|

市場調査レポート

商品コード

1444195

アルツハイマー病の診断と治療:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Alzheimer's Disease Diagnostics and Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アルツハイマー病の診断と治療:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 117 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

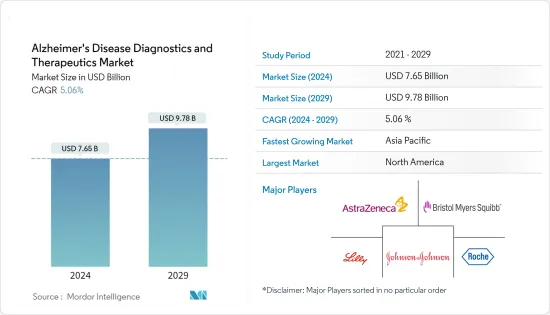

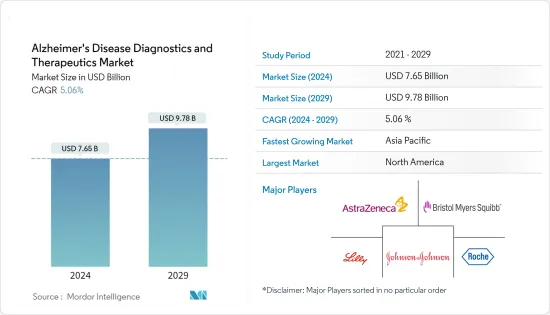

アルツハイマー病の診断と治療市場規模は、2024年に76億5,000万米ドルと推定され、2029年までに97億8,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.06%のCAGRで成長します。

2020年初頭の政府による世界の規則化により、病院や診断センターへの訪問が減少したため、世界中で診断および治療がアルツハイマー病になったため、COVID-19のパンデミックの出現はアルツハイマー病の診断と治療市場に影響を与えました。たとえば、ある記事Brain Sci誌に掲載されました。 2021年2月、認知症患者はCOVID-19感染症に感染すると重症化や死亡のリスクが高まると述べた。したがって、予防策として、病院やその他のヘルスケア施設への治療や診断の受診が減少しています。しかし、現在はパンデミック初期に比べてアルツハイマー病の診断と治療サービスへのアクセスが改善されており、調査期間中に市場は成長ペースを取り戻すと予想されています。

アルツハイマー病の診断と治療市場の成長を促進する主な要因は、アルツハイマー病の診断および医薬品開発におけるバイオマーカーの使用の増加と、世界のアルツハイマー病の有病率の上昇です。たとえば、2022年 9月のWHOの報告書では、世界中で約5,500万人が認知症を患っており、毎年 1,000万人近くの症例が報告されていると述べられています。 WHOはまた、アルツハイマー病は最も一般的な認知症であり、認知症の全症例の約60~70%を占めると述べました。

また、世界中でアルツハイマー病の有病率が高まる中、政府および非政府機関はアルツハイマー病の診断薬や治療薬の開発に多額の投資を行っており、これが市場の成長を促進する可能性があります。たとえば、2021年 6月、ADDF Diagnostics Acceleratorは、アルツハイマー病診断用のデジタルバイオマーカーを開発するための4つの新たな調査投資を開始しました。このような投資は市場の成長をさらに促進すると予想されます。

さらに、診断技術の進歩とこの分野での継続的な調査活動に伴い、両社は自社の製品提供を強化し、合併・買収、戦略的提携、他社への新たな投資などの事業拡大イニシアチブと併せて新製品の発売を行っています。予測期間中のアルツハイマー病の診断と治療市場の成長を補完するために。たとえば、2021年 11月、米国ボストンのブリガムアンドウィメンズ病院は、アルツハイマー病に対する新しい経鼻ワクチンの安全性と有効性をテストする臨床試験を開始しました。したがって、そのような治療薬の開発はアルツハイマー病治療のためのより良い薬につながり、それによって研究対象市場の成長を促進します。

したがって、バイオマーカーの使用、研究開発の増加、および高度な診断技術により、調査対象の市場は予測期間中に健全な成長を遂げると予想されます。ただし、診断と治療に関連する臨床研究の高い失敗率とアルツハイマー病の早期診断における課題、予測期間中の市場の成長が妨げられる可能性があります。

アルツハイマー病の診断と治療市場の動向

コリンエステラーゼ阻害剤は、予測期間中に大幅な成長を遂げると予想されます。

アセチルコリンエステラーゼ阻害剤としても知られるコリンエステラーゼ阻害剤は、神経伝達物質であるアセチルコリンの正常な分解を停止する治療薬の一種です。コリンエステラーゼ阻害剤は、体内のアセチルコリン神経伝達物質の分解に関与する酵素コリンエステラーゼの作用を遮断します。コリンエステラーゼ阻害剤は、軽度から中等度の集中性アルツハイマー病に苦しむ人々の脳機能の喪失をわずかに遅らせることが判明しているため、記憶、思考、言語、判断、その他の思考プロセスに関連する症状を治療するために広く処方されています。現在、市場で入手可能でアルツハイマー病に使用されている主なコリンエステラーゼ阻害薬は、ドネペジル、ガランタミン、リバスチグミン、メマンチンです。

現在市場では、コリンエステラーゼ阻害剤がアルツハイマー病に利用できるアルツハイマー病治療薬となっています。これは、酵素コリンエステラーゼがアルツハイマー病の重要な主要な治療薬であるためです。したがって、いくつかの製薬会社がコリンエステラーゼ阻害剤に基づいたアルツハイマー病治療薬を開発しているため、このセグメントは予測期間中に成長すると予想されます。

また、2021年12月にAGSジャーナルに掲載された論文では、アルツハイマー病の高齢者はコリンエステラーゼ阻害剤で治療すると反応が良くなると述べています。したがって、アルツハイマー病の高齢者人口の増加はコリンエステラーゼ阻害剤の需要の増加につながり、それによってこの分野の成長に貢献しています。

したがって、アルツハイマー病の治療におけるコリンエステラーゼ阻害剤の実用的な成果により、新製品の発売と高齢者人口の増加により、予測期間中に大幅な成長が見込まれると予想されます。

北米は、予測期間中に大幅な成長を遂げると予想されます。

北米は、アルツハイマー病の高い負担と高齢化人口の増加、研究開発活動への巨額の投資、この地域での新製品の発売により、予測期間中に大幅な成長が見込まれると予想されます。たとえば、2021年6月、カナダアルツハイマー病協会の最高科学責任者はインタビューで、今後10年間でカナダでは100万人以上が認知症を抱えて暮らすことになると予想されると述べた。これは、北米地域におけるアルツハイマー病の有病率の増加により、アルツハイマー病の診断と治療製品の需要が増加すると予想され、それが予測期間中に市場の成長を促進する可能性があることを示しています。

また、高齢者人口は加齢に伴うアルツハイマー病のような神経変性疾患にかかりやすいため、この地域の高齢化人口の増加によりアルツハイマー病の負担が増大すると予想されています。たとえば、2022年 3月のアルツハイマー病協会の報告書では、米国では65歳以上の約620万人がアルツハイマー病に関連した認知症を患っており、この数は2060年までに1,380万人に増加すると予測されています。

アルツハイマー病の診断と管理に関連する調査研究の数が増加していること、および政府および民間団体によるアルツハイマー病に対する国内への多額の投資により、米国市場は予測期間中に成長すると予想されます。たとえば、2021年10月、ソーク研究所はアルツハイマー病治療薬CMS121のヒトにおける安全性を評価するための第1相臨床試験を開始しました。したがって、そのようなパイプライン医薬品はアルツハイマー病のより優れた治療法の開発につながり、それによってこの地域で研究されている市場の成長を推進しています。

したがって、アルツハイマー病の高い負担と研究開発活動への巨額の投資、および新製品の発売により、この地域のアルツハイマー病の診断と治療薬市場は予測期間中に成長すると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 診断と医薬品開発におけるバイオマーカーの使用

- 多数の医薬品がパイプラインにある

- 新たな診断技術の登場

- 市場抑制要因

- 後期医薬品の高い失敗率

- 代替マーカーの欠如と早期診断の課題

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品やサービスの脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品

- 治療学

- コリンエステラーゼ阻害剤

- NMDA受容体拮抗薬

- その他の治療法

- 診断

- 脳画像検査

- アルツハイマー病のCFS検査

- 治療学

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- F. Hoffmann-La Roche

- Bristol-Myers Squibb

- AstraZeneca PLC

- Corium Inc.

- Eisai Co. Ltd

- Biogen Inc.

- Johnson &Johnson

- Eli Lilly and Company

- Lupin Limited

- AbbVie Inc.

- Siemens Healthineers

- Zydus Cadila

- Merz Pharma

- Teva Pharmaceutical Industries Ltd

- Adamas Pharmaceuticals Inc.

第7章 市場機会と将来の動向

The Alzheimer's Disease Diagnostics and Therapeutics Market size is estimated at USD 7.65 billion in 2024, and is expected to reach USD 9.78 billion by 2029, growing at a CAGR of 5.06% during the forecast period (2024-2029).

The emergence of the COVID-19 pandemic impacted the Alzheimer's disease diagnostics and therapeutics market, as diagnostic and therapeutic procedures worldwide were Alzheimer's due to the decline in visits to hospitals and diagnostic centers because of government regularizations globally in early 2020. For instance, an article published in Brain Sci. in February 2021 stated that patients with dementia were at increased risk of severe disease and death when infected with COVID-19. Thus, as a measure of prevention, there is a decrease in the treatment and diagnostic visits to hospitals and other healthcare facilities. However, as better access to affectedAlzheimer'sr's diagnostic and therapeutic services is currently compared to the initial pandemic times, the market is expected to regain its growth pace over the studied period.

The major factors driving the growth of the Alzheimer's disease diagnostics and therapeutics market are the increasing use of biomarkers in Alzheimer's diagnosis and drug development and the rising prevalence of Alzheimer's worldwide. For instance, in September 2022, a report by the WHO stated that about 55 million people around the world are living with dementia, and nearly 10 million cases are reported annually. WHO also said that Alzheimer's is the most common form of dementia and constitutes about 60-70% of the total cases of dementia.

Also, with the growing prevalence of Alzheimer's around the world, government and non-government entities are investing heavily in developing diagnostics and therapeutics for the disease, which may augment the market's growth. For instance, in June 2021, the ADDF Diagnostics Accelerator launched four new research investments to develop digital biomarkers for Alzheimer's diagnosis. Investments like these are further expected to propel the market growth.

Additionally, with the advancement in diagnostic technologies and ongoing research activities in the area, the companies are enhancing their product offering and launching new products coupled with other business expansion initiatives like mergers and acquisitions, strategic collaboration, and new investments into other companies are also expected to complement the growth of the Alzheimer's disease diagnostics and therapeutics market over the forecast period. For instance, in November 2021, Brigham and Women's Hospital in Boston, United States, started a clinical trial to test the safety and efficacy of a new nasal vaccine for Alzheimer's disease. Thus, such therapeutics development leads to better drugs for Alzheimer's treatments, thereby driving the growth of the studied market.

Thus, due to the use of biomarkers, increasing research and development, and advanced diagnostic technologies, the studied market is expected to witness healthy growth over the forecast period. However, high failure rates of clinical studies related to diagnosis and treatment and challenges in early diagnostics of Alzheimer's may impede the market growth over the forecast period.

Alzheimer's Disease Diagnostics & Therapeutics Market Trends

Cholinesterase Inhibitors is Expected to Witness a Significant Growth Over the Forecast Period.

Cholinesterase inhibitors, also known as acetylcholinesterase inhibitors, are a class of therapeutics that stop the normal breakdown of acetylcholine, a neurotransmitter. The cholinesterase inhibitors shut off the action of the enzyme cholinesterase, which is responsible for breaking down acetylcholine neurotransmitters in the body. As cholinesterase inhibitors are found to slightly delay the loss of brain function in people suffering from mild to moderate focus Alzheimers disease, they are widely prescribed to treat symptoms related to memory, thinking, language, judgment, and other thought processes. Currently, the major cholinesterase inhibitor drugs available and Alzheimer's use in the market are donepezil, galantamine, rivastigmine, and memantine.

Currently, in the market, cholinesterase inhibitors are the Alzheimer's drugs available for Alzheimer's because the enzyme cholinesterase is a significant therapeutic primary for Alzheimer's. Hence, the segment is expected to grow over the forecast period as several pharmaceutical companies Alzheimer's developing Alzheimer's therapeutics based on cholinesterase inhibitors. For instance, in October 2021, Corium, Inc., reported the USFDA has set a PDUFA target actionCorium'sium's new drug application for once-weekly ADLARITY (donepezil transdermal systcommonly it's a patch formulation of donepezil. This patch treats dementia due to mild, moderate, or severe Alzheimer's disease.

Also, an article published by AGS journal in December 2021 stated that older adults with Alzheimer's disease respond better when treated with cholinesterase inhibitors. Thus, the rising geriatric population with Alzheimer's disease is leading to increasing demand for cholinesterase inhibitors, thereby contributing to the growth of this segment.

Thus, due to the practical results of cholinesterase inhibitors in treating Alzheimer's disease, new product launches and the increasing geriatric population is expected to witness significant growth over the forecast period.

North America is Expected to Witness a Significant Growth Over the Forecast Period.

North America is expected to witness significant growth over the forecast period owing to the high burden of Alzheimer's disease and the increasing aging population, huge investment in research and development activities, and the launch of new products in the region. For instance, in June 2021, in an interview, the Chief Science Officer of the Alzheimer's Society of Canada stated that in the upcoming 10 years, it is anticipated that more than one million people in Canada will be living with dementia. This indicates that the increasing prevalence of Alzheimer's in the North American region is expected to increase the demand for diagnostic and therapeutic products for Alzheimer's, which may drive market growth over the forecast period.

Also, the growing aging population in the region is expected to increase the burden of Alzheimer's disease, as the geriatric population is more prone to neurodegenerative diseases like Alzheimer's as it is an age-associated disease. For instance, in March 2022, the Alzheimer's Association Report stated that approximately 6.2 million people of age 65 years and more are living with Alzheimer's-related dementia in the United States, and it is projected that this number will increase to 13.8 million people by 2060.

With the increasing number of research studies related to the diagnosis and management of Alzheimer's disease and high investment in the country over Alzheimer's by the government and private entities, the market is expected to grow in the United States over the forecast period. For instance, in October 2021, Salk Institute initiated a phase 1 clinical trial of the investigational Alzheimer's drug CMS121 to evaluate its safety in humans. Thus, such pipeline drugs are leading to the development of better therapeutics for Alzheimer's disease, thereby driving the growth of the studied market in the region.

Therefore, due to the high burden of Alzheimer's disease and huge investment in research and development activities, coupled with the launch of new products, the Alzheimer's disease diagnostics, and therapeutics market is expected to grow over the forecast period in the region.

Alzheimer's Disease Diagnostics & Therapeutics Industry Overview

The Alzheimer's disease diagnostics and therapeutics market is moderately competitive and consists of several significant players; some of the companies are F. Hoffmann-La Roche, Bristol-Myers Squibb, AstraZeneca PLC, Corium Inc., Eisai Co. Ltd, Biogen Inc., Johnson & Johnson, Eli Lilly and Company, Lupin Limited, AbbVie Inc., Siemens Healthineers, Zydus Cadila, Merz Pharma, Teva Pharmaceutical Industries Ltd., and Adamas Pharmaceuticals Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Use of Biomarkers in Diagnosis and Drug Development

- 4.2.2 Large Number of Drugs in Pipeline

- 4.2.3 Emerging Novel Diagnostic Technologies

- 4.3 Market Restraints

- 4.3.1 High Failure Rates of Late-stage Drugs

- 4.3.2 Lack of Surrogate Markers and Challenges in Early Diagnosis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Product

- 5.1.1 Therapeutics

- 5.1.1.1 Cholinesterase Inhibitors

- 5.1.1.2 NMDA Receptor Antagonists

- 5.1.1.3 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Brain Imaging

- 5.1.2.2 CFS Test for Alzheimer's Disease

- 5.1.1 Therapeutics

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche

- 6.1.2 Bristol-Myers Squibb

- 6.1.3 AstraZeneca PLC

- 6.1.4 Corium Inc.

- 6.1.5 Eisai Co. Ltd

- 6.1.6 Biogen Inc.

- 6.1.7 Johnson & Johnson

- 6.1.8 Eli Lilly and Company

- 6.1.9 Lupin Limited

- 6.1.10 AbbVie Inc.

- 6.1.11 Siemens Healthineers

- 6.1.12 Zydus Cadila

- 6.1.13 Merz Pharma

- 6.1.14 Teva Pharmaceutical Industries Ltd

- 6.1.15 Adamas Pharmaceuticals Inc.