|

市場調査レポート

商品コード

1639406

アウェイ・フロム・ホーム用ティッシュと衛生用品:市場シェア分析、産業動向と統計、成長予測(2025~2030年)Away-From-Home Tissue and Hygiene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アウェイ・フロム・ホーム用ティッシュと衛生用品:市場シェア分析、産業動向と統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

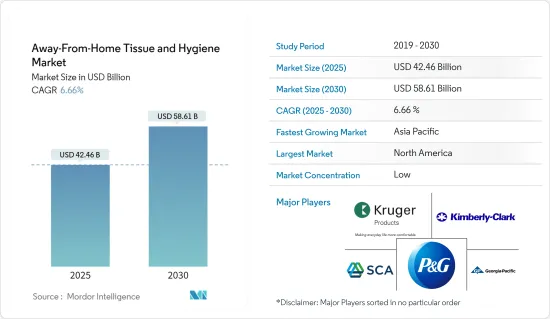

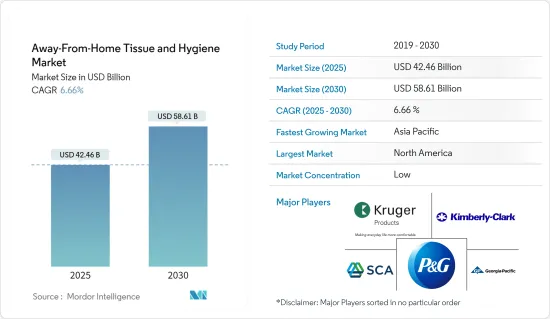

アウェイ・フロム・ホーム用ティッシュと衛生用品市場規模は2025年に424億6,000万米ドルと推定・予測され、2030年には586億1,000万米ドルに達すると予測されており、予測期間(2025~2030年)のCAGRは6.66%となっています。

世界中で加工される紙製品の9%以上がティッシュ製品になり、少なくとも年間2,100万トンのティッシュペーパーが生産されると推定されています。近年では、家庭外製品が世界のティッシュ消費量の3分の1以上を占めていると推定され、これらの製品は毎年緩やかなペースで増加しています。さらに、ロシア・ウクライナ戦争は市場全体のエコシステムに影響を与えています。

主要ハイライト

- アウェイ・フロム・ホーム用ティッシュと衛生用品の大半は、ビル所有者、施設、清掃業者が販売業者から直接購入しています。製品は通常大量に購入され、そのブランドに対する顧客の忠誠心を維持するために、施設内で使用されるディスペンサーに設置されることが多いです。競合の主要争点は通常、製品の価格、ディスペンサーとの互換性、補充のしやすさです。

- これらの製品は、世界で最も広く使われている日用品のひとつとなっています。主に衛生市場を牽引しているのは、アウェイ・フロム・ホーム用ティッシュと衛生用品に対する都市部からの需要の増加です。レストランや屋台から業務用ユーザーまで、多くのエンドユーザーは、小売のバリエーションに頼る地方の施設に比べ、都市市場ではこれらの製品に対する一定の需要があります。

- 原料価格の高騰は、世界中でティッシュ市場の成長を制限している重要な要因です。さらに、電子乾燥機などの革新的な新製品が市場開拓に影響を与えています。

アウェイ・フロム・ホーム用ティッシュと衛生用品市場の動向

トイレットペーパーが最大需要を占める

- 市場における紙タオルや布タオルは、電子乾燥機のような他の代替品に比べ、乾燥能力が最も高いことが証明されています。著名な医療雑誌であるMayo Clinic Proceedingsが行った、いくつかの手指乾燥方法の乾燥効率に関する研究によると、ジェットドライヤーや温風乾燥機と比較して、ペーパータオルの方がより効率的に手指から残留水分を除去できるという結果が出ています。

- 最近の調査によると、買い物客の10人に3人がトイレ用ティッシュのヘビーユーザーで、毎月約13ロールの買い物をしているといいます。トイレットペーパーは、効果的なカテゴリー・セグメンテーションと付加価値イノベーションの支援により、優位性を発揮しています。皮膚科学的テスト済み、水に流せる、二重構造のトイレットペーパーなどの革新的な製品は、一般的なトイレットペーパーと高級なトイレットペーパーを区別しています。

- 国によっては、プレミアムトイレットペーパーやスーパー・プレミアムトイレットペーパーの採用が市場の成長を完全に牽引しています。こうしたプレミアムやスーパープレミアムの家庭外用ティッシュや衛生用品の差別化は、すでに高級包装という形でスーパーマーケットの棚に並んでおり、家庭外市場の最大のサブセクターであるトイレ用ティッシュは、すでに100%に近い世帯普及率を享受しています。

アジア太平洋が最も急成長する市場

- アジア太平洋では、中国、オーストラリア、シンガポール、インドといった国々が、これらの製品の主要な需要源となっています。病院や医療ユニット、ホスピタリティユニット、フードビジネス、その他のビジネスなどの市場チャネルからの高い需要が、この地域におけるアウェイ・フロム・ホーム用ティッシュと衛生用品の需要を牽引しています。最も需要が高いのは、レストラン、店舗、公衆トイレなど、衛生用品を広く顧客に提供する環境衛生のニーズです。

- アジア太平洋諸国の多くで中流階級の人口が急速に増加し、国民の可処分所得が増加しているため、国内旅行が大幅に増加し、アウェイ・フロム・ホーム用ティッシュと衛生用品の需要を牽引しています。

- この地域はまた、最も有名な医療ツーリズムの拠点のひとつになりつつあります。同地域では、毎日30万人以上の出産と10万人以上の死亡があり、これが、国内ユーザーと病院や医療産業のような商業ユーザーの両方で、ワイプ、ペーパータオル、ナプキンのような外出用ティッシュと衛生用品の消費増加につながります。

アウェイ・フロム・ホーム用ティッシュと衛生用品産業概要

アウェイ・フロム・ホーム用ティッシュと衛生用品市場は非常にセグメント化されています。需要が高いため、多くの企業が市場に参入し、様々なエンドユーザー用途向けの高品質な製品を開発することで、市場に牙城を築いています。主要参入企業としては、Kimberly-Clark Corporation、Georgia Pacific LLC (Koch industries)、SCA (Svenska Cellulosa Aktiebolaget)、Procter & Gamble、Clearwater Paper Corporation、Wausau Paper Corp.、Kruger Productsなどが挙げられます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の成果

- 調査の前提

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- リサイクル製品に対する需要の増加

- 衛生への支出の増加

- 市場抑制要因

- 電子乾燥機の動向の高まり

- 市場の低成長

- 産業のバリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ別

- 紙ナプキン

- 紙タオル

- ワイプ

- トイレットペーパー

- 失禁用品

- その他

- エンドユーザー別

- 業務用

- 飲食品産業

- 病院・医療

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情勢

- 企業プロファイル

- Kimberly-Clark Corporation

- Georgia Pacific LLC

- SCA(Svenska Cellulosa Aktiebolaget)

- Procter & Gamble

- Cascades Tissue Group Inc.

- Wausau Paper Corp.

- Sofidel Group

- Clearwater Paper Corporation

- Kruger Products

第7章 投資分析

第8章 市場機会と今後の動向

The Away-From-Home Tissue and Hygiene Market size is estimated at USD 42.46 billion in 2025, and is expected to reach USD 58.61 billion by 2030, at a CAGR of 6.66% during the forecast period (2025-2030).

It is estimated that more than 9% of the paper products processed worldwide end up as tissue products, accounting for at least 21 million tons of tissue paper annually. In recent years, away-from-home products are estimated to be accountable for more than one-third of global tissue consumption, and these products are increasing at a moderate pace every year. Furthermore, the Russia-Ukraine war has an impact on the overall ecosystem of the market.

Key Highlights

- Most away-from-home tissue products are bought by building owners, institutions, and janitorial services directly from distributors. The products are usually bought in bulk and are often installed in dispensers used in their establishments to maintain customers' loyalty toward that brand. The primary ground of competition usually revolves around the product's price, compatibility with dispensers, and ease of replenishment.

- These products have become one of the most widely used commodities in the world. The increasing demand from urban regions for away-from-home tissue products is mainly driving the hygiene market. Many end users, from restaurants and food trucks to commercial users, have a constant demand for these products in urban markets compared to rural establishments that rely on retail variants.

- The high raw material price is a significant factor that is limiting the growth of the market for tissue all over the world. Moreover, new innovative products, such as electronic dryers, are impacting the development of the market.

Away From Home Tissue Market Trends

Toilet Paper to Occupy the Maximum Market Demand

- Paper and cloth towels in the market are proven to have the highest drying capacity compared to other alternatives, like electronic dryers. According to a study conducted by Mayo Clinic Proceedings, a prominent medical journal, on the drying efficiency of several hand drying methods, the results indicated that residual water was more efficiently removed from the hands by paper towels compared to jet and hot air dryers.

- Recent studies claim that 3 in 10 shoppers are considered heavy users of bathroom tissues and shop for about 13 rolls every month. Toilet papers are seeing the advantage of the support of effective category segmentation and added value innovations. Prime innovations, like dermatologically tested, flushable, and double-layered toilet papers, distinguish general toilet papers from premium ones.

- In some countries, the market's value growth is entirely driven by the introduction of premium and super-premium toilet paper. The differentiation of these premium and super-premium away-from-home tissue and hygiene products are already seen on supermarket shelves in the form of premium packaging, as the biggest sub-sector of away-from-home market bathroom tissues are already enjoying household penetration rates close to 100%.

Asia-Pacific to be the Fastest Growing Market

- In Asia- Pacific, countries like China, Australia, Singapore, and India stood as the key source of demand for these products. The high demand from the market channels, such as hospitals and healthcare units, hospitality units, food businesses, and other businesses, is driving the demand for away-from-home tissue and hygiene products in the region. The highest demand was recorded in restaurants, stores, public toilets, etc., for environmental sanitation needs, where hygiene products are provided widely for customers.

- The rapidly growing middle-class population in many Asia-Pacific countries and the increasing disposable incomes of the population significantly increased domestic travel, which drives the demand for away-from-home tissue and hygiene products.

- The region is also becoming one of the most famous medical tourism hubs. There are more than 0.3 million births and 0.1 million deaths every day in the region, which leads to increased consumption of away-from-home tissue and hygiene products, such as wipes, paper towels, and napkins, in both domestic users and commercial users, like hospitals and the healthcare industry.

Away From Home Tissue Industry Overview

The away-from-home tissue and hygiene market is highly fragmented. Due to high demand, many players are entering the market to have a stronghold in it by developing high-quality products for various end-user applications. Some key players include Kimberly-Clark Corporation, Georgia Pacific LLC (Koch industries), SCA (Svenska Cellulosa Aktiebolaget), Procter & Gamble, Clearwater Paper Corporation, Wausau Paper Corp., and Kruger Products, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Recycled Products

- 4.2.2 Increased Spending on Hygiene

- 4.3 Market Restraints

- 4.3.1 Growing Trend of Electronic Dryers

- 4.3.2 Slow Growth In the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Paper Napkins

- 5.1.2 Paper Towels

- 5.1.3 Wipes

- 5.1.4 Toilet Papers

- 5.1.5 Incontinence Products

- 5.1.6 Other Product Types

- 5.2 By End User

- 5.2.1 Commercial

- 5.2.2 Food and Beverages Industry

- 5.2.3 Hospitals and Healthcare

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Kimberly-Clark Corporation

- 6.1.2 Georgia Pacific LLC

- 6.1.3 SCA (Svenska Cellulosa Aktiebolaget)

- 6.1.4 Procter & Gamble

- 6.1.5 Cascades Tissue Group Inc.

- 6.1.6 Wausau Paper Corp.

- 6.1.7 Sofidel Group

- 6.1.8 Clearwater Paper Corporation

- 6.1.9 Kruger Products