|

市場調査レポート

商品コード

1907332

紙包装:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 紙包装:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

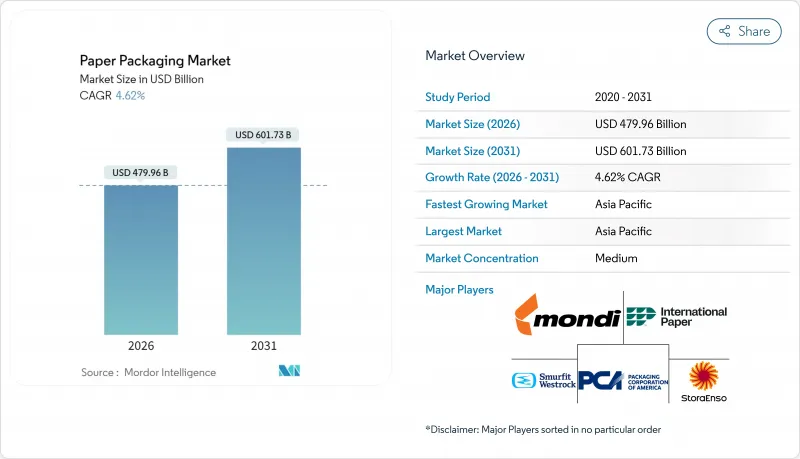

紙包装市場は2025年に4,588億米ドルと評価され、2026年の4,799億6,000万米ドルから2031年までに6,017億3,000万米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは4.62%と見込まれます。

この拡大は、再生可能な基材を奨励する環境規制、オンライン小売の継続的な成長、そして紙がプラスチックと水分・油分抵抗性で競合できるバイオベースバリアコーティングの急速な進歩によって推進されています。生産者は、多層プラスチックと比較して繊維ベース材料のコンプライアンスコストを低減する拡大生産者責任(EPR)料金体系の恩恵を受けています。同時に、ナノセルロース技術への投資は、迫り来る米国およびEUの化学物質段階的廃止に合致するPFASフリー性能を約束しています。デジタル印刷と小ロット生産の経済性によって支えられた供給側の柔軟性により、コンバーターは魅力的な利益率で短納期・高度にカスタマイズされたキャンペーンに対応できるようになり、紙包装市場の対応可能量が拡大しています。

世界の紙包装市場の動向と洞察

バリアコーティング紙板ソリューションの開発がプレミアム用途を牽引

バイオポリマーやナノセルロースを基盤とした高度な防水・防湿・防油バリアコーティングは、紙の性能を向上させつつリサイクル性を維持しています。実験室試験では、セルロースナノフィブリルコーティングが未コーティング板紙と比較し、酸素透過率を90%以上低減し、折り曲げ耐久性を2倍に高めることが確認されています。米国食品医薬品局(FDA)は、PFASを含む耐油剤が食品接触市場から撤退したことを確認し、需要はより安全な化学物質へと移行しています。欧州では、複数の加工業者が、強力な水蒸気遮断性を提供し、堆肥化基準を満たすホウ酸架橋ポリビニルアルコールコーティングの工業生産を急ピッチで進めています。ブランドオーナーが保存期間を損なうことなくプラスチック代替を追求する中、プレミアムバリアコーティング板紙は、即席食品、冷凍食品、パーソナルケアギフトパックの標準仕様となりつつあり、紙包装市場の価値成長を促進しています。

Eコマース向け段ボール需要の急増が生産優先順位を再構築

世界のオンライン小売は実店舗販売を上回る成長を続けており、各小包には自動化処理に耐え得る保護性と積載性を備えた外装包装が求められます。段ボールケースは現在、EC出荷の約80%を占めると推定され、ラストマイル物流の主力としての地位を確固たるものにしております。中国とインドを中心としたアジアの巨大市場では、2024年に小包数が数十億個増加し、箱工場の拡張やウェブショップ向け高速デジタル印刷ラインの導入が進んでいます。生産構成は、輸送コストを削減しつつ圧縮強度を維持する軽量フルートプロファイルへ移行しており、統合生産企業はEC需要の牽引に追随するため、グラフィック用紙グレードよりも段ボール原紙の増産を優先しています。この需要基盤が、成熟経済圏と新興経済圏双方における紙包装市場の着実な量成長を支えています。

森林伐採監視が従来のサプライチェーン構造に課題をもたらす

EU森林破壊規制により、輸入業者は2025年末までに全ての木材系原料について区画レベルのトレーサビリティ証明が義務付けられます。EU向け特殊グレードパルプ輸入の60%を占める米国産クラフトパルプには、第三者機関による検証済み地理座標の記載が必須となりました。衛星監視や管理連鎖監査の導入は調達コストの増加や出荷遅延リスクを伴います。高度なデータシステムを欠く中小製紙工場は、認証森林を保有する垂直統合型大手企業にシェアを奪われ、紙包装市場内の競争バランスが変化する可能性があります。時間の経過とともに、より厳格な原産地規則が供給を圧迫し、輸入繊維に依存する市場における同セクターの成長可能性を抑制する恐れがあります。

セグメント分析

2025年時点で、段ボール原紙は段ボール産業の基盤が整っていること、および電子商取引の配送において中心的な役割を担っていることから、紙包装市場で54.12%のシェアを占めました。一方、カートンボードは繊維グレード中最も高い7.05%のCAGRを記録しています。食品やパーソナルケア製品のスリーブ包装における高級品浸透を反映し、カートンボード用途の紙包装市場規模は拡大が見込まれます。コンバーター各社は、休眠中のグラフィック用紙製造機を、固形漂白硫酸パルプ(SBS)や折り畳み箱用板紙(Folding Boxboard)生産に適したコーティングヘッドに改造し、設備稼働率の向上を図っています。折り畳み箱用板紙は高精細デジタル印刷との相性が良く、店頭での訴求力を高めます。また分散バリア性の向上により冷蔵食品分野への参入が可能となりました。同時に、段ボール原紙メーカーは輸送重量削減のため軽量クラフトライナーへの投資を進め、持続可能性の向上を図っています。バージン材と再生材の混合使用は強度対重量比を最適化し、段ボール原紙の競争力を維持。これにより紙包装市場における主力製品としての地位を確固たるものにしています。

カートンボードの成長性により、欧州と北米では急速な生産能力拡大に向けた資本が流入しており、新規設備の稼働量は2026年までに100万トンを超える見込みです。食品接触認証や医薬品クリーンルーム対応により、特に固形漂白グレードのトン当たり価値が向上しています。EU複数国における黒色プラスチック規制により、高級菓子や化粧品の包装が白色カートンボード形式へ移行し、需要をさらに押し上げています。ナノクレイなどの性能向上添加剤は、リサイクル性を損なうことなく防湿性を提供し、プラスチックフィルムへの依存度を低減します。小売ブランドが品質と持続可能性を伝える単一素材包装を求める中、板紙は紙包装市場における最大の受益者として浮上しています。

段ボール箱は、輸送・産業・食料品流通分野における比類なき保護強度と汎用性により、2025年時点で紙包装市場の61.48%を占めました。しかしながら、折り畳み式カートンは、パーソナライズされたグラフィック、迅速な季節キャンペーン対応、小ロット生産を背景に、全体成長率を上回る5.12%のCAGRで拡大すると予測されています。型抜き機に統合されたデジタルプリントヘッドは切り替え時間を短縮し、高コストな在庫を抱えることなく大量カスタマイゼーションを実現します。高級化粧品、栄養補助食品、植物性食品はいずれも、美的柔軟性と棚出し可能なフォーマットから折り畳み式カートンを好んで採用しています。

段ボールメーカーは内面印刷や高彩度印刷技術でブランド表示領域を確保しようと対応していますが、折り畳み式カートンは触感仕上げやエンボス加工において優位性を維持しています。家電アクセサリーはプラスチック製クラムシェル包装から、成形繊維インサートを組み合わせた強化カートンへの移行が進み、持続可能性を重視する消費者層を獲得しています。さらに、柔軟性のあるパウチから着想を得た画期的なティアストリップ(破線)開封機能により、利便性がさらに向上しています。こうしたデザインと技術の進歩が、紙包装市場全体における着実なシェア拡大を支えています。

地域別分析

アジア太平洋地域は2025年に47.62%の収益シェアで紙包装市場を牽引し、2031年までCAGR5.51%で拡大が見込まれます。南アジア・東南アジアでは、急速な都市化、拡大する中産階級の購買力、大規模な食品配達エコシステムが繊維需要を支えています。地域プレイヤーは、植林林と自社加工施設を組み合わせたコスト効率の高い統合工場を活用し、輸出志向の顧客向けのリードタイムを短縮しています。地方政府は、省エネ機械に対する関税還付を通じて持続可能な包装への投資を奨励し、生産能力の拡大をさらに加速させています。

北米はイノベーションの中核地として、デジタル印刷技術の普及を推進し、ナノセルロースのパイロット商業化を主導しています。複数の州で強化される埋立規制により、戸別回収可能な包装材の需要が高まり、国内のコンテナボード需要を支えています。米国は豊富な針葉樹資源に恵まれ、輸入古紙(OCC)と混合するバージンパルプの安定供給が確保されています。一方、欧州では厳格なリサイクル目標と拡大生産者責任(EPR)制度の導入により、設備の継続的更新を促す予測可能な政策環境が形成されています。ドイツやスカンジナビアの工場では化石燃料ボイラーからバイオマスボイラーへの転換が進み、高エネルギー価格下でもスコープ1排出量を削減し、コスト競争力を高めています。

ラテンアメリカ、中東・アフリカは、現在、それぞれわずかなシェアしか占めていませんが、両地域とも世界平均を上回る成長を記録しています。ブラジルのパルプ生産者は、商品サイクルの影響を緩和するために下流の板紙事業に統合し、湾岸協力会議(GCC)加盟国は、拡大するEコマースのハブに対応するために段ボールの生産能力を増強しています。アフリカでは、収集ネットワークが未発達であるため、再生繊維の供給が妨げられていますが、国際開発プログラムがパイロット的な材料回収施設に資金を提供しており、将来の循環型経済の基礎を築いています。これらの地域的な動向は、紙包装市場の長期的な回復力を支える多様な需要基盤を強化するものです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- バリアコート紙板ソリューションの開発

- 電子商取引における段ボール需要の増加

- ブランドオーナーの単一素材包装への移行

- 拡大生産者責任(EPR)の義務化

- ナノセルロースバリア技術の画期的な進展

- 加工工場におけるオンサイトデジタル印刷の経済性

- 市場抑制要因

- 森林伐採と繊維供給の精査

- 変動の激しい再生繊維価格

- PFAS「永久化学物質」の段階的廃止コスト

- 新興市場における限られた回収物流

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 世界の再生紙生産統計

- 再生紙- 生産数量

- 再生紙- 輸入額と数量

- 再生紙- 輸出額と数量

- 再生紙生産量- 主要生産国

- カートンボードの輸出入状況

- 輸出(金額と数量)

- 輸入(金額と数量)

第5章 市場規模と成長予測

- グレード別

- カートンボード

- 固形漂白硫酸パルプ(SBS)

- 無漂白硫酸パルプ(SUS)

- 折り畳み用板紙(FBB)

- コート再生板紙(CRB)

- 無塗工再生板紙(URB)

- その他の板紙グレード

- コンテナボード

- ホワイトトップクラフトライナー

- その他のクラフトライナー

- ホワイトトップテストライナー

- その他のテストライナー

- セミケミカルフルーティング

- 再生フルート

- カートンボード

- 製品別

- 折り畳み式カートン

- 段ボール箱

- その他の製品

- エンドユーザー業界別

- 食品

- 飲料

- ヘルスケア

- パーソナルケア

- 家庭用品

- 電気・電子機器

- その他のエンドユーザー産業

- 包装形態別

- 硬質(段ボール、厚紙)

- 半硬質(折り畳み式段ボール箱)

- フレキシブル紙(小袋、包装紙)

- 成形繊維およびパルプ

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Graphic Packaging International, LLC

- Nippon Paper Industries Co. Ltd.

- Sonoco Products Company

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings

- Lee & Man Paper Manufacturing

- Sappi Limited

- Ilim Group

- Klabin S.A.

- Asia Pulp & Paper(APP)