|

市場調査レポート

商品コード

1637795

ゲノミクスにおけるラボオートメーション:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Lab Automation In Genomics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ゲノミクスにおけるラボオートメーション:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

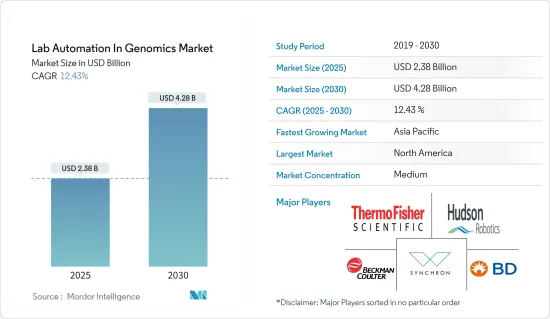

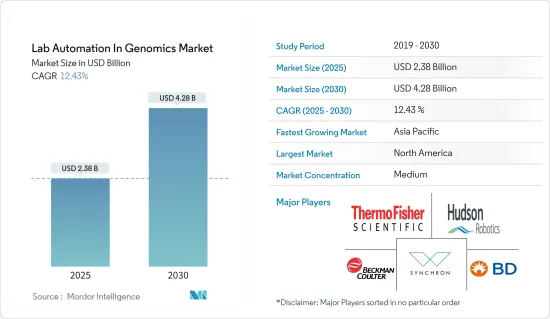

ゲノミクスにおけるラボオートメーション市場規模は、2025年に23億8,000万米ドルと推定され、予測期間中(2025-2030年)のCAGRは12.43%で、2030年には42億8,000万米ドルに達すると予測されます。

未知の相関関係、隠れたパターン、その他の洞察を明らかにするデータ分析の進歩という点で、特に大規模なデータセットをテストする場合に、ゲノム配列決定の理解が著しく向上しています。これは、技術の進歩と計算能力の向上が市場を牽引しているためです。

主なハイライト

- 生物全体の全DNA配列を利用するゲノミクスの開発は、数少ないゲノミクスの巨人の革新的な業績と、最近の次世代シーケンシング技術によるものです。

- 次世代シーケンス技術の開発により、ゲノム配列決定のスピード、量、価格のすべてが劇的に向上しました。さらに、バイオインフォマティクスの進歩により、科学的研究を促進する何百もの生命科学データベースやプログラムが可能になった。これらのデータベースは、そこに整理され保管されている情報を簡単に検索、対照、分析できるようにしています。

- さらに、医学の著しい進歩が急速に起こっているが、その主な理由は最近のゲノム解析の進歩にあります。DNA塩基配列解析は、遺伝子の多様性がどのように病気を引き起こすかを明らかにし、最終的には新しい治療につながります。さらに、ラボオートメーションは、革新的な柔軟性、スループットの向上、コスト効率の良いソリューションのためのスペースを開いた。迅速なハンドリングが可能になり、精度や信頼性を心配することなくプロセスをスピードアップすることができます。ジェノタイピングとDNAシーケンシングのコストが低いため、事業拡大率は高いです。

- DNAシーケンシング技術の向上により、より手頃な価格で広く利用できるようになったため、遺伝子検査の新興企業がひな壇のように誕生しています。しかし、全ゲノムの知識は、特に様々な状況下での遺伝子発現パターンに興味を持つ機能ゲノミクスを実行可能なものにし、ゲノム配列決定プログラムの幅とスピードを急速に増大させることを可能にしました。この場合、最も重要なツールはマイクロアレイとバイオインフォマティクスです。

- 核酸単離、RNAiスクリーニング、CRISPR解析、PCR、遺伝子発現解析は、自動化を利用したゲノミクス・アプリケーションのほんの一部です。ラボオートメーションのプレーヤー/ベンダーは、これらのアプリケーション要件を満たすツールを開発しています。例えば、Tecan Groupの新しい"Fluent Automation Workstation "プラットフォームは、日々のラボオートメーションを簡素化し、ワークフローの生産性を向上させる様々な機能を組み込んでいます。実行中、システムは動的に反応し、連続的に最適なスループットを維持するために実際の時間に基づいて調整され、そのすべてがわかりやすいガントチャートを通してリアルタイムで見えます。

- 両社は顧客のニーズに応えるため、新製品の開発や既存製品への新機能の搭載を進めています。例えば、2023年5月、ラボオートメーションソリューションプロバイダーであるオペントロンズは、液体処理ラボロボットであるオペントロンズ・フレックスロボットの発売を発表しました。フレックス・ロボットは人工知能ツールに対応しています。

- ゲノミクス市場におけるラボオートメーションでは、コストが大きな懸念事項です。初期設定費用は高いので、いくつかの新興諸国は、再生ラボオートメーションのような費用対効果の高いラボオートメーションシステムの採用に注力しています。また、金利の上昇や景気後退により、新しく高価な機器を購入するための個人消費が減少していることも、市場の成長を制限しています。

ゲノミクスにおけるラボオートメーション市場動向

自動リキッドハンドラーが高成長を遂げる

- ゲノミクス研究室では、クロスコンタミネーションが大きな問題となっているが、試薬や反応混合物の管理に自動化システムを採用することで防ぐことができます。人為的な介入を排除することで、より一貫性が高まると考えられています。プラスチック成形業界における数々の技術開発により、必要な化学薬品の数が減り、少量の液体の取り扱いが容易になった。このような開発により、自動液体ハンドリング機械に対応するマイクロリットルやナノリットルのプレートの作成が容易になった。

- 業界のイノベーターたちは、自動リキッドハンドラーを作る基準を確立しました。プロセスの生産性を高めるために、これらの企業は一貫して高品質な製品の設計に投資しています。その一例として、アジレントの適応性が高く省スペースの自動リキッドハンドリングシステムは、常に高い精度で合理的なサンプル調製を可能にします。再現性を維持しながら自動化することで、ラボはより多くのサンプルを処理し、手作業から解放されます。

- さらに、米国を中心に世界中で臨床試験や前臨床試験が急速に拡大しているため、サンプル分析にスピードが求められています。機械は臨床研究においてノンストップで稼動し、適切な稼動を維持するためにはかなりの人員を必要とします。さらに、新しい病気が発見され、古い病気が急速に広がるにつれ、早期治療と診断の需要が高まっています。このため、臨床診断への応用率が高まり、自動リキッドハンドラーの採用が加速すると予想されます。

- 自動リキッドハンドリングロボットは、チューブやウェル内で液体を分散させたりサンプリングしたりするもので、液体クロマトグラフィーシステムのフロントエンドとしてメカニカルインジェクションモジュールとして組み込まれることが多いです。この種の装置には、自動分注システムやマイクロプレートウォッシャーも含まれます。これらの不可欠な省力化ツールは、様々なバイオアッセイ、液体または粉末の計量、サンプル調製、ハイスループットスクリーニング/シーケンス(HTC)のための正確なサンプル調製を提供します。

- ロボット産業協会によると、ライフサイエンス産業は、自動液体ハンドラー、自動プレートハンドラー、ロボットアームなどの面で、需要を満たす産業用ロボットの成長率が3番目に高いです。

北米が最大の市場シェアを占める

- 北米は長年にわたり臨床研究のパイオニアです。この地域には、ファイザー、ノバルティス、グラクソ・スミスクライン、J&J、ノバルティスなどの大手製薬会社があります。この地域はまた、開発業務受託機関(CRO)が最も集中している地域でもあります。重要なCROには、Laboratory Corp. of America Holdings、IQVIA、Syneos Health、Parexel International Corp.などがあります。

- 業界大手各社の存在とFDAの厳しい規制により、この地域の市場競争は激しいです。競合他社よりも優位に立つために、この地域のゲノム研究機関は、ラボにロボット工学と自動化を採用する傾向を強めています。

- ゲノム産業、特に米国はまだ成長段階にあり、今後数年間は速いペースで成長すると予想されます。新しいゲノムシーケンシング技術の利用可能性、確立されたヘルスケアインフラ、高齢者人口の増加が、市場の収益成長に大きく寄与しています。

- 米国では、成長への対応と効率化の必要性から、血液センターが全自動ウォークアウェイシステムを導入し、型検査やスクリーニング、あるいは感染症検査やその両方を行うようになっています。

- 米国のゲノム産業は今後数年間、速いペースで成長すると予想されます。新しいゲノムシーケンシング技術の利用可能性、確立されたヘルスケアインフラ、高齢者人口の増加は、市場の収益成長に大きく寄与する要因です。さらに、国内では精密医薬品に対する需要が高まっています。

ゲノミクスにおけるラボオートメーション産業の概要

ゲノミクスにおけるラボオートメーション市場は、多くの大小プレーヤーが多くの国に製品を輸出しているため、競争は中程度です。大手企業が採用する主な戦略は、開発における技術進歩、パートナーシップ、M&Aです。市場の主要企業には、Thermo Fisher Scientific Inc.、F. Hoffmann-La Roche Ltd.、Siemens Healthineers、Danaher Corporation、PerkinElmerなどがあります。

2023年1月、Becton, Dickinson, and Company(BD)は新しいラボオートメーションソリューション、微生物検査室向けの「第3世代のBD Kiestra Total Lab Automation System」を発表しました。この新しい自動ロボティックトラックシステムは、ワークフローの合理化とラボスペースの最適化を支援します。これは、ラボの検体処理を自動化するBDキエストラ微生物検査室ソリューションとともに使用されます。

2023年2月、ラボオートメーションソリューションプロバイダーであるAutomata社は、米国における事業拡大を発表しました。オートマタ社の技術により、米国のライフサイエンス業界は生産量を増やし、ワークフロー時間を最大50%削減し、既存のラボスペースを増やし、科学者が革新的な研究に取り組む時間を節約することができます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- サプライチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 市場抑制要因

- IoTによる検査室のデジタルトランスフォーメーションの動向の高まり

- 膨大なデータの効率的管理

- 市場の課題

- 高額な初期設定費用

第6章 市場セグメンテーション

- 装置別

- 自動リキッドハンドラー

- 自動プレートハンドラ

- ロボットアーム

- 自動保管・検索システム(AS/RS)

- ビジョンシステム

- 地域別

- 北米

- 欧州

- アジア

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Thermo Fisher Scientific Inc.

- Danaher Corporation/Beckman Coulter

- Hudson Robotics Inc.

- Becton, Dickinson and Company

- Synchron Lab Automation

- Agilent Technologies Inc.

- Siemens Healthineers AG

- Tecan Group Ltd.

- Perkinelmer Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

第8章 投資分析

第9章 今後の動向

The Lab Automation In Genomics Market size is estimated at USD 2.38 billion in 2025, and is expected to reach USD 4.28 billion by 2030, at a CAGR of 12.43% during the forecast period (2025-2030).

There has been a significant improvement in understanding genome sequencing in terms of data analytics advances that reveal unknown correlations, hidden patterns, and other insights, especially when testing data sets on a large scale. This is due to technological advancements and increasing computational capacities driving the market.

Key Highlights

- The development of genomics, which uses the availability of whole DNA sequences for entire organisms, is due to the innovative work of a few genomics giants and the more recent next-generation sequencing technology.

- The speed, volume, and price of genome sequencing have all dramatically increased because of the development of next-generation sequence technologies. Additionally, hundreds of life science databases and programs that promote scientific study have been made possible because of advancements in bioinformatics. These databases make it simple to search, contrast, and analyze the information that is organized and kept there.

- Furthermore, significant medical advancements are occurring quickly, mostly due to recent improvements in genomic analysis. DNA sequence analysis clarifies how genetic diversity causes disease and ultimately results in novel treatments. Additionally, laboratory automation has opened space for innovative flexibility, increased throughput, and cost-effective solutions. It allows for quick handling and enables the process to be sped up without worrying about accuracy and dependability. Due to the low cost of genotyping and DNA sequencing, the expansion rate is strong.

- Genetic testing start-ups have been springing up like daisies due to improvements in DNA sequencing technology that have made it more affordable and widely available. However, the knowledge of whole genomes has made functional genomics viable, particularly interested in gene expression patterns under various situations, making it possible for genome sequencing programs to increase rapidly in breadth and speed. The most important tools, in this case, are microarrays and bioinformatics.

- Nucleic acid isolation, RNAi screening, CRISPR analysis, PCR, and gene expression analysis are just a few of the genomics applications that use automation. Laboratory automation players/vendors are developing tools to meet these application requirements. For example, Tecan Group's new "Fluent Automation Workstation" platform incorporates a variety of capabilities to simplify day-to-day laboratory automation and increase workflow productivity. During a run, the system reacts dynamically, adjusting based on actual times to maintain continuous optimal throughput, all of which are visible in real-time via an easy-to-understand Gantt chart.

- The companies are developing new products or incorporating new features in the existing products to meet the needs of the customer. For instance, in May 2023, opentrons, a lab automation solution provider, announced the launch of an Opentrons Flex robot, a liquid-handling lab robot. Flex Robot is compatible with artificial intelligence tools.

- The cost is the major concern in lab automation in the genomics market. The initial setup cost is high, so several developing countries focus on the adoption of cost-effective lab automation systems such as refurbished lab automation. Also, declining consumer spending on buying new and costly equipment due to increasing interest rates and economic downturns restrict market growth.

Lab Automation in Genomics Market Trends

Automated Liquid Handlers to Witness High Growth

- In the genomics lab, cross-contamination is a significant issue that can be prevented by employing automated systems to manage the reagents and reaction mixtures. It is thought that eliminating human intervention leads to more consistency. Numerous technological developments in the plastics molding industry have decreased the number of chemicals needed and made it easy to handle smaller volumes of liquid. These developments have made it easier to create micro- and nanoliter plates that can work with automated liquid-handling machinery.

- Industry innovators have established the standard to create automated liquid handlers. To boost process productivity, these businesses consistently invest in designing quality products. As an illustration, Agilent's adaptable and space-saving automated liquid handling systems allow for streamlined sample preparation with consistently high accuracy. While retaining repeatability, automation enables labs to run more samples and free up manual labor.

- Additionally, the quick expansion of several clinical and pre-clinical trials across the globe, mostly in the US, has made the requirement for speed in sample analysis essential. The machines operate nonstop in clinical research and require sizable personnel to maintain proper operation. Additionally, the demand for early treatments and diagnostics grows as new diseases are discovered and old ones spread quickly. This is anticipated to accelerate the adoption of automated liquid handlers by raising the rate at which clinical diagnostic applications are made.

- Automated liquid handling robots disperse and sample liquids in tubes or wells and are frequently integrated as mechanical injection modules as the front end of liquid chromatographic systems. This kind of equipment can also include automated pipetting systems and microplate washers. These essential labor-saving tools provide accurate sample preparation for various bioassays, liquid or powder weighing, sample preparation, and high throughput screening/sequencing (HTC).

- The life science industry, in terms of automated liquid handlers, automated plate handlers, and robotic arms, among others, has had the third-highest growth in industrial robots, according to the Robotic Industries Association, to fulfill the demand.

North America Occupies the Largest Market Share

- North America has been a pioneer in clinical research for years. This region is home to some of the major pharmaceutical companies, like Pfizer, Novartis, GlaxoSmithKline, J&J, and Novartis. The region also has the highest concentration of contract research organizations (CROs). Some of the significant CROs are Laboratory Corp. of America Holdings, IQVIA, Syneos Health, and Parexel International Corp.

- Owing to the presence of all the major players in the industry and stringent FDA regulations, the market is very competitive in the region. To gain an advantage over competitors, the genomics research organizations in the region are increasingly adopting robotics and automation in labs.

- The genomic industry, especially in the United States, is still in its growing phase and is expected to grow at a fast pace over the coming years. The availability of new genome sequencing technologies, well-established healthcare infrastructure, and the increasing geriatric population are significant contributing factors toward the revenue growth of the market.

- In the United States, the need to accommodate growth and the drive to boost efficiency are priming blood centers to acquire fully automated walkaway systems, either to perform types and screens or to test specimens for infectious diseases or both.

- The US genomic industry is expected to grow at a fast pace over the coming years. The availability of new genome sequencing technologies, well-established healthcare infrastructure, and the increasing geriatric population are significant contributing factors toward revenue growth of the market. Additionally, the demand for precision medicines is rising in the country.

Lab Automation in Genomics Industry Overview

Lab automation in the genomics market is moderately competitive, owing to many small and big players exporting products to many countries. The key strategies adopted by the major players are technological advancement in development, partnerships, and mergers and acquisitions. Some of the major players in the market are Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Siemens Healthineers, Danaher Corporation, PerkinElmer, and others.

In January 2023, Becton, Dickinson, and Company (BD) introduced a new lab automation solution - 'the third-generation BD Kiestra Total Lab Automation System' for microbiology laboratories. The new automated robotic track system will assist in streamlining workflow and optimizing lab space. It is used with the BD Kiestra microbiology laboratory solution that automates lab specimen processing.

In February 2023, Automata, a laboratory automation solution provider, announced a business expansion in the United States as it will likely help the United States life science industry to save lab spaces with automation. With Automata's technology, the United States life sciences industry will increase output and cut workflow times by up to 50%, increase existing lab space, and save scientists time to work on innovative research.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Restraints

- 5.1.1 Growing Trend of Digital Transformation for Laboratories with IoT

- 5.1.2 Effective Management of the Huge Amount of Data Generated

- 5.2 Market Challenges

- 5.2.1 Expensive Initial Setup

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Automated Liquid Handlers

- 6.1.2 Automated Plate Handlers

- 6.1.3 Robotic Arms

- 6.1.4 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5 Vision Systems

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fisher Scientific Inc.

- 7.1.2 Danaher Corporation / Beckman Coulter

- 7.1.3 Hudson Robotics Inc.

- 7.1.4 Becton, Dickinson and Company

- 7.1.5 Synchron Lab Automation

- 7.1.6 Agilent Technologies Inc.

- 7.1.7 Siemens Healthineers AG

- 7.1.8 Tecan Group Ltd.

- 7.1.9 Perkinelmer Inc.

- 7.1.10 Eli Lilly and Company

- 7.1.11 F. Hoffmann-La Roche Ltd.