|

市場調査レポート

商品コード

1685863

半導体(シリコン)知的財産-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Semiconductor (Silicon) Intellectual Property - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体(シリコン)知的財産-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 173 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

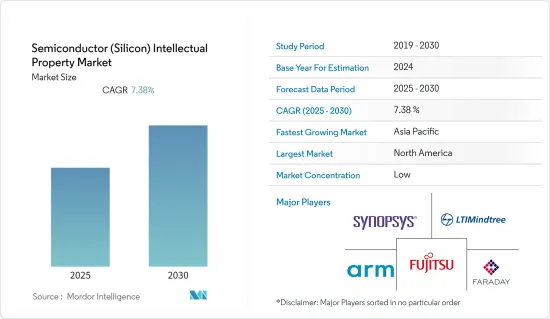

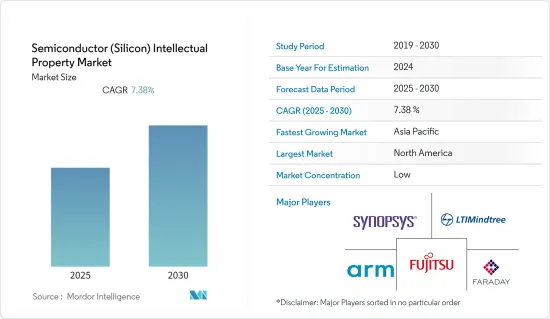

半導体知的財産市場は予測期間中にCAGR 7.38%を記録すると予想されます。

半導体IP(SIP)市場は、半導体販売の成長に伴い、急成長を遂げています。調査対象市場は、完全に半導体産業に依存しています。半導体事業は過去20年間に大きな成長を遂げています。

主なハイライト

- SIPのビジネス慣行には、従来の半導体や特定用途向け集積回路(ASIC)、電子設計自動化(EDA)、設計サービス市場と同様の要素が含まれています。しかし、ASICやEDA業界における確立されたビジネスモデルとは異なり、SIPのビジネスモデルは、サプライチェーンにおける複数の関係者がIC設計における商用SIPの成功に関与するため、より複雑になる傾向があります。

- ビジネス慣行やSIPビジネスモデルはある程度統一されてきているが、SIP製品のタイプや顧客ニーズは多種多様であり、EDAツールやプロセス技術も頻繁に変更されるため、業界はまだ標準化を達成する必要があります。設計コストの上昇と市場からのプレッシャーの増大により、企業は半導体IPメーカーのサービスを求めざるを得なくなっています。この市場の様々なアプリケーションには、自動車、スマートデバイス(携帯電話やタブレット)、コンピュータ、周辺機器などが含まれます。この市場の重要な成長促進要因には、コンシューマーデバイスの世界の普及や、先進的なSOC設計とコネクテッドデバイスの需要が含まれます。組み込み型やプログラマブルDSP-IPなどの新技術が市場をさらに押し上げると予想されます。

- SEMIの最新四半期報告書「World Fab Forecast」によると、世界の半導体産業は2021年から2023年にかけて、自動車やハイパフォーマンスコンピューティング(HPC)を含む84の大規模チップ製造施設の建設に5,000億米ドル以上を投資し、支出増を促進するとしています。また、世界の半導体材料市場は2022年に726億9,000万米ドルの収益を上げ、そのうち201億3,000万米ドルが台湾で生産されたとしています。さらに129億7,000万米ドルが中国で創出され、2021年から7%増加しました。

- システムオンチップ(SoC)設計の複雑さは、システムエンジニアリング能力を凌駕しています。設計の複雑化はデータサイズの増大をもたらし、半導体開発を以前よりも困難なものにしています。これが市場の成長を抑制すると予想されます。

半導体シリコン知的財産(IP)市場動向

コンシューマー・エレクトロニクスが最大のエンドユーザー市場に

- 半導体知的財産コアは、スマートフォン、ゲーム機、電子レンジ、冷蔵庫などの民生用電子機器に広く使用されています。コンシューマ・エレクトロニクス業界は飛躍的に進化しており、消費者の需要圧力によりベンダーは差別化された製品を提供し、市場をリードする必要に迫られています。半導体は、携帯電話などの通信機器や、ゲーム機、テレビ、家電製品などの家電製品に組み込まれています。

- 集積回路(IC)の発明は、ブロードバンドやモバイル・アプリケーションの増加など、コンシューマー・エレクトロニクス産業発展の主な原動力のひとつです。

- 同市場は、タブレット端末や通信市場向けスマートフォンの販売増加により、堅調な成長が見込まれています。例えば、エリクソンによると、世界のスマートフォンモバイルネットワーク契約数は、2022年の64億2,000万台から2028年には77億4,000万台に増加すると推定されています。中国、インド、米国がスマートフォンのモバイルネットワーク契約数が最も多いです。

- 今日、スマート製品は複雑な電子システムで構成されており、エラーのない動作が求められています。データ速度の向上、デバイスの小型化、複数の無線技術のサポート、バッテリー寿命の延長には、詳細な分析が必要です。さらに、さまざまな機能を1つのデバイスに統合する必要があるため、PCB設計が複雑になっています。

- マルチコア・プロセッサー市場は、家電向けパーソナル・コンピューティングの進歩やスマートフォン向けオクタコア・プロセッサーの登場で大きく成長しています。マルチコアプロセッサの成長は、調査対象の市場に力強い成長機会を提供すると予想されます。

北米が主要市場シェアを占める

- 米国は、ベンダーとエンドユーザーの観点から、半導体市場全体における主要市場の一つです。米国の多くの産業でインテリジェントなコマンドと制御のニーズが高まっており、多くの半導体メーカーに不可欠な市場機会を提供しています。

- 市場ベンダーの多くは、この地域でのプレゼンスを拡大しています。さらに、市場ベンダーの多くは米国を拠点としており、この地域市場に競争上の優位性をもたらしています。米国政府も半導体シリコン知的財産(IP)市場を支援し、この地域の半導体ビジネス開拓に重要な役割を果たしています。

- カナダの半導体IP産業には、家電、ヘルスケア、運輸、通信など多くの分野に利益をもたらす様々な製品とサービスが含まれます。半導体の開発は、特にプレシード、シード、アーリーステージ・ラウンド、および後期ステージにおいて、国内資本源へのアクセス格差に全国的に直面してきました。このため、カナダ企業全体の外国人所有比率はかなり高くなっています。同時に、資金不足は、カナダ企業の早期撤退に不利な環境を生み出しました。

- カナダの市場は、IoT接続、5G、人工知能・機械学習(AI/ML)の加速といった分野の開発と革新が進んでいます。産学連携が世界の半導体IP環境におけるカナダの地位をさらに強固なものにし、技術を進歩させ、業界全体を後押しすることが期待されます。

半導体シリコン知的財産(IP)産業の概要

半導体(シリコン)知的財産権市場は細分化されており、後方および前方統合が可能な大規模ディーラーと、国内および国際的な地域でビジネスを展開する多くの企業が存在します。

2023年7月、Faraday Technology Corporationは、UMC 28nmプロセスノードのSerDes IP設計を含む完全なSerDes(シリアライザ/デシリアライザ)ソリューションを発表しました。さらに、IPサブシステムの統合、PHYハードコアの実装、徹底的なシグナルインテグリティ/パワーインテグリティ(SI/PI)解析を含むIP先進(IPA)サービスを提供し、パッケージとPCB設計を組み込んでいます。

2023年6月、Synopsys Inc.はSamsung鋳造との提携を拡大し、半導体製造向けに設計されたさまざまな知的財産(IP)を共同で作成することになりました。その目的は、設計リスクを最小化し、シリコンの成功に向けたプロセスを迅速化することです。過去に要約すると、シノプシスとサムスンは、8LPU、SF5、SF4、SF3など、サムスンの複数のプロセス向けIPソリューションの開発で提携しました。これらには、ファンデーションIP、USB、PCI Express、112 G Ethernet、UCIe、LPDDR、DDR、MIPI、その他さまざまなIPコンポーネントが含まれます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 産業バリューチェーン分析

- 主要マクロ動向の影響評価

第5章 市場力学

- 市場促進要因

- コネクテッドデバイスの需要拡大

- 最新のSoC設計に対する需要の高まり

- 市場抑制要因

- IPビジネスモデルと規模の経済

第6章 市場セグメンテーション

- 収益タイプ別

- ライセンス

- ロイヤルティ

- サービス

- IPタイプ別

- プロセッサIP

- 有線・無線インターフェースIP

- その他のIPタイプ

- 業界別

- コンシューマー・エレクトロニクス

- コンピューターと周辺機器

- 自動車

- 産業用

- その他の業界別

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- アジア

- 中国

- 台湾

- 日本

- 韓国

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Faraday Technology Corporation

- Fujitsu Ltd

- LTIMindtree Limited

- ARM Ltd(SoftBank)

- Synopsys Inc.

- Cadence Design Systems Inc.

- CEVA Inc.

- Andes Technology Corporation

- MediaTek Inc.

- Digital Media Professionals

- Imagination Technologies Ltd

- VeriSilicon Holdings Co., Ltd

- Achronix Semiconductor Corporation

- Rambus Incorporated

- eMemory Technology Inc.

- MIPS Tech, LLC

- ベンダー市場シェア

第8章 投資分析

第9章 市場の将来

The Semiconductor Intellectual Property Market is expected to register a CAGR of 7.38% during the forecast period.

The semiconductor IP (SIP) market is witnessing rapid growth, with growing semiconductor sales. The market studied is entirely dependent on the semiconductor industry. The semiconductor business has experienced significant growth in the last two decades.

Key Highlights

- The SIP business practices include elements similar to those in traditional semiconductor or application-specific integrated circuits (ASIC), electronic design automation (EDA), and design services markets. However, unlike the well-established business models in the ASIC and EDA industries, SIP business models tend to be more complex, as several parties in the supply chain are involved with successfully deploying commercial SIP in an IC design.

- Although business practices and SIP business models have become somewhat uniform, the industry still needs to achieve standardization due to the wide variety of SIP product types, customer needs, and frequent changes in EDA tools and process technologies. Rising design costs and increasing market pressures are forcing companies to seek the services of semiconductor IP manufacturers. The various applications of this market include automobiles, smart devices (mobiles and tablets), computers, and peripherals. The significant growth driver of the market studied includes the emerging global adoption of consumer devices and the demand for advanced SOC designs and connected devices. Emerging technologies such as embedded and programmable DSP-IP are expected to further boost the market.

- According to SEMI's latest quarterly World Fab Forecast report, the worldwide semiconductor industry will invest more than USD 500 billion between 2021 and 2023 in building 84 large-scale chip manufacturing facilities, including automotive and high-performance computing ( HPC), fueling the spending increases. The source also states that the global semiconductor materials market generated revenues of USD 72.69 billion in 2022, of which USD 20.13 billion was made in Taiwan. A further USD 12.97 billion was generated in China, a 7 percent increase from 2021.

- The complexity of system-on-chip (SoC) designs is outpacing systems engineering capabilities. Increasing design complexity has given rise to growing data size and, thus, making semiconductor development more challenging than before. This is expected to restrain the growth of the market.

Semiconductor Silicon Intellectual Property (IP) Market Trends

Consumer Electronics to be the Largest End-user Vertical

- Semiconductor intellectual property cores are widely used in consumer electronics like smartphones, gaming consoles, microwaves, refrigerators, etc. The consumer electronics industry is evolving by leaps and bounds, and consumer demand pressures are forcing vendors to offer differentiated products and be ahead of the market. Semiconductors are incorporated into communication devices such as mobile phones and home appliances such as game consoles, televisions, and home appliances.

- The invention of integrated circuits (ICs) is one of the main drivers of the development of the consumer electronics industry, such as broadband and increasingly mobile applications.

- The market is anticipated to witness robust growth driven by increased tablet and communications market smartphone sales. For instance, according to Ericsson, the number of smartphone mobile network subscriptions worldwide was estimated to increase from 6.42 billion units in 2022 to 7.74 billion units in 2028. China, India, and the United States have the highest number of smartphone mobile network subscriptions.

- Today, smart products consist of complex electronic systems that require error-free operation. Increasing data speeds, miniaturizing devices, supporting multiple wireless technologies, and extending battery life require detailed analysis. Additionally, the requirement to integrate various functions into one device complicated PCB design.

- The market for multi-core processors is growing significantly with advancements in personal computing for consumer electronics and the advent of octa-core processors for smartphones. The growth in multi-core processors is anticipated to offer robust growth opportunities for the market studied.

North America to Hold Major Market Share

- The United States is one of the major markets in the overall semiconductor market, from vendors' and end-user perspectives. The growing need for intelligent command and control in many industries in the United States presents essential market opportunities for many semiconductor manufacturers.

- Most of the market vendors are expanding their presence in the region. Furthermore, many market vendors are US-based, which provides a competitive advantage to the regional market. The US government is also playing a significant role in developing the regional semiconductor business, supporting the semiconductor silicon intellectual property (IP) market.

- The Canadian semiconductor IP industry includes a variety of products and services that benefit a number of sectors, including consumer electronics, healthcare, transportation, and telecommunication. Semiconductor development has faced a gap in access to domestic sources of capital, especially in pre-seed, seed, and early-stage rounds and later stages across the country. This led to a significant percentage of foreign ownership across Canadian companies. At the same time, a lack of funding created an unfavorable environment for Canadian companies to exit too early.

- The market in Canada is experiencing development and innovation in areas like IoT connection, 5G, and artificial intelligence/ machine learning (AI/ML) acceleration due to prominent players like CMC Microsystems and LSI Computer Systems, Inc. driving the pace. It is anticipated that industry-academia collaboration would further solidify Canada's position in the global semiconductor IP environment, advancing technology and boosting the industry as a whole.

Semiconductor Silicon Intellectual Property (IP) Industry Overview

The semiconductor (Silicon) intellectual property market is fragmented, with large-scale dealers capable of backward and forward integration and many players running the business in national and international territories. The significant players primarily adopt strategies like product innovation and mergers and acquisitions to stay ahead. The players in the market are Faraday Technology Corporation., Synopsys Inc., Fujitsu Ltd., ARM Ltd (SoftBank), LTI, and Mindtree Limited. among others.

In July 2023, Faraday Technology Corporation introduced a complete SerDes (serializer/deserializer) solution that includes SerDes IP design on the UMC 28 nm process node. Additionally, they offer an IP advanced (IPA) service, encompassing IP subsystem integration, PHY hardcore implementation, and thorough signal integrity/power integrity (SI/PI) analysis on the system, incorporating package and PCB design.

In June 2023, Synopsys Inc. extended its partnership with Samsung Foundry to collaborate on creating a range of intellectual property (IP) designed for semiconductor manufacturing. The aim is to minimize design risk and expedite the process of achieving successful silicon outcomes. In the past, Synopsys and Samsung partnered to develop IP solutions for several of Samsung's processes, such as 8LPU, SF5, SF4, and SF3. These offerings included foundation IP, USB, PCI Express, 112 G Ethernet, UCIe, LPDDR, DDR, MIPI, and various other IP components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of the Impact of Key Macro Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Connected Devices

- 5.1.2 Growing Demand for Modern SoC Designs

- 5.2 Market Restraints

- 5.2.1 IP Business Model and Economies of Scale

6 MARKET SEGMENTATION

- 6.1 By Revenue Type

- 6.1.1 License

- 6.1.2 Royalty

- 6.1.3 Services

- 6.2 By IP Type

- 6.2.1 Processor IP

- 6.2.2 Wired and Wireless Interface IP

- 6.2.3 Other IP Types

- 6.3 By End-user Vertical

- 6.3.1 Consumer Electronics

- 6.3.2 Computers and Peripherals

- 6.3.3 Automobile

- 6.3.4 Industrial

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Taiwan

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 India

- 6.4.3.6 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Faraday Technology Corporation

- 7.1.2 Fujitsu Ltd

- 7.1.3 LTIMindtree Limited

- 7.1.4 ARM Ltd (SoftBank )

- 7.1.5 Synopsys Inc.

- 7.1.6 Cadence Design Systems Inc.

- 7.1.7 CEVA Inc.

- 7.1.8 Andes Technology Corporation

- 7.1.9 MediaTek Inc.

- 7.1.10 Digital Media Professionals

- 7.1.11 Imagination Technologies Ltd

- 7.1.12 VeriSilicon Holdings Co., Ltd

- 7.1.13 Achronix Semiconductor Corporation

- 7.1.14 Rambus Incorporated

- 7.1.15 eMemory Technology Inc.

- 7.1.16 MIPS Tech, LLC

- 7.2 Vendor Market Share