|

市場調査レポート

商品コード

1849941

航空宇宙用接着剤:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aerospace Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空宇宙用接着剤:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月17日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

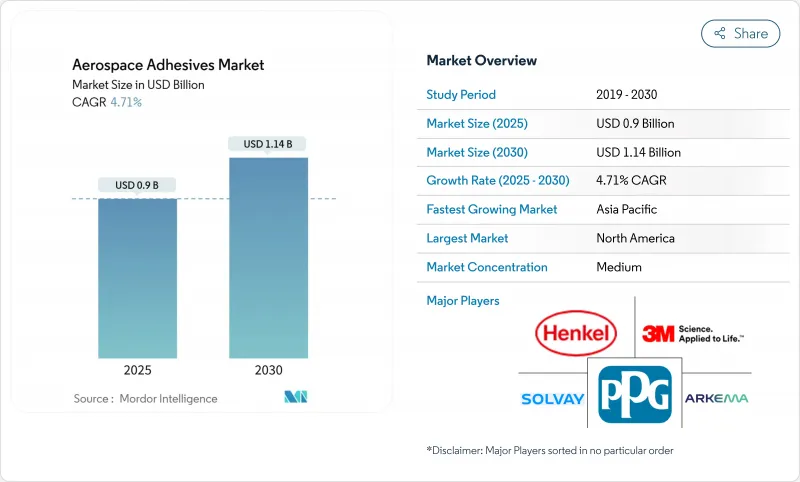

航空宇宙用接着剤市場規模は2025年に9億米ドルと推定され、予測期間(2025-2030年)のCAGRは4.71%で、2030年には11億4,000万米ドルに達すると予測されます。

より軽量で燃料効率の高い航空機への需要が持続しているため、生産者はメカニカルファスナーから、強度を損なうことなく重量を削減する高性能接着ソリューションへとシフトする意欲を高めています。PPGのPR-2940に代表されるエポキシ系シンタクチックペースト接着剤は、極端な使用荷重下で複合材や金属基材を接着するためにサプライヤーがどのように配合を適応させているかを示しています。米国と欧州における国防予算の伸び、エアバス社とボーイング社における航空機の生産台数の増加、新しい生産ラインにおける自動塗布システムの普及が、量の伸びをさらに後押ししています。一方、不安定な原料価格と米国および欧州連合(EU)における環境規制の進展は、生産者に水溶性化学物質や反応性化学物質の技術革新を加速するよう促しています。中東における戦略的な現地化イニシアティブと民間宇宙プログラムの拡大が、需要の道をさらに広げています。

世界の航空宇宙用接着剤市場の動向と洞察

航空機製造における複合材料の普及拡大

主なハイライト

- 複合材により、設計者は機体を軽量化しながら耐疲労性を高めることができるが、その一方で、荷重を均等に分散し、剥離を回避する接着剤が必要となります。ヘクセルは現在、HexPlyプリプレグとHexBond構造用フィルムを組み合わせた統合システムを供給しており、ラミネート全体の化学的適合性を確保しています。この組み合わせは、長い耐用年数にわたって剛性を維持しながら、より軽量な翼や胴体部分が得られるため、航空会社に好まれています。OEMが複合材部品の製造を内製化することを決定し、接着剤サプライヤーとの硬化プロファイルの調整に関する協力関係が強化されたことで、採用の機運が高まっています。熱膨張と吸湿をカバーする標準化されたデータパックは、川下のMROチームがより迅速に修理を実施するのに役立ち、航空宇宙用接着剤市場をさらに押し上げます。

エアバスとボーイングのランプアップ目標に対応する自動ロボットボンディングライン

エアバスの2024年における受注残は8,658機と記録されており、記録的な受注残に対応するため、メーカー各社は接着剤の計量、混合、吐出を手作業を上回る再現可能な速度で行うロボットを導入しています。フラウンホーファーIFAMの適応型塗布ヘッドは、輪郭のばらつきに対してリアルタイムでビード径を補正しますヘンケルは、マシンビジョンを統合して硬化前のビード位置を検証し、無駄と手戻りを抑制します。タクトタイムの短縮は月間ジェット生産量の増加に直結し、当面の航空宇宙用接着剤市場見通しを強化します。

エポキシおよびイソシアネート原料サプライチェーンにおける慢性的な不安定性

生産拠点が東アジアに集中しているため、工場の操業停止や貿易摩擦による混乱リスクが高まっています。ダウは、レヌーバ・プラットフォームの下でバイオ原料を拡大し、依存度を緩和しているが、航空宇宙産業の認定サイクルにより、迅速な切り替えが遅れています。戦略的在庫を持たない小規模生産者は、マージンを侵食するスポット価格高騰の影響を受けやすいです。

セグメント分析

溶剤系グレードは、長期にわたる実地データ、強固な剥離強度、幅広い使用温度範囲により、2024年の航空宇宙用接着剤市場シェアの58%を占めました。翼のトーションボックス、ナセル構造、燃料タンクライナーなどでの役割が定着し、コンプライアンス・コストの上昇にもかかわらず安定した需要を支えています。水性化学品は、せん断強度を高めるナノフィラー補強に助けられ、CAGR 4.92%でその差を縮めています。エポキシとポリウレタンブロックを組み合わせたハイブリッド反応性システムは、オーブンサイクルを必要としない迅速な硬化を可能にし、自動化セルアーキテクチャにスムーズに適合します。

自動化は、技術構成をさらに変化させる。ロボット・スプレーとビーズ・ディスペンス・ユニットは、極薄で一貫性のあるウェット・フィルム形成を実現し、溶剤のフラッシュ・ロスを削減します。しかし、設備投資は複数プログラムの生産を行うプラントに有利であり、小規模施設での即時導入は制限されます。長期的には、管轄区域をまたがる規制の調整により、次世代の水性および100%固形分技術の認証コストが正常化し、溶剤を使用する優位性が緩和されると予想されます。

エポキシ配合物は、金属、炭素繊維複合材料、ハニカムコアの接着における汎用性を反映して、2024年には50%のシェアを占める。2030年までのCAGRは5.01%で、エポキシは依然として航空宇宙用接着剤市場の価値創造の原動力です。シリコーンおよびハイブリッドポリサルファイド-エポキシブレンドは、それぞれ熱管理および耐燃料性のニッチに対応しています。ポリウレタンは、強靭性と低温柔軟性がイソシアネート規制を凌駕しているにもかかわらず、REACHの訓練義務化によって新たなプログラムの採用に下方圧力がかかっています。

新たな化学物質はリサイクル性に重点を置いています。エボニックの「デボンド・オンデマンド」エポキシは、穏やかな熱と触媒のトリガーで活性化する開裂可能な連結を統合しており、破壊的な機械加工なしで複合パネルの補修を可能にします。このような特徴は、循環型経済の目標に合致しており、再生炭素繊維市場における将来の収益源を解き放つ可能性があります。

地域分析

北米は、堅調な国防支出と集中的なOEM生産により、2024年の売上高の40%を占める。PPGがノースカロライナ州に建設予定の工場などの資本プロジェクトにより、航空宇宙用コーティング剤とシーラントにおける地域の自給自足が強化されます。カリフォルニア州大気資源委員会(California Air Resources Board)による規制の監視は、配合メーカーを低VOC化学物質に向かわせるが、航空宇宙プログラムでは、移行に息抜きを与える免除措置を確保することが多いです。

アジア太平洋は、2030年までのCAGRが5.12%で最も急成長している地域です。中国のC919ナローボディやインドのAMCA戦闘機に代表されるように、国産航空機の取り組みが現地の接着剤需要を高めています。Aero India 2025におけるヘクセルの技術展示は、ラピッドキュアプリプレグとテーラード接着剤の組み合わせが特徴で、この拡大をサポートするサプライヤーのコミットメントを示すものです。また、シンガポールとマレーシアではMROクラスターが成長しており、アフターマーケットの牽引役となっています。

欧州は、フランス、ドイツ、スペインのエアバス組立ラインを中心に強力な足場を維持しています。2023年に発効するジイソシアネート規制は、特定のポリウレタンシステムからの移行を加速させ、代替エポキシやシラン末端ポリマーの技術革新を刺激します。サーキュラー・バイオベース・欧州共同事業を通じた公的資金は、2億1,100万ユーロをバイオベース材料研究に注ぎ込み、接着剤はその主要な重点分野となっています。

中東とアフリカは、新たな成長ポケットです。サウジアラビアの「ビジョン2030」は現地化された部品製造への投資を促進し、UAEの宇宙開発への野心は特殊高温接着剤の需要を拡大します。ラテンアメリカでは、エンブラエルとメキシコの地域MROハブが生産ラインの近代化を進めており、緩やかな成長が見られるが、マクロ経済的な制約が当面の拡大を抑制しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 航空機製造における複合材料の普及拡大

- エアバスとボーイングの生産増強目標を満たす自動化ロボット接合ライン

- 米国の国防費増加

- 防衛相殺政策が中東における接着剤の現地生産を促進

- 宇宙計画の拡大

- 市場抑制要因

- エポキシおよびイソシアネート原料サプライチェーンにおける慢性的な不安定性

- 厳格なREACHおよびCARB VOC規制による溶剤系配合物の制限(欧州/米国)

- 民間航空におけるバイオベース接着剤の適格性評価のボトルネック

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 技術別

- 水媒介

- 溶剤系

- 反応的

- 樹脂タイプ別

- エポキシ

- ポリウレタン

- シリコーン

- その他

- 機能タイプ別

- 構造的

- 非構造的

- 最終用途別

- オリジナル機器製造会社(OEM)

- 保守、修理、運用(MRO)

- 地域別

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリアとニュージーランド

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- 3M

- Arkema

- Ashland

- Beacon Adhesives Inc.

- Chemetall GmbH(BASF)

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dymax

- Flamemaster Corp.

- Gurit Services AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hernon Manufacturing Inc

- Hexcel Corporation

- Huntsman International LLC.

- Hybond

- Hylomar Products

- IPS Corporation

- L&L Products

- Master Bond Inc.

- Parker Hannifin Corp

- Parson Adhesives Inc.

- Permabond LLC

- PPG Industries Inc.

- Sika AG

- Solvay