|

市場調査レポート

商品コード

1907217

電気エンクロージャー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電気エンクロージャー:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 159 Pages

納期: 2~3営業日

|

概要

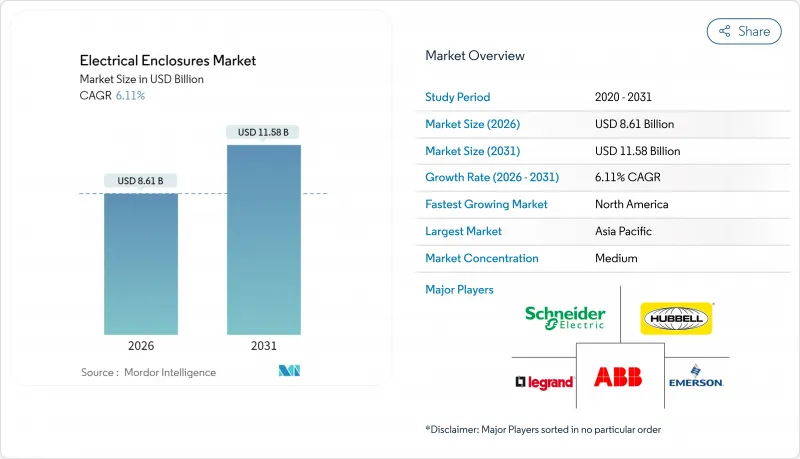

電気エンクロージャー市場は、2025年に81億1,000万米ドルと評価され、2026年の86億1,000万米ドルから2031年までに115億8,000万米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは6.11%と見込まれます。

電力会社、工場、通信事業者が、センサー、エッジプロセッサ、無線モジュールを搭載するインテリジェント筐体へ従来のキャビネットを置き換える動きが需要を加速させております。電力セクターの急速な拡張、5Gの高度化、交通機関の電動化が受注サイクルを堅調に維持する一方、UV安定化ポリカーボネートやガラス繊維などの材料革新が腐食、熱、重量といった課題に対応しております。ベンダー各社はモジュール性、熱管理、IIoT接続性で差別化を図り、データセンター、再生可能エネルギー、送電網近代化といったニッチ分野に焦点を当てた戦略的合併を推進しています。

世界の電気エンクロージャー市場の動向と洞察

再生可能エネルギー設備の加速的拡大

ユーティリティ規模の太陽光発電所や洋上風力発電所では、塩水噴霧、1,000 W/m2を超える紫外線照射、70℃を超える内部温度に耐えるIP67/IP68規格のキャビネットが指定されています。太陽光発電コンバイナーボックス、インバーターハウジング、バッテリーエネルギー貯蔵用配電盤においては、能動冷却、サージ保護、統合通信モジュールが基本要件となっております。IEC 61215およびUL 1741規格への準拠により、エンクロージャー設計はアーク故障検出と絶縁トラッキングの強化へと導かれ、安全な系統連系を支えております。

産業オートメーションとインダストリー4.0の拡大

デジタル化されたプラントでは、振動・湿度・温度センサーを開閉装置に直接組み込み、計画外のダウンタイムを最大82%削減しています。エッジサーバーが制御室から現場へ移行するにつれ、キャビネットはより高い熱負荷を放散する必要があります。パネル内部の温度が10℃上昇するごとに、故障リスクは2倍になります。モジュラーフレームとクイックマウントレールシステムにより迅速な再調整が可能となり、自動車、電子機器、食品メーカーが受注生産戦略に適合することを支援します。

原材料価格の変動

2024年にはエネルギーコストの急騰と輸出規制によりアルミニウムのプレミアム価格が10%上昇し、筐体の粗利益率を圧迫、二重調達契約の締結を促しました。ステンレス鋼の追加料金はニッケル価格の変動に連動し、300mmを超えるキャビネットではOEMメーカーがガラス繊維強化プラスチックやポリカーボネートへの移行を迫られています。為替変動がコスト計算をさらに複雑化させているため、複数年契約ではジャストインタイム在庫管理や価格調整条項の導入が進んでいます。

セグメント分析

2025年における電気エンクロージャー市場シェアは、金属製筐体が74.15%を維持しました。工場自動化分野では炭素鋼、食品・医薬品・海洋環境分野では316Lステンレス鋼が主力です。非金属代替品における電気エンクロージャー市場規模は、ポリカーボネートがステンレス鋼の約3分の1のコストでIK10耐衝撃等級と25年間の紫外線耐性を実現することから、7.98%のCAGRで成長し、市場全体の成長曲線を上回ると予測されます。ガラス繊維強化ポリエステルは成形性と耐薬品性により300mm×300mm超のキャビネット市場を独占し、アルミニウムは鉄道・航空宇宙分野の軽量化要求に対応します。

ポリカーボネート製ボックスは、目視検査用の透明蓋と、組立時間を40%短縮する特許出願中のヒンジレススナップを統合しています。ガラス繊維の絶縁耐力は通電作業を可能にし、接地ハードウェアを不要にします。ステンレスは、溶接のない継ぎ目と滑らかな#4仕上げが細菌繁殖を抑制する衛生用途で引き続き優位性を保っています。ベンダー各社は、性能を損なわずにライフサイクル排出量を削減する次世代難燃性樹脂やバイオベース複合材で競争しています。

壁掛け型キャビネットは、分散制御ループおよびビルオートメーション端末向け市場において、2025年に46.20%の収益シェアを獲得しました。しかしながら、施設拡張やデータセンター需要が電気エンクロージャー市場をフロア設置型ラックへ牽引しており、ハイパースケール事業者が3,500ポンド耐荷重の通路封じ込めフレームを採用する中、CAGR7.51%が見込まれます。モジュラー式ベース台座は全方向からのケーブル導入を可能とし、耐震キットはカリフォルニア州及び日本の耐震基準(Zone 4)を満たします。

電柱・地盤設置型は電力計、EV充電器、5Gノードに対応し、粉体塗装アルミニウム筐体と耐破壊ロックを組み合わせています。地下設置型は郊外配電網向けに設計され、地上レベルの蓋下に開閉装置を隠蔽することで街路景観を保持します。メーカー各社は、狭い通路でも技術者が障害なく機器を保守できるクイックスイングドアや180度ヒンジを推進しています。

地域別分析

北米は2025年収益の38.10%を占め、米国における老朽化開閉装置の交換やサイバー脅威に対する送電網強化策が牽引しています。連邦政府資金によるスマートグリッド展開では、筐体レベルの侵入検知機能とIEEE 1613規格準拠のサージ保護が必須要件となっています。カナダでは、-40℃の冬に直面する鉱業、LNG、風力発電プロジェクトからの需要が増加しており、断熱効果の高いグラスファイバーや二重壁鋼板が好まれています。

アジア太平洋地域は7.22%という最速のCAGRで推移する見込みです。各国政府が送電回廊、半導体工場、高速鉄道に3兆米ドル以上を投入しているためです。中国では溶接鋼板製ボックスから、変電所のデジタルツインに情報を提供するインテリジェントでセンサーを豊富に搭載したキャビネットへの移行が進んでいます。インドのスマートシティ計画では、33kVのリングメインユニットと、モンスーンの洪水に耐えられるパッド設置型複合キオスクを組み合わせています。東南アジアでは電子機器製造の移転を受け入れ、相対湿度90%に耐えるステンレス製制御機器の受注が増加しています。

欧州では洋上風力、水素、工場自動化プログラムが着実に進展しております。ドイツはインダストリー4.0導入を主導し、リタールVXシリーズラックに状態監視機能を組み込んでおります。北欧の電力会社は、シリコンヒーターと通気性のある親水性ベントを備えた寒冷地用エンクロージャーを要求しております。EUサイバーレジリエンス法は、パネルドアへのセキュアブートと改ざん記録機能の組み込みをOEMに義務付け、認証の複雑性を高めております。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 再生可能エネルギーの急速な普及拡大

- 産業オートメーションとインダストリー4.0の拡大

- 送電網の近代化と変電所の改修

- より厳格な世界の安全基準および防塵防水規格

- 屋外設置型5Gスモールセル展開には、防塵防水規格(IP規格)対応ハウジングが必要です

- 予知保全向けスマートIoT対応筐体

- 市場抑制要因

- 原材料価格の変動性(鉄鋼、アルミニウム)

- シール完全性および熱管理の故障

- 接続型筐体におけるサイバー攻撃リスク

- 特注品製造における熟練労働者の不足

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 素材別

- 金属(炭素鋼、ステンレス鋼、アルミニウム)

- 非金属(ポリカーボネート、ガラス繊維強化プラスチック、ポリエステル、ABS樹脂)

- 設置タイプ別

- 壁掛け式

- 床置き型/ 独立設置型

- 地下設置型/ 地上設置型

- ポール設置型

- フォームファクター別

- 小型(10リットル以下)

- コンパクト(10~50リットル)

- フリーサイズ/ フルサイズ(50リットル以上)

- モジュラー/構成可能なシステム

- エンドユーザー業界別

- エネルギー・電力

- 石油・ガス

- 工業製造およびロボット工学

- 金属・鉱業

- 運輸(鉄道、道路、航空、電気自動車充電)

- データセンターおよび通信

- 食品・飲料・医薬品

- 地域別

- 北米

- 米国

- カナダ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- アラブ首長国連邦

- サウジアラビア

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

- nVent Electric plc(Hoffman and Schroff)

- Rittal GmbH and Co. KG

- Emerson Electric Company

- Hubbell Incorporated

- Pentair plc

- Legrand SA

- Hammond Manufacturing Ltd.

- AZZ Inc.

- Adalet(Scott Fetzer Company)

- Allied Moulded Products, Inc.

- Fibox Oy Ab

- Eldon Holding AB

- Siemens AG

- General Electric Company

- Saginaw Control and Engineering

- BOXCO Co., Ltd.

- Nitto Kogyo Corp.

- Socomec Group SA

- Bison ProFab Inc.

- Integra Enclosures Inc.

- Austin Electrical Enclosures

- ITS Enclosures(Builder's Service Company)