|

市場調査レポート

商品コード

1686247

HVDC(高圧直流)送電:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)HVDC Transmission Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| HVDC(高圧直流)送電:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

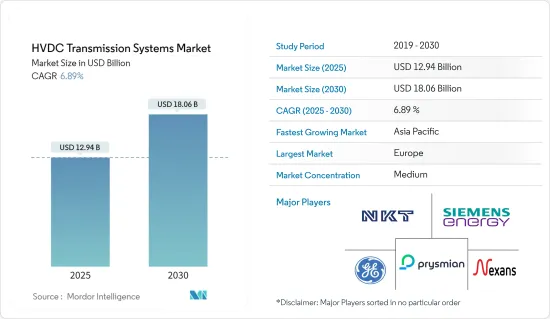

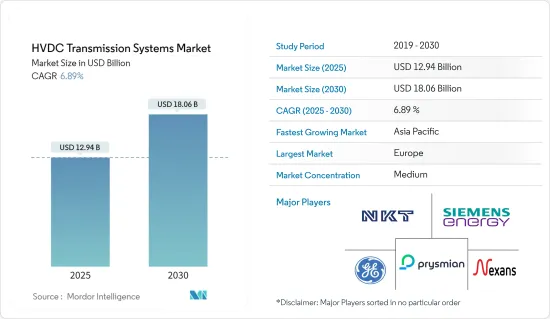

HVDC(高圧直流)送電の市場規模は2025年に129億4,000万米ドル、2030年には180億6,000万米ドルに達すると予測、予測期間(2025-2030年)のCAGRは6.89%。

主なハイライト

- 中期的には、再生可能エネルギー発電や老朽化した電力網の統合の増加、送配電インフラへの投資といった要因が、予測期間中のHVDC送電市場を牽引すると予想されます。

- 一方、分散型発電やオフグリッド発電のシェア拡大が、予測期間中のHVDC送電市場に脅威をもたらします。

- とはいえ、新興国市場や未開拓市場における洋上風力発電への関心の高まりは、近い将来、HVDC送電システム市場に大きなビジネスチャンスをもたらすと期待されています。

- 欧州地域が市場を独占しており、エネルギー需要の増加と欧州全域での送電ネットワークの拡大により、予測期間中に大きな成長を記録する可能性が高いです。

HVDC(高圧直流)送電市場動向

海底HVDC(高圧直流)送電が大きく成長

- 海底HVDC送電システム市場は、世界の海底送電システムの市場開拓により大きく成長する可能性が高いです。海底送電は、国家間の電力取引への注目の高まりにより重要性を増しています。

- HVDC海底送電システムは、将来の送電ネットワーク開発にとって極めて重要です。HVDC(高圧直流)送電は、長い海底距離を大電力で送電するための唯一のソリューションです。HVDC海底送電が果たす主な目的は、海で隔てられた国や島を相互接続することと、遠隔地の海上プラットフォームを主要なトランスミッション・グリッドに接続することです。

- また、HVDC海底送電システムは、洋上風力発電プラットフォームで岸壁への送電にも利用されています。世界風力エネルギー会議によると、2023年の世界の洋上風力発電の総発電量は72GWで、前年比年間成長率は13%です。このように、洋上風力発電の増加に伴い、HVDC海底送電システムの利用が増加すると予想されます。

- 海底ケーブル・プロジェクトは世界中でいくつか建設中です。例えば2023年6月、日本は米国、オーストラリアとともに、東ミクロネシア島嶼国を接続し、インド太平洋地域のネットワークを拡大するための9,500万米ドルの海底ケーブル・プロジェクトに調印したと発表しました。プロジェクトは全長約2,250km。

- 2024年10月、すべての関係当局がスコットランドとイングランド間のHVDC海底送電の計画同意書を承認しました。スコティッシュ・アンド・サザン・エレクトリック・ネットワークス・トランスミッション(SSEN)とナショナル・グリッド・エレクトリック・トランスミッション(NGET)の合弁会社が、スコットランドのピーターヘッドからイングランドのドラックスまで、525kV、2GWの高圧直流(HVDC)海底送電ケーブル、イースタン・グリーン・リンク2(EGL2)の建設を開始します。

- 2023年10月、クリーン・パス・ニューヨーク(Clean Path NY)は、米国最大級の送電インフラ・プロジェクトに海底ケーブル・システムを提供することでプライスミアン・グループと合意したと発表しました。クリーンパスNYは、風力発電と太陽光発電の3,800MWと、175マイルの新しい地下・海底トランスミッションからなる110億米ドルの再生可能エネルギープロジェクトです。これらの資産を合わせると、毎年750万メガワット時以上の無排出エネルギーの供給が可能になります。

- 以上のことから、海底HVDC送電システムの需要は予測期間中に増加すると予想されます。

欧州が市場を独占する見込み

- ドイツ、スペイン、ベルギー、フランスなどの国々では、低炭素経済への移行が進んでおり、今後数年間で、欧州の発電ミックスは自然エネルギーに大きく変化すると予想されています。この地域には、EUの再生可能エネルギー指令や各国の再生可能エネルギー行動計画など、低炭素エネルギーシステムへの移行を支援する政策もいくつかあります。

- 2050年までにCO2排出量を80%削減し、総エネルギー消費量に占める再生可能エネルギーの割合を60%、再生可能エネルギーによる発電量を80%に引き上げるという野心的な目標を掲げており、エネルギー転換はドイツのエネルギー事情にとって不可欠な要素であり続けています。

- 再生可能エネルギー源の統合が進み、供給の安定性を高める必要性が高まるなか、HVDC送電網技術は同国で発展していくと予想されます。さらに、洋上風力産業、太陽光発電、送電網の拡張、エネルギー貯蔵プロジェクトへの投資には、変動する再生可能エネルギー源の供給バランスをとるためのスマート・エネルギー・インフラが必要です。

- さらに2023年7月には、ナショナル・グリッド・エレクトリック・トランスミッション(NGET)とSSENトランスミッションが、英国最長の海底高圧直流(HVDC)送電システムを建設する5年間の合弁事業を設立しました。イースタン・グリーン・リンク2(EGL2)プロジェクトは、スコットランドのピーターヘッドとイングランドのドラックスを結ぶ525kV、2GWのHVDCリンクを構築します。

- ノース・シー・リンク(NSL)のHVDCインターコネクターは全長720km、ヴァイキングのインターコネクターは全長765kmだが、このプロジェクトは全長436kmと、英国で唯一最長のエネルギー・トランスミッション・プロジェクトとなります。工事は2024年に開始され、規制当局Ofgemの最終許可が下り次第、2029年の運用開始を目指します。

- ドイツでは、北海とバルト海で洋上風力発電所が急速に展開されています。洋上風力発電はドイツの再生可能エネルギー発電戦略の要であり、沿岸資源を活用してクリーンな発電を行うことを目指しています。洋上風力発電所では、高圧直流(HVDC)トランスミッションの設置が増加しています。

- 例えば2023年5月、TenneTはNKT、Nexans、Jan De Nul Group、LS Cable &System、Denysのコンソーシアムと55億ユーロの契約を結び、2031年までにドイツとオランダの10件の洋上風力発電プロジェクトとドイツの1件の陸上プロジェクトにHVDCケーブルシステムを設置します。この契約は、525kV HVDCケーブルの設計、エンジニアリング、製造、納入、敷設を含む約7,000kmのケーブルを対象としています。

- ドイツはHVDCケーブルを通じて近隣諸国と相互接続しており、国境を越えた電力交換を促進し、送電網の信頼性を高めています。例えば、Cenergy Holdingsは2023年7月、同社のケーブル部門であるHellenic CablesがJan De Nul Groupと共同で、ドイツのゾーンN-3.7 &N-3.8で開発される洋上風力発電所向けのHVAC洋上グリッド接続ケーブル3本のターンキー供給をTenneTから受注したと発表しました。

- 以上のことから、HVDC送電システム市場は今後欧州が支配的な地位を占めると予想されます。

HVDC(高圧直流)送電業界の概要

HVDC(高圧直流)送電市場は半固体化しています。市場の主要企業(順不同)には、NKT AS、Siemens Energy AG、General Electric Company、Prysmian SpA、Nexans SAなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2029年までの市場規模および需要予測(単位:米ドル)

- 最近の動向と開発

- 市場力学

- 促進要因

- 再生可能エネルギー発電の統合の増加

- 送電網の老朽化とトランスミッション・配電インフラへの投資

- 抑制要因

- 分散型発電とオフグリッド発電のシェア拡大

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場セグメンテーション

- 送電タイプ

- 海底HVDC(高圧直流)送電

- HVDC架空送電システム

- HVDC地中送電システム

- コンポーネント

- コンバーター・ステーション

- トランスミッション(ケーブル)

- 地域

- 北米

- 米国

- カナダ

- その他北米地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- NKT AS

- Siemens Energy AG

- Sumitomo Electric Industries, Ltd.

- General Electric Company

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Prysmian S.P.A.

- Nexans S.A.

- Market Player Ranking

第7章 市場機会と今後の動向

- 新興および未開拓市場における洋上風力発電への関心の高まり

目次

Product Code: 51065

The HVDC Transmission Systems Market size is estimated at USD 12.94 billion in 2025, and is expected to reach USD 18.06 billion by 2030, at a CAGR of 6.89% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing integration of renewable energy generation and aging power grids and investments in transmission and distribution infrastructure are expected to drive the HVDC transmission market during the forecast period.

- On the other hand, the increasing share of distributed and off-grid power generation poses a threat to the HVDC transmission market during the forecast period.

- Nevertheless, the increasing interest in offshore wind power in developing and untapped markets is expected to create significant opportunities for the HVDC transmission systems market in the near future.

- The European region dominates the market and will likely register significant growth during the forecast period, with increasing energy demand and the expansion of transmission networks across Europe.

HVDC Transmission Systems Market Trends

Submarine HVDC Transmission Systems to Witness Significant Growth

- The submarine HVDC transmission system market is likely to grow significantly due to the development of submarine power transmission systems worldwide. Submarine electricity transmission is gaining importance due to the increasing focus on power trading between countries.

- The HVDC submarine power transmission system is crucial for developing future power transmission networks. HVDC transmission is the only solution for transferring high power across long subsea distances. The major purposes served by HVDC submarine transmission are to interconnect countries or islands separated by sea and to connect remote offshore platforms to main transmission grids.

- The HVDC submarine power transmission system is also used in offshore wind platforms to transmit power to the shore. In 2023, according to the Global Wind Energy Council, the global total offshore wind accounted for 72 GW, with an annual growth rate of 13% compared to the previous year. Thus, with the increasing power generation from offshore wind, the use of the HVDC submarine power transmission system is expected to increase.

- Several subsea cable projects are under construction worldwide. For instance, in June 2023, Japan announced that it had joined the United States and Australia in signing a USD 95 million undersea cable project to connect East Micronesia Island nations and expand networks in the Indo-Pacific region. The project is around 2,250 km long.

- In October 2024, all relevant authorities granted planning consent for an HVDC subsea electricity transmission between Scotland and England. The joint venture between Scottish and Southern Electricity Networks Transmission (SSEN) and National Grid Electricity Transmission (NGET) will start the construction of a 525kV, 2GW Eastern Green Link 2 (EGL2), a high voltage direct current (HVDC) subsea transmission cable from Peterhead in Scotland to Drax in England.

- In October 2023, Clean Path New York (Clean Path NY) announced an agreement with Prysmian Group to provide submarine cable systems for one of the largest transmission infrastructure projects in the United States. Clean Path NY is a USD 11 billion renewable energy project comprising 3,800 MW of wind and solar power and a new 175-mile underground and submarine transmission link. Together, these assets will enable the delivery of more than 7.5 million megawatt-hours of emissions-free energy every year.

- Thus, owing to the above points, demand for the submarine HVDC transmission system is expected to increase in the forecast period.

Europe is Expected to Dominate the Market

- The European power generation mix is expected to change considerably in favor of renewables over the next few years, with countries such as Germany, Spain, Belgium, and France, increasingly moving toward a low-carbon economy. The region also has several policies, such as the EU's renewable energy directive and national renewable energy action plans, that support the transition to a low-carbon energy system.

- The energy transition continues to be an integral part of Germany's energy landscape, with ambitious goals to cut CO2 emissions by 80% and increase the share of renewable energy in total energy consumption to 60% and 80% of electricity generated from renewable sources by 2050.

- With the increasing integration of renewable energy sources and the growing need to enhance the security of supply, HVDC grid technology is expected to evolve in the country. Moreover, investments in the offshore wind industry, solar photovoltaic, grid expansion, and energy storage projects require smart energy infrastructure to balance the fluctuating supply of renewable sources.

- Moreover, in July 2023, National Grid Electricity Transmission (NGET) and SSEN Transmission created a five-year joint venture to build the United Kingdom's longest subsea high voltage DC (HVDC) power system. The Eastern Green Link 2 (EGL2) project will create a 525kV, 2GW HVDC link between Peterhead in Scotland and Drax in England.

- Although the North Sea Link (NSL) HVDC interconnector is 720 km long and the Viking interconnector is 765km long, this will be the UK's single longest energy transmission project at 436km. The work will begin in 2024, with a target operational date of 2029, once final clearance from the regulator Ofgem is secured.

- In Germany, offshore wind farms are rapidly deployed in the North and Baltic Seas. Offshore wind is a cornerstone of Germany's renewable energy strategy, aiming to capitalize on its coastal resources to generate clean electricity. There has been an increase in the installation of high voltage direct current (HVDC) transmission systems in offshore wind farms.

- For instance, in May 2023, TenneT signed a EUR 5.5 billion agreement with NKT, Nexans, and a consortium of Jan De Nul Group, LS Cable & System, and Denys to install HVDC cable systems for ten offshore wind projects in Germany and the Netherlands and one onshore project in Germany by 2031. The deal covers approximately 7,000 km of cables, including design, engineering, production, delivery, and installation of 525 kV HVDC cables.

- Germany is interconnected with neighboring countries through HVDC cables, facilitating cross-border electricity exchange and enhancing grid reliability. For instance, in July 2023, Cenergy Holdings announced that Hellenic Cables, its cables division, in collaboration with Jan De Nul Group, was awarded by TenneT the turnkey supply of three HVAC offshore grid connection cables for the offshore wind farms to be developed in zones N-3.7 & N-3.8 in Germany.

- Thus, owing to the above points, Europe is expected to dominate the HVDC transmission systems market in the future.

HVDC Transmission Systems Industry Overview

The High Voltage Direct Current (HVDC) transmission systems market is semi-consolidated. Some of the major players in the market (in no particular order) include NKT AS, Siemens Energy AG, General Electric Company, Prysmian SpA, Nexans SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 Increasing Integration Of Renewable Energy Generation

- 4.4.1.2 Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 4.4.2 Restraints

- 4.4.2.1 Increasing Share of Distributed and Off-Grid Power Generation

- 4.4.1 Drivers

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Transmission Type

- 5.1.1 Submarine HVDC Transmission System

- 5.1.2 HVDC Overhead Transmission System

- 5.1.3 HVDC Underground Transmission System

- 5.2 Component

- 5.2.1 Converter Stations

- 5.2.2 Transmission Medium (Cables)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 United Arab Emirates

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of the Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of the South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NKT AS

- 6.3.2 Siemens Energy AG

- 6.3.3 Sumitomo Electric Industries, Ltd.

- 6.3.4 General Electric Company

- 6.3.5 Toshiba Corporation

- 6.3.6 Mitsubishi Electric Corporation

- 6.3.7 Prysmian S.P.A.

- 6.3.8 Nexans S.A.

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Interest In Offshore Wind Power in the Developing And Untapped Markets