|

市場調査レポート

商品コード

1851332

クレーン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クレーン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月04日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

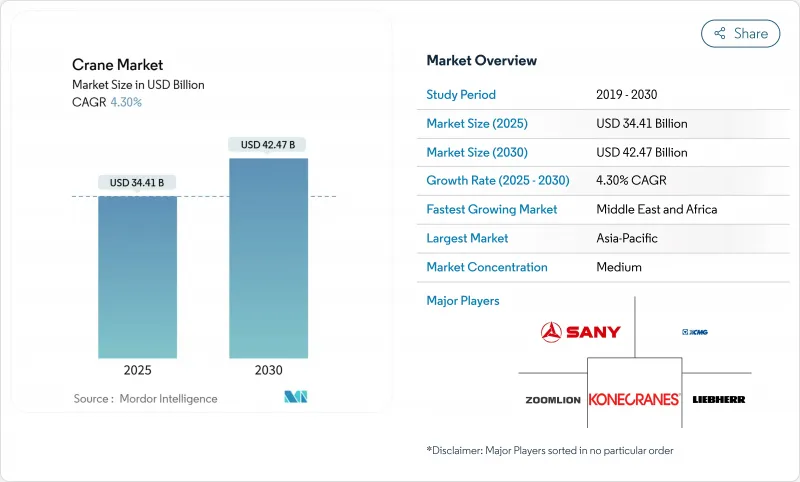

クレーン市場は2025年に344億1,000万米ドルに達し、2030年には424億7,000万米ドルに拡大すると予測され、CAGRは4.30%です。

安定した公共支出、大規模な民間メガプロジェクト、再生可能エネルギーへの世界的シフトが、クレーン市場の中核的需要エンジンを形成しています。米国インフラ投資・雇用促進法に代表される政府のインフラ計画は、請負業者を短期的な景気変動から守るため、複数年にわたる受注残を生み出しています。洋上風力発電、ソーラーパーク、送電網のアップグレードは、特に特殊な重量物用機器や船舶用機器にとって、この明るい見通しを補強しています。同時に、電化義務化はハイブリッドクレーンや完全電動クレーンへの投資に拍車をかけ、テレマティクスの採用はフリートの稼働率を上げ、ダウンタイムを抑制します。既存企業がゼロ・エミッション・プラットフォームの研究開発を加速し、ニッチなイノベーターを買収してポートフォリオを拡大するため、競合は激化します。

世界のクレーン市場の動向と洞察

高まるインフラ整備

インフラストラクチャーの近代化は、クレーン需要の主要な触媒として浮上しており、インフラ投資・雇用促進法(Infrastructure Investment and Jobs Act)だけでも、交通、エネルギー、デジタル・インフラストラクチャー全体で1兆2,000億米ドルを超える投資が計画されています。このインフラ推進の規模は、従来の道路や橋のプロジェクトにとどまらず、特殊な重量物運搬能力を必要とするデータセンター、半導体工場、クリーンエネルギー施設にまで及んでいます。建設支出は年間2兆1,300億米ドルに達すると予測され、公共インフラは前年比8%近い伸びを占める。このインフラ・ルネッサンスは、クレーン事業者に複数年にわたる見通しをもたらし、プロジェクトのバックログを2027年まで延長します。インフラ・プロジェクトにおけるモジュール式建設技術へのシフトも、数百トンのプレハブ部品を扱うことができる精密リフティング機器の需要を促進しています。連邦政府のインフラ資金援助により、各州は労働力開発プログラムに投資することが可能になり、そうでなければ市場成長を抑制しかねないクレーン認定オペレーターの深刻な不足に対処しています。

再生可能エネルギー導入の急増

再生可能エネルギーの移行はクレーンの市場力学を根本的に変えており、洋上風力発電設備は2,500トンを超えるタービン部品を吊り上げることができる特殊な海上クレーンの需要を牽引しています。Cadeler社のWind Peakをはじめ、風力タービン据付用船舶は、15MWのタービン一式を7台積載することができるなど、ますます洗練されたクレーンシステムを搭載するようになってきています。再生可能エネルギーの導入規模は前例のないものであり、Huisman社のような企業は、150メートルを超える高さでコンポーネントを取り扱うための、特殊な洋上風力据付クレーンやモーション補正プラットフォームを開発しています。太陽光発電の設置は、特にパネルや設置システムが広大な地域で正確な位置決めを必要とするユーティリティ・スケールのプロジェクトにおいて、移動式クレーンの需要を促進しています。再生可能エネルギーセクターの成長は、浮体式洋上風力プラットフォームから、特殊なリフティングソリューションを必要とする集光型太陽光発電設備まで、新たなクレーンアプリケーションカテゴリーを生み出しています。再生可能エネルギー・インフラは、継続的なメンテナンスと部品交換を必要とするため、このエネルギー転換は、従来の建設サイクルをはるかに超えてクレーンの需要成長を維持すると予想されます。

高い資本コストと運転コスト

ManitowocのModel 31000のような新型重量物クレーンの価格は3,000万米ドルに達する一方、多額の継続的メンテナンス投資が必要です。材料費のインフレにより、建設資材価格は主要市場で平均15%上昇し、クレーンの製造コストとレンタル料に直接影響を与えています。高金利はこうした課題をさらに深刻化させ、設備資金調達コストは大幅に上昇し、クレーンの購入やレンタル需要に影響を及ぼしています。中小のクレーンオペレーターは、価格上昇を吸収する規模がないため、こうしたコスト圧力に特に弱く、市場からの撤退や大手プレーヤーとの統合を余儀なくされる可能性があります。最新のクレーンシステムは複雑であるため、専門技術者や高価な交換部品を必要とし、オペレーターの予算を圧迫する可能性があります。認定オペレーターのトレーニングコストは増加しており、シミュレーションベースのプログラムは、トレーニング時間の短縮と安全性の向上という長期的なメリットがあるにもかかわらず、多額の先行投資を必要としています。

セグメント分析

移動式クレーンは、建設、インフラ、産業用途の汎用性を反映して、2024年に45.25%の最大市場シェアを維持します。移動式クレーンセグメントは、多様な現場への適応性と複数のプロジェクトに迅速に展開できる能力から利益を得ており、多様な作業量を管理する請負業者にとって好ましい選択肢となっています。海上およびオフショアクレーンは、2025~2030年のCAGRが7.45%と最も強い成長軌道をたどっています。これは、オフショア風力発電設備の前例のない拡大と、船舶に搭載される特殊なリフティングソリューションの必要性によるものです。

タワークレーンや天井クレーンを含む固定クレーンは、高層建築や産業施設で重要な役割を果たし、特に中東やアジア太平洋の都市メガプロジェクトで需要が高まっています。海洋・オフショア部門の急成長は、洋上風力タービンの設置という特殊な性質を反映しており、クレーンは何千トンもの部品を扱いながら厳しい海洋環境で稼働しなければならないです。Cadeler社のような企業は、成長する洋上風力発電市場に対応するため、2,200トン級のクレーンを備えた風力タービン据付船に多額の投資を行っています。洋上風力タービンの大型化が進むにつれ、厳しい気象条件下でも精密な吊り上げが可能な、ますます洗練された舶用クレーンシステムの需要が高まっています。

51~150トンのセグメントは2024年に33.90%と最大の市場シェアを占め、一般建設および産業用途のスイートスポットとなっています。容量300トン以上のセグメントは、CAGR 8.25% 2025-2030で最も速い成長を経験しており、前例のないリフティング能力を必要とするメガプロジェクトへの業界のシフトを反映しています。このミッドレンジ容量セグメントは、リフティング能力と操作の柔軟性のバランスから恩恵を受け、商業ビルからインフラ開発まで様々な建設プロジェクトに適しています。

重量物吊り上げ用途は、原子炉部品、プロセスモジュール、タービンアセンブリを吊り上げることができるクレーンを必要とする原子力発電所建設、石油化学施設、海洋エネルギープロジェクトによって推進されています。Mammoetが開発した容量6,000トンのSK6000クレーンは、超重量リフティング能力への業界の後押しを例証しています。50トンまでのセグメントは小規模な建設プロジェクトやメンテナンス用途に対応し、151~300トンレンジは中規模産業やインフラのニーズに対応します。Zoomlionの3,600トンのクローラークレーンは、単一リフティング重量の世界記録を打ち立て、重量物リフティング能力の技術的進歩を実証しています。モジュラー建築の動向は、プレハブ部品が正確なリフティングと位置決め能力を必要とするため、すべての能力範囲にわたって需要を牽引しています。

地域分析

アジア太平洋地域は、2024年のクレーン市場収益の42.10%を占め、これは中国が高い公共事業支出を維持し、インドが工場建設を加速させたためです。中国の港湾自動化のサクセスストーリーは、1時間に平均60.9個のコンテナを移動させる1基の橋型クレーンで、スループット性能における地域のリーダーシップを物語っています。インドの2025年連邦予算は、選挙期間中の警戒にもかかわらず、クローラーとタワークレーンに対する継続的な需要を下支えし、高水準のインフラ配分を維持した。日本と韓国は、施設のメンテナンスと近代化によって、1桁台前半の伸びを記録します。

中東・アフリカ地域は、2025~2030年のCAGRが最速の6.65%になると予測されます。サウジアラビアだけでも、NEOMと関連するギガ・プロジェクトのために約2万台のタワークレーンを配備する予定です。WolffkranとZamil Groupの新工場のような現地合弁事業は、輸入リードタイムを短縮し、現地化されたサプライチェーンを構築します。原油価格の高騰は、重量物用クローラークレーンに依存する下流の石油化学コンビナートに収益をもたらし、用途の多様性を広げます。

北米は、1兆2,000億米ドルのインフラ投資・雇用促進法の恩恵を受け、6万以上のプロジェクトに資金を供給し、複数年の仕事量を維持します。米国の設備レンタル部門は2025年に773億米ドルに達すると予測され、クレーンが大きなシェアを占める。欧州は、洋上風力発電が設備需要を加速させる一方で、金利上昇が商業用不動産の着工を抑制するという、複雑なシグナルに直面しています。ラテンアメリカの回復はコモディティ価格次第だが、ブラジルのエネルギー入札が再開されたことで、この地域の大型リフトの受注が増加しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- インフラ整備の進展

- 再生可能エネルギー(ウィンドファーム)設置の急増

- 新興国の産業成長

- 都市化の加速と巨大プロジェクトのパイプライン

- テレマティクスによる車両最適化(アンダーレーダー)

- サイトエミッション規制を満たすためのハイブリッド/Eクレーンの採用(アンダーレーダー)

- 市場抑制要因

- 高い資本コストと運営コスト

- 建設支出の景気循環性

- クレーン認定オペレーターの不足(アンダーレーダー)

- カーボンフットプリントの精査とゆりかごから墓場までの報告(アンダーレーダー)

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- モバイルクレーン

- オールテレインクレーン

- ラフテレインクレーン

- クローラークレーン

- トラック積載型クレーン

- その他の移動式クレーン

- 固定クレーン

- モノレールとアンダーハング

- オーバーヘッドトラックマウント

- タワークレーン

- マリン&オフショアクレーン

- モバイルハーバークレーン

- 固定ハーバークレーン

- オフショアクレーン

- シップクレーン

- モバイルクレーン

- 容量別

- 最大50 T

- 51~150 T

- 151~300 T

- 300トン以上

- 電源別

- ディーゼル

- ハイブリッド

- フル電動

- ブームタイプ別

- ラティス・ブーム

- 伸縮ブーム

- 用途別

- 建設・鉱業

- エネルギー・公益事業

- 造船と港湾

- 工業生産

- 物流・倉庫

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Liebherr-International AG

- Tadano Ltd.

- Konecranes Plc

- Manitowoc Co.

- XCMG Group

- Terex Corporation

- SANY Group

- Zoomlion Heavy Industry Sci and Tech

- Kobelco Construction Machinery

- Palfinger AG

- Hitachi Sumitomo Cranes

- Favelle Favco Group

- Cargotec Oyj(Hiab)

- Sarens NV

- Mammoet

- Link-Belt Cranes

- Altec Inc.

- Effer SpA

- Bocker Maschinenwerke