|

市場調査レポート

商品コード

1687243

スマート水道メーター- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Smart Water Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマート水道メーター- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 190 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

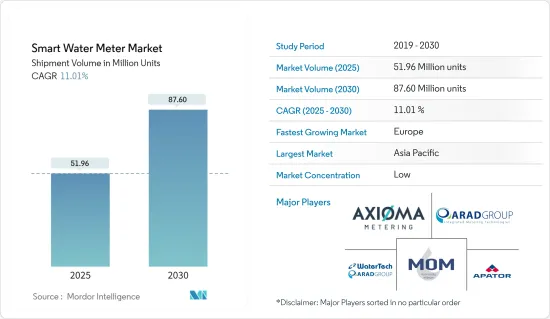

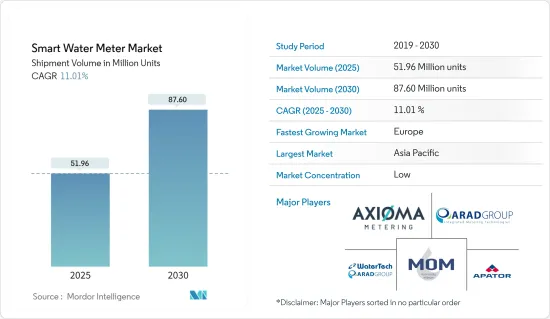

スマート水道メーター市場規模は出荷台数ベースで、2025年の5,196万台から2030年には8,760万台に拡大し、予測期間(2025~2030年)のCAGRは11.01%と予測されます。

スマート水道メーター市場効率化と節約を促進

主要ハイライト

- 支援的な政府規制が採用を加速:政府の取り組みと規制がスマート水道メーター市場を大きく前進させています。公共事業や自治体は、従来のメーターをスマートな代替品に置き換えることを目的とした多額の資金提供の恩恵を受けています。例えば、ウェスト・メンフィスは9,000台以上のスマートメーターを設置するために285万米ドルの助成金を受け、サンノゼ・ウォーターは先進計測インフラ(AMI)への1億米ドルの投資の承認を得ました。これらの取り組みは、顧客サービスの向上、温室効果ガス排出量の削減、節水の促進に重点を置いています。

- 政府の資金援助大規模なスマートメーター設置の実現

- 規制支援:電力会社によるAMI技術への投資許可

- 環境目標:持続可能性と保全の取り組みとの整合性

- 水道使用量と効率の改善の必要性:水道事業者は、効率性の向上とインフラの老朽化への対応を迫られています。スマート水道メーターは、水道事業者が漏水を検知し、水損失を削減し、リアルタイムの使用量データを提供するのに役立ちます。例えば、ドバイ電力・水道局(DEWA)は130万件以上の漏水を検知し、CO2排出量を21万8,373トン削減しました。毎日60億ガロン近くの処理水が失われている米国では、インフラへの投資が急増しています。

- 漏水検知:スマートメーターは迅速な特定と軽減を可能にする

- リアルタイムデータ:節水戦略の改善をサポート

- インフラ投資:大幅な改善が計画されている

- 需要の増加による無収水ロスの削減:無収水量(NRW)の損失は、財政的にも環境的にも、水道事業体にとって重大な課題です。スマートメーターは、正確な測定、漏水の検知、データ分析を可能にすることで役立っています。アジア開発銀行は、サービスの普及率を向上させ、増大する需要に対応するために、NRW削減の重要性を強調しています。例えば、マニラのメイニラッド社は、地区計量とスマート技術を利用して、NRWを30.31%まで削減する一方、サービス提供範囲を95%まで拡大しました。

- NRW削減:スマートメーターは水損失の定量化と削減に役立つ

- 地区メータリング:水損失の管理努力を改善

- 公益事業の成功:スマート技術によるNRW削減でオペレーションを強化

- デジタル化と業務効率化:スマート水道メーターは、水道使用量に関する正確で詳細な情報を提供するAMIシステムを通じて、水道事業のデジタル変革を推進しています。このデータにより、意思決定が改善され、収益が増加し、請求効率が向上します。サルデーニャのAbbanoa SpAとイトロンのコラボレーションは、スマートメーター技術が、超音波技術を使用して漏水を検出し、NRWを削減するのに役立つことを実証しています。

- AMIシステム:公益事業企業に実用的な洞察を提供

- リアルタイムモニタリング:迅速な漏水検知と問題解決が可能

- デジタルトランスフォーメーション:公益事業の運営と顧客サービスの向上

- 市場情勢と競合環境:スマート水道メーター市場は競争が激しく、Badger Meter、Honeywell、Itronのような既存参入企業と、IoT技術を活用するWaterGroupのような新興参入企業が存在します。技術・プロバイダーと公益事業者のパートナーシップの強化により、各地域でカスタマイズ型ソリューションの採用が加速しています。

- 既存参入企業包括的ソリューションでイノベーションを推進

- 技術パートナーシップ:スマートメーターの世界の普及を加速

- 多様な製品:多様な公益事業ニーズに対応

水不足と効率的な資源管理の重要性が高まるにつれ、スマート水道メーター市場はさらに拡大する構えです。先進的通信プロトコルとデータ分析の統合により、スマート水道メーターの役割が強化され、将来の水管理における地位が確固たるものになると考えられます。

スマート水道メーター市場動向

住宅用途セグメントが大きな市場シェアを占めると予想される

- 市場の優位性と成長軌道:自動検針(AMR)技術セグメントがスマート水道メーター市場で最大の市場シェアを占め、2022年には市場全体の63.95%を占めます。AMR技術の出荷台数は2028年までに3,273万台に達し、2023~2028年のCAGRは5.04%で成長すると予測されます。

- AMR市場シェア:スマート水道メーター産業ではAMRが優位を保つ。

- CAGR予測:このセグメントはCAGR 5.04%で安定成長すると予測されます。

- コスト効率:AMRは公益事業企業の運用コストを削減し、効率を高めています。

- 技術的優位性が採用を促進:AMR技術により、公益事業企業はメーターに物理的にアクセスすることなく検針値を収集できるため、運用コストを削減し、効率を向上させることができます。この技術は、より頻繁で正確な検針を可能にし、より良い水管理と無収水ロスの削減につながります。

- 遠隔検針:AMRにより、公益事業企業はメーターデータを遠隔地から収集することができます。

- 運営上の利点:人件費と輸送費の削減による効率の向上。

- 水管理:頻繁な検針により、水資源の管理が向上

- 先進的ソリューションへの移行AMRが依然として主流である一方、市場はより先進的ソリューションへと徐々に移行しています。先進計測インフラ(AMI)セグメントは、規模こそ小さいもの、CAGR 18.27%とはるかに速いペースで成長しており、より先進的スマート水道計測システムへの動向を示しています。

- AMIの成長:AMI技術はCAGR 18.27%で成長しています。

- 先進的機能:AMIはより詳細なデータとリアルタイムのモニタリング機能を記載しています。

- 技術の進化:AMIへのシフトは、リアルタイムデータに対する需要の高まりを表しています。

- 産業の開発と導入:さまざまな地域の公益事業者が、従来の水道メーターシステムをAMR技術にアップグレードしています。例えば、2023年1月、スウィートウォーター市は、5ヶ月間で約4,500台の超音波スマート水道メーターを家庭や企業に設置する計画を発表しました。

- 新たな展開スウィートウォーターの2023年のスマート水道メーター設置は、地域的な導入の例となります。

- 時間単位のデータ:消費者は、詳細でリアルタイムの水使用量に関する洞察を得ることができます。

- 漏水警告:自動漏水警告は節水を向上させ、水の損失を減らします。

- 市場促進要因と将来展望:節水ニーズの高まりと、多くの地域における水道インフラの老朽化が、AMR技術の採用を促進しています。例えば米国では、220万人が水道と基本的な屋内配管を欠き、4,400万人以上が不十分な水道設備を持つなど、水管理が大きな課題となっています。こうした要因により、今後数年間はAMR技術の需要が維持されると予想されます。

- 節水:水不足の深刻化は、AMR技術導入の主要な促進要因です。

- インフラの課題:水道システムの老朽化が、公益事業者にスマートソリューションの採用を促しています。

- 将来の需要:水に関する課題が続いているため、AMR技術の需要は引き続き堅調に推移すると予想されます。

欧州は大幅な成長が見込まれる

- 市場の成長と予測:欧州はスマート水道メーター市場で最も急成長している地域セグメントであり、出荷台数は2022年の1,066万台から2028年には2,101万台に増加し、予測期間中のCAGRは12.02%になると予測されます。

- 地域拡大:2023~2028年のCAGRは12.02%で欧州がリードしています。

- 旺盛な需要:水不足への懸念と規制圧力が同地域の需要を牽引。

- 出荷の伸び:欧州の出荷量は2028年までにほぼ倍増します。

- 地域成長の原動力:欧州の急成長は、厳しい節水規制、水インフラの老朽化、水不足問題に対する意識の高まりなど、いくつかの要因に起因しています。欧州連合(EU)の水管理と持続可能性に関する施策が、公益事業企業にスマート水計測ソリューションの採用を促しています。

- 規制の後押し:EUの節水施策が採用を加速

- システムの老朽化:欧州の公益企業は、老朽化したインフラに対するソリューションを求めています。

- 持続可能性:持続可能性に重点を置くこの地域では、スマート水道メーターが推進されています。

- 技術の進歩と革新:欧州の企業は、スマート水道メーター技術開発の最前線にいます。例えば、デンマークのKamstrupは、高精度で長期安定した水計測を実現するflowIQシリーズなど、さまざまなスマート水道メーターソリューションを提供しています。

- イノベーション・リーダー:カムストロップをはじめとする欧州の企業は、技術開発をリードしています。

- 高精度ツール:flowIQシリーズは、高精度の水道メーターソリューションを提供しています。

- 持続可能性の重視:長期的な安定性と節水が特徴です。

- 市場での取り組みとコラボレーション欧州各地の政府と公益事業会社は、水インフラの近代化に向けたイニシアチブを開始しています。2023年6月、英国の水道規制当局Ofwatは、2025年末までに46万2,000台のスマートメーターを設置することを目標に、7つのスマート水道メーター計画の展開を加速する22億ポンド(29億3,000万米ドル)の計画を承認しました。

- 規制による支援Ofwatの22億ポンド(29億3,000万米ドル)計画は、英国におけるスマートメーターの導入を加速します。

- 広範な展開:2025年までに、英国で46万2,000台のスマートメーターが設置されます。

- インフラの近代化これらのイニシアチブは水道インフラの近代化を目標としています。

スマート水道メーター市場概要

世界参入企業が連結市場を独占

主要企業は技術と規模を活用:Honeywell、Itron、Landis+Gyrなどの世界参入企業は、大規模な事業と広範な製品ポートフォリオを活用して市場をリードしています。例えば、Honeywellは9万7,000人の従業員を抱え、AMI用の次世代セルラー・モジュール(NXCM)で技術革新を続けています。これらの参入企業は、優位性を維持するために、技術の進歩と戦略的パートナーシップに重点を置いています。

大規模事業:市場リーダーは規模とリーチによって優位に立つ

技術重視:リーダーシップ維持の鍵は技術革新

製品ポートフォリオ:包括的な製品提供により市場での地位を強化

市場成功のための戦略:成功する戦略には、IoT、AI、長寿命バッテリーシステムへの投資が含まれます。Xylemのような企業は、Hidden Revenue Locatorのような革新的なソリューションに注力しています。SensusとLarsen & Toubroとの協業のようなパートナーシップは、インフラの課題に取り組む上で極めて重要です。

イノベーションの焦点:IoTとAIが製品開発を推進

マネージドサービス:公益企業の業務効率化をサポート

戦略的提携:市場拡大とソリューション提供を推進

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

- 産業バリューチェーン分析

- スマート水道メーターのタイプ別技術スナップショット

- スマートメーターのROI分析

- 主要使用プロトコルとその比較

- LoraWAN導入のステップ/主要使用事例/長期的な影響

- スマートメーターの実装により公益事業者が達成した利点/デジタル化

第5章 市場力学

- 市場促進要因

- 政府による支援規制

- 水道使用量と効率の改善ニーズ

- 無収水量ロスの削減需要の増加

- 市場抑制要因

- 高コストとセキュリティへの懸念

- スマートメーターとの統合の難しさ

- 事業者の切り替えコスト

第6章 市場セグメンテーション

- 技術別

- 自動検針

- 高度計測インフラ

- 用途別

- 住宅用

- 商業

- 産業用

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Watertech S.P.A(Arad Group)

- Mom Zrt

- Apator SA

- Arad Group

- Axioma Metering

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Honeywell International Inc.

- Suntront tech Co., Ltd.

- Maddalena SPA

- WavIoT

- Itron Inc.

- BETAR Company

- Kamstrup A/S

- Landis+GYR Group AG

- Integra Metering AG

- G. Gioanola Srl

- Sensus Usa Inc.(Xylem Inc.)

- Zenner International Gmbh & Co. KG

第8章 投資分析

第9章 市場機会と今後の動向

The Smart Water Meter Market size in terms of shipment volume is expected to grow from 51.96 million units in 2025 to 87.60 million units by 2030, at a CAGR of 11.01% during the forecast period (2025-2030).

Smart Water Meter Market: Driving Efficiency and Conservation

Key Highlights

- Supportive Government Regulations Accelerate Adoption: Government initiatives and regulations are significantly advancing the smart water meter market. Utilities and municipalities are benefiting from substantial funding aimed at replacing traditional meters with smart alternatives. For instance, West Memphis received a USD 2.85 million grant to install over 9,000 smart meters, while San Jose Water secured approval for a USD 100 million investment in Advanced Metering Infrastructure (AMI). These efforts focus on enhancing customer service, reducing greenhouse gas emissions, and promoting water conservation.

- Government funding: Enables large-scale smart meter installations

- Regulatory support: Allows utilities to invest in AMI technology

- Environmental goals: Align with sustainability and conservation efforts

- Need for Improvement in Water Utility Usage and Efficiency: Water utilities are under increasing pressure to improve efficiency and address aging infrastructure. Smart water meters help utilities detect leaks, reduce water loss, and provide real-time usage data. For example, Dubai Electricity and Water Authority (DEWA) detected over 1.3 million leaks, leading to a reduction in CO2 emissions by 218,373 tons. In the U.S., where nearly 6 billion gallons of treated water are lost daily, investments in infrastructure are ramping up.

- Leak detection: Smart meters allow prompt identification and mitigation

- Real-time data: Supports improved water conservation strategies

- Infrastructure investment: Significant improvements are being planned

- Increasing Demand to Reduce Non-revenue Water Losses: Non-revenue water (NRW) losses represent a critical challenge for water utilities, both financially and environmentally. Smart meters help by providing accurate measurements, detecting leaks, and enabling data analysis. The Asian Development Bank highlights the importance of NRW reduction to improve service coverage and meet growing demand. For instance, Maynilad in Manila has reduced NRW to 30.31% while expanding service coverage to 95% using district metering and smart technology.

- NRW reduction: Smart meters help quantify and reduce water losses

- District metering: Improves water loss management efforts

- Utility success: NRW reduction through smart technology enhances operations

- Digitalization and Operational Efficiency: Smart water meters are driving the digital transformation of water utilities through AMI systems, which provide accurate, detailed information on water usage. This data improves decision-making, increases revenue, and enhances billing efficiency. Itron's collaboration with Abbanoa SpA in Sardinia demonstrates how smart metering technology can help detect leaks and reduce NRW using ultrasound technology.

- AMI systems: Offer actionable insights for utilities

- Real-time monitoring: Enables rapid leak detection and issue resolution

- Digital transformation: Improves utility operations and customer service

- Market Landscape and Competitive Environment: The smart water meter market is highly competitive, featuring established players like Badger Meter, Honeywell, and Itron, along with emerging startups such as WaterGroup, which leverage IoT technologies. Increased partnerships between technology providers and utilities are accelerating the adoption of tailored solutions across regions.

- Established players: Drive innovation through comprehensive solutions

- Tech partnerships: Accelerate smart meter adoption globally

- Diverse offerings: Cater to a variety of utility needs

As water scarcity and efficient resource management grow in importance, the smart water meter market is poised for further expansion. The integration of advanced communication protocols and data analytics will enhance the role of smart water meters, solidifying their place in the future of water management.

Smart Water Meter Market Trends

Residential Application Segment is Expected Hold Significant Market Share

- Market dominance and growth trajectory: The Automatic Meter Reading (AMR) technology segment holds the largest market share in the Smart Water Meter Market, accounting for 63.95% of the total market in 2022. AMR technology shipments are projected to reach 32.73 million units by 2028, growing at a CAGR of 5.04% from 2023 to 2028.

- AMR market share: AMR remains dominant in the smart water meter industry.

- CAGR forecast: The segment is projected to grow steadily at 5.04% CAGR.

- Cost efficiency: AMR reduces operational costs for utilities, enhancing efficiency.

- Technological advantages driving adoption: AMR technology offers utilities the ability to collect meter readings without physical access to the meter, reducing operational costs and improving efficiency. This technology enables more frequent and accurate readings, leading to better water management and reduced non-revenue water losses.

- Remote readings: AMR allows utilities to collect meter data remotely.

- Operational benefits: Improved efficiency through reduced labor and transportation costs.

- Water management: Frequent readings enable better management of water resources.

- Transition to advanced solutions: While AMR remains dominant, the market is witnessing a gradual shift towards more advanced solutions. The Advanced Metering Infrastructure (AMI) segment, though smaller, is growing at a much faster rate of 18.27% CAGR, indicating a trend towards more sophisticated smart water metering systems.

- AMI growth: AMI technology is growing at 18.27% CAGR.

- Advanced features: AMI provides more detailed data and real-time monitoring capabilities.

- Technological evolution: The shift towards AMI represents the growing demand for real-time data.

- Industry developments and implementations: Utilities across various regions are upgrading their traditional water metering systems to AMR technology. For instance, in January 2023, the city of Sweetwater announced plans to install approximately 4,500 Ultrasonic Smart Water Meters in homes and businesses over a five-month period, allowing customers to view hourly water usage data and receive automatic leak alerts.

- New deployments: Sweetwater's 2023 smart water meter installation exemplifies regional adoption.

- Hourly data: Consumers benefit from detailed, real-time water usage insights.

- Leak alerts: Automatic leak alerts improve water conservation and reduce water loss.

- Market drivers and future outlook: The growing need for water conservation, coupled with the aging water infrastructure in many regions, is driving the adoption of AMR technology. The United States, for example, faces significant water management challenges, with 2.2 million people lacking running water and basic indoor plumbing, and over 44 million having inadequate water systems. These factors are expected to sustain the demand for AMR technology in the coming years.

- Water conservation: Rising water scarcity is a key driver for AMR technology adoption.

- Infrastructure challenges: Aging water systems push utilities to adopt smart solutions.

- Future demand: AMR technology demand is expected to remain strong due to ongoing water challenges.

Europe is Expected to Witness Significant Growth

- Market growth and projections: Europe represents the fastest-growing regional segment in the Smart Water Meter Market, with shipments expected to increase from 10.66 million units in 2022 to 21.01 million units by 2028, registering a CAGR of 12.02% during the forecast period.

- Regional expansion: Europe leads with a 12.02% CAGR from 2023 to 2028.

- Strong demand: Water scarcity concerns and regulatory pressures drive demand in the region.

- Shipment growth: European shipments are set to nearly double by 2028.

- Drivers of regional growth: The rapid growth in Europe can be attributed to several factors, including stringent water conservation regulations, aging water infrastructure, and increasing awareness of water scarcity issues. The European Union's policies on water management and sustainability are driving utilities to adopt smart water metering solutions.

- Regulatory push: EU water conservation policies accelerate adoption.

- Aging systems: European utilities seek solutions for aging infrastructure.

- Sustainability: The region's focus on sustainability promotes smart water metering.

- Technological advancements and innovations: European companies are at the forefront of smart water meter technology development. For instance, Kamstrup, a Danish company, offers a range of smart water metering solutions, including the flowIQ series, which provides high accuracy and long-term stability in water measurement.

- Innovation leaders: Kamstrup and other European firms lead in technology development.

- Precision tools: flowIQ series offers high-accuracy water metering solutions.

- Sustainability focus: Long-term stability and water conservation are core features.

- Market initiatives and collaborations: Governments and utilities across Europe are launching initiatives to modernize water infrastructure. In June 2023, Britain's water regulator, Ofwat, approved a GBP 2.2 billion (USD 2.93 billion) plan to accelerate the rollout of seven smart water meter schemes, aiming to install 462,000 smart meters by the end of 2025.

- Regulatory support: Ofwat's GBP 2.2 billion (USD 2.93 billion) plan accelerates smart meter adoption in the UK.

- Broad rollout: By 2025, 462,000 smart meters will be installed in the UK.

- Infrastructure modernization: These initiatives target water infrastructure modernization.

Smart Water Meter Market Overview

Global Players Dominate Consolidated Market

Top Players Leverage Technology and Scale: Global players such as Honeywell, Itron, and Landis+Gyr lead the market, capitalizing on their large-scale operations and extensive product portfolios. Honeywell, for example, employs 97,000 people and continues to innovate with its Next Generation Cellular Module (NXCM) for AMI. These players focus on technological advancements and strategic partnerships to maintain dominance.

Large-scale operations: Market leaders dominate through size and reach

Technological focus: Innovation is key for maintaining leadership

Product portfolios: Comprehensive offerings strengthen market position

Strategies for Market Success: Successful strategies include investing in IoT, AI, and long-life battery systems. Companies like Xylem are focusing on innovative solutions like the Hidden Revenue Locator. Partnerships, such as Sensus's collaboration with Larsen & Toubro, are crucial for addressing infrastructure challenges.

Innovation focus: IoT and AI drive product development

Managed services: Support operational efficiency for utilities

Strategic collaborations: Drive market expansion and solution delivery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot for types of Smart Water Meter

- 4.5 ROI Analysis for Smart Meters

- 4.6 Prominent Protocols Used and their Comparison

- 4.7 Steps Involved in Implementing LoraWAN/Prominent Use-cases/Long-term Implications

- 4.8 Advantages/Digitalization Achieved by Utilities by Smart Meter Implementations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations

- 5.1.2 Need for Improvement in Water Utility Usage and Efficiency

- 5.1.3 Increasing Demand to Reduce Non-revenue Water Losses

- 5.2 Market Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic Meter Reading

- 6.1.2 Advanced Metering Infrastructure

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Watertech S.P.A (Arad Group)

- 7.1.2 Mom Zrt

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Axioma Metering

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Honeywell International Inc.

- 7.1.9 Suntront tech Co., Ltd.

- 7.1.10 Maddalena SPA

- 7.1.11 Waviot

- 7.1.12 Itron Inc.

- 7.1.13 BETAR Company

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+GYR Group AG

- 7.1.16 Integra Metering AG

- 7.1.17 G. Gioanola Srl

- 7.1.18 Sensus Usa Inc. (Xylem Inc.)

- 7.1.19 Zenner International Gmbh & Co. KG