|

市場調査レポート

商品コード

1849868

地理空間分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 地理空間分析:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月18日

発行: Mordor Intelligence

ページ情報: 英文 123 Pages

納期: 2~3営業日

|

概要

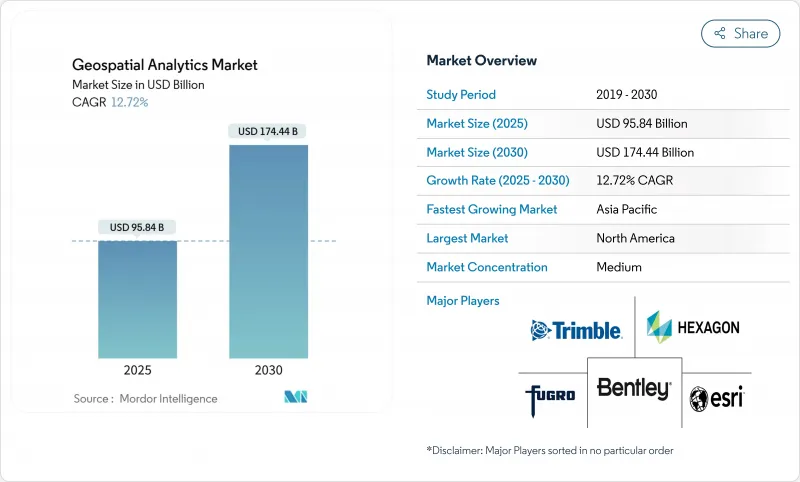

地理空間分析市場の2025年の市場規模は958億4,000万米ドルで、2030年には1,744億4,000万米ドルに達すると予測され、CAGRは12.72%で進展します。

ロケーションベースの洞察に対する需要の高まり、衛星コンステレーションの急速な立ち上げ、スマートシティへの投資により、この分野はデジタルトランスフォーメーションの不可欠な柱として位置づけられています。企業は、人工知能が特徴抽出と予測モデリングを自動化するのに伴い、空間インテリジェンスを活用して業務効率を高め、リスクを軽減し、戦略的意思決定を合理化します。デジタル・ツインに対する政府の刺激策、5Gの展開、センサー・データをローカルに処理するエッジ・コンピューティングの能力は、採用をさらに推進します。一方、個人情報保護規制の強化やハードウェアのサプライチェーンによる圧力は成長を抑制しているが、全体的な上昇基調は減速していないです。

世界の地理空間分析市場動向と洞察

スマートシティプログラムの採用

都市におけるデジタルツインイニシアチブは、自治体が交通、エネルギー、ユーティリティをリアルタイムで可視化することを求め、地理空間分析市場の需要を加速させます。日本のプロジェクトPLATEAUは、防災や土地利用計画をサポートするために200以上の都市の3Dモデルを提供しています。中国のデジタルインフラ義務化により、標準化された空間フレームワークが地方自治体に組み込まれ、継続的なプラットフォーム購入が促進されています。英国の公共部門地理空間協定は、地下資産マッピングのために10億英ポンドを確保し、工事のストライキやメンテナンスの遅れを最小限に抑えています。また、欧州の地方自治体では、デジタルツインを使用してカーボンニュートラリティの進捗状況を追跡し、持続可能性目標とロケーションインテリジェンスとの関連性を強化しています。これらのプログラムにより、数年にわたる購入サイクルが維持され、自治体の業務の奥深くに空間分析が組み込まれています。

5G位置情報サービスの統合

5Gのサブメートル単位の測位精度とミリ秒単位の遅延は、ダイナミックな交通オーケストレーションからドローンの自律ルーティングまで、リアルタイムの地理空間アプリケーションを解放します。基地局に併設されたエッジコンピューティングは、画像やセンサーフィードをローカルで処理し、ヘルスケアや防衛におけるデータ主権ルールの遵守を保証します。小売業者は買い物客のナビゲーションに屋内測位を採用し、工場はGPSなしで資産追跡を最適化します。5GとAIの相乗効果により、検知から決定までのサイクルが短縮され、常時オンでコンテキストを意識した空間サービスへの期待が高まる。

高いコストと運用の複雑さ

企業が高精度LiDARに予算を割く際の参入障壁は依然として高く、スキャナ1台あたり最高15万米ドル、年間ソフトウェア・ライセンスは5万米ドルに迫る。衛星、ドローン、レガシーGISのアーカイブを統合するには、希少なスキルが要求されます。地理空間データ科学者の給与は20~30%割高です。企業は、座標系を調整し、フォーマットを調和させるために、プロジェクト時間の大半を費やし、Time-to-Valueを遅らせています。サブスクリプションは、設備投資を削減する一方で、分析をフル稼働させるとオペレックスが急増します。トレーニングプログラムと認定は、毎年従業員1人当たり1万~2万5,000米ドルを追加し、中小企業の予算を圧迫しています。

セグメント分析

サービスがCAGR 12.9%で成長すると予測されるが、これは組織がますます複雑な空間ソリューションを採用するようになり、スキルギャップが拡大していることを反映しています。ソフトウェアは、2024年の地理空間分析市場シェア42.7%を維持するが、バイヤーは現在、展開を加速するためにコンサルティングとマネージドサービスを優先しています。ハードウェアの売上は、センサーの価格低下とサテライトの拡大により堅調に推移しているが、コモディティ化が進むにつれて伸びは鈍化しています。

マネージド・アナリティクスの利用が増加していることは、ライセンス所有から成果ベースの契約へのシフトを示しています。CARTOとIndigo Agのコラボレーションは、アグリビジネスがデータ融合とダッシュボード配信をアウトソーシングすることで、スタッフを作物科学のイノベーションのために解放する方法を示しています。アウトソーシング・モデルはまた、空間リスク・スコアリングが不可欠でありながら非中核業務である保険や不動産における人材不足を緩和します。その結果、サービス部門は地理空間分析市場全体の長期的な経常収益の柱となっています。

2024年の地理空間分析市場規模の35.7%は地表面解析であり、洪水予測やインフラ立地を支えています。一方、経営陣は直感的なビジュアルを求めるようになっており、CAGR 14.8%でジオビジュアライゼーションを推進しています。ネットワーク分析も勢いを維持しており、公共事業のルーティングやラストマイル配送の最適化をサポートしています。

エコー・アナリティクスの歩行者動線ダッシュボードは、3Dビジュアルとヒートマップがいかに都心の店舗計画を加速させるかを示しています。拡張現実のオーバーレイは、ゾーニングの承認や資本事業の資金調達のために利害関係者の賛同を促します。人工知能がテーママップを自動生成するため、ジオビジュアライゼーションは非GIS専門家の参入障壁を下げ、対応可能な地理空間分析市場を拡大します。

地理空間分析市場は、コンポーネント別(ソフトウェア、サービス、ハードウェア)、分析タイプ別(サーフェス分析、ネットワーク分析、その他)、展開モデル別(オンプレミス、クラウド)、エンドユーザーバーティカル別(政府、防衛、インテリジェンス、その他)、地域別に分類されています。市場予測は金額(米ドル)で提供されます。

地域別分析

北米は2024年に地理空間分析市場の24.7%を占め、成熟した衛星インフラ、広範な5G展開、持続的な国防支出に支えられています。米国国防総省の1,000基の監視衛星計画は、新鮮な画像ストリームを注入し、分析プラットフォームのアップグレードに拍車をかける。カナダの地理空間オープンデータ構想やメキシコの都市モビリティ試験も、米国が収益の大半を占めるとはいえ、地域的な需要を増加させる。国家地理空間情報局(National Geospatial-Intelligence Agency)のLuno商業分析契約などの連邦政府プログラムは、一貫した調達フローを強化します。

アジア太平洋は2030年までCAGR 14.5%を記録すると予測され、スマートシティ補助金、交通回廊の整備、民間投資の増加がその推進力となります。中国のリモートセンシング市場は、北京がハイパースペクトルやレーダーのペイロードに資金を提供することで、2033年までに4倍に拡大する可能性があります。日本のProject PLATEAUとインドのNational Spatial Data Infrastructureは、標準化されたプラットフォームに対する公共部門の意欲をさらに実証しています。インドネシア、ベトナム、フィリピンの急速な都市化により、洪水リスクモデリング、交通オーケストレーション、地租電子化に対する自治体の支出が増加し、この地域の地理空間分析市場が深化します。

欧州では、オープンデータ政策やグリーン・トランジションへの資金援助により、着実な成長を遂げています。英国は10億英ポンドの地理空間戦略により、国家資産台帳とデジタルツインの展開を支えます。ドイツはインダストリー4.0のロードマップに位置情報分析を組み込み、フランスはウクライナと共同諜報能力で協力し、防衛市場の引き合いを強調しています。北欧は炭素収支と精密農業に空間ツールを活用し、ソリューションの輸出を簡素化する国境を越えた相互運用性基準を育成しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- スマートシティプログラムの導入

- 5G対応位置情報サービスの統合

- IoT由来の空間データの普及

- 小型衛星コンステレーションによる高再訪画像撮影

- 超ローカルESGおよび気候リスク分析の需要

- 自律運用のためのリアルタイムジオフェンシング

- 市場抑制要因

- 高コストと運用の複雑さ

- 法的およびプライバシー上のハードル

- AI駆動型空間モデルにおけるデータバイアス

- 異機種標準間の相互運用性

- サプライチェーン分析

- テクノロジーの展望

- 規制情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 市場におけるマクロ経済要因の評価

第5章 市場規模と成長予測

- コンポーネント別

- ソフトウェア

- サービス

- ハードウェア

- 分析タイプ別

- 表面分析

- ネットワーク分析

- 地理視覚化

- その他

- 展開モデル別

- オンプレミス

- クラウド

- エンドユーザー別

- 政府

- 防衛と情報

- 農業

- 天然資源

- ユーティリティとコミュニケーション

- 運輸・物流

- ヘルスケアとライフサイエンス

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Esri Inc.

- Hexagon AB

- Trimble Inc.

- Maxar Technologies Inc.

- Bentley Systems Inc.

- Fugro NV

- L3Harris Technologies Inc.

- Airbus Defence and Space

- MDA Ltd.

- Atkins PLC(SNC-Lavalin)

- Intermap Technologies

- Oracle Corporation

- SAP SE(HANA Spatial)

- Google LLC(Google Maps Platform)

- Amazon Web Services(Location Service)

- Microsoft Corporation(Azure Maps)

- HERE Technologies

- TomTom NV

- CARTO

- Precisely(MapInfo)