|

|

市場調査レポート

商品コード

1914123

地理空間インテリジェンスの世界市場:地理空間AI、地理空間アナリティクス、取得システム、技術 - 予測(~2030年)Geospatial Intelligence Market by GeoAI, Geospatial Analytics, Acquisition Systems, Technology - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 地理空間インテリジェンスの世界市場:地理空間AI、地理空間アナリティクス、取得システム、技術 - 予測(~2030年) |

|

出版日: 2026年01月12日

発行: MarketsandMarkets

ページ情報: 英文 521 Pages

納期: 即納可能

|

概要

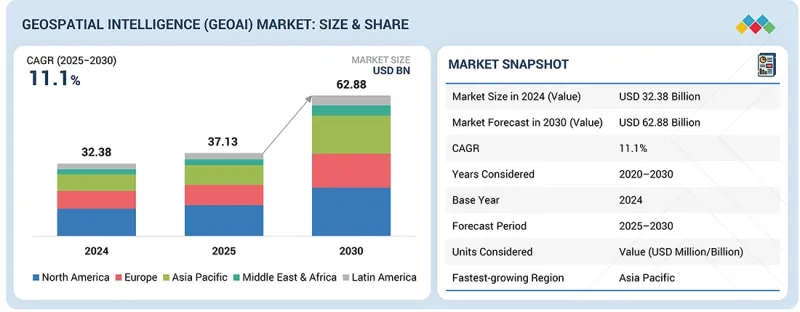

世界の地理空間インテリジェンス(GeoAI)の市場規模は、2025年の371億3,000万米ドルから2030年までに628億8,000万米ドルに達すると予測され、予測期間にCAGRで11.1%の成長が見込まれます。

市場の成長は、衛星、ドローン、センサー、コネクテッドデバイスから生成される複雑な地理空間データセットを分析するためのAIと機械学習の活用の拡大によって促進されています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 提供、コア技術アーキテクチャ、データタイプ、用途、業界、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、ラテンアメリカ |

防衛、インフラ、医療、環境モニタリングなどの分野の組織は、意思決定、リスクの評価、業務効率の向上を図るため、地理空間インテリジェンスソリューションを採用しています。クラウドコンピューティング、データフュージョン、リアルタイムアナリティクスの進歩により、地理空間インテリジェンスプラットフォームのスケーラビリティとアクセシビリティが向上しています。並行して、スマートインフラ、公共安全、気候変動への耐性強化に向けた取り組みへの投資が増加しており、先進のGeoAI機能への需要がさらに高まっています。

「提供別では、センシング・キャプチャセグメントが予測期間にもっとも高いCAGRで成長すると見込まれています。」

センシング・キャプチャは、地理空間インテリジェンス(GeoAI)市場において、地理空間取得システムの中でもっとも急速に成長しているセグメントです。このセグメントには、地理空間データを収集するために使用される衛星、航空プラットフォーム、ドローン、LiDARシステム、地上ベースのセンサーが含まれます。成長は、地球観測衛星の展開の拡大、無人航空システムの使用の増加、高頻度データ収集の需要によって促進されています。これらの取得システムは、下流の地理空間インテリジェンス・アナリティクスに必要な基礎的なデータを提供します。センサーの解像度、範囲、コスト効率の継続的な改良により、防衛、インフラモニタリング、環境評価、災害対応などのさまざまなユースケースにおける採用が加速しています。

「画像データセグメントが地理空間インテリジェンス(GeoAI)市場において最大のシェアを占めると予測されます。」

画像データは、地理空間インテリジェンス(GeoAI)市場において最大のデータタイプセグメントを占めています。衛星画像と航空写真は、監視、マッピング、変化検出、アセットモニタリング用途に広く活用されています。高解像度画像は、複数の部門におけるAIによる特徴抽出、物体認識、予測的空間分析を支えています。画像の解像度、再訪頻度、分析能力の継続的な向上により、画像ベースのインテリジェンスの価値が高まっています。防衛、都市計画、環境モニタリング、商業用途における強力な採用が、画像データセグメントの支配的な地位を維持しています。

「北米が地理空間インテリジェンス(GeoAI)市場をリードする一方、アジア太平洋がもっとも急速に成長している地域として台頭しています。」

北米が予測期間に地理空間インテリジェンス(GeoAI)市場で最大のシェアを維持すると見込まれます。同地域は、持続的な政府支出と成熟した地理空間技術エコシステムに支えられ、防衛、公共安全、インフラ、医療用途における強力な採用の恩恵を受けています。連邦機関や企業における衛星画像、地理空間分析、AI対応インテリジェンスプラットフォームの広範な利用が、市場での主導的地位を推進しています。主要な地理空間技術プロバイダーやクラウドサービスプラットフォームのプレゼンスが、展開をさらに加速させています。

アジア太平洋は、地理空間インテリジェンス(GeoAI)市場においてもっとも高い成長率を記録すると予測されています。急速な都市化、スマートシティ構想への投資の増加、中国、インド、東南アジア諸国などにおける地球観測プログラムの拡大が採用を促進しています。同地域の政府は、インフラ開発、環境モニタリング、災害管理に地理空間インテリジェンスを活用しています。衛星データの可用性の向上と分析能力の進化により、アジア太平洋は予測期間における重要な成長地域としての地位を確立しています。

当レポートでは、世界の地理空間インテリジェンス市場について調査分析し、主な促進要因と抑制要因、製品開発とイノベーション、競合情勢に関する知見を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- 地理空間インテリジェンス(GeoAI)市場における魅力的な機会

- 地理空間インテリジェンス(GeoAI)市場:上位3つの用途

- 北米の地理空間インテリジェンス(GeoAI)市場:提供別、エンドユーザー別

- 地理空間インテリジェンス(GeoAI)市場:地域別

第4章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 地理空間インテリジェンス(GeoAI)市場におけるアンメットニーズ

- ホワイトスペースの機会

- 相互接続された市場と部門横断的な機会

- 相互接続された市場

- 部門横断的な機会

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- 地理空間インテリジェンスの進化(GeoAI)

- ポーターのファイブフォース分析

- マクロ経済の見通し

- GDPの動向と予測

- 世界のビッグデータ・アナリティクス業界の動向

- 世界のサイバーセキュリティ業界の動向

- サプライチェーン分析

- エコシステム分析

- 地理空間取得システムプロバイダー

- ソフトウェアプロバイダー

- サービスプロバイダー

- 価格設定の分析

- 製品(地理空間インテリジェンス取得システム)の平均販売価格:主要企業別(2025年)

- ソフトウェア・サービスの平均販売価格(2025年)

- 貿易分析

- 輸入シナリオ(HSコード9015)

- 輸出シナリオ(HSコード9015)

- 主な会議とイベント(2025年~2026年)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響 - 地理空間インテリジェンス(GeoAI)市場

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 最終用途産業への影響

第6章 戦略的破壊:特許、デジタル、AIの採用

- 主な新技術

- 先進のAI/ML技術

- リモートセンシング、EO、マルチセンサーデータフュージョン

- 高忠実度3Dマッピング、デジタルツイン

- クラウドエッジコンピューティング

- 補完技術

- IoT・センサーネットワーク

- 5G接続性

- フェデレーテッドラーニング(FL)・プライバシー保護AI

- 隣接技術

- 空間コンピューティング

- 生成AI・GeoLLM

- ブロックチェーン

- テクノロジーロードマップ

- 短期:基盤構築・標準化フェーズ(2025年~2027年)

- 中期:コンバージェンス・自動化フェーズ(2028年~2030年)

- 長期:自律型・認知型相互運用性フェーズ(2031年~2035年)

- 特許分析

- 調査手法

- 特許出願件数:書類タイプ別(2016年~2025年)

- イノベーションと特許出願

第7章 規制情勢

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 主な規制

- 業界標準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購買プロセスに関与する主なステークホルダーとその評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

- さまざまな業界のアンメットニーズ

第9章 地理空間インテリジェンス(GeoAI)市場:提供別

- ソフトウェア

- 地理空間取得システム

- サービス

第10章 地理空間インテリジェンス(GeoAI)市場:コア技術アーキテクチャ別

- ベクター・GIS分析

- ラスター・画像解析

- ストリーミング・リアルタイムアナリティクス

- 地理視覚化

第11章 地理空間インテリジェンス(GeoAI)市場:データタイプ別

- 画像データ

- 非画像データ

- ジオテンポラル・フュージョン

第12章 地理空間インテリジェンス(GeoAI)市場:用途別

- アセットモニタリング・資産管理

- リスク評価・モデリング

- 精密農業

- 災害管理・対応

- 都市計画・デジタルツイン

- 監視・セキュリティ

- サプライチェーン・ルート最適化

- 環境・気候モニタリング

第13章 地理空間インテリジェンス(GeoAI)市場:業界別

- エネルギー・公益事業

- 政府・防衛

- 通信

- 保険・金融サービス

- 不動産・建設

- 自動車・輸送

- 医療・ライフサイエンス

- 鉱業

- 農業

- その他の業界

第14章 地理空間インテリジェンス(GeoAI)市場:地域別

- 北米

- 北米の地理空間インテリジェンス(GeoAI)市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州の地理空間インテリジェンス(GeoAI)市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋の地理空間インテリジェンス(GeoAI)市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- ASEAN

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの地理空間インテリジェンス(GeoAI)市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- サウジアラビア

- アラブ首長国連邦

- トルコ

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの地理空間インテリジェンス(GeoAI)市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第15章 競合情勢

- 概要

- 主要参入企業の戦略(2020年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- ブランドの比較分析

- ブランドの比較分析:地理空間インテリジェンス取得システム別

- ブランドの比較分析:地理空間インテリジェンス(GeoAI)ソフトウェア別

- 企業の評価マトリクス:主要企業(ソフトウェア・サービスベンダー)

- 企業の評価マトリクス:主要企業(地理空間取得システムベンダー)

- 企業の評価マトリクス:スタートアップ企業/中小企業

- 企業の評価と財務指標

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- HEXAGON AB

- TOMTOM

- ALTERYX

- IBM

- AIRBUS

- TRIMBLE

- CALIPER CORPORATION

- PRECISELY

- ESRI

- MICROSOFT

- BENTLEY SYSTEMS

- HERE TECHNOLOGIES

- NV5 GEOSPATIAL

- TELEDYNE GEOSPATIAL

- RMSI

- LANTERIS SPACE SYSTEMS

- VANTOR

- MAPLARGE

- BAE SYSTEMS

- GENERAL ELECTRIC

- FUGRO

- PLANET LABS

- SBL

- ECS

- AWS

- CGI

- スタートアップ/中小企業

- VEXEL IMAGING

- CAPELLA SPACE

- EARTHDAILY ANALYTICS

- MAPIDEA

- GEOSPIN(EMA SMARTSERVICE)

- SPARKGEO

- CARTO

- MAPBOX

- BLUE SKY ANALYTICS

- LATITUDO40

- ECOPIA.AI

- SPATIAL.AI

- DISTA

- EOS DATA ANALYTICS

- MAGNASOFT

- WHEROBOTS

- OUSTER

- GEOWGS84.AI

- EUROPA TECHNOLOGIES

- MAPULAR

第17章 調査手法

第18章 隣接市場と関連市場

- 地理空間画像解析市場 - 世界の予測(~2030年)

- 市場定義

- 市場の概要

- 位置情報サービス(LBS)・リアルタイム位置情報システム(RTLS)市場 - 世界の予測(~2028年)

- 市場定義

- 市場の概要