|

市場調査レポート

商品コード

1640458

ワイヤレスセンサネットワーク:市場シェア分析、産業動向、成長予測(2025~2030年)Wireless Sensors Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ワイヤレスセンサネットワーク:市場シェア分析、産業動向、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

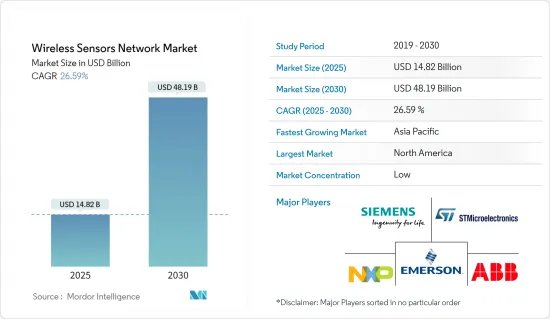

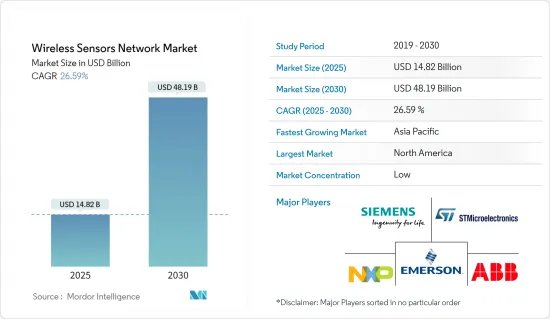

ワイヤレスセンサネットワークの市場規模は、2025年に148億2,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは26.59%で、2030年には481億9,000万米ドルに達すると予測されています。

ロボット工学におけるワイヤレスセンサネットワークの用途は、高度なロボット・センシング、複数ロボットの協調、ロボットのプランニングとナビゲーション、ロボットのローカライゼーションなど多岐にわたる。ワイヤレスセンサネットワークを使うことで、緊急対応ロボットが電磁場監視、森林火災検知などの状況を意識するのに役立ちます。

主なハイライト

- オートメーションとロボット産業の成長、資産監視、セキュリティ、輸送における無線センサーネットワーク需要の増加、通信技術の進歩による信頼性の向上が、無線センサーネットワーク(WSN)市場を牽引する大きな要因となっています。

- 安全のためにセンサーの利用を増やすよう政府が規制を強化しているため、例えば、非常に高い圧力や高温など、環境条件が厳しい地域で無線センサーの需要が伸びています。ワイヤレス・センサを使えば、安全な距離から継続的に施設を制御・監視することが容易になります。無線センサーは、アクセスが困難な場所からのデータ取得に役立ちます。

- IoT(モノのインターネット)の採用が増加していることも、市場の成長を促す大きな要因となっています。このようなIoT接続デバイスの増加は、無線センサーネットワークの需要を促進すると予測されています。

- センサーメーカーは、スマートシティや自律走行車など、無線技術に大きく依存する新興の垂直分野に対応するため、技術に多額の投資を行っています。インテリジェントセンサーなどのセンサー技術の革新は、市場での無線技術の急速な採用をサポートすると予想されます。これらすべての要因が無線センサーネットワーク市場の成長に寄与すると予想されます。

- その実用性の高さにもかかわらず、ワイヤレスセンサネットワーク・システムの利用には課題もあります。センサーノードの数は数個から数個まで様々であるため、このようなセンサーネットワークシステムの規模には大きな違いがあります。配備密度にも調整が必要です。ワイヤレスセンサーノードは、不十分な電力供給で機能しなければならないことを考えると、ソフトウェアとハードウェアの設計は、目の前のタスクのために効果的に動作するように最適化する必要があります。

- WSNには、電源、ストレージ、多数のアルゴリズムなど、いくつかの制約があるため、これらすべてのメンテナンスに深刻な課題があります。インターネットに依存する他のアプリケーションと同様に、WSNにもセキュリティの問題があります。あらゆる方法でデータの盗難に対抗するためには、適切なデータ・トランスミッション管理を実施する必要があります。

ワイヤレスセンサネットワークの市場動向

医療分野は大きな成長が期待される

- コストの高騰、医療ミスの増加、人材不足、高齢化など、ヘルスケア業界が直面している問題はいくつかあります。このような課題にもかかわらず、ヘルスケア専門家は最新技術を導入すると同時に、より良いサービスを提供する必要に迫られています。ユビキタスヘルスケアを提供することで、長期的なコストを削減し、サービスの質を向上させることができます。ワイヤレスセンサネットワークは、ますます普及するヘルスケアシステムに効率的なソリューションを提供できます。

- 消費電力の少ないセンサーやネットワーク技術の進歩により、ヘルスケア向けのWSNが近年登場し始めています。ワイヤレスセンサネットワークは、次世代ヘルスケアシステムの重要な構成要素として頻繁に登場しています。WSNはZigbeeをベースとしたマルチホップ・システムであり、マルチキャストやブロードキャストを用いて重要な情報を配信します。メッセージの速度と信頼性は、このようなシステムの本質的な特徴です。

- 様々なセンサーからのリアルタイムの健康情報の収集に関連しています。ワイヤレスプロトコル、無線スペクトル、データ帯域幅、暗号化、エネルギー消費、モビリティは、これらのネットワークの本質的な特徴です。

- ウェアラブルセンサーの開発により、ユーザーはヘルスケアにおいてワイヤレスセンサネットワークの助けを借りて生理学的データを常時モニターすることができます。患者の入院中や居住中は、ボディ・エリア・ネットワークが患者の健康をモニターし続ける。このサービスは、患者の状態に関するデータをヘルスケア提供者に転送することで、緊急時に役立つ可能性があります。記憶力の向上、健康データへのアクセス、がんの発見、ぜんそくの症状、血糖値のモニタリングなど、人々にヘルスケア・サービスを提供することも有用です。

- さらに、遠隔医療と連動した新しい医療モノのインターネットが設置され、病気の監視と予防に重要な役割を果たすだろうとRBSA Advisorsは報告しています。人工知能による分析、ツール、機械は、ヘルスケアプロバイダーが、より効果的で、正確で、インパクトのある介入に関して、患者ごとに適切なアプローチを選択するのに役立ちます。

- インドでは、新たな技術がコストを下げながら、斬新でより良い治療法の開発に役立っています。今後数年間で、人工知能(AI)、データ、IoMTは、心臓ポンプ率や血中酸素濃度などのバイタルサインを追跡するように設計された単純な機器から、心電図などの複雑なスキャンも可能なスマートウォッチや、血圧を追跡し心臓発作のリスクも予測できるスマートテキスタイルへと急速に拡大していくと思われます。

北米が最大の市場シェアを占める

- 北米は、スマートシティやビル・産業オートメーションのような最先端技術を採用する初期段階にあるため、予測期間中、無線センサーネットワークの重要な市場になると予想されます。また、同地域におけるWSN市場の成長は、ヘルスケアインフラにおける技術進歩や、ウェアラブルに対する消費者の関心の高まりによって牽引されると予想されます。

- スマート工場、インテリジェント製造の採用、多くの産業用ワイヤレスセンサネットワークメーカーの存在が、今後数年間の北米市場の成長を促進すると予想されます。また、ABB Ltd.、Emerson Electric Co.、Honeywell International Inc.などの主要企業が存在することも、この地域の市場成長を促すと予想されます。

- ワイヤレスセンサネットワークは、健康アプリケーションに使用され、病院内の統合患者モニタリング、診断、薬剤投与、人体生理学的データの遠隔モニタリング、病院内の医師や患者の追跡・モニタリングなどに役立っています。

- 北米の貨物鉄道業界も、高度な監視と警告のために鉄道車両に搭載されたWSNを活用しようとしています。鉄道環境では、貨物列車のWSNは、かなりの長さの線形チェーンのようなトポロジーを示します。

- さらに、商用市場でのウェアラブルデバイスの普及が進むにつれ、ウェアラブルデバイスは、その多くの利点から産業用としても人気が高まっています。例えば、エアバスはアクセンチュアと共同で航空宇宙・防衛産業にウェアラブル・デバイスを導入しました。

ワイヤレスセンサネットワーク産業の概要

ワイヤレスセンサネットワーク市場は細分化されています。単一の支配的なプレーヤーが存在しない、競争の激しい市場です。各プレイヤーは、新製品革新のための戦略的投資、協業・提携、市場での地位強化のためのM&Aに注力しています。

- 2023年11月STマイクロエレクトロニクスは、ワイヤレス・デバイス設計における同社の専門知識と、高性能で効率的なSTM32アーキテクチャを融合した新しいマイクロコントローラ(MCU)を発表しました。

- 2023年10月NXPセミコンダクターズは、車載規格に準拠した新しいワイヤレス・コネクティビティ・ソリューション、AW693を発表しました。AW693は、車載用にゼロから設計され、業界で最も完全な車載用ワイヤレス・コネクティビティ・ポートフォリオの一部であり、NXPの統合EdgeLockセキュアサブシステムによって保護されたデュアルWi-Fi 6EとBluetooth 5.3の同時接続を可能にし、車内で多くのセキュアな接続を実現します。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 技術スナップショット

- 分類

- スター

- メッシュ

- ハイブリッド

- ツリー

- センサー

- MEMS

- CMOSセンサー

- LEDセンサー

- ネットワーク技術(接続性)

- ワイヤレスHART

- ZigBee

- Wi-Fi

- IPv6

- Bluetooth

- ダッシュ7

- Zウェーブ

- 分類

- マクロ経済動向が市場に与える影響

第5章 市場力学

- 市場促進要因

- ワイヤレス技術の採用拡大

- ワイヤレスセンサーのコスト削減

- 市場の課題

- 高いセキュリティニーズと設置コスト

第6章 市場セグメンテーション

- エンドユーザー別

- 軍事・セキュリティ

- 医療

- 輸送・物流

- 石油・ガス

- 上下水道

- 消費者向けパッケージ商品(飲食品)

- その他エンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- アジア

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- ABB Ltd

- Atmel Corporation

- Siemens AG

- ST Microelectronics

- NXP Semiconductors

- General Electric Company

- Emerson Electric Co.

- Analog Devices

- Radiocrafts AS

- Honeywell International Inc.

- Silicon Laboratories

- Yokogawa Electric Corporation

第8章 投資分析

第9章 市場機会と今後の動向

The Wireless Sensors Network Market size is estimated at USD 14.82 billion in 2025, and is expected to reach USD 48.19 billion by 2030, at a CAGR of 26.59% during the forecast period (2025-2030).

There are many applications of wireless sensor networks in robotics, such as advanced robotic sensing, multiple robot coordination, robot planning and navigation, and robot localization. Using wireless sensor networks helps emergency response robots to be conscious of conditions, such as electromagnetic field monitoring, forest fire detection, etc.

Key Highlights

- The growing automation and robotics industry, increasing demand for a wireless sensor network in asset monitoring, security, and transportation, and improved reliability with communication technology advancements are the significant factors driving the market for wireless sensor networks (WSN).

- Owing to the increased government regulation for the increased use of sensors for safety, the demand for wireless sensors is growing, for instance, in areas with challenging environmental conditions, such as extremely high pressure and high temperature. With the help of wireless sensors, it becomes easy to control and monitor the facility from a safe distance continually. They help acquire data from locations that are difficult to access.

- The rising adoption of IoT (Internet-of-Things) is another major factor driving the market's growth. This growth in IoT-connected devices is projected to fuel the demand for wireless sensor networks.

- Sensor manufacturers heavily invest in technology to cater to emerging verticals, such as smart cities and autonomous vehicles, which are substantially dependent on wireless technologies. Innovation in sensor technologies, such as intelligent sensors, is expected to support the rapid adoption of wireless technologies in the market. All these factors are expected to contribute to the growth of the wireless sensor network market.

- Despite their highly practical usefulness, there are some challenges in using wireless sensor network systems. There are vast differences in the scale of such sensor networking systems, as the number of sensor nodes may vary from a few to several. An adjustment also follows this in the density of deployment. The software and hardware design needs to be optimized to operate effectively for the task at hand, given that wireless sensor nodes have to function on an insufficient power supply.

- WSN has several constraints like power supply, storage, and a large number of algorithms, so there is a serious challenge in the maintenance of all these. Like all internet-dependent applications, WSN also has an insecurity scare. In order to combat data thefts in all possible ways, it is necessary to implement appropriate data transmission management.

Wireless Sensors Network Market Trends

Medical Segment is Expected to Witness Significant Growth

- There are several issues facing the healthcare industry: soaring costs, growing incidences of medical errors, staffing shortages, aging populations, etc. Despite the challenges, healthcare professionals are under pressure to deliver improved services while at the same time adopting modern technologies. Long-term costs can be decreased, and the quality of services can be improved by offering ubiquitous healthcare. Wireless sensor networks can provide efficient solutions to an increasingly widespread healthcare system.

- Due to advances in sensors and network technologies that do not use much power, WSNs for healthcare have begun to emerge in recent years. The wireless sensor network is frequently emerging as a significant component of the next-generation healthcare system. They are a multihop Zigbee-based system that uses multicasting or broadcasting to deliver vital information. The speed and reliability of messages is an essential feature of such a system.

- They relate to the collection of real-time health information from various sensors. Wireless protocols, radio spectrum, data bandwidth, encryption, energy consumption, and mobility are essential features of these networks.

- With the development of wearable sensors, users can constantly monitor physiological data aided by wireless sensor networks in healthcare. During patient hospitalization or residence, a body area network will continue to monitor their health. This service may be helpful in emergency cases when it transfers data on patients' condition to a healthcare provider. Providing healthcare services for people, including memory enhancement, health data access, cancer detection, asthma symptoms, and blood glucose monitoring, can also be helpful.

- In addition, a new Internet of Medical Things has been set up in conjunction with telemedicine and will play an important role in the monitoring and prevention of diseases, RBSA Advisors reports. Analytics, tools, and machines driven by artificial intelligence can help healthcare providers select the right approach for each patient regarding more effective, accurate, and impactful interventions.

- In India, emerging technologies are helping the development of novel and better treatments while lowering costs. Over the next few years, artificial intelligence (AI), data, and IoMT will have swiftly expanded from simple devices that are designed to track vital signs such as heart pump rate and blood oxygen levels to smartwatches that are capable of even complex scans such as ECGs and smart textiles that can track blood pressure and also predict the risk of heart attacks.

North America Holds Largest Market Share

- North America is expected to be an important market for wireless sensor networks during the forecast period, as it is at the very early stage of adopting cutting-edge technologies like smart cities and building and industry automation. In addition, the WSN market's growth in the region is expected to be driven by technological advances in healthcare infrastructure and increasing consumer interest in wearables.

- The adoption of smart factories, intelligent manufacturing, and the presence of many industrial wireless sensor network manufacturers are expected to drive the growth of the North American market in the coming years. The presence of several key players, such as ABB Ltd, Emerson Electric Co., and Honeywell International Inc., is also expected to prompt market growth in this region.

- Wireless sensor networks were used in health applications to provide impaired interfaces, integrated patient monitoring, diagnostics, and drug administration in hospitals, telemonitoring of human physiological data, and tracking and monitoring of doctors or patients within a hospital.

- The North American freight railroad industry is also trying to leverage WSN onboard railcars for advanced monitoring and alerting. In railroad environments, freight train WSNs exhibit a linear chain-like topology of significant length.

- Furthermore, with the increasing penetration of wearable devices in the commercial market, wearable devices are also becoming increasingly popular for industrial usage due to their numerous benefits. For instance, Airbus implemented wearable devices in the aerospace and defense industries in collaboration with Accenture.

Wireless Sensors Network Industry Overview

The wireless sensors network market is fragmented. It is a highly competitive market without any single dominant player present in the market. The players are focused on strategic investments to innovate new products, collaborations and partnerships, and mergers and acquisitions to strengthen the market position.

- November 2023: STMicroelectronics released a new microcontroller (MCU) that fuses the company's expertise in wireless-device design with its high-performing and efficient STM32 architecture, especially valuable in remotely deployed applications, including metering and monitoring devices and data from alarm systems, actuators, and sensors in today's smart buildings, smart factories, and smart cities.

- October 2023: NXP Semiconductors announced the launch of AW693, a new automotive-qualified wireless connectivity solution. Designed for automotive from the ground up and part of the industry's most complete automotive wireless connectivity portfolio, AW693 enables concurrent dual Wi-Fi 6E and Bluetooth 5.3 connections, protected by NXP's integrated EdgeLock secure subsystem, to deliver many secure connections in the car.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Topology

- 4.3.1.1 Star

- 4.3.1.2 Mesh

- 4.3.1.3 Hybrid

- 4.3.1.4 Tree

- 4.3.2 Sensors

- 4.3.2.1 MEMS

- 4.3.2.2 CMOS-based Sensors

- 4.3.2.3 LED Sensors

- 4.3.3 Network Technology (Connectivity)

- 4.3.3.1 Wireless HART

- 4.3.3.2 ZigBee

- 4.3.3.3 Wi-Fi

- 4.3.3.4 IPv6

- 4.3.3.5 Bluetooth

- 4.3.3.6 Dash 7

- 4.3.3.7 Z-Wave

- 4.3.1 Topology

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies

- 5.1.2 Reducing Cost of Wireless Sensors

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Installation Costs

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Military and Security

- 6.1.2 Medical

- 6.1.3 Transportation and Logistics

- 6.1.4 Oil and Gas

- 6.1.5 Water and Wastewater

- 6.1.6 Consumer Packaged Goods (Food and Beverage)

- 6.1.7 Other End-users

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Mexico

- 6.2.5.3 Argentina

- 6.2.6 Middle East and Africa

- 6.2.6.1 United Arab Emirates

- 6.2.6.2 Saudi Arabia

- 6.2.6.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Atmel Corporation

- 7.1.3 Siemens AG

- 7.1.4 ST Microelectronics

- 7.1.5 NXP Semiconductors

- 7.1.6 General Electric Company

- 7.1.7 Emerson Electric Co.

- 7.1.8 Analog Devices

- 7.1.9 Radiocrafts AS

- 7.1.10 Honeywell International Inc.

- 7.1.11 Silicon Laboratories

- 7.1.12 Yokogawa Electric Corporation