|

|

市場調査レポート

商品コード

1719535

小口径弾薬市場- 世界および地域別分析:用途別、弾薬タイプ別、口径別、弾丸タイプ別、銃タイプ別、地域別 - 分析と予測(2025年~2035年)Small Caliber Ammunition Market - A Global and Regional Analysis: Focus on Application, Ammunition Type, Caliber, Bullet Type, Gun Type, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 小口径弾薬市場- 世界および地域別分析:用途別、弾薬タイプ別、口径別、弾丸タイプ別、銃タイプ別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年05月08日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

小口径弾薬市場は、防衛、法執行、民間市場にとって不可欠であり、ダイナミックで急速に開発されている産業です。

ピストル、ライフル、サブマシンガンで頻繁に使用される小口径弾薬は、直径0.50インチ(12.7mm)以下のカートリッジと定義されます。この市場は、個人の保護と安全、軍の近代化構想、レクリエーションの射撃や狩猟活動に対する需要の増加によって活性化されています。プレミアム小口径弾薬市場は、より高い精度、より少ない反動、改良された終端弾道などの武器技術の開発によってさらに活性化しています。同市場は、主要参入企業間の熾烈な競争、継続的な技術革新、コンプライアンスと安全性を保証する厳格な規則によって特徴付けられています。

小口径弾薬市場のルーツは、銃器技術の向上により、より効率的で小型の武器が誕生した19世紀にあります。弾薬の保管と再装填にシンプルで信頼できる方法を導入することで、.22リムファイアのような金属カートリッジは業界を一変させました。小口径弾薬は、20世紀の間、両世界大戦、その他の軍事活動や国際的な法執行活動に不可欠でした。小口径弾薬の性能と適応性は、推進剤科学、弾丸設計、製造技術の開発の結果、時代を通じて向上し、護身用、標的射撃用、狩猟用など様々な用途に適するようになっています。

小口径弾薬市場は現在大きく拡大し、進化しています。小口径弾薬の継続的な需要の高さには、個人の安全やセキュリティに対する関心の高まり、軍事費の増加、射撃スポーツやレジャー活動への関心の拡大など、多くの変数が関係しています。市場はまた、精度を高め、末端性能を向上させ、環境への影響を小さくすることを目的とした技術開発も見ています。メーカー各社は、絶えず変化する最終消費者の要求を満たす最先端のソリューションを生み出すため、研究開発に投資しています。

この分野における小口径弾薬製品と技術の進歩は、世界市場に好影響を与えると予想されます。いくつかの組織や政府機関は、世界の小口径弾薬市場に新しい技術を導入しようと取り組んでいます。異なる口径などの小口径弾薬製品と比較すると、7.62mm口径の需要が際立っています。

近年、小口径弾薬市場は防衛産業からの需要の急激な急増を記録しており、軍や法執行機関への需要が高いです。さらに、地政学的な紛争や緊張の高まり、軍事近代化プログラムのため、小口径弾薬市場は過去数年間で大幅に成長しています。例えば、2023年2月、Winchester Ammunitionは米国陸軍と、500万個の6.8mm次世代分隊兵器(NGSW)カートリッジを製造、試験、納入する契約を締結しました。

軍事分野は、世界中の軍隊で重要な役割を担っているため、小口径弾薬市場の主要な消費者です。軍は多くの理由で小口径弾薬に広く依存しています。まず、小口径弾薬は機動性と殺傷力のバランスが取れており、単独部隊や小規模部隊の使用に最適です。小口径の武器や弾薬は軽量でコンパクトに設計されているため、兵士は機動性を損なうことなく、大量の弾薬を携行することができます。例えば、M16やそのバリエーションなどのライフルで使用される5.56mm NATO弾は軽量で反動が少ないため、兵士は素早く効果的に標的を攻撃できます。

さらに、小口径弾薬はさまざまな軍事活動や任務特性に適応できます。徹甲弾、トレーサー弾、無傷弾など多くの弾種が利用できるため、任務の特殊な要件に基づいてカスタマイズした弾薬を選択することができます。例えば、トレーサー弾は目標捕捉を支援し、低照度の状況で視覚的なフィードバックを提供する一方、徹甲弾は装甲目標を攻撃するために不可欠です。さらに、小口径弾薬は汎用性が高いため、近距離戦から中距離戦まで、さまざまな戦闘状況に対応できます。

北米は、予測期間(2025年~2035年)のCAGRが6.5%で、全地域の中で最も成長率の高い市場です。アジア太平洋は、Australian Munitions、Hughes Precision Manufacturing Pvt.Ltd.、POONGSAN CORPORATIONなどの衛星スペクトル監視メーカーが多数存在するため、小口径弾薬の生産で牽引力を増すと予想されます。さらに、有利な政府政策も、予測期間中の欧州と世界の小口径弾薬市場の成長をサポートすると予想されます。

小口径弾薬市場の最近の動向

- 2023年2月、Winchester Ammunition社は米国陸軍と6.8mm次世代分隊兵器(NGSW)カートリッジ500万個の製造、試験、納入契約を締結しました。

- 2022年10月、CBC Global Ammunitionはインドの防衛メーカーSSS Defenceと提携し、ネパール陸軍に同社の5.56x45mm弾を供給する契約を獲得しました。このパートナーシップは2019年に設立され、弾薬生産業務は2021年に開始されました。

- 2022年6月、FN HERSTALと、アウトドアスポーツ用コンポーネントの普及を専門とするイタリアのFiocchi Munizioni SPAは、米国商業市場向けに小口径弾薬を共同で製造・供給するライセンス契約を含む提携を発表しました。この提携は主に5.7x28mm口径の弾薬に焦点を当てています。

需要- 促進要因と限界

市場需要促進要因:地政学的紛争と緊張

軍事近代化計画:軍事近代化計画は、小口径弾薬の需給ニーズを高める可能性があります。各国が軍隊を近代化し、時代遅れの武器に取って代わろうとしているため、新しい武器システムと互換性のある小口径弾薬に対するニーズが高まっています。このようなニーズは、特殊な弾薬を必要とする最新鋭の武器を、更新された歩兵部隊、特殊部隊、その他の軍人に装備させる必要性から生じています。

市場の課題:サプライチェーン・マネジメント

品質管理と安全基準:小口径弾薬を提供する企業は、品質管理と安全規制のために運営上大きな問題を抱えています。そもそも、品質と安全性の一貫性を維持することは、消費者の期待や業界標準を満たすために依然として不可欠です。弾薬製造には複雑さと正確さが要求されるため、原材料の調達から製造、最終検査に至るまで、厳格な品質管理手順を実施しなければなりません。品質上の逸脱や矛盾があれば、不具合や安全上のリスク、会社の評判を損なうことになりかねません。さらに、劣悪な弾薬によって引き起こされる災難や負傷の可能性を減らすためには、安全規制の遵守が不可欠です。消費者の信頼の失墜、製品リコール、法的責任はすべて、高水準の維持に失敗した場合に起こりうる結果です。

製品/イノベーション戦略:製品タイプは、配備可能な製品の種類とその世界の可能性を理解するのに役立ちます。さらに、小口径弾薬市場を用途別(軍事、国土安全保障/法執行/政府機関、狩猟・スポーツ、商業(護身))および製品タイプ別(口径、銃タイプ、弾薬タイプ、弾丸タイプ)に詳細に理解することができます。

成長/マーケティング戦略:小口径弾薬市場は、事業拡大、提携、協力、合弁など、市場で事業を展開する主要企業による主要な開拓が見られます。各社にとって好ましい戦略は、小口径弾薬市場における地位を強化するためのM&Aです。例えば、2020年10月、Vista Outdoor Operations LLCは、特定のアクティブ資産の選択的買収により、Remington Outdoor Companyの弾薬およびアクセサリー事業を買収しました。この取引は、関連する知的財産を含めて8,140万米ドルと評価されました。

当レポートでは、世界の小口径弾薬市場について調査し、市場の概要とともに、用途別、弾薬タイプ別、口径別、弾丸タイプ別、銃タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的出来事の影響分析

- 市場力学の概要

- 成長機会の分析と推奨

第2章 小口径弾薬市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 小口径弾薬市場(用途別)、金額(100万米ドル)

- 軍隊

- 国土安全保障省/法執行機関/政府機関

- 狩猟とスポーツ

- 商用(自己防衛)

第3章 小口径弾薬市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 小口径弾薬市場(口径別)、金額(100万米ドル)

- .22LR

- .308

- 5.56mm

- 7.62mm

- 9mm

- .223レム

- 12ゲージ

- 小口径弾薬市場(銃タイプ別)、金額(100万米ドル)

- 拳銃

- ライフル

- ショットガン

- その他

- 小口径弾薬市場(弾薬タイプ別)、金額(100万米ドル)

- フルメタルジャケット弾薬

- 曳光弾

- 焼夷弾

- 徹甲弾

- 小口径弾薬市場(弾丸タイプ別)、金額(100万米ドル)

- 銅

- 鉛

- 真鍮

第4章 地域

- 小口径弾薬市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合情勢と企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Aguila Ammunition

- Australian Munitions

- BAE Systems

- CCI Ammunition

- CBC Global Ammunition

- Denel PMP

- Elbit Systems

- FN HERSTAL

- Global Ordnance

- Hughes Precision Manufacturing Pvt. Ltd

- Nammo AS

- POONGSAN CORPORATION

- Ultra Defense Corp

- Vista Outdoor Operations LLC

- Winchester Ammunition

- その他の主要企業一覧

第6章 調査手法

List of Figures

- Figure 1: Small Caliber Ammunition Market (by Scenario), $Billion, 2025, 2028, and 2035

- Figure 2: Small Caliber Ammunition Market (by Region), $Million, 2024, 2027, and 2035

- Figure 3: Small Caliber Ammunition Market (by Application), $Million, 2024, 2027, and 2035

- Figure 4: Small Caliber Ammunition Market (by Product), $Million, 2024, 2027, and 2035

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 11: U.S. Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 12: Canada Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 13: Germany Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 14: France Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 15: U.K. Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 16: Russia Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 17: Italy Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 18: Rest-of-Europe Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 19: China Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 20: Japan Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 21: South Korea Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 22: India Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 23: Rest-of-Asia-Pacific Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 24: South America Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 25: Middle East and Africa Small Caliber Ammunition Market, $Million, 2024-2035

- Figure 26: Strategic Initiatives (by Company), 2021-2025

- Figure 27: Share of Strategic Initiatives, 2021-2025

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Small Caliber Ammunition Market Pricing Forecast, 2024-2035

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Small Caliber Ammunition Market (by Region), $Million, 2024-2035

- Table 8: North America Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 9: North America Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 10: U.S. Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 11: U.S. Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 12: Canada Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 13: Canada Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 14: Europe Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 15: Europe Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 16: Germany Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 17: Germany Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 18: France Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 19: France Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 20: U.K. Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 21: U.K. Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 22: Russia Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 23: Russia Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 24: Italy Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 25: Italy Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 26: Rest-of-Europe Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 27: Rest-of-Europe Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 28: Asia-Pacific Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 29: Asia-Pacific Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 30: China Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 31: China Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 32: Japan Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 33: Japan Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 34: South Korea Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 35: South Korea Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 36: India Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 37: India Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 38: Rest-of-Asia-Pacific Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 39: Rest-of-Asia-Pacific Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 40: Rest-of-the-World Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 41: Rest-of-the-World Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 42: South America Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 43: South America Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 44: Middle East and Africa Small Caliber Ammunition Market (by Application), $Million, 2024-2035

- Table 45: Middle East and Africa Small Caliber Ammunition Market (by Product), $Million, 2024-2035

- Table 46: Market Share

Introduction to the Small Caliber Ammunition Market

The small caliber ammunition market is a dynamic, quickly developing industry that is essential to the defense, law enforcement, and civilian markets. Small caliber ammunition, which is frequently used in pistols, rifles, and submachine guns, is defined as cartridges having a diameter of .50 inches (12.7mm) or less. This market is fueled by an increase in the demand for personal protection and safety, military modernization initiatives, and recreational shooting and hunting activities. The premium small caliber ammunition market has been further fueled by developments in weapon technology, including higher accuracy, less recoil, and improved terminal ballistics. The market is characterized by fierce rivalry among the major players, ongoing innovation, and strict rules to guarantee compliance and safety.

Market Introduction

Small caliber ammunition market had its roots in the 19th century when improvements in firearms technology led to the creation of more efficient and smaller weapons. By introducing a simple and dependable method of ammunition storage and reloading, metallic cartridges, such as the .22 rimfire, transformed the industry. Small caliber ammunition was essential to both world wars, as well as other military engagements and international law enforcement activities, during the 20th century. Small caliber ammunition's performance and adaptability have increased throughout time as a result of developments in propellant science, bullet design, and manufacturing techniques, thereby making it suitable for a variety of uses such as self-defense, target shooting, and hunting.

The small caliber ammunition market is currently expanding and evolving significantly. A number of variables, including increased worries about personal safety and security, rising military spending, and expanding interest in shooting sports and leisure activities, all contribute to the continued high demand for small caliber ammunition. The market is also seeing technical developments that aim to increase accuracy, improve terminal performance, and have a smaller environmental effect. Manufacturers are investing in R&D to produce cutting-edge solutions that satisfy the constantly changing demands of end consumers.

Industrial Impact

The small caliber ammunition products and technological advancements in the field are expected to have a positive impact on the global market. Several organizations and government agencies are working to introduce newer technologies into the global small caliber ammunition market. When compared to small caliber ammunition products such as different caliber, the demand for 7.62mm caliber stands out as the caliber in high demand.

In recent years, small caliber ammunition market has registered an exponential surge in demand from the defense industry, with high demands for military and law enforcement agencies. Additionally, due to the rising geopolitical conflicts and tensions and military modernization programs, small caliber ammunition market has grown significantly during the past few years. For instance, in February 2023, Winchester Ammunition signed a contract with the U.S. Army to manufacture, test, and deliver a batch of 5 million 6.8mm next-generation squad weapon (NGSW) cartridges.

Market Segmentation:

Segmentation 1: by Application

- Military

- Homeland Security/Law Enforcement/Government Agency

- Hunting and Sports

- Commercial (Self-Defense)

Military Application to Continue its Dominance as the Leading Application Segment

The military segment is the primary consumer of small caliber ammunition market due to its essential role in armed forces around the world. The military extensively relies on small caliber ammunition for a number of reasons. First off, small caliber ammunition strikes a balance between mobility and lethality, making it perfect for use by lone troops and small units. Soldiers can carry a sizable amount of ammunition without compromising mobility because of the lightweight and compact design of small caliber weapons and ammunition. For instance, the 5.56mm NATO round, which is used in rifles such as the M16 and its variations, is light and has little recoil, allowing soldiers to attack targets quickly and effectively.

Furthermore, small caliber ammunition offers adaptability for a range of military activities and mission characteristics. The availability of many bullet types, including armor-piercing, tracer, and frangible rounds, enables the selection of customized ammo based on the particular requirements of the task. For instance, tracer rounds assist with target acquisition and provide visual feedback in low-light situations, while armor-piercing ammunition is essential for striking armored targets. Additionally, the versatility of small caliber ammunition allows it to be used in a variety of combat situations, from close-quarter warfare to medium-range battles.

Segmentation 2: by Caliber

- .22LR Caliber

- .308 Caliber

- 5.56mm Caliber

- 7.62mm Caliber

- 9mm Caliber

- .223 Rem Caliber

- 12 Gauge

Segmentation 3: by Gun Type

- Handguns

- Rifles

- Shotguns

- Others

Segmentation 4: by Ammunition Type

- Full Metal Jacket Ammunition

- Tracer Ammunition

- Incendiary Ammunition

- Armor Piercing Ammunition

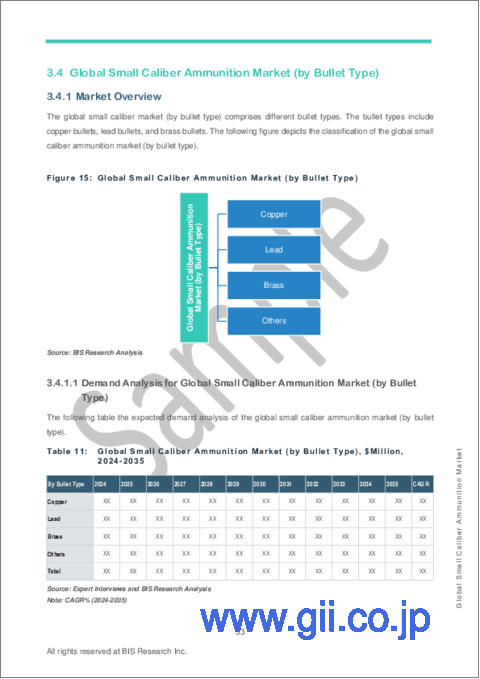

Segmentation 5: by Bullet Type

- Copper

- Lead

- Brass

Segmentation 6: by Region

- North America - U.S. and Canada

- Europe - U.K., Germany, France, Russia, Italy, and Rest-of-Europe

- Asia-Pacific - Japan, India, China, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa and South America

North America was the highest-growing market among all the regions registering a CAGR of 6.5% during the forecast period (2025-2035). Asia-Pacific is anticipated to gain traction in terms of small caliber ammunition production owing to the presence of a large number of satellite spectrum monitoring manufacturers such as Australian Munitions, Hughes Precision Manufacturing Pvt. Ltd., and POONGSAN CORPORATION. Moreover, favorable government policies are also expected to support the growth of the small caliber ammunition market in Europe and Rest-of-the-World during the forecast period.

Recent Developments in the Small Caliber Ammunition Market

- In February 2023, Winchester Ammunition signed a contract with the U.S. Army to manufacture, test and deliver a batch of 5 million 6.8 mm next-generation squad weapon (NGSW) cartridges.

- In October 2022, CBC Global Ammunition, in partnership with SSS Defence, an Indian defense manufacturer, won a contract to supply the Nepal Army with its 5.56x45 mm rounds. The partnership was established in 2019, with ammunition production operations beginning in 2021.

- In June 2022, FN HERSTAL and Fiocchi Munizioni SPA, an Italian firm specializing in facilitating outdoor sports components, announced a partnership inclusive of a licensing agreement to collaboratively manufacture and supply small caliber ammunition for the U.S. commercial market. The partnership primarily focuses on the 5.7x28 mm caliber ammunition.

Demand - Drivers and Limitations

Market Demand Drivers: Geopolitical Conflicts and Tensions

Military Modernization Programs: Military modernization programs can boost the supply and demand needs for small caliber ammunition. There is an increasing need for small caliber ammunition that is compatible with new weapon systems as nations want to modernize their militaries and replace outmoded weapons. This need results from the requirement to outfit updated infantry units, special forces, and other military personnel with cutting-edge weapons that call for specialized ammunition.

Market Challenges: Supply Chain Management

Quality Control and Safety Standards: Companies that offer small caliber ammunition have major operational problems due to quality control and safety regulations. To begin with, maintaining consistency in quality and safety remains essential for meeting consumer expectations and industry standards. Due to the complexity and accuracy required for ammunition manufacture, strict quality control procedures must be implemented from the procurement of raw materials through manufacturing and final inspection. Any quality deviation or inconsistency might result in malfunctions, safety risks, or harm to the company's reputation. Furthermore, compliance with safety regulations is essential to reduce the possibility of mishaps or injuries brought on by subpar ammunition. Loss of consumer trust, product recalls, and legal liability are all possible outcomes of failing to maintain high standards.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the small caliber ammunition market by application (military, homeland security/law enforcement/government agency, hunting and sports, and commercial (self-defense) and product (caliber, gun type, ammunition type, and bullet type).

Growth/Marketing Strategy: The small caliber ammunition market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been mergers and acquisitions to strengthen their position in the small caliber ammunition market. For instance, in October 2020, Vista Outdoor Operations LLC acquired the ammunition and accessories businesses of Remington Outdoor Company with the selective acquisition of certain active assets. The deal was valued at $81.4 million dollars, inclusive of the related intellectual property.

Competitive Strategy: Key players in the small caliber ammunition market analyzed and profiled in the study involve major small caliber ammunition products offering companies providing ammunition, guns, different ammunition, and bullets. Moreover, a detailed competitive benchmarking of the players operating in the small caliber ammunition market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, are employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, will be extracted for each company from secondary sources and databases. Revenues specific to product/service/technology will then be estimated for each market player based on fact-based proxy indicators as well as primary inputs.

- Based on the classification, the average selling price (ASP) has been calculated using the weighted average method.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the military and ammunition manufacturing industry, including ammunition providers and gun providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Spacenews, Bloomberg, Factiva, Businessweek, and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as www.nasa.gov.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights, which are gathered from primary experts.

Some of the prominent companies in this market are:

- Nammo AS

- Aguila Ammunition

- CBC Global Ammunition

- CCI Ammunition

- Elbit Systems

- Denel PMP

- FN Hertsal

- Global Ordnance

- Hughes Precision Manufacturing Pvt. Ltd.

- BAE Systems

- Ultra Defense Corp

- Vista Outdoor Operations LLC

- POONGSAN Corporation

- Winchester Ammunition

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend by Country and by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.5.3 End User Analysis

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

- 1.8 Growth Opportunity Analysis and Recommendation

- 1.8.1 Green Ammunition and Electronic Blanks Overview

- 1.8.2 Increased Procurement of Ammunition by Law Enforcement and Civilian End Users

2. Small Caliber Ammunition Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Small Caliber Ammunition Market (by Application), Value ($Million)

- 2.3.1 Military

- 2.3.2 Homeland Security/Law Enforcement/Government Agency

- 2.3.3 Hunting and Sports

- 2.3.4 Commercial (Self-Defense)

3. Small Caliber Ammunition Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Small Caliber Ammunition Market (by Caliber), Value ($Million)

- 3.3.1 .22LR

- 3.3.2 .308

- 3.3.3 5.56mm

- 3.3.4 7.62mm

- 3.3.5 9mm

- 3.3.6 .223 Rem

- 3.3.7 12 Gauge

- 3.4 Small Caliber Ammunition Market (by Gun Type), Value ($Million)

- 3.4.1 Handguns

- 3.4.2 Rifles

- 3.4.3 Shotguns

- 3.4.4 Others

- 3.5 Small Caliber Ammunition Market (by Ammunition Type), Value ($Million)

- 3.5.1 Full Metal Jacket Ammunition

- 3.5.2 Tracer Ammunition

- 3.5.3 Incendiary Ammunition

- 3.5.4 Armor Piercing Ammunition

- 3.6 Small Caliber Ammunition Market (by Bullet Type), Value ($Million)

- 3.6.1 Copper Bullets

- 3.6.2 Lead Bullets

- 3.6.3 Brass Bullets

4. Region

- 4.1 Small Caliber Ammunition Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Application

- 4.2.6.1.2 Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Application

- 4.2.6.2.2 Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Application

- 4.3.6.1.2 Product

- 4.3.6.2 France

- 4.3.6.2.1 Application

- 4.3.6.2.2 Product

- 4.3.6.3 U.K.

- 4.3.6.3.1 Application

- 4.3.6.3.2 Product

- 4.3.6.4 Russia

- 4.3.6.4.1 Application

- 4.3.6.4.2 Product

- 4.3.6.5 Italy

- 4.3.6.5.1 Application

- 4.3.6.5.2 Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Application

- 4.3.6.6.2 Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Application

- 4.4.6.1.2 Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Application

- 4.4.6.2.2 Product

- 4.4.6.3 South Korea

- 4.4.6.3.1 Application

- 4.4.6.3.2 Product

- 4.4.6.4 India

- 4.4.6.4.1 Application

- 4.4.6.4.2 Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Application

- 4.4.6.5.2 Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Application

- 4.5.6.1.2 Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Application

- 4.5.6.2.2 Product

- 4.5.6.1 South America

5. Markets - Competitive Landscape & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Aguila Ammunition

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Australian Munitions

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 BAE Systems

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 CCI Ammunition

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 CBC Global Ammunition

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Denel PMP

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Elbit Systems

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 FN HERSTAL

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Global Ordnance

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Hughes Precision Manufacturing Pvt. Ltd

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Nammo AS

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 POONGSAN CORPORATION

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Ultra Defense Corp

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Vista Outdoor Operations LLC

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Winchester Ammunition

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 Aguila Ammunition

- 5.4 List of Other Key Companies