|

市場調査レポート

商品コード

1851524

スモールスケールLNG:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Small-scale LNG - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スモールスケールLNG:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月05日

発行: Mordor Intelligence

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

概要

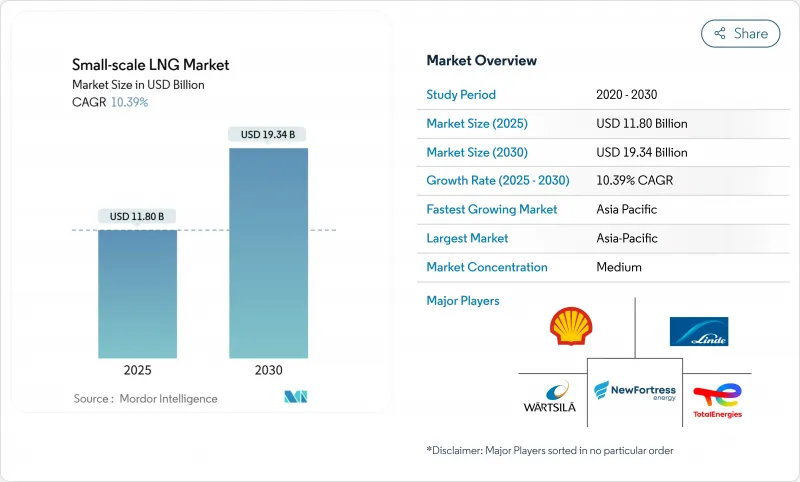

スモールスケールLNG市場規模は2025年に118億米ドルと推定・予測され、2030年には193億4,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは10.39%です。

需要は、石油・ディーゼルから天然ガスへの切り替えを進める産業界や遠隔地のコミュニティによって推進され、開発業者は座礁ガスを収益化し、建設スケジュールを短縮するプレハブプラントを展開します。1MTPA以下の容量に最適化された液化技術、大型輸送におけるLNG利用の拡大、主要経済国における規制上の優遇措置が、堅調な資本形成を支えています。世界的なエネルギー・メジャーと機敏な専門家が、優良資産の確保、戦略的提携、バリュー・チェーン全体にわたる独自の技術プラットフォームの確立を競い合い、競合は激化しています。地政学的不確実性の高まりと短期契約への軸足移行のため、スポット価格のボラティリティは高まっているが、電力、船舶、トラック輸送の各分野でLNGの採用が続いており、持続的な成長機会が見込まれています。

世界のスモールスケールLNG市場動向と洞察

IMOとFuelEUの海上硫黄上限規制強化が海上LNGバンカリングの採用を加速

IMOとFuelEU Maritimeパッケージによって設定された新しい硫黄と温室効果ガス規制は、船舶運航者が炭素コンプライアンスコストの上昇を避けるためにLNGを採用することを奨励しています。EUの排出量取引制度は、EUの港に寄港する大型船舶のCO2排出量に価格をつけるようになり、FuelEUのルールは、2025年までに炭素強度を2%削減することを要求しているが、LNG燃料船は、ライフサイクル排出量が76.3~92.3gCO2e/MJであるため、2034年までこの目標を達成できます。世界のバンカー需要は2023年に1,290万トンに達し、2024年末までに56隻のLNGバンカー船隊がこれを支えます。船主は記録的なデュアル燃料の新造船発注と改装でこれに応え、欧州の港湾全体で陸上ローディングアーム、低温ホース、安全プロトコルへの投資を促進しています。

遠隔地採鉱とオフグリッド発電のためのモジュール式液化プラントの迅速な構築

スキッドやバージに搭載された工場生産型の液化プラントは、パイプライン網がまばらな地域での参入障壁を低くしています。ベーカー・ヒューズ社は、設置面積を縮小し、現場作業とモジュール製造の重複を可能にする航空転用タービントレインと電気モーター駆動装置の受注が増加していることに注目しています。インドネシアのパイロット・プログラムでは、遠隔地のディーゼル火力発電所にLNGを供給することで、平準化発電コストを55~60%削減できることが示されました。モジュラー・アプローチは、フレアガスの収益化を目指すアフリカの鉱山業者にとっても同様に魅力的であり、ディーゼル輸入に比べて投資回収期間が短くなります。

サハラ以南のアフリカにおけるまばらなISOタンク・バックホール・ロジスティクス

ナイジェリアの150 tcfの確認ガス埋蔵量は、ISOタンクフリートが貧弱な道路網と最小限の双方向貿易フローに直面しているため、依然として十分に活用されていないです。リターンカーゴの不足により、事業者は空のコンテナの再配置を余儀なくされ、トリップあたりのコストが膨らみ、内陸州の市場競争力が低下しています。地域エネルギー機関は、LNGが住宅や小規模商業分野でバイオマスに取って代わるようになるには、複合輸送回廊と調和した税関手続きの必要性を強調しています。

セグメント分析

液化ターミナルは2024年の収益の62.5%を占め、パイプラインがない場所でのガスの収益化における極めて重要な役割を反映しています。スモールスケールLNG市場規模のこの部分は、資本コストとエネルギー効率のバランスをとる簡素化されたSMRプロセストレインによって支えられています。米国だけでも、マイクロLNGの生産能力を日産230万ガロンまで引き上げる計画を持っています。液化設備が占めるスモールスケールLNGの市場シェアは、再ガス化設備が急速に成長するにつれて若干低下すると予想されるが、鉱山や地方の公益事業からの新たな非電化需要を考えると、絶対的な処理量は増加すると思われます。

浮体式貯蔵・再ガス化ユニットの波が並行して押し寄せており、新興バイヤーの輸入オプションが再構築されつつあります。FSRUの試運転に必要な費用は3億米ドル、試運転期間は1~3年と、陸上の代替施設をはるかに下回り、2030年までのCAGRは14%と予測されます。喫水の浅い船体や連結式タグボートなどの技術革新により、かつては到達不可能とされていた河川や沿岸近くの停泊地へのアクセスが可能になります。開発者は、これらのユニットをパワーバージやモジュール式コンバインドサイクルプラントと組み合わせることで、アフリカ、南アジア、カリブ海諸国でのオフテイクの増加を可能にしています。

道路を利用した配送は、パイプライン・グリッドから外れた場所への配送能力のおかげで、2024年の収益の52.5%を占めました。スタビリス・ソリューションズ社だけでも、4万3,000台のトラックで4億2,000万ガロン以上を輸送しており、この「バーチャル・パイプライン」モデルの回復力を実証しています。コスト競争力は、モジュール式低温ポンプ、標準的なISOタンク・インターフェース、およびターンアラウンド時間を最適化するGPS連動フリート・スケジューリング・ツールに起因します。

バンカリングはCAGR14.5%と最も急激な伸びを示し、LNGデュアル燃料船を優遇する低硫黄海上規則が後押ししています。LNGは現在198の港で利用可能で、バンカー船隊は56隻の専門船で構成されています。サプライ・チェーンは、港のレイアウトや船舶のスケジュールに合わせて、トラックから船へ、船から船へ、パイプラインから船への配送方法をますます組み合わせています。

スモールスケールLNG市場レポートは、タイプ別(液化ターミナル、再ガス化ターミナル)、供給形態別(トラック、積み替え・バンカリング、パイプライン・鉄道、ISOコンテナ)、用途別(輸送、発電、その他)、エンドユーザー別(公益事業・IPP、石油・ガス上流事業者、その他)、地域別(北米、欧州、アジア太平洋、南米、中東・アフリカ)に分類しています。

地域分析

アジア太平洋地域は2024年に世界収益の47.5%を生み出し、2030年まで最高のCAGR16%を維持すると予測されます。この地域の輸入能力は、2022年の1,527万トン/年から2025年には2,300万トン/年になると予想されます。中国は、2024年に78.64トンのLNGを輸入し、「青い回廊」給油ノードを積極的に展開します。インドネシアは、スモールスケールLNGが高速ディーゼルを最大60%下回ることを実証し、数百の島送電網への道を開くことで、このモデルを裏付けています。

欧州は、厳しい炭素規制とロシア産ガスからの多様化により、市場価値の約25%を占めました。同大陸には28の大規模輸入ターミナルと8つの小規模施設があり、その合計227bcmの再ガス供給能力は、2024年の需要の40%に相当します。北欧のクラスターは、海上輸送において最先端の環境入札を導入しており、ロッテルダム、ゼーブルッヘ、クライペダなどの港は、地域のバンカリングネットワークを支えています。EUのガス供給全体に占めるLNGの割合は2021年以降2倍以上に増加しており、柔軟な移動式ターミナルの安定したベースロードとなっています。

北米は売上高の約20%を占め、米国は技術リーダーであり最大の輸出国です。米国のLNG輸出能力は2018年以降3倍に増加し、2030年までに認可されたプロジェクトでほぼ2倍に増加します。この地域のスモールスケールLNG市場は、シェールガスの豊富さ、税控除、トラックや鉄道燃料としてのLNG採用の加速に後押しされ、2018年の4億9,900万ガロンから2030年には19億ガロンへと上昇しました。カナダとメキシコの開発業者も、遠隔地の鉱山や工業団地をつなぐモジュール式プラントを模索しています。

残りの需要は、ラテンアメリカ、中東・アフリカに分かれます。ラテンアメリカの成長の中心は、ブラジル、チリ、ドミニカ共和国で、浮体式輸入ソリューションにより、LNG-電力プロジェクトの迅速な立ち上げが可能です。中東では、豊富なガス原料を活用して、主に遠隔地での油田操業や島の観光施設にスモールスケールLNGが使用されています。アフリカは、ロジスティクスの格差に制約され、最も普及していない地域であるが、ナイジェリアとモザンビークは、輸送のボトルネックが緩和されれば、かなりのアップサイドが見込まれます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- IMOとFuelEUの海上硫黄上限規制強化が海上LNGバンカリング導入を加速(欧州)

- 遠隔地採掘とオフグリッド発電のためのモジュール式液化プラントの急速な建設(アジア太平洋地域)

- 中国の「青の回廊」計画における大型トラックのLNGシフト

- カリブ海と中米のマイクログリッドのLNG電力への転換

- スモールスケールLNG米国インフレ抑制法における設備に対する税制優遇措置

- 北欧のLNGバス・フェリー補助金制度がバンカリング需要を牽引

- 市場抑制要因

- サハラ以南のアフリカにおけるまばらなISOタンクバックホール物流

- 0.05MTPA以下のプラントではボイルオフと再液化のコストが高め

- ブラジルにおける移動式液化設備の断片的な許可枠組み

- ロシアとウクライナの紛争がスポットLNGの地政学的リスクプレミアムを高める

- サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- 液化ターミナル(マイクロ、ミニ、小型)

- 再ガス化ターミナル(陸上および海上FSRU)

- 供給形態別

- トラック

- パイプラインと鉄道

- 積み替えとバンカリング(船から船へ、船から陸へ)

- ISOコンテナ

- 用途別

- 輸送(道路および海上バンカリング)

- 産業用原料

- 発電

- その他の用途

- エンドユーザー別

- 公益事業およびIPP(独立系発電事業者)

- 石油・ガス上流事業者

- 製造業

- 商業および自治体

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- 北欧諸国

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- エジプト

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的な動き(M&A、パートナーシップ、PPA)

- 市場シェア分析(主要企業の市場ランク/シェア)

- 企業プロファイル

- Linde plc

- Wartsila Oyj Abp

- Baker Hughes Co.

- Honeywell UOP

- Chart Industries Inc.

- Black & Veatch

- New Fortress Energy LLC

- Shell plc

- TotalEnergies SE

- Eni SpA

- PJSC Gazprom

- Novatek PJSC

- Gasum Oy

- Engie SA

- Anthony Veder Group NV

- Stolt-Nielsen Gas Ltd

- Eagle LNG Partners

- Guanghui Energy Co.

- Equinor ASA

- Pavilion Energy Pte Ltd