|

市場調査レポート

商品コード

1686621

フリーフロム食品:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Free-from Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フリーフロム食品:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 189 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

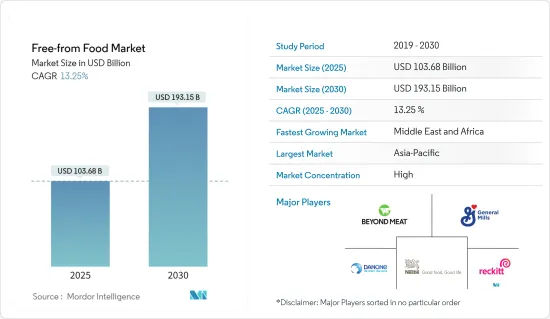

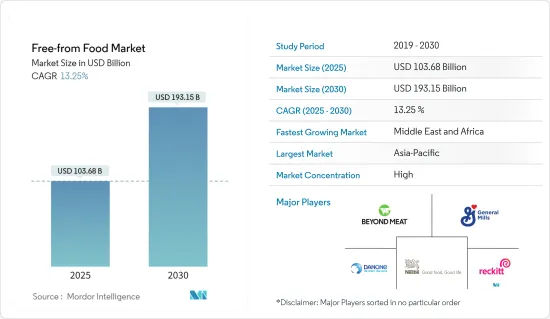

フリーフロム食品市場規模は2025年に1,036億8,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは13.25%で、2030年には1,931億5,000万米ドルに達すると予測されます。

主なハイライト

- フリーフロム食品の世界市場規模は、今年度中に713億8,120万米ドルとなりました。フリーフロム食品市場は、免疫系からのさまざまな反応を分析し確かな理解を提供する医学の進歩に照らしても繁栄しており、消費者が食品を購入する際に意識的な決定を下すことを可能にしています。

- 植物性食品に対する需要は、ライフスタイルの変化とベジタリアン食の利点に対する意識の高まりによって増加しています。消費者は、ベジタリアンやビーガンの食品は血液中の有害なコレステロール値を下げ、全体的な健康状態を改善するのに役立つと考えるようになっています。

- 例えば、植物性食品に関する欧州消費者調査(European Consumer Survey on plant-based)によると、英国の植物性ミルク、代替肉、ビーガン・マーガリン、ビーガン・チーズ、ビーガン・レディ・ミール/持ち帰り食品、代替魚介類の購入率および消費率は欧州で最も高いです。

- アレルゲンフリーや乳製品不使用の製品表示やその他の成分表示に関する消費者の意識が、これらの食品市場を牽引しています。さらに、食品安全当局による有利な規制は、市場の主要企業に生産量増加の機会をもたらすと予想されます。

フリーフロム食品市場の動向

クリーン・ラベル製品の開発とそれに伴う表示コンプライアンス

- 米国、ドイツ、英国、中国、インドなどの国々では、フリーフロム、ナチュラル、オーガニックと謳った製品の需要が急増し始めています。フリーフロム食品に対する消費者の需要の増加と、製品におけるクリーンラベルの主張の高まりが、世界市場の成長を加速させました。

- グルテンフリー」、「乳製品不使用」、「肉不使用」、「非遺伝子組み換え」、「砂糖不使用」など、さまざまな表示文句を掲げた製品は、ここ数年、消費者に利益をもたらしています。さらに、最近の消費者は、食品を購入する前に常に食品ラベルをチェックしています。消費者の購買行動に関するいくつかの組織調査では、食品ラベルに記載されている優れた原材料を探ることへの消費者の関心が高まっていることが明らかになっています。

- 国際食品情報協議会(IFIC)が2021年に発表した調査によると、調査対象者の大多数(94%)が少なくとも1つのパッケージ前(FOP)ラベルを熟知しており、半数以上(54%)がFOPラベルが飲食品の購入に影響を与えると回答し、約4分の1(24%)が大きな影響を与えると回答しました。

- このように、クリーンラベル製品の開発とそれに伴うラベリングのコンプライアンスは、市場の成長を促進すると予想されます。

アジア太平洋が最大の地域

- 健康的で高品質な食品に対する消費者の嗜好の高まりが、フリーフロム食品市場を牽引すると予想されます。学術誌『Research Gate』が発表した「Prevalence of Lactase Deficiency in Chinese children of different ages(中国の異なる年齢の子供におけるラクターゼ欠乏症の有病率に関する調査)」によると、3~5歳の子供で乳糖欠乏症だったのはわずか38.5%で、7~8歳と11~13歳のグループでは87%が乳糖と乳製品に不耐症でした。

- 一方、乳糖不耐症や乳児用調製粉乳アレルギーに関する大規模なメディア露出や政府による教育が、関連する健康問題を抱える消費者の間で、乳糖不使用の粉ミルクや乳製品の購入を後押ししました。

- 予測期間におけるフリーフロム食品の市場販売を促進するもう1つの重要な要因は、クリーンラベル食品の動向が続いていることであり、非遺伝子組換え、乳糖不使用、アレルゲン不使用、グルテン不使用はこの地域で最も急成長している主張です。このため、メーカー各社も潜在市場に対応するために革新的な製品を発売しています。

- 例えば、2022年10月、インドの食肉新興企業Licious社は、UnCraveというブランドを立ち上げ、植物性食肉分野に参入しました。同社の声明によると、このブランドはベジタリアンのチキンとマトンのシークケバブを消費者に直接提供します。このように、アジア太平洋地域におけるフリーフロム食品の動向の高まりとメーカーの製品革新は、予測期間中にアジア太平洋地域の市場成長を増大させるであろう。

フリーフロム食品産業の概要

フリーフロム食品市場は、国内外に複数のプレーヤーが存在するため競争が激しいです。市場の主要企業には、Danone SA、Nestle SA、General Mills Inc.、Reckitt Benckiser Group Plc、Beyond Meatなどがあります。このセグメントの主要企業が採用している主な戦略は製品の革新であり、これによって企業は日々変化する消費者の嗜好に対応することができます。また、同じ戦略を用いることで、企業は製品ポートフォリオを拡大し、消費者に数多くの製品を提供することもできます。例えば、2021年4月、ゼネラル・ミルズは「チェックス」ブランドの朝食用シリアルの新フレーバーを発売しました。この製品はアップルシナモンフレーバーで、同社が主張するように、もともとグルテンフリーです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ

- グルテンフリー

- 乳製品不使用

- ミートフリー

- その他のタイプ

- 最終製品

- ベビーフード

- 乳製品不使用食品

- 代替肉

- 飲料

- その他の最終製品

- 流通チャネル

- スーパーマーケット/ハイパーマーケット

- オンライン小売店

- コンビニエンスストア

- その他の流通チャネル

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- 中国

- 日本

- オーストラリア

- インド

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 主要企業の戦略

- 市場シェア分析

- 企業プロファイル

- Danone SA

- Blue Diamond Growers

- Abbott Laboratories

- Dr. Schar AG/SPA

- Beyond Meat

- The Kellogg Company

- General Mills Inc.

- Reckitt Benckiser Group PLC

- Nestle S.A.

- Oatly Group AB

第7章 市場機会と今後の動向

第8章 免責事項

The Free-from Food Market size is estimated at USD 103.68 billion in 2025, and is expected to reach USD 193.15 billion by 2030, at a CAGR of 13.25% during the forecast period (2025-2030).

Key Highlights

- The global free-from food market was valued at USD 71,381.2 million during the current year. The free-from food market is also thriving in the light of medical advancements that have analyzed and provided a solid understanding of different responses from the immune system, enabling consumers to make conscious decisions in purchasing their food products.

- The demand for plant-based foods is increasing due to changing lifestyles and growing awareness of the benefits of a vegetarian diet. Consumers increasingly believe that vegetarian and vegan food products can help reduce harmful cholesterol levels in the blood and improve overall health.

- For instance, the European Consumer Survey on plant-based found that the United Kingdom's purchase and consumption rates of plant milk, meat alternatives, vegan margarine, vegan cheese, vegan ready meals/food to go, and seafood alternatives are the highest in Europe.

- Consumer awareness regarding labeling allergen-free and dairy-free product claims and other ingredient claims is driving the market for these food products. Moreover, favorable regulations by the food safety authorities are expected to bring more opportunities for the major players in the market to increase output.

Free-From Food Market Trends

Clean Label Product Development and Associated Labeling Compliance

- Products claimed as free-from, natural, and organic have started to witness soaring demand in countries like the United States, Germany, the United Kingdom, China, India, and others. The increased consumer demand for free-from-food products and the rising clean-label claims on products accelerated the global market growth.

- Products with various label claims, such as "gluten-free," "dairy-free," "meat-free," "non-GMO," and "reduced sugar," have been benefitting customers over the past few years. Moreover, consumers constantly check food labels these days before purchasing any food product. Several organizational surveys on consumers' buying behavior reveal the rising consumers' interest in probing for superior ingredients on food labels.

- According to a study published by the International Food Information Council (IFIC) in 2021, the vast majority of survey takers (94%) were familiar with at least one front-of-package (FOP) label; over half (54%) said that FOP labels impact food and beverage purchases, and about a quarter (24%) said that they have a significant impact.

- Thus, clean label product development and associated labeling compliances are expected to drive the market's growth.

Asia-Pacific is the Largest Region

- The increasing consumer preference for healthy and high-quality food products is expected to drive the free-from food market. According to a study on the Prevalence of Lactase Deficiency in Chinese children of different ages published by the journal Research Gate, only 38.5% of children aged between 3 and 5 years old were lactose-deficient, and 87% of those in the 7-8 year and 11-13-year-old groups were lactose- and dairy-intolerant.

- On the other hand, the massive media exposure and government education on lactose intolerance and infant allergies helped boost the purchase of free-from lactose baby milk formula and dairy products among consumers with related health issues.

- Another significant driver boosting the sales of free-from foods in the market over the forecast period is the ongoing trend of clean-label food products, with non-GMO, lactose-free, allergen-free, and gluten-free being the fastest-growing claims in the region. Thus, manufacturers are also launching innovative products to cater to the potential market.

- For instance, in October 2022, Licious, a meat startup in India, entered the plant-based meat sector with the launch of the brand UnCrave. According to the company statement, the brand will offer vegetarian chicken and mutton sheek kebabs directly to consumers. Thus, the growing trend of free-from food in the region and the product innovation from manufacturers will increase the market growth in the Asia-Pacific region over the forecast period.

Free-From Food Industry Overview

The free-from-food market is highly competitive due to the presence of several domestic and international players. Some of the key players in the market include Danone SA, Nestle SA, General Mills Inc., Reckitt Benckiser Group Plc, and Beyond Meat, among others. The key strategy used by some of the top players in the segment is product innovation, as this enables companies to meet the consumers changing preferences on a daily basis. Also, using the same strategy, a company can expand its product portfolio and even offer numerous products to consumers, which will help elevate sales. For instance, in April 2021, General Mills launched a new flavor of breakfast cereal under the brand Chex. The product was made available in Apple Cinnamon flavor and is gluten-free by nature, as claimed by the company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Gluten-free

- 5.1.2 Dairy-Free

- 5.1.3 Meat-Free

- 5.1.4 Other Types

- 5.2 End Product

- 5.2.1 Baby Food

- 5.2.2 Dairy-free Foods

- 5.2.3 Meat Substitutes

- 5.2.4 Beverages

- 5.2.5 Other End Products

- 5.3 Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Online Retail Stores

- 5.3.3 Convenience Stores

- 5.3.4 Other Distribution Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by the Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Danone SA

- 6.3.2 Blue Diamond Growers

- 6.3.3 Abbott Laboratories

- 6.3.4 Dr. Schar AG / SPA

- 6.3.5 Beyond Meat

- 6.3.6 The Kellogg Company

- 6.3.7 General Mills Inc.

- 6.3.8 Reckitt Benckiser Group PLC

- 6.3.9 Nestle S.A.

- 6.3.10 Oatly Group AB