|

市場調査レポート

商品コード

1851967

クリーンラベル原料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Clean Label Ingredient - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クリーンラベル原料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年08月01日

発行: Mordor Intelligence

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

概要

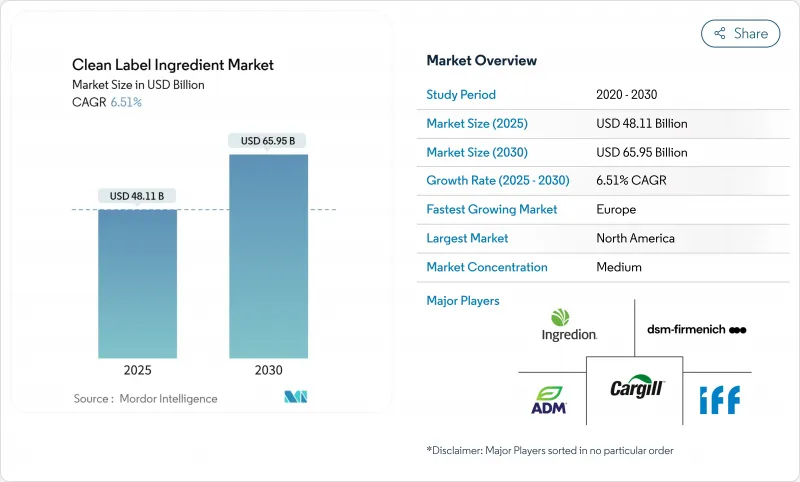

クリーンラベル原料の市場規模は2025年に481億1,000万米ドルと推定され、2030年には659億5,000万米ドルに成長すると予測され、市場推計・予測期間中のCAGRは6.51%です。

この成長の原動力となっているのは、シンプルでわかりやすい原材料を求める消費者ニーズの高まり、パンデミック後の健康意識の高まり、成分表を簡素化しようとする小売業者の努力です。米国食品医薬品局(FDA)が石油系色素を段階的に廃止するなどの規制上の取り組みが、天然着色料、香料、保存料の採用をさらに後押ししています。これを受け、メーカーは透明性を確保し、クリーンラベルの主張を検証するため、植物抽出、発酵プロセス、トレーサビリティ技術に焦点を当てた研究開発に投資しています。現在、天然成分の価格は合成着色料より25~35%高いが、生産規模の拡大や供給契約の強化に伴い、価格差は縮小しています。さらに、小売のプライベート・ラベル・プログラムやeコマース・プラットフォームの拡大が、クリーンラベル原料がニッチ市場から様々な地域の主流動向へと移行していることを示す、より大きな普及の原動力となっています。

世界のクリーンラベル原料市場の動向と洞察

人工食品添加物に関連する健康問題

人工食品添加物と健康上の有害な結果との関連性を示す科学的証拠がますます増えており、消費者がよりクリーンなラベルの代替品を求めるよう促しています。国立医学図書館による2024年の重要な研究では、合成食品着色料と呼吸器系の問題、特に子供の肺機能障害との間に強い結びつきがあることが判明しました。食生活と健康の関連性に対する認識が高まるにつれ、消費者は加工食品によく見られる人工添加物や保存料を積極的に避けるようになっています。この消費者感情の変化は、国際食品情報協議会(International Food Information Council)の2024年調査にも表れています。この調査では、米国の回答者の26%が「自然」を健康食品の最重要指標とみなし、16%が「非遺伝子組み換え」の表示を優先しています。こうした感情は、クリーン・ラベルの原則との顕著な一致を浮き彫りにし、自然で加工度の低い原材料を強調しています。このような消費者のシフトと科学的裏付けの高まりに対応して、規制機関も動き出しています。2025年4月、米国食品医薬品局(FDA)は、石油系合成色素を食品供給から段階的に排除する主要な取り組みを開始しました。これは極めて重要な規制の転換であり、公衆衛生に対する政府のコミットメントを明確に示すものです。こうした規制、科学、消費者主導の動きが一体となって、食品安全基準を再構築し、業界の透明性を高め、クリーン・ラベル運動が現代の食品生産において傑出した存在となりつつあります。

植物由来および有機食材へのシフト

クリーン・ラベル運動は勢いを増し、植物由来の革命と融合して、世界の食品業界のイノベーション戦略を再形成しています。この連携は、食生活と健康の関連性、環境問題、および倫理的消費へのシフトに対する意識の高まりによって推進されています。消費者は現在、原材料調達の透明性を求め、合成添加物よりも天然で加工が最小限に抑えられた植物由来の代替食品を好んでいます。この動向は、香料・調味料分野で特に顕著です。メーカー各社は、人工的な化合物から天然由来の成分へと急速に移行しています。各社は、精密発酵、酵素抽出、無溶媒処理などの最先端技術に投資を注いでいます。これらの進歩は、強化された機能性、安定性、保存性を誇る天然風味調整剤を生み出すことを目的としています。例えば、2024年3月、BASF Aroma Ingredients社はIsobionics Natural beta-Caryophyllene 80を発売し、Isobionicsポートフォリオを強化しました。純度80%のこの成分は、飲食品、フレグランスの多様な用途に対応し、クリーンラベルと植物由来のイノベーションに対する業界の献身を際立たせています。このような躍進は、これらの運動間の絆の深まりと、将来の製品開発への影響力の共有を強調しています。

クリーンラベル原料のコスト上昇

メーカーは、クリーンラベル原料の割高な価格設定という課題に直面し、経済性を確保しながら消費者の期待に応える努力をしています。天然着色料について考えてみよう。天然着色料は、合成着色料に比べ25~35%高い価格で取引され、バリューチェーン全体の利幅を圧迫しています。この価格差には、複雑な調達ネットワーク、天然抽出による収率の低さ、天然成分の品質管理の厳しさなど、いくつかの要因が絡んでいます。例えば、ビーツやターメリックのような天然着色料を調達するには、季節ごとの収穫量を把握し、加工時に汚染されないようにする必要があるため、コストが増大します。さらに、天然成分の生産には拡張性が限られており、原料は季節によって入手できないことが多いため、コスト格差が拡大します。例えば、コチニール昆虫由来の天然の赤色着色料であるカルミンの生産には手間がかかり、昆虫の入手可能性の変動に左右されます。この格差は、クリーンラベル製品のプレミアムを合理化するための戦略的価格設定と消費者教育の必要性を浮き彫りにしています。

セグメント分析

2024年には、食品香料と調味料が33.38%の圧倒的なシェアでクリーンラベル原料市場を独占します。これは、製品の食べやすさを確保し、消費者の受容を確保する上で極めて重要な役割を担っていることを裏付けています。この分野が突出しているのは、よりクリーンな配合に移行しながらも、官能的な魅力を維持することにメーカーが戦略的に重点を置いていることを浮き彫りにしています。ジボダン(Givaudan)、センシエント・テクノロジーズ(Sensient Technologies)、シムライズ(Symrise)などの企業は、クリーンラベル製品に対する需要の高まりに対応し、天然フレーバー・ソリューションに大規模な投資を行っています。例えば、Sensient Flavors and Extracts社は2024年3月、グルメ料理製品に求められる人気のスモーキーな香りの全領域を捉えた、ナチュラルでクリーンラベルの新フレーバーシリーズ、SmokeLess Smokeを発表しました。

逆に、食品着色料は急成長しており、2025年から2030年までのCAGRは7.98%と予測され、最も急成長しているセグメントとして知られています。この急成長は主に、FDAが最近3つの天然着色料添加物を認可したことによる:ガルディエリアエキスブルー、バタフライピー花エキス、リン酸カルシウムです。さらに、飲料、菓子類、乳製品における天然着色料の採用が増加していることも、このセグメントの拡大を後押ししています。同時に、食品保存料はルネッサンスを経験しており、革新的な植物由来の抗菌ソリューションへのシフトが顕著です。例えば、ローズマリー抽出物や柑橘類由来の化合物が、効果的な天然保存料として台頭してきています。この移行は、妥協のない保存安定性を確保しつつ、合成保存料に代わる選択肢をメーカーに提供します。

地域分析

2024年、北米はクリーンラベル原料市場で35.43%のシェアを占め、消費者意識の高まりと厳しい規制状況に支えられています。石油系合成色素を排除し、食品表示の透明性を高めるというFDAの最近の動きは、この地域の優位性をさらに強固なものにしています。カナダは健康志向の消費者が成長の原動力となっているが、メキシコの拡大には中間層の急増と健康意識の高まりが拍車をかけています。

2025年から2030年にかけてのCAGRが6.64%と予測される欧州は、厳格な規制基準と天然製品に対する消費者の強い傾倒により、最も急成長する地域となると思われます。欧州委員会のクリーン産業ディールは、持続可能な生産を提唱し、管理負担を軽減することで、クリーンラベルメーカーの競争力を強化しています。欧州市場では英国とドイツが先陣を切っており、英国はブレグジット後の規制を乗り越えて高い食品成分基準を維持しています。一方、フランス、スペイン、イタリアは、品質を重視する料理の伝統を背景に、力強い成長を遂げています。ロシアとその他の欧州諸国は、消費者の意識が高まるにつれて、徐々に市場シェアを拡大しつつあります。

消費者の意識と規制の明確化というハードルにもかかわらず、アジア太平洋地域はクリーンラベル原料市場で特筆すべき地位を築きつつあります。膨大な中産階級人口を抱える中国とインドは、食品の安全性と品質に対する懸念の高まりに後押しされ、成長の呼び水となっています。洗練された食文化を持つ日本と、厳格な規制と健康志向の消費者に支えられたオーストラリアが牽引役となっています。採用率は地域によって異なるが、先進国が最前線にあります。都市化、可処分所得の増加、および健康志向の若年層が、この地域の成長を後押ししています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 人工食品添加物に関する健康問題

- 植物由来およびオーガニック原料へのシフト

- アレルゲンフリーおよびグルテンフリー製品に対する需要の高まり

- ビーガン・ベジタリアン製品ラインの拡大

- より健康的な食品選択の必要性を強調する世界の健康危機

- クリーンラベル製剤に対する企業の研究開発投資の増加

- 市場抑制要因

- 原材料の高騰

- 新興国における認知度の低さ

- 複雑な規制要件が市場参入を阻む

- より安価な伝統的原料との競争

- サプライチェーン分析

- 規制の見通し

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 成分タイプ別

- 食品保存料

- 食品甘味料

- 食品着色料

- 食品用ハイドロコロイド

- 食品香料と強化剤

- その他の原料の種類

- 形態別

- ドライ

- 液体

- 用途別

- ベーカリー・菓子

- 乳製品・冷凍デザート

- 飲料

- 食肉および食肉製品

- ソース、調味料

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- オランダ

- ポーランド

- ベルギー

- スウェーデン

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- シンガポール

- その他アジア太平洋地域

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- ナイジェリア

- エジプト

- モロッコ

- トルコ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング分析

- 企業プロファイル

- Cargill Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate and Lyle PLC

- Kerry Group PLC

- DSM-Firmenich

- International Flavors & Fragrances Inc.(IFF)

- Sensient Technologies Corporation

- Ajinomoto Co. Inc.

- Corbion N.V.

- Givaudan S.A.

- Roquette Freres S.A.

- Dohler GmbH

- Kalsec Inc.

- CP Kelco(J.M. Huber Corp.)

- Puratos Group

- Sudzucker AG

- Nexira SAS

- Limagrain Ingredients

- Camlin Fine Sciences Ltd.