|

市場調査レポート

商品コード

1640561

学校向けエンタープライズリソースプランニング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Enterprise Resource Planning for Schools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 学校向けエンタープライズリソースプランニング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

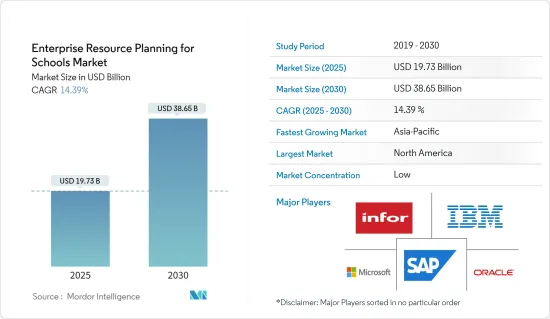

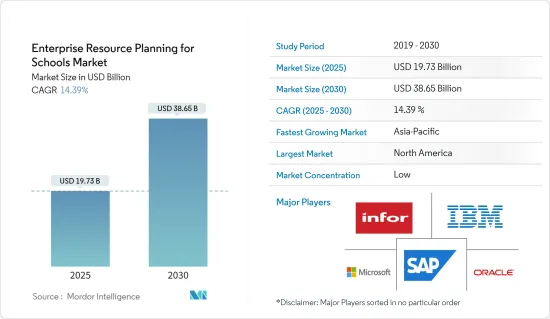

学校向けエンタープライズリソースプランニングの市場規模は、2025年に197億3,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは14.39%で、2030年には386億5,000万米ドルに達すると予測されます。

学校向けERPとは、基幹業務プロセスを統合管理するもので、多くの場合、ソフトウェアとテクノロジーを介してリアルタイムで行われます。ERPは通常、ビジネス管理ソフトウェアのカテゴリとして参照され、通常、組織が様々なビジネス活動からデータを収集、保存、管理、解釈するために使用できる統合アプリケーションのスイートです。

主なハイライト

- 教育におけるクラウドコンピューティングは、教室での体験を大きく変えました。ネットアップのCloud Volumes ONTAPを使用すれば、教育機関やソリューションプロバイダは、複雑なインフラストラクチャをサポートし、ストレージコストを抑え、機密性の高いデータを損失や破損から保護しながら、スケーラビリティや弾力性など、教育分野におけるクラウドコンピューティングのあらゆるメリットを享受できます。

- リアルタイムのデータ分析は、市場の重要な促進要因です。データ分析により、学校管理者は教員、生徒、保護者をリアルタイムで測定、監視、対応できるようになります。IMS Caliper Analyticsは、学習情報サービス(LIS)が学習管理システム、図書館管理システム、ラーニング・オブジェクト・リポジトリなどの他のシステムに入力するために使用される教育コミュニティによって作成された、教育クリックストリーム分析のための世界初の相互運用性仕様です。

- より迅速な意思決定のために、学校ビジネス全体で一貫したデータの利用可能性が市場を牽引しています。MyClassCampusは、学校、大学、教育機関向けのモバイルアプリとウェブベースのプラットフォームで、すべての利害関係者との迅速かつ組織的で効果的なコミュニケーションとリソース共有を実現します。MyClassCampusは、すべての生徒の記録とデータを整理されたアクセスしやすい形式で管理するためのワンクリック・ツールであり、学校のビジネスを効果的に実行するのに役立ちます。

- 学校では、子どもたちがよりよく学べるように、新しいテクノロジーやスマートなツール、国際的な教育方法を活用しています。テクノロジーが急速に進歩しているとはいえ、事務作業のほとんどはいまだに手作業で行われています。

クラウドベースのERPシステムに切り替える教育機関が増えており、この傾向は来年以降も続くと思われます。クラウドベースのシステムには、セキュリティの向上、拡張性の向上、ヘルプの充実など、教育機関が求めるメリットがあります。また、COVID-19の影響で学校が在宅勤務をするようになったため、市場が拡大する可能性も高いです。例えば、インドのERPプロバイダーであるMasterSoft社は、100校以上の教育機関がMicrosoft Teams上で稼動し、オンライン入試や学費徴収を楽に管理できるよう支援しました。

学校向けエンタープライズリソースプランニングの市場動向

教育用ソフトウェア/アプリケーションが市場の需要を牽引

- 現在、世界の教育セクターは急速に開発・拡大しており、教育ソフトウェアソリューションは学生情報を効率的に合理化・管理し、利害関係者のプロセスを自動化しています。

- 時間割管理システムは、自動と手動の両方の時間割作成を可能にします。教員の交代に関するタイムリーな更新を保証し、リソース、教室、教員の優れた管理を支援します。

- 成績・試験管理システムは、オンライン試験の実施、生徒の成績検討、成績表の作成、図書管理の差別化、学校での大規模な競争試験や入学試験の実施、ソフトウェアシステムを通じた生徒への結果提供などの機能を提供します。

- ホステル管理モジュールソフトウェアは、教師の宿泊施設や学生寮の部屋の予約や手配を支援します。それは、このように規律を確保し、訪問者の記録や学生の外出を追跡するのに役立ちます。また、部屋設備の管理、部屋の移動と交換プロセス、その他の重要なロジスティックサポートもサポートします。

- マスターソフトは学校運営のための包括的なモジュールを提供しています。例えば、LIB-Manはクラウドベースで完全に統合されたユーザーフレンドリーなマルチユーザーパッケージであり、図書館内のすべての業務をコンピューター化することができます。この図書館ソフトウェアは使いやすく、パワフルです。Lib-Manには、多言語フォント、QRコード、バーコードフォント、自動化のためのRFID統合機能が組み込まれています。また、学校での蔵書検索のためのスマートフォンアプリにも対応しています。

北米が大きなシェアを占める

- 北米は、様々な学術プロセスを管理する需要の増加により、大きな市場シェアを占めています。この地域では、教育機関におけるERPソリューションの採用により、管理者が学生の請求、登録、入学などの業務プロセスを効率的に管理できるようになっています。

- 例えば、Ellucian社のソフトウェアは、北米の教育機関全体を多機能な高等教育ERPで統合し、プロセスをより効果的にし、教職員、学生、スタッフに情報を提供します。教育機関のデータをまとめる独自の統合モデルは、複雑な質問に答え、カリキュラムデータにリアルタイムで簡単にアクセスできます。

- BigSISは北米の私立学校向けのクラウドベースの学生情報システムです。入試、入学、成績表などを管理する統合モジュールを提供しています。教師が生徒の学習状況を保護者に伝えるのに役立つ統合Eメールシステムも提供しています。

- さらに、内蔵のカレンダー機能は、教師と生徒の両方が授業のスケジュールを追跡するのに役立ちます。このソリューションには、寄付の受付、学校行事のオンライン申込受付、保護者へのボランティア募集のお知らせなどのモジュールもあります。

学校向けエンタープライズリソースプランニング業界の概要

ローカルおよび世界プレーヤーは、研究開発プロセスを通じて技術革新を打ち出すことによって競争している学校向けエンタープライズリソースプランニング市場は断片化されています。プレーヤーは、製品革新、拡張、およびパートナーシップのような戦略を採用し、競争をリードし、市場でのリーチを拡大します。最近の市場開拓の動向をいくつか紹介しよう:

2022年1月、オラクル・クラウドは、学校が高等教育の次の時代を受け入れるのを支援します。Butler Community College、Skidmore College、Bowie State University、Coppin State University、University of Pittsburghなどの学校は、ビジネス・プロセスの合理化、リソースの最大化、教職員へのサポートの向上を実現しています。オラクルは、Oracle Cloud Infrastructure(OCI)、Oracle Fusion Cloud Applications、およびOracle Student Cloudを含む高等教育向けクラウドを発表しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19が学校向け基幹業務システム市場に与える影響

第5章 市場力学

- 市場促進要因

- より迅速な意思決定のための学校ビジネス全体にわたる一貫したデータ利用可能性

- リアルタイムのデータ分析

- 学業における教育ソフトウェア/アプリケーションの使用の増加

- 市場抑制要因

- ビジネスニーズに応じたカスタマイズの難しさ

第6章 市場セグメンテーション

- 展開別

- オンプレミス

- クラウド

- 機能別

- 管理部門

- 給与計算

- アカデミック

- 財務

- 輸送

- 物流業務

- その他の機能

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- NetSuite Inc.

- SYSPRO(Pty)Ltd

- Plex Systems Inc.

- FinancialForce.com Inc.

- Infor Inc.

- Epicor Software Corporation

- International Business Machines Corporation(IBM)

- The Sage Group PLC

- IQMS Inc.

- Lake Financial Systems

- Sage AU

第8章 投資分析

第9章 市場機会と今後の動向

The Enterprise Resource Planning for Schools Market size is estimated at USD 19.73 billion in 2025, and is expected to reach USD 38.65 billion by 2030, at a CAGR of 14.39% during the forecast period (2025-2030).

Enterprise resource planning (ERP) for schools is the integrated management of core business processes, often in real-time and mediated by software and technology. ERP is usually referred to as a category of business management software, typically a suite of integrated applications that an organization can use to collect, store, manage, and interpret data from various business activities.

Key Highlights

- Cloud computing in education has transformed the classroom experience. NetApp's Cloud Volumes ONTAP allows education institutions and solution providers to reap all the advantages of cloud computing in education, such as scalability and elasticity, while supporting complex infrastructures, containing storage costs, and protecting highly sensitive data from loss or corruption.

- Real-time data analytics is a key driver for the market. Data analytics allows school management to measure, monitor, and respond in real-time to faculty, students, and parents. IMS Caliper Analytics is the world's first interoperability specification for educational clickstream analytics created by the education community where Learning Information Services (LIS) is used to populate other systems, such as Learning Management Systems, Library Management Systems, and Learning Object Repositories.

- Consistent data availability across the school business for faster decision-making is driving the market. MyClassCampus is a mobile app and web-based platform for schools, colleges, and educational organizations for quick, organized, and effective communication and resource sharing with all the stakeholders. It can be a one-click tool for institutes to manage all the student records and data in an organized and easy-to-access format, which can help the school's business run effectively.

- Schools are using new technologies, smart tools, and international ways of teaching to help children learn better.Even though technology has advanced quickly in schools, most of the administrative work is still done by hand.But for a school to grow in all ways, its administrative and academic parts should grow at the same rate.

An increasing number of institutions are making the switch to a cloud-based ERP system, a trend that will continue over the next year. Cloud-based systems have the benefits that institutions want, such as better security, more scalability, and more help. The market was also likely to grow because schools were working from home because of COVID-19. For instance, MasterSoft, an ERP provider in India,helped over 100 institutions go live on Microsoft Teams and manage online admissions and fee collection effortlessly.

Schools Enterprise Resource Planning Market Trends

Education Software/ Application in Academics is Driving the Market Demand

- Nowadays, the education sector worldwide is developing and expanding quite rapidly, with education software solutions streamlining and managing student information efficiently and automating processes for the stakeholders.

- A timetable management system enables the creation of both automatic and manual timetables. It guarantees timely updates on faculty substitution and assists in the superior management of resources, rooms, and faculty.

- The grades and exam operation system provides the ability to conduct online examinations, consider the student's performance, generate report cards, differentiate book management, hold mass competitive and entrance exams in schools, and provide the students with the results through the software system.

- Hostel management module software aids in the reservation and arrangement of rooms for teacher accommodations and student hostels. It helps track visitor records and student outings, thus ensuring discipline. It also assists in controlling room facilities, room shifting and interchanging processes, and other important logistical support.

- MasterSoft provides comprehensive modules for school operations. For instance, LIB-Man is a cloud-based, fully integrated, user-friendly, multi-user package for the computerization of all the library's in-house operations. This library software is easy to use and powerful. Lib-Man is embedded with multi-lingual fonts, QR Code and Bar Code fonts, and RFID integration for automation. It also supports smartphone apps for book searches in school.

North America to Hold a Significant Share

- North America holds a significant market share due to increased demand for managing various academic processes. The adoption of ERP solutions in educational institutions has enabled administrators to effectively manage their business processes, such as student billing, registration, and enrolment, in this region.

- For instance, Ellucian software unites the entire institution with a versatile higher education ERP to make processes more effective and keep faculty, students, and staff informed in North America. Its unique integration model to bring the institution's data together answers complex questions and easily accesses curriculum data in real-time.

- BigSIS is a cloud-based student information system for private schools across North America. It offers integrated modules for managing admissions, enrollments, grade books, and more. It provides an integrated email system that helps teachers communicate student progress to parents.

- Moreover, a built-in calendar feature helps both teachers and students keep track of their class schedules. The solution also has modules for accepting donations, taking online applications for school events, letting parents know about opportunities to volunteer, and so on.

Schools Enterprise Resource Planning Industry Overview

The enterprise resource planning market for schools is fragmented as local and global players compete by coming up with innovations through the R&D process. Players adopt strategies like product innovation, expansions, and partnerships to stay ahead of the competition and expand their market reach. Some of the recent developments in the market are:

In January 2022, Oracle Cloud will help schools embrace the next era of higher education. Schools like Butler Community College, Skidmore College, Bowie State University, Coppin State University, and the University of Pittsburgh are streamlining business processes, maximizing resources, and improving support for their faculty and staff. Oracle introduced its cloud for higher education, which includes Oracle Cloud Infrastructure (OCI), Oracle Fusion Cloud Applications, and Oracle Student Cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Enterprise Resource Planning for Schools Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Consistent Data Availability Across the School Business for Faster Decision Making

- 5.1.2 Real-time Data Analytics

- 5.1.3 Increasing Use of Education Software/ Application in Academics

- 5.2 Market Restraints

- 5.2.1 Difficulties in Customization According to Business Needs

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Function

- 6.2.1 Administration

- 6.2.2 Payroll

- 6.2.3 Academics

- 6.2.4 Finance

- 6.2.5 Transportation

- 6.2.6 Logistical Operations

- 6.2.7 Other Functions

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 NetSuite Inc.

- 7.1.5 SYSPRO (Pty) Ltd

- 7.1.6 Plex Systems Inc.

- 7.1.7 FinancialForce.com Inc.

- 7.1.8 Infor Inc.

- 7.1.9 Epicor Software Corporation

- 7.1.10 International Business Machines Corporation (IBM)

- 7.1.11 The Sage Group PLC

- 7.1.12 IQMS Inc.

- 7.1.13 Lake Financial Systems

- 7.1.14 Sage AU