|

市場調査レポート

商品コード

1850064

小口径弾薬:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Small Caliber Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小口径弾薬:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月26日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

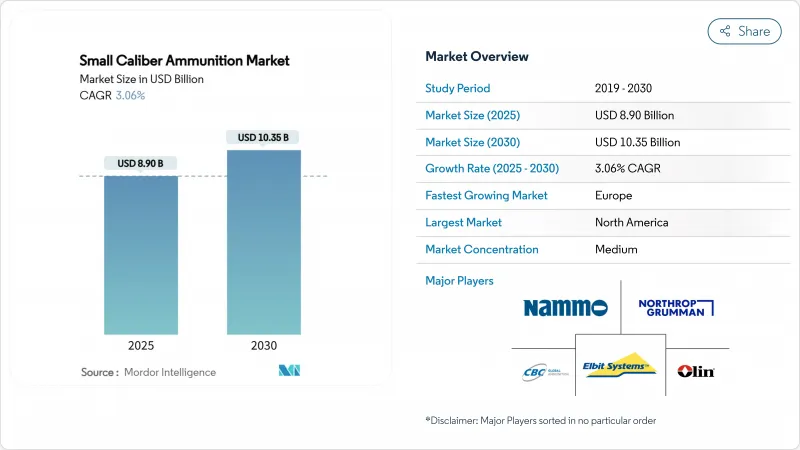

小口径弾薬の市場規模は2025年に89億米ドルとなり、2030年にはCAGR 3.06%で103億5,000万米ドルに達すると予測されています。

現在の成長は、着実な国防調達、民間射撃基盤の増加、米国陸軍が5.56mm弾薬から6.8mm弾薬への移行を決定したことによる。この移行は、すでにNATOパートナーや世界のサプライチェーンに影響を及ぼしています。目先の需要は、北米と欧州の弾薬予算の増加によって下支えされるが、アジア太平洋地域の需要は、インドや他の地域の軍隊が自給自足を目指す中で最も急速に増加します。民間消費は、米国における狩猟や標的射撃の持続的な参加によって底堅さを維持しています。しかし、ニトロセルロースとアンチモンに対する中国の輸出規制以降、生産は原材料不足に直面しており、欧米のメーカーには調達先を多様化するよう圧力がかかっています。環境政策も構造的な原動力となっており、生産者を無鉛弾やポリマーケースへと向かわせる。

世界の小口径弾薬市場の動向と洞察

国防予算の伸びが運用・訓練用弾丸の需要を持続的に促進

世界的な国防費の増加は、戦闘・訓練用弾薬の需要を持続させています。米国国防総省は2025会計年度に298億米ドルを軍需品に充当しており、このうち59億米ドルは特に弾薬購入に割り当てられています。欧州の多くの政府は、ウクライナ紛争からの教訓を受けて、2021年以降、生産能力を拡大するために新たに55億ユーロ(63億8,000万米ドル)の資金を追加しました。現在、軍事調達は複数年契約が主流となっており、生産者は自信を持って設備投資を計画することができます。中東では、サウジアラビアによる1,000億米ドルの武器パッケージが、地域の緊張が従来のNATOの顧客からいかに需要を多様化させているかを明確に示しています。

民間人の銃器保有率の上昇とスポーツへの関心が市販弾薬の売上を維持

レクリエーションと狩猟活動が民間チャネルを活気づけています。全国即時犯罪歴調査システムは、4年以上連続して毎月100万件以上のチェックを処理しており、これは一貫した銃器取得と弾薬消費の根底にあることを示しています。メーカー各社は、ショット・ショーなどの見本市で新しいプレミアム・ラインを展示する一方、野生生物保護区での鉛フリー弾を奨励する規制パイロットは、適合した生産者に新たな機会を提供しています。人口密集地での屋内射撃場の増加も、狭い場所での射撃用に設計された弾薬の安定した需要を生み出しています。

銃器・弾薬の輸出規制強化で国際貿易の流れが制限される

国家安全保障に関する審査は、買収のスケジュールを長期化させ、国境を越えた統合を制約しています。米国当局はサプライチェーンのリスクについてすべての主要な取引を精査し、欧州の許認可機関も同様の厳格さを適用しています。こうした規制は国内生産者を保護する一方で、輸出企業の海外進出を制限し、競争を自国市場の大きなプレーヤーに傾ける。

セグメント分析

5.56mmの小口径弾薬市場規模は、2024年の世界売上高の26.76%に達し、在庫とレガシー兵器システムの普及により依然として大きいです。しかし、6.8mmカートリッジは、米国と同盟国の軍隊が新型小銃を配備するのに伴い、2030年までCAGR 7.89%で拡大します。この成長層は、旧口径の調達先細りを補うものです。予測期間中、多くのNATO加盟国は5.56 mmと6.8 mmの弾薬を二重調達し、急激な物流シフトを緩和します。

シグ・ザウアーのハイブリッド・ケース・デザインは、6.8mmが将来の殺傷力の中心である理由を示しています。北欧の試験プログラムと英国陸軍の口径評価は、次世代弾道に対する幅広い関心を示しています。従って、この分野は、レガシー維持ラインと将来性ラインに分かれ、柔軟な生産者に豊富な需要を生み出しています。

ライフル弾薬は2024年の世界売上高の32.77%を占め、歩兵の作戦や精密なスポーツ射撃に不可欠な存在であり続けています。それでも、小口径弾薬市場では、サブマシンガンに使用されるコンパクト弾の注文が増加しており、2030年までのCAGRは5.12%と予測されています。都市部の対テロ任務や警察部隊は、これらのプラットフォームが提供する短い銃身と敏捷性を高く評価しています。

インドがアスミ・マシン・ピストルを採用したことは、殺傷力を維持したまま、より軽量な武器でライフルを補おうという軍の動向を示しています。弾薬会社は、短い銃身に合わせて燃焼速度を最適化したカートリッジを設計し、信頼性の高いサイクルと終末エネルギーを確保することで対応しています。

地域分析

北米は、米国の8,498億米ドルの国防予算と活気ある民間射撃文化に支えられ、2024年の売上高シェア29.89%で首位に立ちました。レイクシティ陸軍弾薬工場だけで米軍の小口径銃の需要の約85%を供給しており、同時に市販の余剰弾薬を市場に販売しています。無鉛狩猟を推進する連邦政府および州政府のプログラムにより、製品の多様性は高く保たれ、地元の生産者は研究開発資金を無毒性処方に振り向けざるを得ないです。

アジア太平洋地域は、2030年までのCAGRが4.90%と、最も速い軌道を示しています。インドのAtmanirbhar Bharat政策により、国産弾薬ラインへの大幅な投資が行われ、従来のサプライヤーからの調達の遅れが、ニューデリーにベンダー基盤の拡大を促しています。南シナ海と東シナ海における地域紛争は、各国が備蓄を拡大する動機付けとなっています。例えば韓国は、世界最大級の105ミリ弾の在庫を維持し、パートナー国に弾薬を提供する意欲を示しています。

ウクライナ紛争で供給不足が露呈した欧州は、産業基盤の再編を進めています。ラインメタル社は砲弾の年間生産量を一桁増やし、9カ国のSAATイニシアチブは相互運用性を確保するために弾薬規格の調和を求めています。同時に、欧州化学物質庁の鉛規制ロードマップは、欧州のメーカーに銅ベースの弾丸の製造ラインの改修を強要しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 国防予算の増加が、作戦および訓練弾の持続的な需要を刺激している

- 民間の弾薬所有とスポーツへの関心の高まりが商業弾薬の販売を支えている

- 高性能口径を基盤とした軍用弾薬の近代化

- 環境規制により鉛フリー弾薬への移行が加速

- 軽量ポリマーとハイブリッドケーシングが多国間の試験を推進

- シミュレーションと屋内トレーニングの需要が専門ラウンドを促進

- 市場抑制要因

- 銃器と弾薬の輸出規制強化により国際貿易の流れが制限される

- サプライチェーンの混乱がプライマーと推進剤の供給に影響を及ぼしている

- 銅とアンチモンの原材料費の上昇により製造費が膨らんでいる

- 防衛は指向性エネルギー兵器と無人システムの殺傷力に徐々に移行し、長期的な需要が減少する

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- キャリバー

- 5.56ミリメートル

- 6.8ミリメートル

- 7.62ミリメートル

- 9ミリメートル

- 12.7ミリメートル

- その他の口径

- 武器プラットフォーム別

- 拳銃

- ライフル

- 軽機関銃(LMG)

- サブマシンガン(SMG)

- ショットガン

- 弾丸の種類別

- 真鍮

- 銅

- 鋼鉄

- その他

- 致死性によって

- 致死性が低い

- 致死

- 最終用途別

- 軍隊

- 国土安全保障

- 民間人

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- Olin Corporation

- CBC Global Ammunition

- Nammo AS

- BAE Systems plc

- Beretta Holding S.A.

- Hornady Manufacturing, Inc.

- Fiocchi Munizioni S.p.A.

- Denel SOC Ltd.

- MESKO S.A.

- PT Pindad

- SIG SAUER, Inc.

- FN HERSTAL(FN Browning Group)

- Sellier & Bellot a.s.(Colt CZ Group SE)

- Barnaul Ammunition

- Prvi Partizan A.D.

- Rheinmetall AG