフィルドシリンジ市場を独占すると予想されます。プレフィルドシリンジは、すぐに使用できる性質とあらかじめ計量された用量により、準備時間や投与ミスを減らし、利便性と安全性を高めます。プレフィルドシリンジは、高度な安全機能により、汚染リスクや針刺し損傷を低減します。使い勝手が良く、治療レジメンの遵守を促すことで、特に慢性疾患の患者のコンプライアンスを向上させます。治療用途、特に生物製剤や慢性疾患治療における汎用性は、こうした疾患の有病率の高まりと相まって、市場の優位性をさらに高めています。

材料別では、ガラス製プレフィルドシリンジセグメントがプレフィルドシリンジ市場で最大の市場シェアを占めると予想されます。その優れた化学的不活性は薬剤の安定性を保証し、薬剤と容器の相互作用のリスクを低減するため、幅広い医薬品用途に理想的です。さらに、ガラス製シリンジは視認性が高いため、薬剤の微粒子や変色を容易に検査することができ、品質管理と患者の安全にとって重要です。その結果、製薬会社やヘルスケアプロバイダーは、ドラッグデリバリーにおける信頼性、安全性、効率性からガラス製プレフィルドシリンジを好んで使用しています。

デザイン別では、薬物投与における利便性、安全性、効率性から、シングルチャンバー型プレフィルドシリンジセグメントがプレフィルドシリンジ市場で最大の市場シェアを占めています。1回分の薬剤があらかじめ充填されたこれらの注射器は、投与ミスや汚染のリスクを最小限に抑え、患者の安全性を高める。また、注射プロセスを合理化することで、医療従事者や患者にとって迅速かつ容易なものとなり、コンプライアンスや治療成績の向上につながります。しかしながら、様々な治療分野、特に慢性疾患管理や救急医療に広く採用されていることが、市場の成長をさらに後押ししています。

当レポートでは、世界のプレフィルドシリンジ市場について調査し、タイプ別、デザイン別、素材別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- バリューチェーン分析

- ポーターのファイブフォース分析

- 規制状況

- ケーススタディ分析

- 価格分析

- アンメットニーズ

- エコシステム分析

- サプライチェーン分析

- 隣接市場分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

- 払い戻しシナリオ

- プレフィルドシリンジ部品の市場分析

第6章 プレフィルドシリンジ市場(タイプ別)

- イントロダクション

- 従来のプレフィルドシリンジ

- セーフティプレフィルドシリンジ

第7章 プレフィルドシリンジ市場(デザイン別)

- イントロダクション

- シングルチャンバープレフィルドシリンジ

- デュアルチャンバープレフィルドシリンジ

- カスタマイズドプレフィルドシリンジ

第8章 プレフィルドシリンジ市場(素材別)

- イントロダクション

- ガラス製プレフィルドシリンジ

- プラスチック製プレフィルドシリンジ

第9章 プレフィルドシリンジ市場(用途別)

- イントロダクション

- 糖尿病

- 関節リウマチ

- アナフィラキシー

- がん

- 血栓症

- 眼科

- その他

第10章 プレフィルドシリンジ市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- ブランド/製品比較

- 研究開発費

- 競争状況

- 企業評価と財務指標

第12章 企業プロファイル

- 主要参入企業

- BD

- GERRESHEIMER AG

- SCHOTT

- WEST PHARMACEUTICAL SERVICES, INC.

- APTARGROUP, INC.

- NIPRO

- BAXTER(SIMTRA)

- OWEN MUMFORD LTD.

- WEIGAO MEDICAL INTERNATIONAL CO., LTD

- CREDENCE MEDSYSTEMS, INC.

- NOVARTIS AG

- STEVANATO GROUP

- POLYMEDICURE

- MEDXL INC.

- SHARPS TECHNOLOGY, INC.

- その他の企業

- FRESENIUS KABI USA

- MEDEFIL, INC.

- D.B.M. S.R.L.

- TAISEI KAKO CO., LTD.

- SHANDONG PROVINCE MEDICINAL GLASS CO., LTD.

- SHIN YAN SHENO PRECISION INDUSTRIAL CO., LTD.

- J.O. PHARMA CO., LTD.(OTSUKA HOLDINGS CO., LTD.)

- BMI KOREA

- B. BRAUN SE

- AL SHIFA MEDICAL PRODUCTS CO.

第13章 付録

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: PREFILLED SYRINGES MARKET

- TABLE 3 PREFILLED SYRINGES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE OF PREFILLED SYRINGES, BY TYPE, 2022-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF CONVENTIONAL PREFILLED SYRINGES, BY REGION, 2022-2024 (USD)

- TABLE 11 AVERAGE SELLING PRICE OF SAFETY PREFILLED SYRINGES, BY REGION, 2022-2024 (USD)

- TABLE 12 PREFILLED SYRINGES MARKET: ECOSYSTEM ANALYSIS

- TABLE 13 IMPORT DATA FOR PREFILLED SYRINGES (HS CODE 90183100), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR PREFILLED SYRINGES (HS CODE 90183100), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 LIST OF PATENTS IN PREFILLED SYRINGES MARKET (2022-2024)

- TABLE 16 PREFILLED SYRINGES MARKET: KEY CONFERENCES & EVENTS (2024-2025)

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PREFILLED SYRINGES

- TABLE 18 KEY BUYING CRITERIA FOR PREFILLED SYRINGES

- TABLE 19 PRODUCT ANALYSIS OF KEY PLAYERS IN PREFILLED SYRINGE COMPONENTS

- TABLE 20 PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 21 CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 22 CONVENTIONAL PREFILLED SYRINGES MARKET, BY REGION, 2022-2030 (MILLION UNITS)

- TABLE 23 CONVENTIONAL PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 24 DISPOSABLE PREFILLED SYRINGES MARKET, BY REGION, 2022-2030 (MILLION UNITS)

- TABLE 25 DISPOSABLE PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 26 REUSABLE PREFILLED SYRINGES MARKET, BY REGION, 2022-2030 (MILLION UNITS)

- TABLE 27 REUSABLE PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 28 SAFETY PREFILLED SYRINGES MARKET, BY REGION, 2022-2030 (MILLION UNITS)

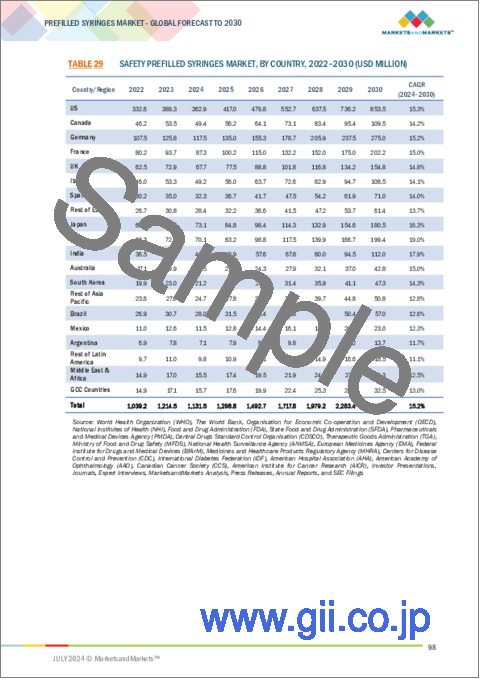

- TABLE 29 SAFETY PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 30 PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 31 SINGLE-CHAMBER PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 DUAL-CHAMBER PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 33 CUSTOMIZED PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 34 PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 35 GLASS PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 36 PLASTIC PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 37 PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 38 PREFILLED SYRINGES MARKET FOR DIABETES APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 PREFILLED SYRINGES MARKET FOR RHEUMATOID ARTHRITIS APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 40 PREFILLED SYRINGES MARKET FOR ANAPHYLAXIS APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 41 PREFILLED SYRINGES MARKET FOR CANCER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 42 PREFILLED SYRINGES MARKET FOR THROMBOSIS APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 43 PREFILLED SYRINGES MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 44 PREFILLED SYRINGES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 45 PREFILLED SYRINGES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 52 US: KEY MACROINDICATORS

- TABLE 53 US: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 54 US: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 55 US: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 56 US: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 57 US: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 58 CANADA: KEY MACROINDICATORS

- TABLE 59 CANADA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 60 CANADA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 61 CANADA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 62 CANADA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 63 CANADA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 64 EUROPE: PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 65 EUROPE: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 66 EUROPE: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 67 EUROPE: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 68 EUROPE: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 69 EUROPE: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 70 GERMANY: KEY MACROINDICATORS

- TABLE 71 GERMANY: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 72 GERMANY: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 73 GERMANY: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 74 GERMANY: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 75 GERMANY: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 76 UK: KEY MACROINDICATORS

- TABLE 77 UK: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 78 UK: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 79 UK: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 80 UK: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 81 UK: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 82 FRANCE: KEY MACROINDICATORS

- TABLE 83 FRANCE: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 84 FRANCE: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 85 FRANCE: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 86 FRANCE: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 87 FRANCE: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 88 SPAIN: KEY MACROINDICATORS

- TABLE 89 SPAIN: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 90 SPAIN: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 91 SPAIN: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 92 SPAIN: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 93 SPAIN: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 94 ITALY: KEY MACROINDICATORS

- TABLE 95 ITALY: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 96 ITALY: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 97 ITALY: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 98 ITALY: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 99 ITALY: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 111 JAPAN: KEY MACROINDICATORS

- TABLE 112 JAPAN: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 113 JAPAN: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 114 JAPAN: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 115 JAPAN: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 116 JAPAN: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 117 CHINA: KEY MACROINDICATORS

- TABLE 118 CHINA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 119 CHINA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 120 CHINA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 121 CHINA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 122 CHINA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 123 INDIA: KEY MACROINDICATORS

- TABLE 124 INDIA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 125 INDIA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 126 INDIA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 127 INDIA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 128 INDIA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 129 AUSTRALIA: KEY MACROINDICATORS

- TABLE 130 AUSTRALIA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 131 AUSTRALIA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 132 AUSTRALIA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 133 AUSTRALIA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 134 AUSTRALIA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 136 SOUTH KOREA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 137 SOUTH KOREA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 139 SOUTH KOREA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 140 SOUTH KOREA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: PREFILLED SYRINGES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 151 LATIN AMERICA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 152 BRAZIL: KEY MACROINDICATORS

- TABLE 153 BRAZIL: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 154 BRAZIL: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 155 BRAZIL: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 156 BRAZIL: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 157 BRAZIL: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 158 MEXICO: KEY MACROINDICATORS

- TABLE 159 MEXICO: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 160 MEXICO: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 161 MEXICO: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 162 MEXICO: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 163 MEXICO: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 164 ARGENTINA: KEY MACROINDICATORS

- TABLE 165 ARGENTINA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 166 ARGENTINA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 167 ARGENTINA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 168 ARGENTINA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 169 ARGENTINA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 173 REST OF LATIN AMERICA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 174 REST OF LATIN AMERICA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 180 GCC COUNTRIES: PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 181 GCC COUNTRIES: CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 182 GCC COUNTRIES: PREFILLED SYRINGES MARKET, BY MATERIAL, 2022-2030 (USD MILLION)

- TABLE 183 GCC COUNTRIES: PREFILLED SYRINGES MARKET, BY DESIGN, 2022-2030 (USD MILLION)

- TABLE 184 GCC COUNTRIES: PREFILLED SYRINGES MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 185 PREFILLED SYRINGES MARKET: DEGREE OF COMPETITION

- TABLE 186 PREFILLED SYRINGES MARKET: TYPE FOOTPRINT

- TABLE 187 PREFILLED SYRINGES MARKET: MATERIAL FOOTPRINT

- TABLE 188 PREFILLED SYRINGES MARKET: DESIGN FOOTPRINT

- TABLE 189 PREFILLED SYRINGES MARKET: APPLICATION FOOTPRINT

- TABLE 190 PREFILLED SYRINGES MARKET: REGION FOOTPRINT

- TABLE 191 PREFILLED SYRINGES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 192 PREFILLED SYRINGES MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SME PLAYERS

- TABLE 193 PREFILLED SYRINGES MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 194 PREFILLED SYRINGES MARKET: DEALS, JANUARY 2021-JUNE 2024

- TABLE 195 PREFILLED SYRINGES MARKET: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 196 BD: COMPANY OVERVIEW

- TABLE 197 BD: PRODUCTS OFFERED

- TABLE 198 BD: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-JUNE 2024

- TABLE 199 BD: DEALS, JANUARY 2021-JUNE 2024

- TABLE 200 BD: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 201 GERRESHEIMER AG: COMPANY OVERVIEW

- TABLE 202 GERRESHEIMER AG: PRODUCTS OFFERED

- TABLE 203 GERRESHEIMER AG: DEALS, JANUARY 2021-JUNE 2024

- TABLE 204 GERRESHEIMER AG: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 205 SCHOTT: COMPANY OVERVIEW

- TABLE 206 SCHOTT: PRODUCTS OFFERED

- TABLE 207 SCHOTT: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 208 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY OVERVIEW

- TABLE 209 WEST PHARMACEUTICAL SERVICES, INC.: PRODUCTS OFFERED

- TABLE 210 WEST PHARMACEUTICAL SERVICES, INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 211 WEST PHARMACEUTICAL SERVICES, INC.: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 212 APTARGROUP, INC.: COMPANY OVERVIEW

- TABLE 213 APTARGROUP, INC.: PRODUCTS OFFERED

- TABLE 214 APTARGROUP, INC.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 215 APTARGROUP, INC.: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 216 NIPRO: COMPANY OVERVIEW

- TABLE 217 NIPRO: PRODUCTS OFFERED

- TABLE 218 BAXTER (SIMTRA): COMPANY OVERVIEW

- TABLE 219 BAXTER (SIMTRA): PRODUCTS OFFERED

- TABLE 220 BAXTER (SIMTRA): DEALS, JANUARY 2021-JUNE 2024

- TABLE 221 BAXTER (SIMTRA): EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 222 OWEN MUMFORD LTD.: COMPANY OVERVIEW

- TABLE 223 OWEN MUMFORD LTD.: PRODUCTS OFFERED

- TABLE 224 OWEN MUMFORD LTD.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 225 OWEN MUMFORD LTD.: DEALS, JANUARY 2021-JUNE 2024

- TABLE 226 WEIGAO MEDICAL INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 227 WEIGAO MEDICAL INTERNATIONAL CO., LTD.: PRODUCTS OFFERED

- TABLE 228 CREDENCE MEDSYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 229 CREDENCE MEDSYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 230 NOVARTIS AG: COMPANY OVERVIEW

- TABLE 231 NOVARTIS AG: PRODUCTS OFFERED

- TABLE 232 NOVARTIS AG: DEALS, JANUARY 2021-JUNE 2024

- TABLE 233 STEVANATO GROUP: COMPANY OVERVIEW

- TABLE 234 STEVANATO GROUP: PRODUCTS OFFERED

- TABLE 235 STEVANATO GROUP: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 236 STEVANATO GROUP: DEALS, JANUARY 2021-MARCH 2024

- TABLE 237 STEVANATO GROUP: EXPANSIONS, JANUARY 2021-JUNE 2024

- TABLE 238 POLYMEDICURE: COMPANY OVERVIEW

- TABLE 239 POLYMEDICURE: PRODUCTS OFFERED

- TABLE 240 MEDXL INC.: COMPANY OVERVIEW

- TABLE 241 MEDXL INC.: PRODUCTS OFFERED

- TABLE 242 SHARPS TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 243 SHARPS TECHNOLOGY, INC.: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PREFILLED SYRINGES MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: BD (2023)

- FIGURE 9 PREFILLED SYRINGES MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION (2023)

- FIGURE 10 PREFILLED SYRINGES MARKET: TOP-DOWN APPROACH

- FIGURE 11 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS (2024-2030)

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 PREFILLED SYRINGES MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 15 CONVENTIONAL PREFILLED SYRINGES MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 16 PREFILLED SYRINGES MARKET, BY MATERIAL, 2024 VS. 2030 (USD MILLION)

- FIGURE 17 PREFILLED SYRINGES MARKET, BY DESIGN, 2024 VS. 2030 (USD MILLION)

- FIGURE 18 PREFILLED SYRINGES MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 19 GEOGRAPHIC SNAPSHOT OF PREFILLED SYRINGES MARKET

- FIGURE 20 RISING PREVALENCE OF CHRONIC DISEASES TO DRIVE GROWTH IN PREFILLED SYRINGES MARKET

- FIGURE 21 CONVENTIONAL PREFILLED SYRINGES ACCOUNTED FOR LARGEST SHARE OF APAC PREFILLED SYRINGES MARKET IN 2023

- FIGURE 22 NORTH AMERICA TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 23 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 25 PREFILLED SYRINGES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 PREFILLED SYRINGES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 PREFILLED SYRINGES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PREFILLED SYRINGES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 ADJACENT MARKETS TO PREFILLED SYRINGES MARKET

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN PREFILLED SYRINGES MARKET

- FIGURE 31 GLOBAL PATENT PUBLICATION TRENDS (JANUARY 2014-JUNE 2024)

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PREFILLED SYRINGES

- FIGURE 33 KEY BUYING CRITERIA FOR PREFILLED SYRINGES, BY TYPE

- FIGURE 34 INVESTMENT/VENTURE CAPITAL SCENARIO IN PREFILLED SYRINGES MARKET, 2021-2024

- FIGURE 35 PREFILLED SYRINGES MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 36 NORTH AMERICA: PREFILLED SYRINGES MARKET SNAPSHOT

- FIGURE 37 EUROPE: PREFILLED SYRINGES MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: PREFILLED SYRINGES MARKET SNAPSHOT

- FIGURE 39 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURING COMPANIES

- FIGURE 40 PREFILLED SYRINGES MARKET: REVENUE ANALYSIS, 2019-2023

- FIGURE 41 PREFILLED SYRINGES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2023

- FIGURE 42 PREFILLED SYRINGES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 PREFILLED SYRINGES MARKET: COMPANY FOOTPRINT

- FIGURE 44 PREFILLED SYRINGES MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 45 PREFILLED SYRINGES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 R&D EXPENDITURE OF KEY PLAYERS, 2022 VS. 2023

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 BD: COMPANY SNAPSHOT (2023)

- FIGURE 50 GERRESHEIMER AG: COMPANY SNAPSHOT (2023)

- FIGURE 51 SCHOTT: COMPANY SNAPSHOT (2023)

- FIGURE 52 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 53 APTARGROUP, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 54 NIPRO: COMPANY SNAPSHOT (2023)

- FIGURE 55 BAXTER (SIMTRA): COMPANY SNAPSHOT (2023)

- FIGURE 56 WEIGAO MEDICAL INTERNATIONAL CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 57 NOVARTIS AG: COMPANY SNAPSHOT (2023)

- FIGURE 58 STEVANATO GROUP: COMPANY SNAPSHOT (2023)

- FIGURE 59 POLYMEDICURE: COMPANY SNAPSHOT (2023)

The prefilled syringes market is projected to reach USD 13.1 billion by 2030 from USD 7.1 billion in 2024, at a CAGR of 10.8% during the forecast period. The prefilled syringes market has had strong growth due to a number of factors such as the rising incidences of chronic diseases like diabetes, rheumatoid arthritis, and cardiovascular disorders. Moreover, prefilled syringes make it easier to administer medications precisely and consistently to patients with chronic conditions, by providing ready-to-use doses that improve patient compliance and lower the possibility of dosage errors. Additionally, the growing trend of self-administration has also played a major role in the market's growth. Prefilled syringes are preferred by patients due to their comfort and ease of use, as they eliminate the need for dose measurement, hence improving safety and lowering the danger of contamination.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Material, Design, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and the GCC countries |

"By type, conventional prefilled syringes segment is expected to have the largest market share in the prefilled syringes market."

Based on the type, the conventional prefilled syringes segment is expected to dominate the the prefilled syringes market due to several factors. Their ready-to-use nature and pre-measured doses enhance convenience and safety by reducing preparation time and dosing errors. They lower contamination risks and needle stick injuries through advanced safety features. Prefilled syringes improve patient compliance, particularly for chronic conditions, by being user-friendly and encouraging adherence to treatment regimens. Their versatility in therapeutic applications, especially for biologics and chronic disease treatments, coupled with the growing prevalence of such conditions, further drive their market dominance.

"By material, glass prefilled syringes segment is expected to have the largest market share in the prefilled syringes market."

Based on material, the glass prefilled syringe segment is expected to hold the largest market share in the prefilled syringes market. Their superior chemical inertness ensures drug stability and reduces the risk of interactions between the drug and the container, making them ideal for a wide range of pharmaceutical applications. Additionally, glass syringes offer high visibility, allowing for easy inspection of the drug for particulates and discoloration, which is critical for quality control and patient safety. As a result, pharmaceutical companies and healthcare providers prefer glass prefilled syringes for their reliability, safety, and efficiency in drug delivery.

"By design, single-chamber prefilled syringes segment is expected to have the largest market share in the prefilled syringes market."

Based on design, the single-chamber prefilled syringe segment accounted for the largest market share of the prefilled syringes market due to their convenience, safety, and efficiency in drug administration. These syringes, which come pre-loaded with a single dose of medication, minimize the risk of dosing errors and contamination, enhancing patient safety. They streamline the injection process, making it quicker and easier for healthcare providers and patients, thereby improving compliance and treatment outcomes. Moroever, their widespread adoption in various therapeutic areas, particularly in chronic disease management and emergency care, further drives growth in the market.

"By application, cancer segment is expected to have the largest market share in the prefilled syringes market."

By application, the cancer segment is expected to hold the largest market share due to the increasing prevalence of cancer globally and the rising need for advanced drug delivery systems. Prefilled syringes offer significant advantages for cancer treatment, including precise dosing, reduced risk of contamination, and enhanced patient safety and compliance. As cancer treatments often involve complex medication regimens requiring regular and accurate administration, the convenience and reliability of prefilled syringes become critical. Additionally, advancements in biologics and targeted therapies, which are frequently used in oncology, further drive the demand for prefilled syringes, making the cancer segment the dominant application area in this market.

"By region, North American region is expected to have the largest market share in the prefilled syringes market."

North America to register for the highest share of the prefilled syringes market during the forecast period due to several factors. These include a well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a significant focus on patient safety and convenience. Moreover, the region benefits from robust regulatory frameworks that encourage the adoption of pre-filled syringes by ensuring stringent quality standards and safety measures. Additionally, increasing incidences of chronic diseases requiring regular injections, coupled with rising healthcare expenditures, contribute to the growing demand for pre-filled syringes in North America. The presence of major pharmaceutical companies and biotechnology firms further enhances market growth through extensive research and development activities aimed at improving drug delivery systems.

A breakdown of the primary participants (supply-side) for the prefilled syringes market referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3-25%

- By Designation: C-level-20%, Director Level-35%, and Others-45%

- By Region: North America-27%, Europe-25%, Asia Pacific-30%, Latin America- 8%, Middle East & Africa-10% .

Prominent players in the prefilled syringes market are BD (US), Gerresheimer AG (Germany), SCHOTT (Germany), and West Pharmaceutical Services, Inc. (US), AptarGroup Inc. (US), Nipro (Japan), Baxter (US), Owen Mumford Ltd. (UK), Weigao Meidcal international Co., Ltd. (China), Credence MedSystems, Inc.(US), Novartis AG (Switzerland), Stevanato Group (Italy), Polymedicure (India), MedXL (Canada), Sharps Technology, Inc.(US), Fresenius Kabi (US), DBM S.R.L. (Italy), Taisei Kako Co.,Ltd (Japan), Shandong Province Medicinal Glass Co., Ltd.(China), SHIN YAN SHENO PRECISION INDUSTRIAL CO., LTD (Japan), J.O. PHARMA CO., LTD. (Japan), BMIKOREA (Korea), B. Braun SE ( Germany), and Al Shifa Medical Products Co. (Saudi Arabia).

Research Coverage:

The report analyzes the prefilled syringes market and aims at estimating the market size and future growth potential of this market based on various segments such as type, material, design, application, and region. The report also includes a competitive analysis of the key players in this market along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall prefilled syringes market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing chronic diseases, incereasing biologics and biosimilars, and technological advancements), restraints (product recalls, and stringent government regulations), opportunities (increasing prevalence of self-administration of injectables and increasing regulatory support) and challenges (presence of alternative drug delivery methods, and infections associated with needlestick injuries)

- Market Penetration: It includes extensive information on products offered by the major players in the global the prefilled syringes market. The report includes various segments in type, material, design, application, and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global prefilled syringes market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by type, materila, design, application, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global the prefilled syringes market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products, and capacities of the major competitors in the global prefilled syringes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 IMPACT OF RECESSION ON PREFILLED SYRINGES MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PREFILLED SYRINGES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PREFILLED SYRINGES MARKET OVERVIEW

- 4.3 PREFILLED SYRINGES MARKET: REGIONAL MIX

- 4.4 PREFILLED SYRINGES MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.5 PREFILLED SYRINGES MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases

- 5.2.1.2 Growing adoption of self-injection devices

- 5.2.1.3 Increasing adoption of prefilled syringes in parenteral dosage forms

- 5.2.1.4 Increased use of biologics and vaccines

- 5.2.1.5 Technological advancements in prefilled syringes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent government regulations

- 5.2.2.2 Impact of product recalls

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing preference for unit-dose medication using prefilled syringes

- 5.2.3.2 Emerging markets with growing healthcare infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Alternative drug delivery methods

- 5.2.4.2 Infections associated with needlestick injuries

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 PREFILLED BIOLOGICS

- 5.3.2 INTEGRATED SAFETY FEATURES

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Integration disinfection unit (IDU)

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Cyclic olefin polymers (COP) and cyclic olefin copolymers (COC)

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Integration with autoinjectors

- 5.4.1 KEY TECHNOLOGIES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY ANALYSIS

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: ENVIRONMENTAL BENEFITS OF USING PREFILLED 'EMERGENCY' DRUGS

- 5.8.2 CASE STUDY 2: DEVELOPMENT OF NOVEL PHARMACEUTICAL DRUG MODALITIES REQUIRING FROZEN STORAGE AND TRANSPORTATION

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OF PREFILLED SYRINGES, BY TYPE, 2022-2024

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.10 UNMET NEEDS

- 5.11 ECOSYSTEM ANALYSIS

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 ADJACENT MARKET ANALYSIS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 TRADE ANALYSIS

- 5.16 PATENT ANALYSIS

- 5.16.1 PATENT PUBLICATION TRENDS FOR PREFILLED SYRINGES

- 5.16.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.16.3 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR PREFILLED SYRINGE PATENTS (JANUARY 2014-APRIL 2024)

- 5.16.4 TOP APPLICANT COUNTRIES/REGIONS PATENTS FOR PREFILLED SYRINGES (JANUARY 2014-APRIL 2024)

- 5.17 KEY CONFERENCES & EVENTS DURING 2024-2025

- 5.18 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 REIMBURSEMENT SCENARIO

- 5.21 MARKET ANALYSIS OF PREFILLED SYRINGE COMPONENTS

- 5.21.1 PLUNGER STOPPERS

6 PREFILLED SYRINGES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CONVENTIONAL PREFILLED SYRINGES

- 6.2.1 DISPOSABLE PREFILLED SYRINGES

- 6.2.1.1 Increasing focus on patient safety to drive market

- 6.2.2 REUSABLE PREFILLED SYRINGES

- 6.2.2.1 Cost-effectiveness and technological advancements to drive market

- 6.2.1 DISPOSABLE PREFILLED SYRINGES

- 6.3 SAFETY PREFILLED SYRINGES

- 6.3.1 INTEGRATED SAFETY FEATURES TO BOOST ADOPTION

7 PREFILLED SYRINGES MARKET, BY DESIGN

- 7.1 INTRODUCTION

- 7.2 SINGLE-CHAMBER PREFILLED SYRINGES

- 7.2.1 CONVENIENCE, SAFETY, AND EFFICIENCY OF SINGLE-CHAMBER SYRINGES TO SUPPORT MARKET GROWTH

- 7.3 DUAL-CHAMBER PREFILLED SYRINGES

- 7.3.1 UNIQUE ADVANTAGES AND SPECIFIC APPLICATIONS OF DUAL-CHAMBER SYRINGES TO DRIVE DEMAND

- 7.4 CUSTOMIZED PREFILLED SYRINGES

- 7.4.1 PATIENT-FRIENDLY FEATURES SUCH AS EASY-TO-READ DOSAGE INDICATORS AND SAFETY MECHANISMS TO BOOST ADOPTION

8 PREFILLED SYRINGES MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 GLASS PREFILLED SYRINGES

- 8.2.1 ABILITY OF GLASS PREFILLED SYRINGES TO OFFER SUPERIOR BARRIER PROPERTIES TO BOOST MARKET GROWTH

- 8.3 PLASTIC PREFILLED SYRINGES

- 8.3.1 IMPROVED SAFETY, COST-EFFECTIVENESS, VERSATILITY, AND CONVENIENCE OF PLASTIC SYRINGES TO SUPPORT ADOPTION

9 PREFILLED SYRINGES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DIABETES

- 9.2.1 INCREASING PREVALENCE OF DIABETES TO FAVOR MARKET GROWTH

- 9.3 RHEUMATOID ARTHRITIS

- 9.3.1 RISING DEMAND FOR EFFECTIVE AND CONVENIENT TREATMENT OPTIONS FOR RHEUMATOID ARTHRITIS TO DRIVE MARKET

- 9.4 ANAPHYLAXIS

- 9.4.1 CONVENIENCE OF PREFILLED SYRINGES TO ADMINISTER MEDICATION QUICKLY DURING ANAPHYLACTIC EPISODES TO BOOST GROWTH

- 9.5 CANCER

- 9.5.1 RISING GLOBAL CANCER RATES TO SUPPORT MARKET GROWTH

- 9.6 THROMBOSIS

- 9.6.1 MINIMIZED RISK OF CONTAMINATION AND INFECTION ASSOCIATED WITH PREFILLED SYRINGES TO DRIVE DEMAND

- 9.7 OPHTHALMOLOGY

- 9.7.1 FEWER SIDE-EFFECTS ASSOCIATED WITH PREFILLED SYRINGES COMPARED TO TOPICAL MEDICATIONS TO SUPPORT GROWTH

- 9.8 OTHER APPLICATIONS

10 PREFILLED SYRINGES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 US

- 10.2.2.1 US to dominate North American prefilled syringes market

- 10.2.3 CANADA

- 10.2.3.1 Increasing government support and rising incidence of chronic diseases to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 GERMANY

- 10.3.2.1 Germany to dominate market in Europe

- 10.3.3 UK

- 10.3.3.1 Growing number of CVD and diabetes patients to drive market growth

- 10.3.4 FRANCE

- 10.3.4.1 Increasing needlestick injuries and growing trend of self-administration to drive market growth

- 10.3.5 SPAIN

- 10.3.5.1 Increase in biologics production to support market growth

- 10.3.6 ITALY

- 10.3.6.1 Growing focus of pharmaceutical and medical device companies to boost market growth

- 10.3.7 REST OF EUROPE (ROE)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 JAPAN

- 10.4.2.1 Increased geriatric population and favorable government initiatives to drive market growth in Japan

- 10.4.3 CHINA

- 10.4.3.1 Rising prevalence of chronic diseases to augment market growth

- 10.4.4 INDIA

- 10.4.4.1 High incidence of cancer and increased adoption of biosimilars to fuel market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Growing healthcare expenditure to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Well-developed healthcare sector and presence of major pharmaceutical manufacturers to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- 10.5.2 BRAZIL

- 10.5.2.1 Rising incidence of chronic diseases and increasing obesity to augment market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing focus of government on healthcare and growing medical tourism to propel market

- 10.5.4 ARGENTINA

- 10.5.4.1 Increasing focus of government on healthcare and growing medical tourism to propel market

- 10.5.5 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GROWING PUBLIC HEALTHCARE SPENDING TO BOOST MARKET

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.7 GCC COUNTRIES

- 10.7.1 INCREASING HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 10.7.2 GCC COUNTRIES: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PREFILLED SYRINGES MARKET

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Type footprint

- 11.5.5.3 Material footprint

- 11.5.5.4 Design footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.7 BRAND/PRODUCT COMPARISON

- 11.7.1 BD

- 11.7.2 GERRESHEIMER AG

- 11.7.3 STEVANATO GROUP

- 11.7.4 SCHOTT GROUP

- 11.7.5 NIPRO

- 11.8 R&D EXPENDITURE

- 11.9 COMPETITIVE SITUATION

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.10 COMPANY VALUATION & FINANCIAL METRICS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BD

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & approvals

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 GERRESHEIMER AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 SCHOTT

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 WEST PHARMACEUTICAL SERVICES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.5 APTARGROUP, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.6 NIPRO

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 BAXTER (SIMTRA)

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.8 OWEN MUMFORD LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 WEIGAO MEDICAL INTERNATIONAL CO., LTD

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 CREDENCE MEDSYSTEMS, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 NOVARTIS AG

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 STEVANATO GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Expansions

- 12.1.13 POLYMEDICURE

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 MEDXL INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 SHARPS TECHNOLOGY, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 BD

- 12.2 OTHER PLAYERS

- 12.2.1 FRESENIUS KABI USA

- 12.2.2 MEDEFIL, INC.

- 12.2.3 D.B.M. S.R.L.

- 12.2.4 TAISEI KAKO CO., LTD.

- 12.2.5 SHANDONG PROVINCE MEDICINAL GLASS CO., LTD.

- 12.2.6 SHIN YAN SHENO PRECISION INDUSTRIAL CO., LTD.

- 12.2.7 J.O. PHARMA CO., LTD. (OTSUKA HOLDINGS CO., LTD.)

- 12.2.8 BMI KOREA

- 12.2.9 B. BRAUN SE

- 12.2.10 AL SHIFA MEDICAL PRODUCTS CO.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS