|

市場調査レポート

商品コード

1850270

免疫療法薬の市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Immunotherapy Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 免疫療法薬の市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月20日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

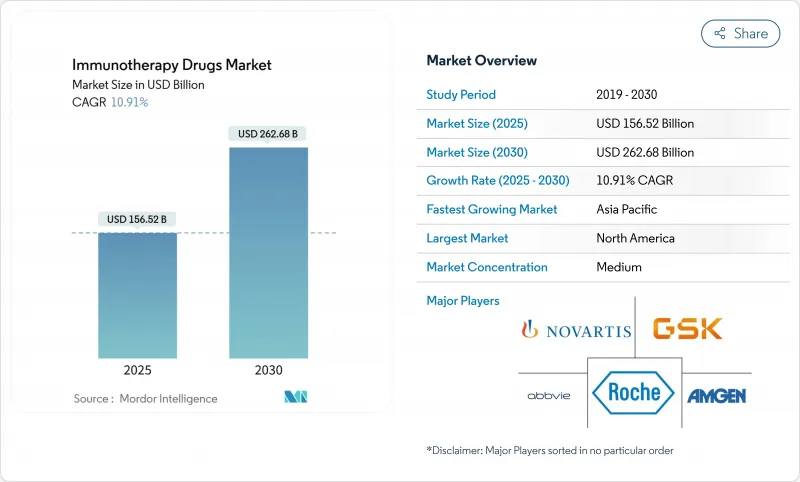

世界の免疫療法薬市場の売上高は、2025年に1,565億2,000万米ドルに達し、2030年には2,626億8,000万米ドルに増加し、CAGRは10.91%に達する見込みです。

急増の背景には、チェックポイント阻害剤の浸透、T細胞工学の急速な成熟、発見サイクルを短縮する人工知能プラットフォームの日常的な使用があります。固形がんでは、モノクローナル抗体と精密バイオマーカーを組み合わせたマルチモーダルレジメンが引き続きファーストラインプロトコルの主流を占め、メラノーマや肺がんでは、特注のネオアンチゲンワクチンが早期臨床試験から極めて重要な試験へと移行しています。規制当局による併用療法の審査が簡素化され、アウトカムベースの支払い試験により医療システムの初期費用負担が軽減されます。アジア太平洋地域における製造規模の拡大により投与量あたりのコストが低下し、リアルタイムのファーマコビジランス・ネットワークにより有害事象の追跡が改善され、複雑な生物製剤の地理的アクセスが拡大します。

世界の免疫療法薬市場の動向と洞察

免疫チェックポイント阻害剤の爆発的なパイプライン

2024年にtislelizumab-jsgrとcosibelimab-ipdlが承認されたことにより、PD-1、PD-L1、CTLA-4プログラムは現在、腫瘍診断および希少がん設定に軸足を置き、多くの場合、ダブルまたはトリプレットレジメンの一部として使用されていることが確認されました。LAG-3、TIGIT、TIM-3候補を含む後期臨床試験は、これまで抵抗性であった集団へのアクセスを示唆し、適応試験デザインは開発期間を短縮します。ニボルマブ+イピリムマブのような併用療法は、メラノーマにおいてより高い完全奏効率を確保し、単剤療法と比較して生存に明らかな利点をもたらす相乗的プロトコールに対して、規制当局が画期的治療薬指定を与え続けている理由を明確にしています。

モノクローナル抗体の優位性の拡大

二重特異性抗体、三重特異性抗体、抗体薬物複合体(ADC)フォーマットなど、工学的な改良が繰り返され、抗体による収益の77.55%の支配が維持されています。Teclistamabは後期多発性骨髄腫で63%の全奏効率を示し、ファイザーのAIガイド付きADC共同研究はリード最適化ウィンドウを数ヶ月から数日に短縮します。CD3エンゲージド・バイスペシフィックは、現在のCAR-Tデリバリーメカニズムでは到達できない固形腫瘍抗原に対するT細胞の細胞傷害性をリダイレクトします。

高い治療費と償還のハードル

CAR-Tの価格は37万3,000ドルから425万米ドルで、支払者の予算に負担をかける。これに対し、CMSは基本支払い額の17%増を提案し、非応答者には払い戻しを行うアウトカムベースの契約を試験的に導入しています。メディケイドのCGTアクセスモデルは、償還を実世界の耐久性指標に結びつけるものだが、新興国では、アンメットニーズが高いにもかかわらず、高価な生物製剤を購入するのに苦労しています。

セグメント分析

免疫療法薬市場は引き続きモノクローナル抗体が支配的であるが、T細胞療法は2030年までのCAGRが18.25%と最も急速に成長する柱です。T細胞療法に割り当てられた免疫療法薬市場規模は、2025年の152億米ドルから2030年には353億米ドルに拡大すると予測されており、再発多発性骨髄腫と侵攻性リンパ腫に対するT細胞療法の変革的なインパクトを強調しています。FDAが承認したイデカブタジェンビクリューセルとチルタカブタジェンオートリューセルは、70%以上の最小残存病変陰性率を示し、デュアルターゲットCARコンストラクトは腫瘍抗原のカバレッジを広げます。チェックポイント阻害剤は併用承認によって安定したシェアを獲得し、mRNAがんワクチンのパイプラインは画期的治療薬指定を背景に加速しています。LOAd703のような腫瘍溶解性ウイルスは、アテゾリズマブとの併用で44%の奏効率を示し、AnktivaのようなIL-15スーパーアゴニストはリンパ球減少性疾患での承認を獲得し、より広い免疫療法薬市場においてサイトカインベースの製品の利益を示しています。

ジェネレイティブケミストリーの進歩により、ADCのペイロード探索が圧縮され、毒性を並行させることなく効力が向上します。こうして、免疫療法薬市場は、単体の生物製剤から、細胞治療と腫瘍溶解プラットフォームや標的サイトカインを組み合わせた統合的な多剤併用レジメンへと移行します。製造の自動化により、自己細胞コンストラクトの静脈から静脈までの時間が短縮されるため、コスト曲線が低下すれば、生物学的製剤が将来の免疫療法薬市場シェアでより大きなスライスを確保することが示唆されます。

地域分析

北米は2025年まで48.72%の売上シェアを維持し、成熟した償還の枠組み、密集したイノベーションクラスター、アウトカムベースの契約の早期導入がその基盤となっています。同地域の既存バイオ医薬品企業は、AIベンチャー企業や製造スペシャリストを買収し、バッチ不良率を低下させながらプラットフォーム管理を強化します。戦略的なオンショアリングによりサプライチェーンが地政学的ショックにさらされにくくなり、この地域の市場競争力が長期的に強化されます。

アジア太平洋地域のCAGRは14.22%と世界最速を記録し、規制の調和、人件費の低下、政府の支援による生産能力拡大がその原動力となっています。中国初の国産IL-4Ra拮抗薬であるスタポキバートの承認は、現地の規制当局の高度化を反映し、欧米のベンチマークと比較して上市までの期間が短縮されました。日本と韓国は条件付き早期承認の道筋を洗練させ、インドのバイオ製造回廊はコスト効率の高い製造枠を求める欧米のスポンサーを誘致し、世界免疫療法薬市場における地域シェアを総体的に引き上げています。

欧州は、細胞治療と遺伝子治療の審査を標準化する先進治療薬規制のもとで、一桁台半ばの着実な成長を示しています。バイオシミラー競争はモノクローナル抗体の価格設定を緩和するが、アクセスは拡大し、市場全体の価値は維持されます。デジタルヘルスイニシアチブは、レジストリとファーマコビジランスポータルをリンクさせ、承認後のモニタリングを合理化し、免疫療法の安全性プロファイルに対する社会的信頼を強化します。

中東・アフリカでは、サウジアラビアのCancer BioShieldプラットフォームなど、地域の遺伝的背景に合わせた免疫回復レジメンを提供する主要プロジェクトが勢いを増しています。地域の政府系ファンドとの多国籍パートナーシップは、近隣の新興市場のハブとして機能する精密腫瘍学センターに資金を提供しています。ラテンアメリカでは、すぐに使える製剤のライセンス供与とリスクシェアリング償還の導入に注力し、胃がんなど負担の大きいがんでの治療導入が徐々に進んでいます。これらの進展により、免疫療法薬市場の世界的な広がりは拡大し、一部の成熟地域への依存度は低下しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 免疫チェックポイント阻害剤の爆発的なパイプライン

- モノクローナル抗体の優位性の拡大

- がんと慢性疾患の発生率の上昇

- バイオマーカー主導の精密医療の導入

- 二重特異性抗体とADCが新たな適応症を開拓

- AIを活用したインシリコ発見が研究開発を加速

- 市場抑制要因

- 高額な治療費と償還のハードル

- バイオ医薬品サプライチェーンの製造における複雑さ

- 免疫関連有害事象管理の負担

- バイオシミラーの競合による価格低下

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 薬剤の種類別

- モノクローナル抗体

- チェックポイント阻害剤

- がんワクチン

- インターフェロンα/β

- インターロイキン

- 腫瘍溶解性ウイルス療法

- T細胞療法(CAR-T、TCR、TIL)

- サイトカインと免疫調節剤

- その他の薬物の種類

- 治療領域別

- がん

- 自己免疫疾患および炎症性疾患

- 感染症

- その他の治療領域

- エンドユーザー別

- 病院とクリニック

- 調査室および学術機関

- 製薬・バイオテクノロジー企業

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb

- F. Hoffmann-La Roche AG

- GSK PLC

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Bayer AG

- Sanofi

- Boehringer Ingelheim

- Gilead Sciences Inc.

- UbiVac

- Regeneron Pharmaceuticals

- Eli Lilly & Co.

- Seagen Inc.

- BeiGene Ltd.