|

市場調査レポート

商品コード

1907236

オメガ3製品:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Omega-3 Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オメガ3製品:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

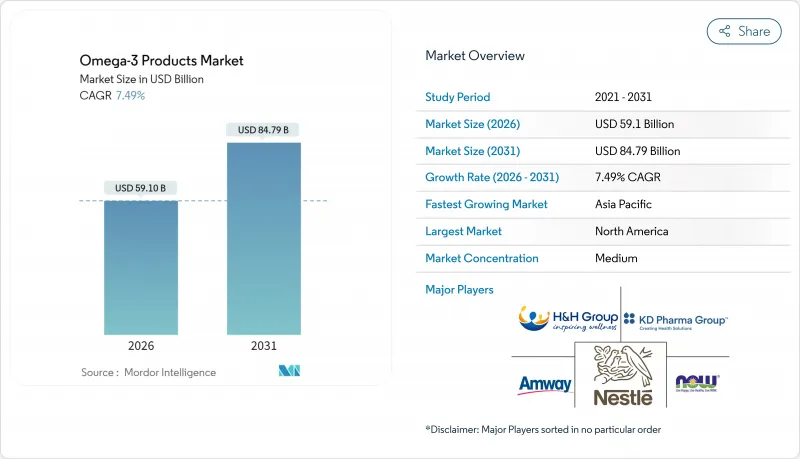

オメガ3製品の市場規模は、2026年には591億米ドルと推定されており、2025年の549億8,000万米ドルから成長が見込まれます。

2031年の予測では847億9,000万米ドルに達し、2026年から2031年にかけてCAGR7.49%で成長すると見込まれています。

市場の拡大は、特に栄養補助食品の人気が高まっている先進地域において、健康的で自然な製品に対する消費者の意識が高まっていることに起因しています。健康意識の高まりに支えられた植物由来製品の需要増加も、市場成長をさらに促進しています。消費者は藻類や亜麻仁などの原料由来のオメガ3サプリメントをますます求めるようになっており、これは持続可能で植物由来の代替品への広範な移行を反映しています。また、多様な消費者の嗜好や栄養ニーズに応えるため、機能性食品、飲料、栄養補助食品へのオメガ3成分の配合が増加していることも、市場に追い風となっています。

世界のオメガ3製品市場の動向と洞察

脳の発達と関節の健康をサポートするサプリメントへの需要増加

様々な調査により、オメガ3脂肪酸が従来の心血管系への効能を超え、認知機能の健康維持においても効果を拡大していることが実証されています。臨床試験では、高用量EPA製剤が従来の薬剤と比較して片頭痛予防に優れた効果を発揮し、患者からは発作の頻度と強度の著しい減少が報告されています。2025年3月に米国防総省が実施した軽度外傷性脳損傷治療におけるオメガ3サプリメントの包括的調査では、広範な臨床試験と記録を通じてこれらの神経学的効果が裏付けられました。さらに、臨床的証拠と医療機関での採用が、特に治療用途において高価格帯の認知機能健康製剤の開発を推進しています。研究によれば、閉経後の女性は男性と比較してEPAとDHAの吸収率が高く、製品開発に役立つ代謝上の差異が明らかになっています。このような生物学的利用能と有効性における性差は、個別化されたオメガ3製品の機会を生み出しています。

妊児・乳児栄養におけるDHAおよびEPAの需要増加

欧州食品安全機関(EFSA)によるSchizochytrium limacinum油の乳児用およびフォローオンフォーミュラへの使用承認は、乳児用調製粉乳へのDHA含有を支持する規制を強化しました。この承認により、従来の魚油由来製品以外のDHA供給源が拡大しました。EFSAの安全性評価では、総脂肪酸の40~43%をDHAが占める本油脂が、乳児用調製粉乳におけるDHA含有量に関するEU規制を満たすことが確認されました。この評価は、欧州食品安全機関の2025年データとも一致しています。様々な臨床研究により、乳児用調製粉乳へのDHAおよびアラキドン酸の添加が、母乳組成を模倣した最適な比率で、認知機能や視力の向上を含む良好な発達結果をもたらすことが実証されています。規制承認と臨床的証拠の収束により、先進国市場における出生率の低下にもかかわらず、持続的な需要が生まれています。低・中所得国では、動物性食品へのアクセスが拡大し、幼児期の栄養摂取の利点に対する認識が高まるにつれ、成長機会が生まれています。

高い生産コスト

中小規模のブランド企業は、代替調達先との交渉力が限られ、マージン縮小を吸収する余力も少ないため、価格面で大きな圧力を受けております。大規模競合他社のような規模の経済を欠くため、原材料コスト上昇時には収益性維持に苦慮するケースが多く見られます。企業はコスト管理のため、藻類由来オメガ3原料の利用など、原料の再配合や代替調達戦略を模索しておりますが、これらは生産コストが高くなる傾向にあります。藻類由来原料への移行は業界の成長動向ですが、技術と生産インフラは依然として高コストです。環境要因と水産養殖需要の増加により魚油供給は逼迫しており、限られた海洋資源では世界の需要増に対応できません。天然魚資源への負荷に加え、気候変動の影響や漁獲割当が供給状況をさらに複雑化させています。垂直統合されたサプライチェーンや長期調達契約を維持する企業は、コスト上昇期において競争優位性を保持します。サプライチェーンをより効果的に管理し、安定した価格体系を維持できるためです。

セグメント分析

乳幼児栄養分野は、規制要件と認知発達への有益性を示す臨床研究に後押しされ、2025年には42.63%と最大の市場シェアを占めます。この優位性は、早期小児栄養に対する保護者の意識向上と発展途上地域における可処分所得の増加によりさらに強化されています。機能性食品セグメントは、強化技術の進歩と便利な栄養オプションに対する消費者需要の高まりを背景に、2026年から2031年にかけてCAGR8.62%で成長すると予測されています。この成長は特に、オメガ3脂肪酸を強化した即飲飲料、強化シリアル、乳製品において顕著です。

栄養補助食品セグメントは、特に高齢層やフィットネス愛好家を中心に、特定の栄養効果を求める消費者需要に牽引され、堅調な市場存在感を維持しております。飼料セグメントは、高級ペットフード需要と持続可能な養殖業への対応として、水産養殖業者やペットフードメーカーがオメガ3強化を統合する動きにより、着実な成長を示しております。乳児用調製粉乳分野では、ボビーズ社が2025年4月に大豆ベースのミルクと高DHA含有量を特徴とする初のUSDAオーガニック認証乳児用調製粉乳を発売した事例が示す通り、市場拡大が続いております。

地域別分析

北米地域は2025年に29.85%の市場シェアを占めております。これは確立されたサプリメント消費習慣、健康強調表示に関する明確な規制枠組み、そしてオメガ3の効能に対する消費者の広範な理解に支えられております。同地域の強固な流通ネットワークと医療提供者の推奨も市場成長に寄与しております。米国心臓協会(AHA)の2024年データによれば、週2回の脂質豊富な魚の摂取推奨と、食事不足を補う栄養補助食品利用が市場拡大を支えています。規制環境は企業が心血管系への健康効果について適格な健康強調表示を行うことを可能にし、市場発展を促進しています。同地域における個別化栄養とプレミアム製品への重視は、新たな配合や送達システムに市場機会を創出しています。

アジア太平洋地域は、可処分所得の増加、健康意識の高まり、予防医療ソリューションを求める拡大する中産階級に支えられ、2026年から2031年にかけて8.81%のCAGRで最も高い成長率を示しています。BASF社の中国市場進出は、同業界が地域的な機会を認識していることを示しており、アジア太平洋地域は栄養・健康製品の主要市場と位置付けられています。各国が機能性食品や栄養補助食品に対して異なるアプローチを構築しているため、地域の多様な規制枠組みは市場における課題と機会をもたらします。アジア市場における魚介類消費の文化的親和性は、オメガ3サプリメント普及の基盤を提供しています。

欧州は包括的な規制枠組みと機能性食品に対する消費者の受容性により強固な市場地位を維持しており、欧州連合健康表示登録制度の明確なマーケティングガイドラインがこれを支えています。持続可能性への取り組みが藻類や植物由来のオメガ3原料の需要を牽引しており、倫理的な製品を求める消費者嗜好を反映しています。規制要件は市場参入障壁となる一方、製品品質と消費者安全を確保し、プレミアム価格設定を支えています。欧州では高齢化が進み、健康的な高齢化への関心が高まっていることから、認知機能や心血管の健康をターゲットとしたオメガ3製品に対する需要は安定しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 脳の発達と関節の健康維持を目的としたサプリメントへの需要増加

- 妊婦・乳幼児栄養分野におけるDHAおよびEPAの需要増加

- 被毛の健康をサポートするオメガ3強化ペット栄養製品への需要急増

- 機能性食品におけるオメガ3需要の増加

- パーソナライズドおよび性別特化型オメガ3製品の拡大

- 抽出、精製、およびマイクロカプセル化における技術的進歩

- 市場抑制要因

- 高い生産コスト

- オメガ3製品に関する消費者の認知度が限定的

- オメガ3原料の調達に関する持続可能性への懸念

- 保存期間が短く酸化する

- サプライチェーン分析

- 規制の見通し

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 機能性食品

- 栄養補助食品

- 乳幼児栄養

- 動物飼料

- その他

- 由来別

- 植物ベース

- 動物ベース

- 販売チャネル別

- スーパーマーケット/ハイパーマーケット

- 健康とスペシャリティストア

- オンラインストア

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング分析

- 企業プロファイル

- Soparfin SCA(Vetoquinol)

- Wiley Companies(AlaskOmega)

- Orkla Health AS(Moller's)

- KD Pharma Group

- Epax Norway(Pelagia)

- Aker BioMarine(Kori)

- UFAC UK Ltd

- Nordic Naturals

- Natures Crops International

- Now Health Group

- Herbalife Ltd.

- Reckitt(Mead Johnson)

- Nestle S.A.

- Body Cupid Pvt Ltd(Wow Life Science)

- Amway Corp.

- Kirin Holdings Company(Blackmores Ltd.)

- Healthwise Pharma

- H&H Group(Swisse)

- The Procter & Gamble Company(Seven Sea)

- VitaBright