|

市場調査レポート

商品コード

1432844

オフショアヘリコプターサービス:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Offshore Helicopter Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オフショアヘリコプターサービス:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 176 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

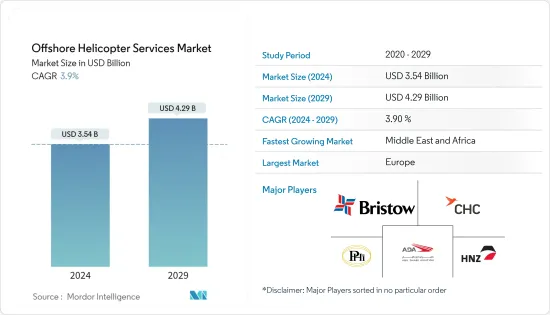

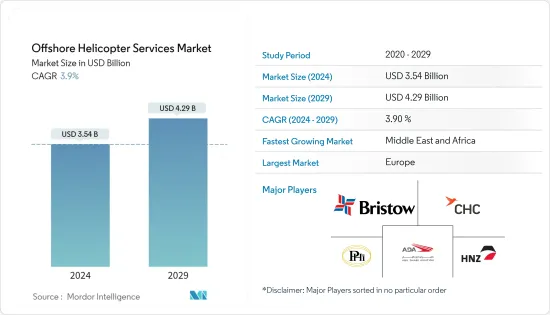

オフショアヘリコプターサービス市場規模は2024年に35億4,000万米ドルと推定され、2029年には42億9,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは3.9%で成長する見込みです。

市場は2020年のCOVID-19によってマイナスの影響を受けました。現在、市場はパンデミック以前の水準に達しています。

主なハイライト

- 中期的に市場を牽引する主な要因は、原油需要の増大と陸上・浅海域での新規発見機会の少なさから、海洋深海での探鉱・開発活動が活発化していることです。洋上風力発電産業がより深く過酷な環境へと移行しているため、風力タービンのメンテナンス活動、ひいては洋上風力発電産業向けの洋上ヘリコプター・サービスの需要が増加すると予想されます。

- その一方で、乗組員輸送船の日当が低いことに加え、石油・ガスのオフショア活動が活発でないため、ヘリコプター・サービス・プロバイダーは日当の削減を余儀なくされ、年間収入に悪影響を及ぼしています。

- とはいえ、地中海、ガイアナ、東アフリカで最近発見され、今後予定されているプロジェクトは、オフショアヘリコプターサービスにとって比較的新しく魅力的な市場になると予想され、サービスプロバイダーが市場での存在感を拡大する機会を生み出しています。

オフショアヘリコプターサービスの市場動向

急成長が期待される洋上風力発電産業

- 以前の洋上風力発電所の多くは陸地の近くに設置され、船で簡単にアクセスできました。しかし、新しく建設された洋上風力発電所は海岸から離れた場所にあり、ヘリコプターは乗組員の移動手段として経済的な選択肢になりつつあります。このため、洋上ヘリコプター・サービスに新たなビジネス分野が生まれました。

- 洋上ヘリコプター・サービスは主に、風力タービンを保守するために乗組員をプラットフォームに移動させるために利用されます。洋上風力タービンはより過酷で腐食性の高い環境に直面するため、洋上風力発電所では頻繁なメンテナンスが必要となります。

- 洋上風力発電産業がより深く、より過酷な環境へと向かうにつれ、風力タービンのメンテナンス活動、ひいては洋上風力発電産業向けの洋上ヘリコプター・サービスの需要が高まっています。

- 国際再生可能エネルギー機関によると、2022年の世界の洋上風力発電設備容量は63,200MWだった。年間成長率は2021年比で約16.5%だった。このように、洋上風力発電の設置容量が増加するにつれて、風力タービンのメンテナンス活動が継続的に発生することが予想され、それが市場を牽引することになります。

- 歴史的には、デンマーク、ドイツ、英国などの欧州諸国が洋上風力発電産業を支配してきました。しかし、中国、台湾、インドなどのアジア諸国も国内の洋上風力発電セクターを発展させる計画を発表しており、これが予測期間中の風力発電所向けヘリコプター・サービス市場の地理的拡大を促進するとみられています。

- さらに、米国エネルギー省によると、同国では複数の洋上風力発電プロジェクトがさまざまな開発段階にあります。例えば、2022年9月、バイデン-ハリス政権は、同国政府が新たな浮体式洋上風力プラットフォームを開発するための協調行動を開始すると発表しました。同国は2030年までに30ギガワット(GW)の洋上風力発電を導入するという目標を掲げており、これが予測期間中の洋上エネルギー市場を牽引することになりそうです。

- エンドユーザー産業の中では、洋上風力産業が予測期間中に最も急成長すると予想されています。

欧州が市場を独占

- 欧州は、調査対象地域の中で最大の市場であると推定されます。これは主に、多くの海洋石油・ガスプラットフォーム、厳しい海象条件、輸送用ヘリコプターサービスを促進する厳しい安全規制によるものです。

- 英国(UK)の生産量の大半は、北海、アイリッシュ海、西シェトランド諸島にまたがる豊富な海洋資源基盤からもたらされています。さらに英国政府は、地元での生産を強化するため、北海の石油・ガス探査ライセンスを数百件追加すると発表する見込みです。これらの発表は、英国大陸棚(UKCS)における将来のE&P活動のための強固なプラットフォームとして機能し、探鉱活動レベルの変革に役立つと予想されるため、調査対象市場の成長にプラスの影響を与えます。

- ノルウェー大陸棚(NCS)では、期待される回収可能資源の約半分しか生産されていないです。同時に、同棚にある施設の多くが耐用年数を迎えようとしています。今後数年間で、これらの施設のいくつかは責任を持って閉鎖され、廃止される可能性が高いです。

- さらに、2022年1月、ヴァル・エネルギとエクイノアは、北海で5年間のヘリコプター・シェアリング契約を締結しました。ヴァル・エネルギ社は、北海で週12便の定期便を運航し、平均180人の乗客を乗せています。北海では、バルダー浮体式生産ユニットとリングホーンプラットフォームを運営し、半潜水艇ウェスト・フェニックスがバルダー・フューチャー・プロジェクトの追加坑井を掘削しています。両社は、ヘリコプターや空席を調整・共有することで、相互に利用可能な輸送能力を最大限に活用することを目指しています。

- また、2017年から2025年にかけて、北海全体で349の油田で廃炉作業が行われる予定であり、そのうち約214の油田がUKCSに、106の油田がオランダ大陸棚に、23の油田がノルウェー大陸棚(NCS)に、6つの油田がデンマーク大陸棚にあります。

- UKCSとNCSにおけるオフショアデコミッショニング活動の拡大は、予測期間中の市場成長を促進すると予想されます。

オフショアヘリコプターサービス産業の概要

世界のオフショアヘリコプターサービス市場は集中しています。主要企業(順不同)には、CHC Group Ltd、Bristow Group Inc.、PHI Inc.、Abu Dhabi Aviation、HNZ Group Inc.などがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模および需要予測(金額)

- 海洋掘削リグの実績と需要予測(金額):2028年まで

- オフショアCAPEXの実績と需要予測(金額):水深別、2019年~2028年

- オフショアCAPEXの需要予測(金額):地域別、2019-2028年

- 今後の主なオフショアアップストリームのプロジェクト

- オフショア支援フリート:ヘリコプタータイプ別

- 最近の動向と展開

- 政府の規制と政策

- 市場力学

- 促進要因

- 深海オフショア探査・開発活動の活発化

- 抑制要因

- 乗組員輸送船との競合激化

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- 小型ヘリコプター

- 中型・大型ヘリコプター

- エンドユーザー産業

- 石油・ガス産業

- 洋上風力産業

- その他のエンドユーザー産業

- 用途

- 掘削

- 生産

- 移設と廃止措置

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- その他北米

- アジア太平洋

- 中国

- インド

- 日本

- その他アジア太平洋地域

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東とアフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 市場シェア分析

- 企業プロファイル

- サービスプロバイダー

- Bristow Group Inc.

- CHC Group Ltd

- HNZ Group Inc.

- PHI Inc.

- Abu Dhabi Aviation Airways PJSC(Abu Dhabi Aviation)

- ヘリコプター製造

- Airbus SE

- Leonardo SpA

- Textron Inc.

- Lockheed Martin Corporation

- サービスプロバイダー

第7章 市場機会と今後の動向

- 地中海、ガイアナ、東アフリカにおける最近の発見と今後のプロジェクト

The Offshore Helicopter Services Market size is estimated at USD 3.54 billion in 2024, and is expected to reach USD 4.29 billion by 2029, growing at a CAGR of 3.9% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium period, major factors driving the market studied are rising deepwater offshore exploration and development activities, due to the growing crude oil demand and little scope for new discovery in land and shallow water areas. As the offshore wind power industry is moving toward deeper and harsher environments, the demand for wind turbine maintenance activity and in turn, offshore helicopter services for the offshore wind industry is expected to increase.

- On the other hand, the low day rates of crew transfer vessels, coupled with a lack of offshore oil and gas activities, have forced helicopter service providers to reduce their day rates, which negatively impacted their annual revenue.

- Nevertheless, the recent discovery and upcoming projects in Mediterranean, Guyana, and East Africa are expected to be relatively new and attractive markets for the offshore helicopter services, creating an opportunity for service providers to expand their market presence.

Offshore Helicopter Services Market Trends

Offshore Wind Power Industry Expected to Witness Fastest Growth

- Many of the earlier offshore wind farms were installed close to the land and are easily accessible by boat. However, the newly built offshore wind farms are located farther from the shore, and helicopters are becoming an economical option for transporting crew members to and from the installations. This has created new business areas for offshore helicopter services.

- Offshore helicopter services are mainly used for transferring the crew to the platforms to maintain the wind turbines. As offshore wind turbines face rougher and more corrosive environments, offshore wind farms require frequent maintenance.

- As the offshore wind power industry moves toward deeper and harsher environments, the demand for wind turbine maintenance activities and, in turn, offshore helicopter services for the offshore wind industry is increasing.

- In 2022, according to the International Renewable Energy Agency, the total offshore wind installed capacity worldwide was 63,200 MW. The annual growth rate was approximately 16.5% compared to 2021. Thus, as the installed offshore wind capacity increases, maintenance activities for wind turbines are expected to occur continuously, which, in turn, will drive the market.

- Historically, European nations like Denmark, Germany, and the United Kingdom dominated the offshore wind power industry. But Asian countries, such as China, Taiwan, and India, have also announced plans to develop the domestic offshore wind sector, which is expected to drive the geographical expansion of the helicopter services market for wind farms during the forecast period.

- Furthermore, according to the US Department of Energy, several offshore wind power projects are in various stages of development in the country. For instance, in September 2022, the Biden-Harris Administration announced that the country's government was launching coordinated actions to develop new floating offshore wind platforms. The country set a target of deploying 30 gigawatts (GW) of offshore wind by 2030, which will likely drive the offshore energy market during the forecast period.

- Among the end-user industries, the offshore wind industry is expected to grow fastest during the forecast period.

Europe to Dominate the Market

- Europe is estimated to be the largest market among the regions for the market studied. This is mainly due to the many offshore oil and gas platforms, severe sea conditions, and strict safety regulations promoting helicopter services for transportation.

- Most of the United Kingdom's (UK) production comes from the rich offshore resource base straddling the North Sea, Irish Sea, and West Shetlands. Moreover, the British government is expected to announce hundreds of additional North Sea oil and gas exploration licenses to enhance local production. These announcements are expected to act as a robust platform for future E&P activities across the United Kingdom Continental Shelf (UKCS) and help transform exploration activity levels, thus positively impacting the growth of the market studied.

- Only about half of the expected recoverable resources on the Norwegian Continental Shelf (NCS) have been produced. At the same time, many of the facilities on the shelf are approaching the end of their expected lives. In the coming years, several of these facilities will likely be shut down and decommissioned responsibly, which may create a demand for offshore helicopter services.

- Moreover, in January 2022, Var Energi and Equinor signed a five-year helicopter-sharing agreement in the North Sea. Var Energi operates 12 regular North Sea flights per week, carrying 180 passengers on average. In the North Sea, it operates the Balder floating production unit and the Ringhorne platform, while the semisubmersible West Phoenix drills additional wells for the Balder Future project. The two companies aim to maximize the utilization of mutually available transportation capacity by coordinating and sharing helicopters and unoccupied seats.

- In addition, decommissioning is expected to take place on 349 fields across the North Sea during 2017-2025, out of which around 214 fields are in the UKCS, 106 fields in the Dutch Continental Shelf, 23 fields in the Norwegian Continental Shelf (NCS), and six fields on the Danish Continental Shelf.

- The growing offshore decommissioning activities in the UKCS and NCS are expected to drive market growth during the forecast period.

Offshore Helicopter Services Industry Overview

The global offshore helicopter services market is concentrated. Some of the major companies ( not in a particular order) include CHC Group Ltd, Bristow Group Inc., PHI Inc., Abu Dhabi Aviation, and HNZ Group Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Historic and Demand Forecast of Offshore Drilling Rigs in Numbers, till 2028

- 4.4 Historic and Demand Forecast of Offshore CAPEX in USD, by Water Depth, 2019-2028

- 4.5 Demand Forecast of Offshore CAPEX in USD, by Region, 2019-2028

- 4.6 Major Upcoming Offshore Upstream Projects

- 4.7 Offshore Support Fleets, by Helicopter Type

- 4.8 Recent Trends and Developments

- 4.9 Government Policies and Regulations

- 4.10 Market Dynamics

- 4.10.1 Drivers

- 4.10.1.1 Rising Deepwater Offshore Exploration and Development Activities

- 4.10.2 Restraints

- 4.10.2.1 Increasing Competition from Crew Transfer Vessels

- 4.10.1 Drivers

- 4.11 Supply Chain Analysis

- 4.12 Porter's Five Forces Analysis

- 4.12.1 Bargaining Power of Suppliers

- 4.12.2 Bargaining Power of Consumers

- 4.12.3 Threat of New Entrants

- 4.12.4 Threat of Substitute Products and Services

- 4.12.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Light Helicopters

- 5.1.2 Medium and Heavy Helicopters

- 5.2 End-user Industry

- 5.2.1 Oil and Gas Industry

- 5.2.2 Offshore Wind Industry

- 5.2.3 Other End-user Industries

- 5.3 Application

- 5.3.1 Drilling

- 5.3.2 Production

- 5.3.3 Relocation and Decommissioning

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States of America

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Asia-Pacific

- 5.4.2.1 China

- 5.4.2.2 India

- 5.4.2.3 Japan

- 5.4.2.4 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of the Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of the Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Service Providers

- 6.4.1.1 Bristow Group Inc.

- 6.4.1.2 CHC Group Ltd

- 6.4.1.3 HNZ Group Inc.

- 6.4.1.4 PHI Inc.

- 6.4.1.5 Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation)

- 6.4.2 Helicopter Manufacturers

- 6.4.2.1 Airbus SE

- 6.4.2.2 Leonardo SpA

- 6.4.2.3 Textron Inc.

- 6.4.2.4 Lockheed Martin Corporation

- 6.4.1 Service Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recent Discovery and Upcoming Projects in Mediterranean, Guyana, and East Africa