|

市場調査レポート

商品コード

1444790

プロバイオティクス栄養補助食品:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Probiotic Dietary Supplement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プロバイオティクス栄養補助食品:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

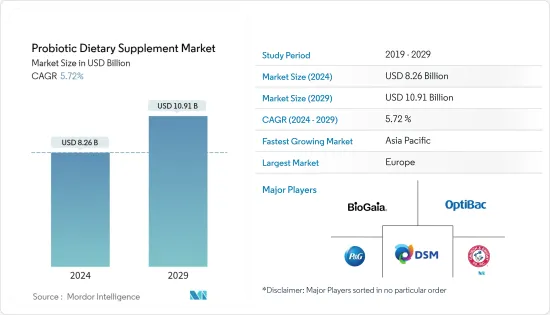

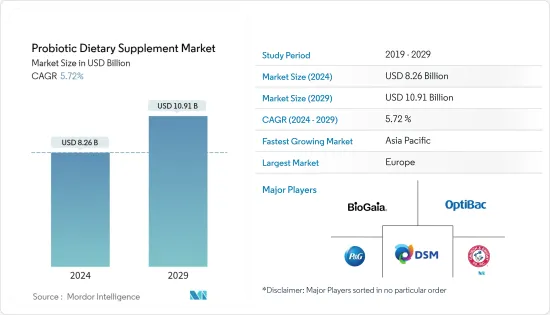

プロバイオティクス栄養補助食品の市場規模は、2024年に82億6,000万米ドルと推定され、2029年までに109億1,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に5.72%のCAGRで成長します。

主なハイライト

- 消費者は健康を意識するようになり、プロバイオティクスサプリメントの健康に対する利点をよく知り、市場の需要を押し上げています。プロバイオティクスサプリメントの摂取が宿主にプラスの影響を与えることを示すさまざまな研究が、市場の需要をさらに促進しています。メーカーは消費者の需要に応えるために革新的なサプリメントを導入しています。

- 例えば、消費者が摂取すべきプロバイオティクスの内容についてますます意識するようになっているため、彼らは個人のニーズに応じてカスタマイズされたプロバイオティクスサプリメントを提供しています。液体、カプセル、粉末などのさまざまな送達形式が市場に導入されています。

- たとえば、2021年 4月、韓国に本拠を置くサプリメント会社Cosmax NBTは、Zeta Probiotics Technologyを開発しました。この技術により、凍結乾燥プロセスを経た後にプロバイオティクス微生物の細胞壁を修復することができるため、腸内でのプロバイオティクス株の生存率と接着性が向上します。

- プロバイオティクス栄養補助食品市場は、オンライン自己教育への関心の高まり、地域の需要を牽引する予防ヘルスケアへの強い重点によって、大きなプラスの影響を受けています。チュアブルグミやカプセルなどのコンビニエンスダイエット製品は、プロバイオティクス栄養補助食品の大幅な成長に貢献しています。これらの製品は、リンゴ、オレンジ、ラズベリーなど、さまざまなフレーバーで提供されており、消費者を魅了しています。

- サーモフィルス連鎖球菌は、プロバイオティクスサプリメントで一般的に使用される乳酸菌で、消化管の機能と免疫系の反応を調節するのに役立ちます。乳酸菌もサプリメントに含まれる別の乳酸生成菌で、消化管の調節を助け、下痢、皮膚疾患、高コレステロール、過敏性腸症候群、肺感染症の治療に効果的です。

- 市場関係者は、さまざまな健康疾患に対処できる有益な細菌をベースにした新しいプロバイオティクス製剤の開発に焦点を当てています。たとえば、2021年6月にロンザは、カリフォルニアに拠点を置くスポーツ栄養企業であるケイジド・マッスルとコラボレーションしました。

プロバイオティクス栄養補助食品市場動向

健康意識の高まり需要の促進

- 消費者は自分の健康に対する意識をますます高めており、これにより消化器系の健康補助食品、特にプロバイオティクスの需要が高まることが予想されます。多くの消費者は現在、体重、エネルギーレベル、身体全体の健康を維持する上で消化器官の健康が果たす役割を受け入れており、これによりプロバイオティクスの需要は今後数年にわたって高まると考えられます。

- 栄養が健康に及ぼす影響についての消費者の意識の高まりと、より健康的な食事への志向の高まりにより、メーカーによる特定の健康強調表示を伴う食品の生産および商品化が行われています。消費者が健康的な生活に向けて総合的なアプローチを採用している西側市場では、プロバイオティクスの消費が増加しています。

- プロバイオティクスのサプリメントは何十年も前から入手可能であり、消費者にとって菌株特有の健康上の利点によって消費が促進されています。プロバイオティクスおよびプレバイオティクスの国際科学協会によると、プロバイオティクス株に関する科学的研究により、早産児の壊死性腸炎を軽減し、乳児の湿疹や母乳で育てられた乳児の疝痛症状などのアトピー性問題の発生を軽減し、上気道感染症または腸感染症のリスクや期間を軽減するという健康上の利点が明らかになりました。

- 国際食品情報評議会による2021年の調査では、アメリカ人の51%が腸の健康をサポートするためにプロバイオティクスを摂取し、33%が免疫の健康をサポートするためにプロバイオティクスを摂取し、38%が一般的な健康とウェルネス、13%が心の健康のためにプロバイオティクスを摂取していることが明らかになりました。

- したがって、良好な消化器の健康維持に対する消費者の関心の高まりは、市場関係者にとって消化器の健康状態に合わせた革新的な製品を開発する素晴らしい機会となります。さらに、より広範囲の健康上の利点を提供する革新的な製品の調査開発と発売は、市場の成長をサポートするに違いありません。

欧州はプロバイオティクス栄養補助食品で主要なシェアを保持

欧州はプロバイオティクス栄養補助食品の世界市場を独占しており、市場シェアの約3分の1を占めています。腸の健康の重要性と、腸の健康と精神的健康、減量、健康な皮膚との関連性が、英国におけるプロバイオティクス製品の成長を促進しています。消費者は、善玉菌が腸内に定着する可能性を高めると主張しているため、強力な細菌株と高いCFU(コロニー形成単位)を含む消化器系サプリメントを選択しています。これにより、予測期間中に消化器系サプリメント市場の成長が促進されると予想されます。この地域のヘルスケア専門家は、国内の消費者の胸やけや消化不良の症状を改善するこれらの消化器系サプリメントを推奨しています。 2021年に英国の健康保険会社が提供したデータによると、英国では10人に約4人に当たるブパが毎年消化不良を起こしています。影響は人によって異なりますが、消化不良の症状には、肋骨のすぐ下または胸の上部に痛みや灼熱感が含まれることがよくあります。したがって、これにより、薬局やドラッグストアでのこれらのサプリメントの販売時点数が増加しました。

ロシアでは国民の間で健康意識が高まっており、栄養不足を克服し、腸の健康を改善できるため、最終製品をベースにしたプロバイオティクス原料の需要が高まっています。これは、予測期間中にロシアのプロバイオティクス製品市場を牽引すると予想されます。 2021年9月、Arnica社はNadezhdinskayaTORで最新のプロバイオティクス生産を開始しました。ユニークな製品の生産は、ロシア国内外の消費者を対象としています。 Associazione Nazionale Produttori e Distributori Prodotti Salutisticiが発表したデータによると、消化管および腸管の健康に関連する食品サプリメントの価値は4億1,300万ユーロに上ります。プロバイオティクスは、2020年に3億8,700万ユーロの売上高を記録しました。たとえば、2021年には、プロバイオティクス企業のプロビと店頭ヘルス&ウェルネス企業のペリーゴが、プレミアムプロバイオティクスの消化器および免疫の健康コンセプトをイタリアにもたらすための半独占契約を締結しました。

プロバイオティクス栄養補助食品食品業界の概要

プロバイオティクス栄養補助食品の主要企業としては、BioGaia、Optibac Probiotics Inc、Procter &Gamble、Koninklijke DSM NV、Church &Dwight Co., Inc.などが挙げられます。市場関係者は、市場での地位を維持するために、製品の革新や発売、パートナーシップ、拡大、買収などの戦略的アプローチを採用しています。たとえば、ペリゴとプロビは2021年2月に、欧州14か国でプレミアムプロバイオティクスの消化器および免疫の健康コンセプトを開始および拡大するための包括的な汎欧州協定に署名しました。これらの製品は検証済みのプロバイオティクス株を提供し、臨床的に肯定的な効果が実証されています。さらに、この提携により、欧州の多くの国におけるプロバイオティクス分野での同社の足場が強化されることは間違いありません。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品タイプ別

- カプセルと錠剤

- 粉末サプリメント

- プロバイオティクスのドリンクとショット

- グミとチュー

- 流通チャネル別

- スーパーマーケット/大型スーパーマーケット

- 薬局/健康店

- オンラインストア

- その他の流通チャネル

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- その他欧州

- アジア太平洋地域

- インド

- 中国

- 日本

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東とアフリカ

- 南アフリカ

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- BioGaia

- Reckitt Benckiser LLC

- Procter &Gamble

- Koninklijke DSM NV

- Church &Dwight Co., Inc.

- PharmaCare Laboratories Pty Ltd

- Optibac Probiotics Inc.

- Dr. Willmar Schwabe GMBH &Co. KG

- Amway Corp.

- Morishita Jintan Co. Ltd.

- Now Foods

第7章 市場機会と将来の動向

The Probiotic Dietary Supplement Market size is estimated at USD 8.26 billion in 2024, and is expected to reach USD 10.91 billion by 2029, growing at a CAGR of 5.72% during the forecast period (2024-2029).

Key Highlights

- Consumers have become health conscious and familiarized themselves with the benefits of probiotic supplements on health, propelling market demand. Various studies stating the positive impact of the consumption of the probiotic supplement on the host is further driving market demand. Manufacturers are introducing innovative supplements to cater to consumer demand.

- For instance, they are offering customized probiotic supplements as per the need of individuals as consumers are becoming increasingly aware of the probiotic content to be taken by them. Different delivery formats, such as liquids, capsules, and powders, are being introduced in the market.

- For instance, in April 2021, Cosmax NBT, a South Korea-based supplements company, developed Zeta Probiotics Technology. The technology enables restoring the cell wall of probiotic microbes after passing through the freeze-drying process, thereby improving the viability and adhesion of probiotic strains in the intestine.

- The probiotic dietary supplements market is majorly positively affected by increasing interest in online self-education, a strong emphasis on preventive healthcare driving the regional demand. Convenience dietary products like chewable gummies and capsules are responsible for the significant growth of probiotic dietary supplements. These products are offered in different flavors, such as apple, orange, and raspberry, which attract consumers.

- Streptococcus thermophilus is a commonly used lactic acid bacteria in probiotic supplements, which helps regulate the digestive tract's functioning and immune system response. Lactobacillus is another lactic acid-producing bacteria in supplements, which helps regulate the digestive tract and is efficient in treating diarrhea, skin disorder, high cholesterol, irritable bowel syndrome, and lung infections.

- Market players are focusing on developing new probiotic formulations based on beneficial bacteria that can address various health ailments. For instance, in June 2021, Lonza collaborated with Kaged Muscle, a sports nutrition company based in California.

Probiotics Dietary Supplements Market Trends

Rising Health Awareness Promoting demand

- Consumers are increasingly becoming aware of their health which is anticipated to propel the demand for digestive health supplements, especially probiotics. Many consumers are now accepting the role of digestive health in maintaining weight, energy levels, and overall physical health, which will likely boost the demand for probiotics over the years.

- The rising consumer awareness about the impact of nutrition on health and rising proclivity towards healthier diets has triggered the production and commercialization of food with certain health claims by manufacturers. The consumption of probiotics is rising in western markets, wherein consumers adopt a holistic approach toward healthy living.

- Probiotic supplements have been available for decades, with consumption being driven by strain-specific health benefits to the consumer. According to the International Scientific Association for Probiotics and Prebiotics, scientific study on probiotic strains reveals health benefits in reducing necrotizing enterocolitis in preterm infants, reducing the occurrence of atopic issues such as eczema in infants and colic symptoms in breastfed babies, reducing the risk or duration of upper respiratory tract infections or gut infections.

- A survey by the International Food Information Council in 2021 revealed that 51% of Americans consume probiotics to support gut health, 33% take them to support immune health, 38% take probiotics for general health and wellness, while 13% revealed that they consume probiotics to support and emotional health.

- Therefore, the augmented interest of consumers in maintaining good digestive health offers a wonderful opportunity for the market players to develop innovative products for digestive health conditions. Furthermore, the research development and the launch of innovative products providing a broader range of health benefits are bound to support market growth.

Europe Holds the Major Share in Probiotic Dietary Supplements

Europe dominated the global market for probiotic dietary supplements, with around one-third of the market share. The importance of gut health and its connection with mental health, weight loss, and healthy skin fosters the growth of probiotics products in the United Kingdom. Consumers are opting for digestive supplements with strong bacterial strains and high CFU (Colony Forming Units) since they claim to increase the chances for good bacteria to colonize the gut. This is expected to boost the growth of the digestive supplements market during the forecast period. Healthcare professionals across the region are recommending these digestive supplements that improve the cases of heartburn or indigestion among consumers in the country. As per the data provided by the health insurance company of the United Kingdom in 2021, Bupa, around four in every ten people in the United Kingdom, gets indigestion every year. It can affect people differently, but indigestion symptoms often include pain or a burning feeling just under the ribs or higher up in the chest. Therefore, this increased the point-of-sale for these supplements via pharmacies and drugstores.

The increasing health awareness among the population in Russia is fueling the demand for probiotic ingredients based on final products, as they can overcome nutritional shortcomings and improve gut health. This is expected to drive Russia's probiotic products market during the forecast period. In September 2021, The Arnica company launched a modern production of probiotics at the NadezhdinskayaTOR. The production of one-of-a-kind products is aimed at consumers both in Russia and abroad. According to the data published by Associazione Nazionale Produttori e Distributori Prodotti Salutistici, Food supplements related to digestive and intestinal tract wellness witnessed a value of EUR 413 million; probiotics recorded a sales value of EUR 387 million in 2020. For instance, in 2021, the probiotics company Probi and over-the-counter health and wellness player Perrigo signed a semi-exclusive agreement to bring premium probiotic digestive and immune health concepts to Italy.

Probiotics Dietary Supplements Industry Overview

Some major players in the probiotic dietary supplements are BioGaia, Optibac Probiotics Inc, Procter & Gamble, Koninklijke DSM NV, and Church & Dwight Co., Inc., among others. Market players adopt strategic approaches like product innovation and launches, partnerships, expansion, acquisitions, etc., to maintain their market position. For instance, Perrigo and Probi signed a comprehensive pan-European agreement in February 2021 to launch and expand premium probiotic digestive and immune health concepts in 14 European countries. The products offer validated probiotic strains and have documented positive effects clinically. Furthermore, the partnership is bound to strengthen the company's foothold in many European countries in probiotics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Capsules and Tablets

- 5.1.2 Powdered Supplements

- 5.1.3 Probiotic Drinks and Shots

- 5.1.4 Gummies and Chews

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/hypermarkets

- 5.2.2 Pharmacy/Health Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BioGaia

- 6.3.2 Reckitt Benckiser LLC

- 6.3.3 Procter & Gamble

- 6.3.4 Koninklijke DSM NV

- 6.3.5 Church & Dwight Co., Inc.

- 6.3.6 PharmaCare Laboratories Pty Ltd

- 6.3.7 Optibac Probiotics Inc.

- 6.3.8 Dr. Willmar Schwabe GMBH & Co. KG

- 6.3.9 Amway Corp.

- 6.3.10 Morishita Jintan Co. Ltd.

- 6.3.11 Now Foods