|

市場調査レポート

商品コード

1687803

世界のビデオ監視システム市場:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Global Video Surveillance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界のビデオ監視システム市場:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

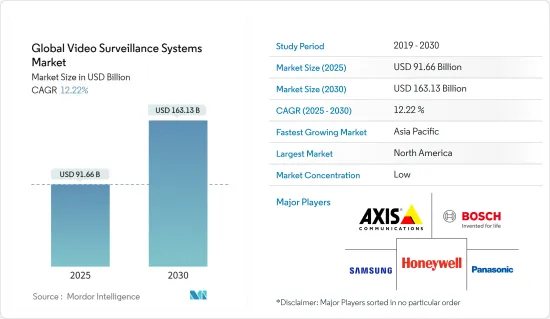

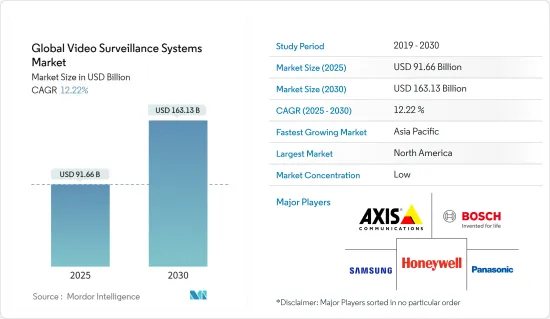

ビデオ監視システムの世界市場規模は、2025年に916億6,000万米ドルと推定され、2030年には1,631億3,000万米ドルに達すると予測され、予測期間中(2025年~2030年)のCAGRは12.22%です。

主なハイライト

- ビデオ監視市場は、新しいIPベースのデジタル技術の導入により成長すると見られています。これらの技術は、万引き、窃盗、破壊行為、テロ攻撃などの望ましくない行動を検知・防止するために設計されています。ビデオ監視は、製造、銀行、金融サービス、運輸、小売など、さまざまな業界で活用されています。これらの方法は、米国、英国、インド、中国、ブラジルなどの国々で広く利用されているが、その主な理由は、関係する産業の規模が大きいことと、消費者の意識が高いことです。

- また、潜在的な犯罪者を特定するためのビデオ分析と監視カメラの使用は、犯罪率を低下させ、統合監視システムの需要を増加させると予想されます。近年、サービスとしてのビデオ監視(VSaaS)の採用が大幅に進んでいます。この改善の背景には、IPカメラの市場浸透率の向上があります。また、VSaaSセグメントの成長は、大手IT企業によるコスト抑制、データセンターの出現、データの一元化に伴う機能性の向上など、いくつかの重要な要因にも支えられています。

- COVID-19の大流行時には、IPビデオ監視システムが複数の国でさまざまなセキュリティ目的に使用されました。これらの高度なカメラは、高性能なコンピューティング・パワーとビデオ解析機能を備えており、ユーザーはリアルタイムの画像を広範なデータ分析に変換することができました。列の管理、人数のカウント、群衆の検出、個人防護具の検出などのビデオ分析技術は、社会的距離を置く措置や規範を実施するために一般的に使用されました。

- COVID-19パンデミックの間、ウイルス感染のリスクを減らすため、遠隔患者監視への依存が高まりました。病院では、離れた場所から患者のバイタルサインを監視するために、室内ビデオカメラと統合遠隔測定システムが使用されました。その結果、患者と医療スタッフとの対面でのやり取りが大幅に減り、ウイルスの蔓延を抑えるのに役立ちました。

- アジア太平洋は、ビデオ監視市場で最も速い成長を示しました。これは主に、インドや中国のような国々がセキュリティと安全ソリューションにかなりの投資を行っているためです。この地域の各国政府は、公共の安全の重要性を認識し、重要な機能であると考えています。都市の絶え間ない成長に伴い、ビデオ監視は人口の動きを監視し、犯罪に対抗するためのますます重要なツールとなっています。

- しかし、ビデオ監視システムは人々のプライバシーを侵害するとして批判され、いくつかの市民的自由団体や活動家によって反対されています。人々は今、誰がビデオを見ているのか、そしてそれがどのように悪用される可能性があるのかをより心配しています。人々は、自分の個人情報が合法的かつ特定の目的にのみ使用されることを期待しており、そのため、このようなシステムの使用に関する懸念が高まっています。

ビデオ監視システムの市場動向

インフラセグメントが大幅な成長を記録する見込み

- インフラ分野には、道路、鉄道、空港、スタジアムなどが含まれます。業界における技術の進歩により、低照度領域で動作するように設計された暗視カメラが開発されています。インフラ分野、特に道路では、交通を監視し、不審な行動を追跡するために暗視カメラが必要です。これらの要因により、インフラ分野でのビデオ監視システムの需要が高まると予想されます。

- 近年、空港でのテロ攻撃や侵入が増加しています。このため、空港運営者にとっては、不正アクセスを防止し、不審な活動を早期に発見することが急務となっています。その結果、セキュリティ・ソフトウェアに対する需要が増加しています。

- ビデオ監視は、スタジアムのセキュリティ・システムの重要な側面のひとつです。例えば、セキュリティ脆弱性データベースであるCVE Detailsによると、2024年の第1週に、世界中のインターネット・ユーザーが新たに612件の一般的なITセキュリティの脆弱性と暴露を発見しました。年間では2023年の2,906万5,000件が最高でした。CVE Detailsは、エクスプロイト、アドバイザリ、製品、CVEリスクスコアに関する情報を提供する脆弱性インテリジェンス・ソリューションを提供しています。警備員の中には、ウェアラブル・カメラを装備してリアルタイムで現場を監視する者も出てくると予想されます。

- 交通運輸省(DOT)は、プロジェクトの監視、安全性の向上、コスト超過の最小化のために現場カメラの利用を拡大しています。

- さらに、スマートカメラと関連する各種センサーの開発により、インバンド分析へのシフトが進んでいます。これがSaaSの強固な基盤となっています。

中国が市場を独占する見込み

- アジア太平洋市場は、セキュリティや法執行の分野でビデオ監視カメラの利用が増加したため、大幅な成長を遂げました。これは主にインドや中国のような国の犯罪率を減らすことを目的としています。中国では、政府出資のカメラが主に公共スペースに設置され、広範なビデオ監視範囲を提供しています。

- 中国におけるスマートシティの導入は、ビデオ監視市場の大きな原動力となりました。先進的なビデオ監視システムが市政に組み込まれ、効率化が図られています。中国の銀川市は、バスからゴミ箱まであらゆるものが統一システムに組み込まれた先進的なスマートシティの一例です。

- 中国の小売・テクノロジー大手アリババが開発した杭州市の「シティ・ブレイン」プロジェクトは、ビデオ監視を交通管理に活用した先駆者のひとつです。このプロジェクトでは、街中にカメラシステムとセンサーを設置し、道路状況のデータをリアルタイムで収集します。このデータはAI対応ハブによって処理され、128の交差点における交通信号の最適化を支援し、市職員がより迅速で情報に基づいた決定を下すのを助ける。

- 中国は、全国の防犯カメラを個人の顔認識プロファイルと個人情報を含む中央データベースにリンクさせるシステムの構築に大きく前進していると報じられています。サウスチャイナ・モーニング・ポスト紙に掲載された記事は、プライバシーや政府の監視に対する懸念など、このようなシステムの潜在的な危険性について議論を巻き起こしました。人々はシステムの導入と、それが国民にどのような影響を与えるかを懸念していました。

- 中国は、ZTE、ファーウェイ、Hikvision、Dahuaのような有名メーカーを抱え、63カ国以上に監視技術を提供しているため、AIを搭載した監視技術において世界的に大きな影響力を持っています。これらの国のうち、32カ国が中国の「一帯一路」構想にすでに署名しており、同地域のビデオ監視需要がさらに拡大しています。

ビデオ監視システム業界の概要

ビデオ監視市場は、複数の大手企業が競争に勝ち残るために常にアップグレードを続けているため、激しい競争が繰り広げられています。市場の主要企業には、Honeywell Security Group、Bosch Security Systems Incorporated、Samsung Group、Schneider Electric SE、Panasonic Corporationなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- 産業バリューチェーン分析

- 技術スナップショット

- COVID-19の市場への影響

第5章 市場力学

- 市場力学のイントロダクション

- 市場促進要因

- IPカメラの需要拡大

- ビデオ監視サービス(VSAAS)の登場

- ビデオ解析の需要増加

- 市場抑制要因

- 高解像度画像用の大容量ストレージの必要性

- プライバシーとセキュリティの問題

- 市場促進要因

第6章 市場セグメンテーション

- タイプ別

- ハードウェア

- カメラ

- アナログカメラ

- IPカメラ

- ハイブリッド

- ストレージ

- ソフトウェア

- ビデオ解析

- ビデオ管理ソフトウェア

- サービス(VSaaS)

- ハードウェア

- 業界別

- 商業

- インフラ

- インスティテューショナル

- 産業

- 防衛

- 住宅

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他の中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Axis Communications AB

- Bosch Security Systems Incorporated

- Honeywell Security Group

- Samsung Group

- Panasonic Corporation

- FLIR systems Inc.

- Schneider Electric SE

- Qognify, Inc.(Battery Ventures)

- Infinova Corporation

- Zhejiang Dahua Technology Company Limited

- Hangzhou Hikvision Digital Technology Company Limited

- Sony Corporation

第8章 投資分析

第9章 市場の将来

The Global Video Surveillance Systems Market size is estimated at USD 91.66 billion in 2025, and is expected to reach USD 163.13 billion by 2030, at a CAGR of 12.22% during the forecast period (2025-2030).

Key Highlights

- The video surveillance market is set to experience growth due to the introduction of new IP-based digital technologies. These technologies are designed to detect and prevent undesirable behaviors such as shoplifting, theft, vandalism, and terror attacks. Video surveillance is utilized in various industries, including manufacturing, banking, financial services, transportation, and retail. These methods are widely used in countries such as the United States, the United Kingdom, India, China, and Brazil, owing primarily to the larger scale of the industries involved and greater consumer awareness.

- Also, the use of video analytics and surveillance cameras to identify potential offenders is expected to reduce crime rates and increase demand for integrated surveillance systems. In recent years, the adoption of video surveillance as a service (VSaaS) has greatly improved. This improvement can be attributed to the increased market penetration of IP cameras. The growth of the VSaaS segment is also being aided by several significant factors, such as cost containment by major IT organizations, the emergence of data centers, and improved functionalities associated with centralized data.

- During the COVID-19 pandemic, IP video surveillance systems were used for various security purposes across multiple countries. These advanced cameras had high-performance computing power and video analytics that allowed users to convert real-time images into extensive data analysis. Video analytic techniques such as queue management, people counting, crowd detection, and personal protective equipment detection were commonly used to enforce social distancing measures and norms.

- During the COVID-19 pandemic, the reliance on remote patient monitoring increased to reduce the risk of transmitting the virus. In-room video cameras and integrated telemetry systems were used in hospitals to monitor patient vital signs from a distance. This resulted in a significant reduction in face-to-face interactions between patients and medical staff, helping to limit the spread of the virus.

- Asia-Pacific witnessed the fastest growth in the video surveillance market, primarily due to the considerable investments in security and safety solutions by countries like India and China. Governments across the region recognize the importance of public safety and consider it a crucial function. With the constant growth of cities, video surveillance has become an increasingly important tool for monitoring population movement and combating crime.

- However, video surveillance systems have been criticized for violating people's privacy and are opposed by several civil liberties organizations and activists. People are now more worried about who watches the video and how it might be misused. They expect their personal information to be used only for legitimate and specific purposes, which has led to increased concerns regarding using such systems.

Video Surveillance Systems Market Trends

The Infrastructure Segment is Expected to Register Significant Growth

- The infrastructure segment encompasses roads, rail, airports, stadiums, etc. Technological advancements in the industry have led to the development of night vision cameras that are designed to work in low-lit areas. Infrastructure segments, particularly roads, need night-vision cameras to monitor traffic and keep track of suspicious activities. These factors are anticipated to propel the demand for video surveillance systems in the infrastructure segment.

- In recent years, there has been a rise in terrorist attacks and intrusions at airports. This has led to an urgent need for airport operators to prevent unauthorized access and detect suspicious activities at an early stage. As a result, there has been an increase in demand for security software.

- Video surveillance is one of the crucial aspects of stadium security systems since manual monitoring of individual entrants becomes difficult during large gatherings. For instance, according to CVE Details, a security vulnerability database, in the first week of 2024, internet users worldwide discovered 612 new common IT security vulnerabilities and exposures. The highest annual figure of 29,065 thousand was recorded in 2023. CVE Details provides a vulnerability intelligence solution that offers information on exploits, advisories, products, and CVE risk scores. Some of the security guards are expected to be equipped with wearable cameras to monitor scenes in real time.

- Departments of transportation (DOTs) are expanding their use of job site cameras to monitor their projects, improve safety, and minimize cost overruns as demand mounts on the infrastructure business to keep up with other sectors in terms of productivity.

- Further, with the development of smart cameras and various associated sensors, there has been a shift toward more in-band analytics. This has laid down a strong foundation for SaaS.

China is Expected to Dominate the Market

- The Asia-Pacific market experienced substantial growth due to the increased usage of video surveillance cameras in the field of security and law enforcement. This was primarily aimed at reducing the crime rate in countries like India and China. In China, government-funded cameras are mainly placed in public spaces to provide widespread video surveillance coverage.

- The implementation of smart cities in China was a major driving force for the video surveillance market. Advanced video surveillance systems have been integrated into city administration to improve efficiency. Yinchuan, a city in China, is an example of an advanced smart city where everything, from buses to trash cans, is incorporated into a unified system.

- The "City Brain" project in Hangzhou, developed by the Chinese retail and technology giant Alibaba, was among the pioneers in utilizing video surveillance for traffic management. The project involves the installation of camera systems and sensors throughout the city, which collect real-time data on road conditions. This data is then processed by an AI-enabled hub, which helps optimize traffic signals at 128 intersections and assists city officials in making faster and more informed decisions.

- China is reportedly making significant strides in creating a system that would link security cameras throughout the country to a central database containing individuals' facial recognition profiles and personal information. An article in the South China Morning Post sparked a debate on the potential dangers of such a system, including concerns about privacy and government surveillance. People were concerned about the implantation of the system and what implications it would have for the population.

- China is a significant global influencer in AI-powered surveillance technology as it harbors renowned manufacturers like ZTE, Huawei, Hikvision, and Dahua, who offer their surveillance technology to over 63 countries. Among these countries, 32 have already signed on to China's Belt and Road Initiative, which is further expanding the demand for video surveillance in the region.

Video Surveillance Systems Industry Overview

The video surveillance market is fiercely competitive due to several major players constantly upgrading to stay ahead of the competition. Some of the leading companies in the market include Honeywell Security Group, Bosch Security Systems Incorporated, Samsung Group, Schneider Electric SE, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.1.1 Market Drivers

- 5.1.1.1 Augmented Demand of IP Cameras

- 5.1.1.2 Emergence Of Video Surveillance-as-a-Service (VSAAS)

- 5.1.1.3 Increasing Demand For Video Analytics

- 5.1.2 Market Restraints

- 5.1.2.1 Need for High-capacity Storage for High-resolution Images

- 5.1.2.2 Privacy and Security Issues

- 5.1.1 Market Drivers

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Camera

- 6.1.1.1.1 Analog

- 6.1.1.1.2 IP Cameras

- 6.1.1.1.3 Hybrid

- 6.1.1.2 Storage

- 6.1.2 Software

- 6.1.2.1 Video Analytics

- 6.1.2.2 Video Management Software

- 6.1.3 Services (VSaaS)

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Commercial

- 6.2.2 Infrastructure

- 6.2.3 Institutional

- 6.2.4 Industrial

- 6.2.5 Defense

- 6.2.6 Residential

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Axis Communications AB

- 7.1.2 Bosch Security Systems Incorporated

- 7.1.3 Honeywell Security Group

- 7.1.4 Samsung Group

- 7.1.5 Panasonic Corporation

- 7.1.6 FLIR systems Inc.

- 7.1.7 Schneider Electric SE

- 7.1.8 Qognify, Inc. (Battery Ventures)

- 7.1.9 Infinova Corporation

- 7.1.10 Zhejiang Dahua Technology Company Limited

- 7.1.11 Hangzhou Hikvision Digital Technology Company Limited

- 7.1.12 Sony Corporation